Tax Policy – The Impact of a Financial Transactions Tax

Key Findings

- A broad-based financial transaction tax (FTT) in the United States would be a substantial revenue source. For example, the Inclusive Prosperity Act proposed by Sen. Bernie Sanders (I-VT), with an FTT levied at 0.5 percent on stocks, 0.1 percent on bonds, and .005 percent on derivatives, has been estimated to raise between approximately $60B and $220B annually.

- An FTT would raise both explicit and implicit transaction costs, decreasing trading volume and lowering asset prices. The decrease in trading volume would reduce the revenue raised by the tax. It is difficult to predict the magnitude of this reduction. As a result, many existing FTTs have missed revenue targets.

- Depending on the design of the tax, derivatives could potentially be substituted for their underlying securities to avoid the tax, reducing the revenue the tax raises.

- An FTT would fail to meet its goal of discouraging risky financial activity. Due to the higher transaction costs, investors and institutions would be incentivized to avoid rebalancing their portfolios and leave risk unhedged. Furthermore, investors and institutions moving to derivatives to avoid the tax would face additional risks associated with trading those instruments.

- The existing literature is inconclusive as to whether an FTT would increase or decrease volatility. Higher volatility leads to lower compound returns and increased risk for investors.

- An FTT would substantially reduce high-frequency trading (HFT). HFT has contributed to declining transaction costs. It can increase volatility and some high-frequency traders have engaged in predatory activity; however, it is unlikely that these concerns have significant implications for investors or that an FTT is the best way to address them.

- An FTT would increase the cost of capital, reducing both owners’ returns to capital and workers’ returns to labor. As a result, the level of GDP would be reduced under an FTT.

- The burden of an FTT would primarily fall on the wealthy, as the wealthy hold and trade financial assets the most frequently. However, the portfolio values of all investors would be decreased by the reduction in asset prices. An FTT would increase the cost of consumer goods, meaning that all taxpayers would be subject to the tax indirectly.

- Many FTTs have been enacted and subsequently repealed. If the U.S. enacts an FTT and it drives current market participants out of the market entirely, the tax could cause lasting damage to the U.S. financial system even if it is later repealed.

Table of Contents

Introduction

Financial transaction taxes (FTT) levy a tax on each unique instance of the buying and selling of financial assets. Following the 2007-2008 financial crisis, FTT proposals have gained steam globally as the FTT tax base—financial markets—is very broad. FTTs are sometimes called “Robin Hood” taxes, as the tax burden is predominantly borne by the wealthy. FTT proponents include several 2020 presidential candidates, who advocate that an FTT would reduce high-frequency trading (HFT) and disincentivize risky and predatory financial activities, including those practices that led to the 2007-2008 financial crisis.

Opponents of the FTT assert that the tax would not have its intended impact on risk management. Opponents also argue that there is a great deal of uncertainty regarding its ability to raise revenue, and that its impact on transaction costs and potential effects on volatility and price discovery make it dangerous to implement.

This paper will discuss the history and current implementation of FTTs, as well as the economic effects they may have on decision-making and market quality in the United States. The paper will also highlight how policymakers should consider the unpredictability of both the revenue created by the tax and the effects it has on the market when deciding on the merits of a financial transaction tax.

How Financial Transaction Taxes Work

Under an FTT, when a financial asset is traded, a small percentage of the asset’s value is paid in taxes. For example, if an investor sells an asset worth $1,000, they would be charged $1 on the transaction under a 0.1 percent FTT. The FTT may be levied on the buyer of the asset, the seller, or the intermediary (like a stock exchange).

A financial transaction tax is one of several names for a tax on financial assets. It is synonymous with other terms such as securities transaction tax and securities transfer tax. Certain terms may denote that the tax applies to select instruments, such as the UK’s Stamp Duty Reserve Tax, which is levied on shares.

The tax base of an FTT is defined by what venues and assets the tax applies to, and this definition is critical in deterring avoidance. For example, Sweden implemented an FTT effective between 1984 and 1991 with a narrow base that only taxed trades intermediated by Swedish brokerages. This resulted in a substantial portion of the market simply moving to London. Conversely, all major plans being proposed in the U.S. have relatively broad bases that would tax all trades that occur on a U.S. exchange, or where one of the parties is a United States person or business.

Another important consideration is whether the tax applies only to trades on exchanges or includes over-the-counter (OTC) trades (those that occur outside of an exchange). The Financial Industry Regulatory Authority (FINRA) regulates OTC markets under the supervision of the Securities and Exchange Commission (SEC),[2] meaning in the United States an FTT could include OTC transactions in its base.

Due to the variety of existing financial instruments, there are many different FTT proposals. For example, the Inclusive Prosperity Act proposed by presidential candidate Sen. Bernie Sanders (I-VT) lists a 0.5 percent tax on stocks, a 0.1 percent tax on bonds, and a 0.005 percent tax on derivatives. Conversely, the Wall Street Tax Act of 2019 proposes a tax of 0.1 percent on all securities. Other plans may exempt certain types of transactions entirely.

Relative to other taxes, FTTs generally have low administrative and compliance costs. For example, the cost to administer the UK’s stamp duty is approximately 0.1 percent of the revenue collected.[3] However, OTC transactions have higher administrative and compliance costs than transactions on exchanges.[4] Both the government’s administrative costs and the taxpayers’ compliance costs would be higher under an FTT such as the ones proposed in the United States, which include OTC transactions.

