Tax Policy – Austria’s New Government Revamps Tax Plans

Last week, Austria’s newly formed government consisting of the Austrian People’s Party and the Greens released its government program, putting tax reform once again on the agenda after the collapse of the previous government. The two overarching goals are to lower the overall tax burden and to align the tax system with environmental priorities. Many proposals aimed at reducing the tax burden match the previous government’s tax plans.

The new plan states that the tax-to-GDP ratio should move closer to 40 percent, down from 42.2 percent in 2018. This will mainly be achieved by lowering personal income tax rates and the corporate income tax rate.

Personal Income Taxes

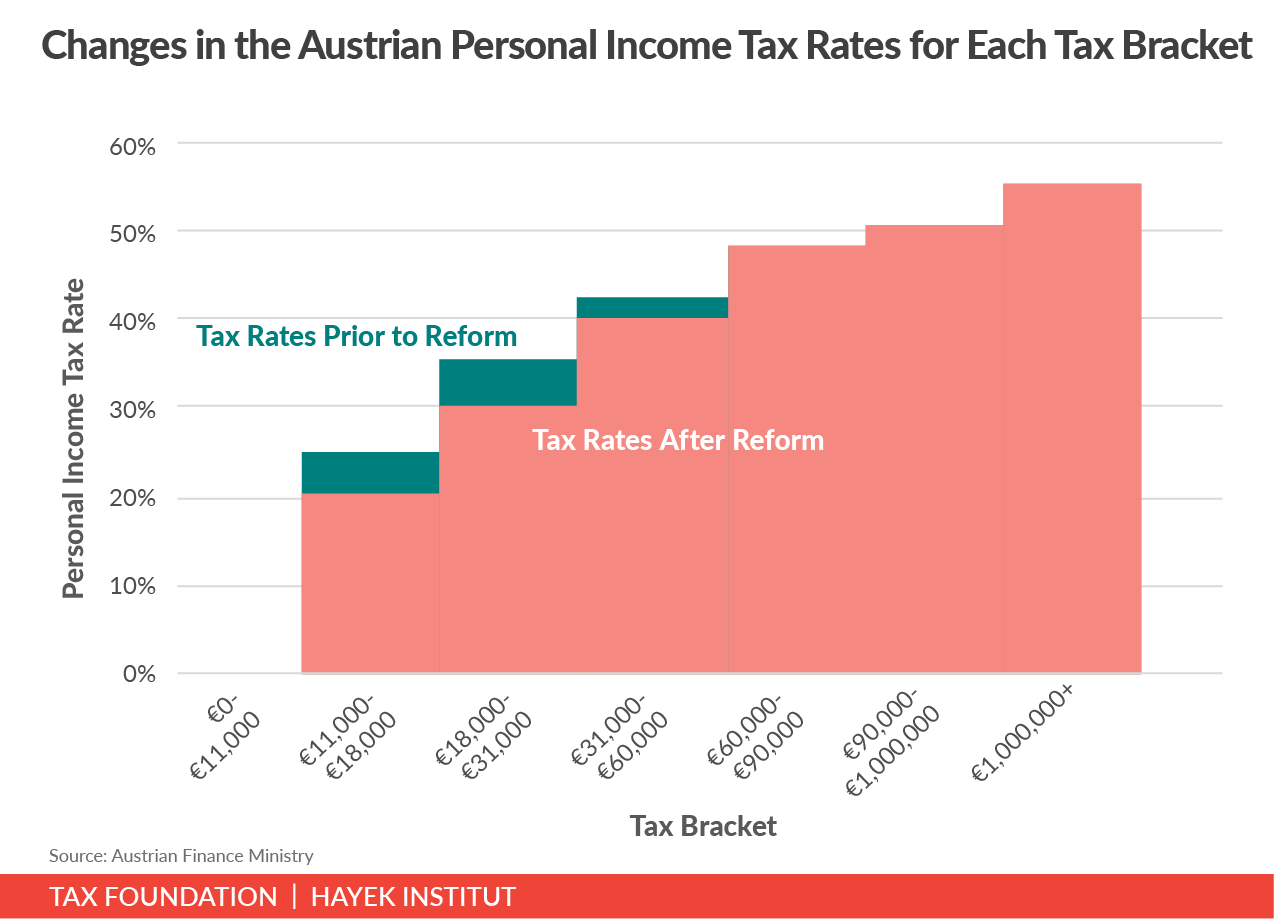

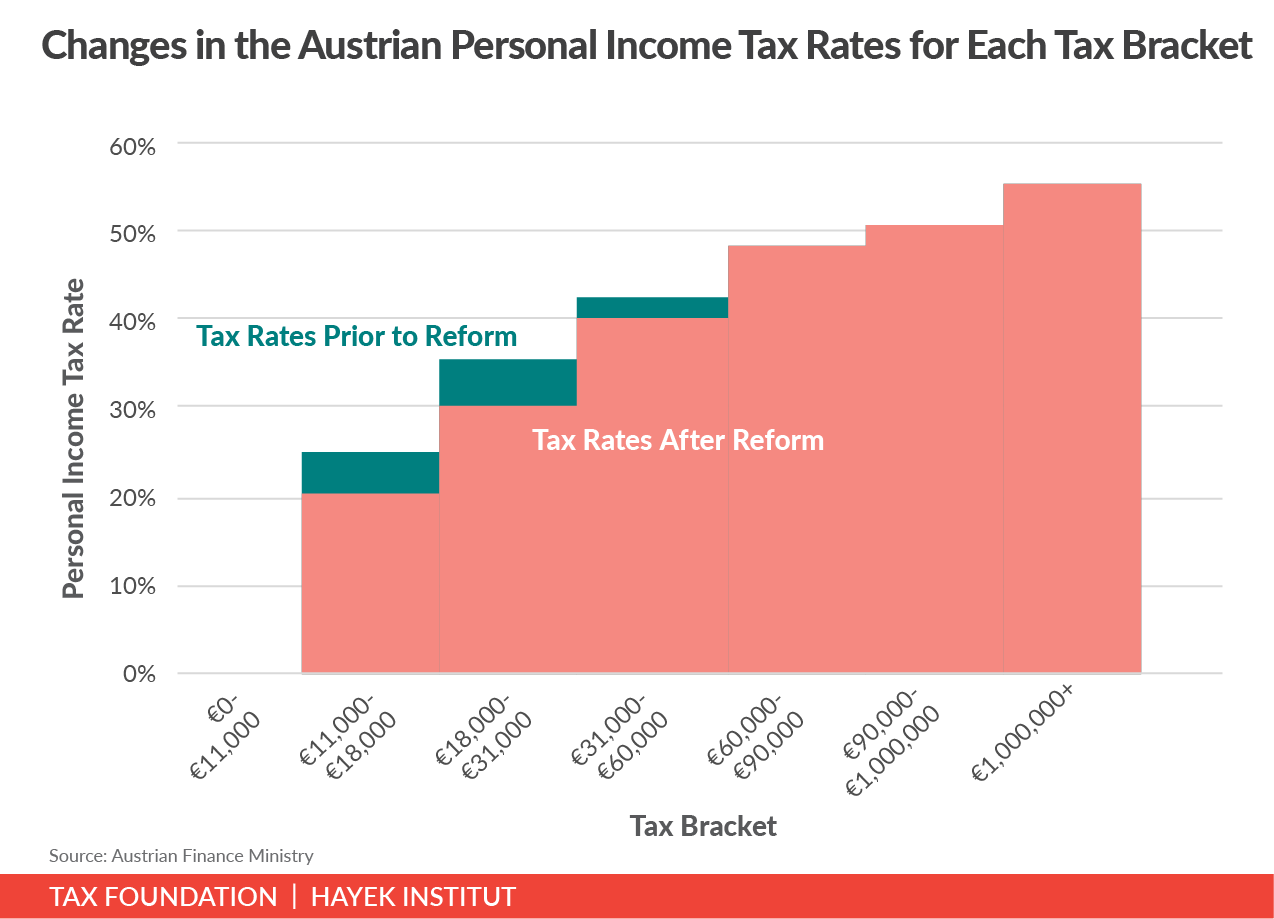

One of the most significant proposed changes is the cut in personal income taxes as proposed by the previous government. The second, third, and fourth lowest brackets of the progressive system would have 20, 30, and 40 percent tax rates, instead of the current 25, 35, and 42 percent, respectively. While the reductions in lower brackets would be beneficial particularly for low- and medium-income earners, the marginal tax rate of 55 percent, initially only introduced temporarily and which is one of the highest in the OECD, remains.