For equities and bonds, the base of the tax is simply the price paid for the security. For derivatives, the base may be defined as the market value (the price the derivative trades at) or the notional value (the value of the underlying securities controlled by the derivative) and may include payments made under the terms of the derivative’s contract.[5]

In 2018, approximately $90 trillion in stocks and $216 trillion in bonds were traded on U.S. exchanges, according to the Securities Industry and Financial Markets Association (SIFMA).[6] The size of the derivatives market is harder to determine. The Tax Policy Center (TPC) estimated that $1.1 quadrillion of derivatives (in notional value) was traded in 2015.[7] The size of the tax base for derivatives is much smaller when market value is instead considered. Using either measure, the total base of an FTT far exceeds U.S. gross domestic product (GDP).

With this massive tax base, the FTT would be a substantial revenue source despite a low tax rate. For example, an FTT of 0.1 percent on all securities would raise $777 billion in revenue over the 10-year budget window, according to the Joint Committee on Taxation (JCT) and the Congressional Budget Office (CBO).[8] However, revenue estimates vary based on assumptions made about the response of the market to the tax. The further trading volume drops in response to the tax, the less revenue the tax raises.

History and Current Implementation of Financial Transaction Taxes

The U.S. previously has implemented and considered FTTs, including levying one from 1914 to 1965, and New York state levied its own FTT from 1905 to 1981.[9] More recently, an FTT has been proposed on trades occurring on the major Chicago exchanges. Currently, the SEC imposes a fee to fund regulatory activities of $20.70 per million dollars (equivalent to an FTT of about 0.002 percent) on all transactions except futures contracts, which are assessed a fee of $.0042 per contract.[10]

Additionally, many other countries currently levy an FTT. Existing FTTs tend to apply only to select financial instruments or have varying rates depending on the asset type. A summary of existing FTTs can be found in Table 1.

|

Source: BNY Mellon, “Financial Transaction Taxes (FTT): A Global Perspective,” 2018, https://www.bnymellon.com/emea/en/_locale-assets/pdf/our-thinking/ftt-globalperspective-brochure-03-2018.pdf. |

|

| Country | Rate |

|---|---|

| Belgium | 0.09-1.32% |

| Philippines | 0.6-1.5% |

| Poland | 1% |

| India | 0.001-0.125% |

| South Africa | 0.25% |

| South Korea | 0.15-0.5% |

| Taiwan | 0.0000125-0.1% |

| Brazil | 1-6% |

| Finland | 1.6-2% |

| France | 0.01-0.3% |

| Italy | 0.02-0.2% |

| Venezuela | 0.75% |

| Cyprus | 0.15-0.2% |

| China | 0.10% |

| Egypt | 0.175-0.3% |

| Hong Kong | 0.10% |

| Ireland | 1% |

| Malaysia | 0.3-0.5% |

| Malta | 2% |

| Pakistan | 0.01-1.5% |

| Singapore | 0.20% |

| Switzerland | 0.15-0.3% |

| Thailand | 0.05-0.1% |

| Trinidad & Tobago | 5% |

| United Kingdom | 0.5-1.5% |

Compare Financial Transactions Taxes in Europe

While the above countries currently levy an FTT, a number have elected to repeal their FTT in the past 25 years, such as Germany, Japan, the Netherlands, and Sweden.

The European Union (EU) has been debating enforcing an FTT across all member states. These efforts are a result of individual member states experiencing difficulties with the migration of trades to other EU countries after instituting an FTT, with the failed tax in Sweden being a prime example. In general, countries appear to be implementing and abandoning FTTs at similar rates. This international activity has helped keep the tax at the forefront of debate in the U.S. in recent years.

Throughout the 2020 presidential cycle, Democratic candidates have voiced support for the tax. Table 2 provides a summary of recent proposals and endorsements of an FTT in the U.S. All nationwide proposals to date cover all transactions on U.S. exchanges and when at least one of the parties is a U.S. person or business.

|

Sources: U.S. Congress, Senate, “Inclusive Prosperity Act of 2019, S 1587,” 116th Congress, 1st sess., introduced May 22, 2019, https://www.congress.gov/bill/116th-congress/senate-bill/1587/text; Dan Diamond and Christopher Cadelago, “Kamala Harris’ New Health Plan: ‘Medicare for All’ – with Private Insurers,” Politico, July 29, 2019, https://www.politico.com/story/2019/07/29/kamala-harris-medicare-for-all-1438631; U.S. Congress, House, “Wall Street Tax Act of 2019, HR 1516,” 116th Cong., 1st sess., introduced Mar. 5, 2019, https://www.congress.gov/116/bills/hr1516/BILLS-116hr1516ih.pdf; Illinois General Assembly, “Financial Transaction Tax Act, IL HB0023,” 101st General Assembly, introduced Jan. 1, 2019, https://www.billtrack50.com/BillDetail/1009002. |

||

| Name | Associated Lawmakers | Proposed FTT Rate(s) |

|---|---|---|

| Inclusive Prosperity Act of 2019 | Senators Kirsten Gillibrand (D-NY) and Bernie Sanders (I-VT) | 0.5% on equities, 0.1% on bonds, and 0.005% on derivatives; allows for a credit against the tax for persons with AGI <$50,000 ($75,000 for married filing jointly) |

| Wall Street Tax Act of 2019 | Senators Brian Schatz (D-HI), Representatives Peter DeFazio (D-OR) and Alexandria Ocasio-Cortez (D-NY) | 0.10% on equities, bonds, and derivatives |

| Financial Transaction Tax Act | Illinois State Representative Mary Flowers (D) | $1/transaction on Chicago Stock Exchange, Chicago Mercantile Exchange, Chicago Board of Trade, Chicago Board Options Exchange; exempts floor trades, retirement accounts, mutual funds |

High-Frequency Trading

Proponents and opponents alike agree that an FTT would reduce high-frequency trading, or HFT. As its name implies, HFT relies on the ability to conduct many trades in very short time frames—high-frequency traders sometimes hold positions for small fractions of seconds. The profit margins on these individual trades are typically small—for example, profit margins could be as little as a few cents in a heavily traded stock. An FTT would make these trades unprofitable and drastically reduce, or even eliminate, HFT activity.

High-frequency trading volume varies across asset types but makes up a considerable portion of total trading volume—for example, it is estimated that HFT makes up about half of U.S. equities trades.[11] The effects of HFT include improved liquidity and price discovery (the process by which prices reflect new information) as well as a more ambiguous impact on volatility (discussed below). An FTT might revert these effects because HFT makes up a sizable portion of U.S. volume and HFT activity likely would be eliminated by an FTT.

Many FTT proponents consider HFT to be nonproductive, or even predatory. Some HFT-oriented trading firms have allegedly engaged in heavily scrutinized (and in some cases illegal) practices, publicized in Michael Lewis’ 2014 book Flash Boys: A Wall Street Revolt.[12] These practices include frontrunning (detecting a large buy/sell order and moving in front of it in anticipation of the resulting price movement) and slow-market arbitrage (simultaneously buying and selling securities on separate exchanges to exploit small, transient price discrepancies).

Despite its steady presence in the markets across all major asset types, HFT equity revenues have declined in recent years, from $5.7B in 2010 to $1.8B in 2018.[13] This modest figure should induce some skepticism towards the idea that high-frequency traders are reaping massive profits at the expense of non-high-frequency traders. Nonetheless, HFT remains a pervasive theme when discussing FTTs. For instance, Sen. Sanders’ Inclusive Prosperity Act states that an FTT would “reduce speculation and high-frequency trading that is destabilizing financial markets.”[14]

Derivatives

The taxation of derivatives presents an important design challenge for FTTs and may necessitate additional regulation to be effective. Derivatives are contracts that derive their value from an underlying asset. Perhaps the most straightforward example of a derivative is a contract for difference (CFD). In a CFD, the seller of the contract will pay the buyer the difference between the price at an agreed upon date and the price at the time of contract. An investor who buys a CFD has identical exposure to the underlying instrument as if they had bought the underlying instrument.

Under an FTT, investors may attempt to avoid the tax by substituting derivatives for their underlying instruments.[15] In the United States CFDs are illegal, but an FTT could expand the trading of OTC derivatives[16] such as forwards and total return swaps, which also generate identical exposure to their underlying instruments. If regulation made this infeasible, investors may shift to the already-active equity options markets and use synthetic positions[17] instead of trading in the underlying securities. Barring further regulation of these instruments, traders will have opportunities to avoid an FTT while maintaining the exposure they are seeking.

The market value of a derivative is typically a fraction of its notional value (theoretically, market value may be as little as zero). If an FTT uses market value as its base for derivatives and/or subjects derivatives to lower rates, derivatives will be used as an avoidance strategy, as this would result in a lower tax liability. The extent to which investors replace equities with derivatives is dependent not only on the precise implementation details of the law but also the individual risk preferences of market participants, which presents uncertainty when estimating how much revenue an FTT would raise.

Distortion of Investment Decisions

Bias against short-term investing already exists in the tax code because of the variable treatment of capital gains, as investments held for over a year are subject to lower tax rates. Additionally, because the capital gains tax is triggered by the sale of assets, investors are incentivized to hold on to assets for a longer period of time—this is known as the lock-in effect. An FTT would increase the lock-in effect, particularly in instances where investors experience low or negative returns—in these cases, the FTT is large in comparison to the capital gains tax despite the FTT’s low rate. In the case of negative returns, an investor would still pay the FTT despite realizing a loss.