In addition, the plan includes a proposal to assess the potential for inflation adjustments of the personal income tax to avoid bracket creep. Following this path is crucial and getting rid of bracket creep should be a priority for the new Austrian government. Without this reform, the tax cuts are in danger of being eroded over time.

Corporate Income Tax

The last time Austria cut its corporate income tax rate was in 2005, when it moved from 34 percent to the current 25 percent. The new government program includes a reduction in the corporate income tax rate from 25 percent to 21 percent. Austria is following a global trend in declining corporate income tax rates. In 2019, the average corporate tax rate among EU countries was 21.8 percent.

The new government also proposes to expand the base for the corporate standard deduction from €30,000 to €100,000, allowing for a maximum standard deduction of €13,000 (at a rate of 13 percent). Currently, businesses can claim a 13 percent standard deduction on profits of up to €30,000, thus capped at €3,900 per year.

In addition, a new incentive for businesses to offer profit-sharing arrangements with their employees is proposed and there will be an assessment of proposals such as i) the elimination of the minimum corporate tax, ii) the current tax treatment of retained earnings and depreciation rules, and iii) potential cuts in employer-side payroll taxes—all promising ideas that we proposed in detail in our own tax proposal for Austria one year ago.

As of January 1, 2020, Austria has implemented a digital services tax. According to the government program, the tax will stay in effect at least until a solution has been found at the EU and OECD levels. Such digital services taxes create complexity and distortions as they target only certain, mainly foreign, digital firms and disincentivize innovation. The Austrian government should reconsider this step taken in fall of last year or fully commit to removing the tax as soon as an agreement is reached at the EU or OECD level.

Environmental Taxes

Considering one of the two coalescing parties is the Green Party, the government plans to implement several environmental tax measures. This is planned to happen in two steps. First, current tax measures such as the car registration fee, truck tolls, reduced taxes on company cars, and commuter allowances will be restructured in a way that better reflects environmental impacts. For example, the car registration fee will be increased and based on a vehicle’s carbon emissions. In addition, there will be a single aviation ticket tax of €12 per ticket instead of the current €3.50 for short-distance, €7.50 for medium-distance and €17.50 for long-distance flights.

In a second step, a task force for carbon pricing will be formed. The tasks will include determining a reference price for carbon emissions, finding the most efficient solution to price carbon emissions that are not covered by the European Union’s Emissions Trading System (EU ETS), and finding ways to offset the additional burden on taxpayers caused by such carbon pricing. The government also supports a border adjustment of the EU ETS and efforts to tax kerosene and maritime diesel at the European or international level.

An interesting part of the plan is a proposal to exempt capital gains on ecological investments from tax. The goal is to incentivize environmental innovation by lowering the tax burden on those investments. By increasing taxes on carbon and providing incentives for environmental innovations, the government is effectively working to correct two potential distortions: (1) externalities due to carbon emissions and (2) potential underinvestment in environmentally friendly technologies. However, defining eligible investments could create new complexities and the attractiveness of capital gains tax relief could create new distortions as investors shift from taxable investments to those that would not face taxes.

Simplification of the Tax System

The government also plans to rewrite the individual income tax code to simplify and modernize the tax system. Such simplification proposals include merging two types of incomes that are currently treated separately, namely self-employed income (selbständige Einkünfte) and income from business operations (Einkünfte aus Gewerbebetrieb), and simplifying the categories of expenses individuals can deduct.

Conclusion

With a tax-to-GDP ratio of greater than 40 percent, Austria has one of the highest tax burdens in the OECD. The proposed reductions in the personal income tax are thus a step in the right direction, particularly in light of the very high tax burden on labor. Lowering the corporate income tax will help improve Austria’s domestic and international competitiveness, contributing to higher economic growth. If the government decides to undertake carbon pricing through the tax code, it will be important to do so through a broad-based approach that captures as many carbon emissions as possible and avoids double taxation.

With this being said, it continues to be true that Austria is in need of a truly comprehensive tax reform, rather than just tweaks here and there. For a more favorable business and work environment, the government can and should be more ambitious. A potential road map for such a pro-growth tax reform can be found here.

Source: Tax Policy – Austria’s New Government Revamps Tax Plans