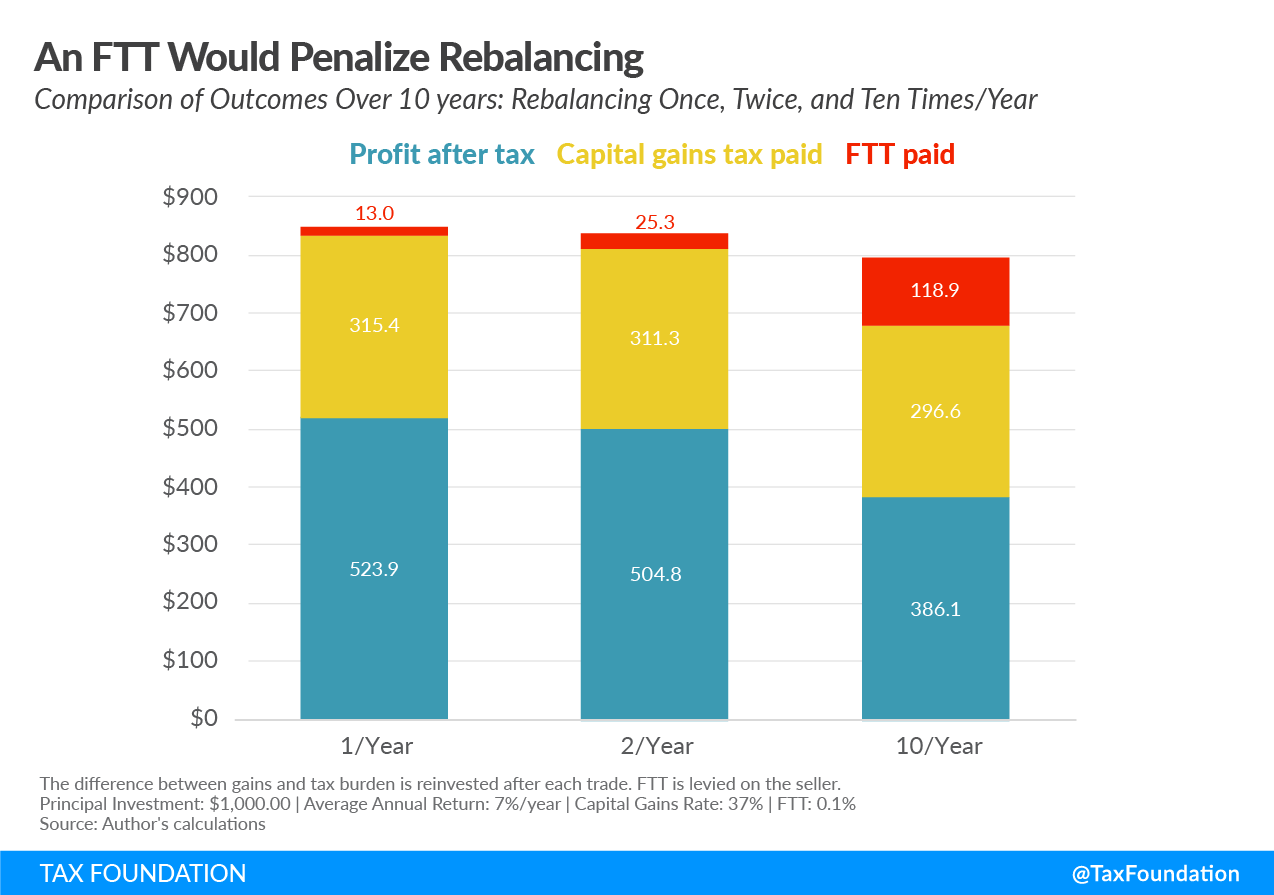

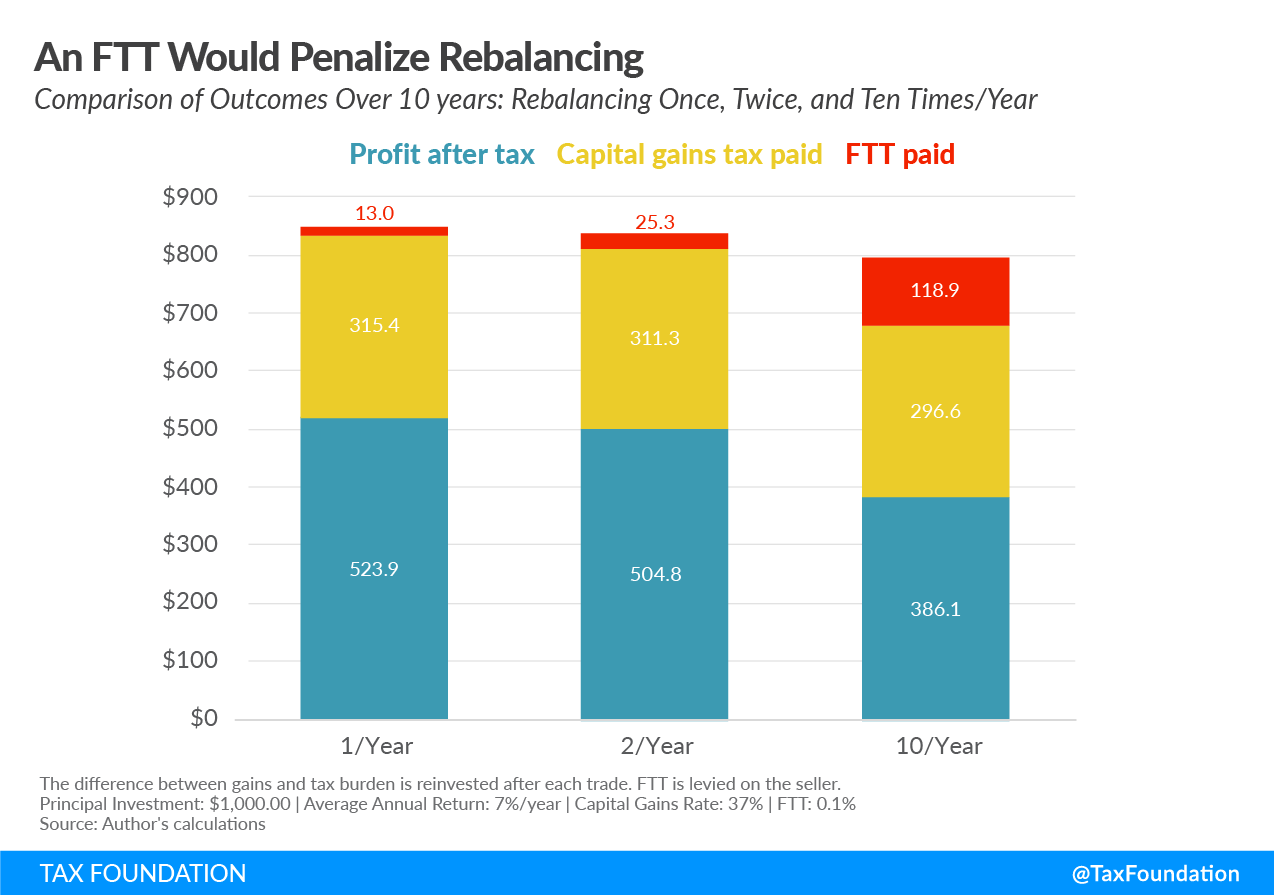

An FTT would also disincentivize frequent trading—this is most apparent in the case of HFT. Because an FTT is levied each time an asset is traded, even more casual retail investors would be incentivized to trade less often. Figure 1 provides an example of the tax burden an investor might face, depending on how frequently they rebalance. The capital gains tax represents a slight penalty on frequent rebalancing, whereas the FTT burden scales linearly with rebalance frequency.

While an FTT could reduce the noise generated by speculative trading, this penalty against rebalancing runs contrary to the stated goal of reducing risky financial activity as it discourages portfolio diversification.

The taxation of derivatives is a catch-22. As discussed previously, if derivatives are under-taxed, investors will be incentivized to substitute high-leverage derivatives for their underlying security and will be subject to the additional risks associated with trading those derivatives. Conversely, over-taxing derivatives will reduce the effectiveness of derivatives as risk management tools. There are numerous usages of derivatives as hedges, such as protecting against downside risk in equities, or trading interest rate derivatives to hedge away interest risk on a large loan. An FTT discourages all such activity and incentivizes retail and institutional investors to leave risk unhedged.

While its proponents frequently cite the 2007-2008 financial crisis as justification for an FTT, the tax would not curb the systemic risk that led to the crisis. Rather, because the tax would increase transaction costs, the usage of leveraged instruments would become more appealing if derivatives were under-taxed. However, if the rate on derivatives is too high, the FTT could also prevent derivatives from being used as hedges. In either case, an FTT could encourage the accumulation of large directional risk.[18]

Liquidity

An FTT would likely make markets less liquid. Liquidity describes how easy it is to enter and exit positions and is often associated with volume—and certain metrics of liquidity, such as Amihud illiquidity,[19] incorporate volume in their calculations. Nonetheless, volume and liquidity are separate concepts. From a practical perspective, liquidity can be measured by the combination of the bid-ask spread and quoted depth. The bid is the best price at which a prospective investor can immediately sell a given security, whereas the ask is the best price at which the security could immediately be bought. The difference between these two prices, or the bid-ask spread, represents an implicit transaction cost that an investor will pay when they submit a market order.[20] The quoted depth of a security is the quantity available at the bid and ask prices.

A market with a tight bid-ask spread might still not be considered liquid if the quoted depth is low: an investor attempting to make a large sale or purchase will be unable to do so without moving the market.[21] These two metrics can be combined into a single one: the effective spread, which represents the cost that a trader will pay to fill a given order beyond the midpoint of the bid-ask.

In 1990, bid-ask spreads in the most actively traded stocks could be as much as 2 to 5 percent of the asset price.[22] Today, spreads in stocks like Apple or Amazon are just a few basis points.[23] Computerization and regulatory changes dating to the 1990s (for example, the decimalization[24] of markets in 2001) paved the way for competition and transparency to drive down spreads. Existing evidence strongly suggests that HFT is partially responsible for this decrease.

Because an FTT would reduce or even eliminate HFT, it is worth exploring HFT’s impact on liquidity to understand how an FTT would impact liquidity. Hendershott, Jones, and Menkveld [25] found that algorithmic trading (AT)[26] has reduced quoted bid-ask spreads in high-market capitalization stocks, although the quoted depth has decreased. The net effect has been a substantial decrease in effective spreads.

In 2012, the Investment Industry Regulatory Organization of Canada instituted a messaging fee, which applied to trades as well as orders submitted and canceled.[27] This fee disproportionately affected HFT, which scaled back in response. Bid-ask spreads increased by 13 percent and effective spreads increased by 9 percent.[28]

The FTTs instituted in France and Italy resulted in substantial increases to quoted bid-ask spreads. Saret[29] found that in France, the average bid-ask spread in taxed equities increased by 75 basis points—when combined with the tax, transaction costs more than tripled. Similarly, in Italy, the bid-ask spread on taxed Italian equities increased by 86 basis points relative to non-Italian equities of similar market capitalization.

It is difficult to project the results of the foreign FTTs to the current U.S. proposals due to differences in both tax structure and the markets in which the taxes are implemented. Nonetheless, the evidence strongly suggests that under an FTT, investors would incur costs not only from the tax itself but also from the higher bid-ask spreads.

Volume

The impact that an FTT will have on the volume of trades is the most important effect of the tax, as it will determine the amount of revenue that the tax can raise. Under an FTT, volume would decline across some or all asset types. The exact effect would largely be determined by the rates assigned to each asset type.

For example, the United Kingdom taxes stock trades while derivatives are exempt. This tax has resulted in the expansion of the UK derivatives market—contracts for difference (CFD) have been substituted for equities and now make up about 40 percent of trading in the UK.[30] Depending on the design of the tax, U.S. investors might similarly substitute derivatives for equities under an FTT. This would reduce equity volume, offset by an increase in derivative volume.

In a 2013 paper, Jeffrey Saret discusses the impact of the French and Italian FTTs.[31] In 2012, France instituted an FTT of 0.2 percent on French stocks of market capitalization greater than €1 billion, and in early 2013, Italy instituted an FTT of 0.12 percent [32] on Italian stocks with a market capitalization of greater than €0.5 billion. Both taxes had narrow bases, exempting both low-market capitalization stocks and certain types of trades in the taxed securities. Trading volume of French equities subject to the tax fell by 24 percent compared to French equities not subject to the tax, and likewise volume in Italian equities subject to the tax fell 8 percent compared to those not subject to the tax. Because of the differences in tax structure between those FTTs and the ones proposed in the U.S., as well as differences in the composition of those countries’ markets, it is difficult to project these results to present-day U.S.

In their revenue estimate of the Inclusive Prosperity Act,[33] Pollin, Heintz, and Herndon assume that under the Inclusive Prosperity Act, volume across all securities would uniformly drop by 50 percent. [34] The paper evaluates Sanders’ FTT’s 50 basis point tax on equities in the context of historical effective bid-ask spreads.[35] These spreads averaged 238 basis points (with a standard deviation of 337 bps) between 1993 and 2006, much larger than the proposed rate on equities.

Pollin, Heintz, and Herndon argue that the assumption of a 50 percent reduction in volume is conservative given the proposal’s small rate in comparison to historical spreads. However, this assumption may not be conservative. Transaction costs have declined substantially: bid-ask spreads in the most actively traded equities are just a couple basis points. Simultaneously, many proprietary trading firms, hedge funds, and banks have seen declines in trading revenues[36],[37],[38] in recent years, making them less able to absorb the increased transaction costs.

The economist James Nunns[39] estimates that stock trades would drop 85.1 percent, bonds 62.9 percent, and derivatives 86.0 percent under the rates prescribed by the Inclusive Prosperity Act. The methodology accounts for different transaction costs across the various types of derivatives, but assumes a uniform elasticity, which may result in some inaccuracy.[40]

While the magnitude of the decrease in trading volume would depend on the rates and the base of an FTT, the evidence indicates that financial transactions taxes reduce trading volume, thus limiting the revenue that such a tax could generate.

Revenue

Because it is difficult to predict the decline in trading volume as a result of an FTT, there is a large degree of uncertainty regarding the tax’s ability to raise revenue. As such, estimates of FTT proposals vary drastically. Likewise, the revenue generation of existing FTTs varies based on the law and the venue where the FTT is levied. In addition to the repealed Swedish FTT, some existing FTTs have yielded less revenue than anticipated.

The target revenue for France’s FTT was €1.5 billion annually, but it has failed to reach this target, peaking at less than half of the target.[41] Similarly, Italy’s FTT has raised only as much as €159 million, a small fraction of the targeted €1 billion (0.01 percent of current GDP).[42]

Conversely, the 0.5 percent UK stamp duty on equities has consistently had moderate success, raising £3.52 billion (0.17 percent of current GDP) in fiscal year 2017-2018.[43] Despite the apparent opportunity for avoidance presented by the large CFD market, equity trading remains a necessity for certain segments of the UK financial sector. For instance, pensions and life insurance funds, which hold approximately 40 percent of UK equities by value, are unable to shift to the derivative markets due to standards administered by the Financial Services Authority.[44]

If an FTT in the U.S. were to raise the same portion of GDP as in the UK, this would equate to about $33 billion annually. A broader-based FTT with similar rates would likely top this figure. U.S. policymakers appear to have learned from some design issues plaguing foreign FTTs—all major proposals tax trades of all U.S. securities, and there is no easy path to simply move trading activities abroad.

However, there would be a revenue offset to some of the revenue generated by an FTT. An FTT would increase the cost of capital, which would lower owners’ returns to capital and workers’ returns to labor. This would reduce revenue from income and payroll taxes. An FTT would increase the existing lock-in effect of capital gains taxation, which encourages investors to hold off on the sale of financial assets to avoid taxation.

Pollin, Heintz, and Herndon estimate that the FTT defined in the Inclusive Prosperity Act would raise approximately $250 billion annually, with offsets in the individual income and capital gains taxes totaling $30 billion for a net revenue increase of $220 billion.[45] Nunns et al. predict much smaller revenue from the Inclusive Prosperity Act’s FTT—they estimate an average annual revenue increase of about $59 billion over the first 10 years (between 2016-2026) of the plan.[46] Neither paper attempts to model the substitution of derivatives for equities, which would result in a decrease in projected revenue because it is an avoidance strategy. This effect could be substantial, but there is a large degree of uncertainty as to the extent of the effect because it is determined by individual risk preferences and undecided implementation details.

Volatility

Volatility is the variability of the returns of a security over time and describes how much a security’s price moves up and down over time. While some speculative traders may benefit from a volatile market, in general low volatility is considered desirable as higher volatility means lower compound returns[47] and more uncertainty for investors as they open and close positions.

There is a considerable degree of uncertainty as to what effect an FTT would have on volatility. Theoretically, increasing transaction costs should reduce speculative trading. However, this effect could be offset by traders requiring larger price movements before they consider it to be profitable to trade to “correct” these movements. Furthermore, if the tax does not exempt market makers[48] (all major U.S. proposals do not), quoted depth may decline, leading to larger price swings from a given order size.

Volatility exists on different time frames—relevant metrics include intraday intervals such as 5-minute or 10-minute volatility and inter-day intervals such as daily or monthly volatility. In general, longer term price behavior is determined by market fundamentals and sentiment rather than trading strategy and technology, so is less likely to be impacted by an FTT. However, intra-day volatility is more likely to be determined by the activity of market participants and therefore by an FTT.

Through the lens of HFT elimination, an FTT would have conflicting effects on volatility. Whether high-frequency traders lead to an increase or decrease in volatility tends to depend on the nature of the trading activity. When high-frequency traders trade passively, their competition tends to drive down the transaction costs without increasing noise trading. Hagströmer and Nordén[49] found that an increase in passive[50] HFT activity in the 30 largest market cap Swedish stocks resulted in decreases in intraday volatility in 5-minute and 10-minute intervals.

Conversely, the 2010 Flash Crash is an example of HFT driving volatility. On May 6, 2010, the Dow Jones Industrial Average fell more than 1,000 points in 10 minutes.[51] The index subsequently recovered 70 percent of that loss. Kirilenko et al. describe how high-frequency trading contributed to the crash.[52] High-frequency traders traded aggressively during the event, using their technological advantage to take liquidity before traditional market makers could adjust their quotes. Market makers responded by withdrawing quotes from the market entirely, reducing quoted depth and compounding volatility.

Similarly, Brekenfelder found that when high-frequency traders competed in securities of the 30 largest market cap Swedish stocks, intraday hourly volatility increased by 20 percent and 5-minute volatility increased by 9 percent.[53] Competing high-frequency traders in the dataset traded primarily aggressively.

Research on existing FTTs yields neutral results. Saret found no substantial change in intraday volatility in French and Italian equities as a result of their respective FTTs.[54] Saporta and Kan found that changes to Great Britain’s stamp duty had no impact on longer-term volatility (daily and weekly).[55] Given the ambiguity of the research on existing FTTs, an FTT in the U.S. could either increase or decrease volatility, or have no noticeable effect.

Price Discovery

Price discovery is the mechanism by which information is incorporated into asset prices. The term is closely related to market efficiency, which describes the degree to which prices reflect information. Efficient price discovery allows investors to be confident that the price of securities reflects all current information. An FTT would deter noise trading[56] but also introduce friction in the process of price discovery by deterring trading on new information.

The SEC summarizes the literature on HFT’s impact on price discovery.[57] Aggressive (liquidity-taking) HFT tends to increase efficiency but can also contribute to noise. Passive (liquidity-providing) HFT strategies tend to improve long-term price discovery—a potential explanation for this is simply that passive HFT drives down the bid-ask spread and therefore transaction costs. Because HFT generally improves price discovery, it follows that an FTT would likely worsen it by reducing HFT.

Research on existing FTTs appears to confirm this. Saret found that after the France FTT was implemented, the time it took for information to be absorbed increased by 30 percent.[58] Italy’s similar FTT increased delays by 170 percent. The discrepancy suggests a difference in market structure (for instance, France’s exchanges could have had greater pre-FTT delays already present in their exchanges than Italy’s exchanges), the nature of the information being absorbed, and/or the composition of market participants. The degree to which an FTT will decrease price discovery will largely depend on the specifics of the market in which it is implemented.

Distribution of the Burden of Financial Transaction Taxes

Because the wealthy hold and trade a disproportionate share of financial assets, and because employees at the financial institutions which would be affected by an FTT tend to have high incomes, an FTT would be progressive. That said, the policy would impact investors of all income levels both directly and indirectly. Because FTTs reduce asset prices,[59] all investors would experience declines in the value of their portfolios. Universities, public pensions, 401ks, and retirement funds would not be immune to increased transactions costs, nor the potential impacts on price behavior stemming from volatility and price discovery.

An FTT would increase the prices of consumer goods. Many industries use options to hedge their exposure to various commodities. For example, an electronics company may purchase copper options to lock in a price at which they can purchase copper sometime in the future. The hypothetical seller of those copper options would likely trade copper futures to hedge their own risk.[60] If the FTT taxes derivatives, the seller’s practice of hedging will become more expensive. In response, the seller will raise the cost of the option, which will be passed on to electronics consumers.[61]

Proponents argue that an FTT might actually save some investors money. By discouraging unproductive trades, an FTT could reduce overhead costs in pension and mutual funds. However, an FTT would also disincentivize productive trading in these funds. It is unclear exactly what effect the tax would have on the behavior of fund managers, and the returns those funds provide to investors.

The increased cost of capital under an FTT would reduce both owners’ returns to capital and workers’ returns to labor. The Tax Policy Center (TPC) distributes the tax in the same manner as they do the corporate tax, approximating the tax to fall 80 percent on owners of capital and 20 percent on labor. This split results in an estimate that 75 percent of the burden of the tax falls on the top quintile, and 40 percent on the top 1 percent.[62] Table 3 displays TPC’s estimate of the distribution of an FTT with a base rate of 0.1 percent. According to this estimate, an FTT would reduce after-tax incomes of all taxpayers, but the burden would fall hardest on those with higher incomes; the FTT is a highly progressive tax.

|

This table displays TPC’s conventional estimate, which applies a rate of 1/10 the base rate to derivatives transactions, using notional value as the base. Source: Leonard Burman et al., “Financial Transaction Taxes in Theory and Practice,” National Tax Journal 69:1 (March 2016), 171-216, https://www.brookings.edu/wp-content/uploads/2016/07/Burman-et-al_-NTJ-Mar-2016-2.pdf using Table 6. |

|||

| Expanded Cash Income Percentile | Share of Total Federal Tax Change | Percent Change in After-tax Income | Percent Change in Average Federal Tax Rate |

|---|---|---|---|

| Lowest Quintile | 1.3 | -0.1 | 0.1 |

| Second Quintile | 3.2 | -0.1 | 0.1 |

| Middle Quintile | 6.8 | -0.1 | 0.1 |

| Fourth Quintile | 13.0 | -0.2 | 0.1 |

| Top Quintile | 74.7 | -0.4 | 0.3 |

| All | 100.0 | -0.3 | 0.2 |

| 80-90 | 10.5 | -0.2 | 0.2 |

| 90-95 | 9.2 | -0.3 | 0.2 |

| 95-99 | 15.0 | -0.4 | 0.3 |

| Top 1 Percent | 40.0 | -0.8 | 0.5 |

| Top 0.1 Percent | 23.5 | -1.0 | 0.7 |

Conclusion

An FTT would violate the principles of sound tax policy—neutrality, stability, transparency, and simplicity. It is nonneutral in that it is discriminatory against the financial sector. FTTs are often unstable sources of revenue, as evidenced by multiple FTTs in other parts of the world, and a wide range of revenue projections that come with imposing an FTT in the United States. The FTT is not a transparent tax, as the tax would affect producers, hedgers, pensioners, consumers, and investors in a series of indirect ways. Furthermore, the tax is highly complicated and would cause a significant disruption to U.S. financial markets.

Advocates of an FTT note that a well-designed FTT would be a substantial source of revenue and its burden would primarily fall on the wealthy. Given that it would be very difficult for individuals and institutions to move abroad to avoid the tax, and given the central role of U.S. financial markets in the global economy, it is improbable that an FTT in the United States would have comparable results to the experience of other countries that have dramatically missed revenue targets.

However, because the proposed FTTs are unprecedented in their comprehensiveness, the U.S. might see substantially greater damage to the health of its financial system than seen in foreign countries. In addition, higher-end revenue estimates for U.S. FTTs tend to use overly optimistic assumptions. The substantial uncertainty associated with predicting the decline in trading volumes means that one should view revenue estimates with skepticism.

An FTT would remove some uncertainty from the markets that are associated with HFT by virtue of eliminating a significant portion of HFT—events such as the 2010 Flash Crash might be less likely to occur were HFT not a factor. However, a tax is unlikely to be the best way to address these concerns. Following the Flash Crash, the SEC employed circuit breakers to ensure that prices stay within a certain band in a given trading day.[63] Further research and regulation (if appropriate) are arguably a better way to address concerns relating to the practices of HFT. Eliminating or substantially reducing HFT would remove the benefits it brings, such as lowering transaction costs and improving price discovery.

Research points towards an FTT having a negative impact on price discovery and an ambiguous impact on volatility—it is unclear to what extent this would affect the various types of market participants. One impact on the health of the financial markets is the FTT’s reduction in liquidity. The combination of increased bid-ask spreads and the tax itself would raise costs for investors.

Beyond discouraging trading in general, an FTT does nothing to disincentivize risky financial activities, and may in fact incentivize investors to keep larger directional risk. Depending on the design of the tax, an FTT could encourage the substitution of leveraged instruments for their underlying securities or discourage hedging.

In general, it is highly unlikely that an FTT would improve the quality of the United States financial system. The opposite scenario in which an FTT catastrophically damages the financial system is also unlikely. However, policymakers should exercise caution in deciding whether to enact an FTT given the uncertainty regarding the FTT’s ability to raise revenue and the significant damage it could cause to the U.S. financial system.

Appendix A: Avoidance Using Derivatives

Under an FTT, individuals and institutions would continue seeking to gain exposure to various financial instruments at the lowest possible cost. This has been demonstrated by the UK’s Stamp Duty Reserve Tax, which exempts derivatives and has led to the expansion of the contract for difference (CFD) market. This appendix describes several types of derivatives which may be substituted for their underlying equities under an FTT.

Futures behave similarly to CFDs. The buyer of a physically-settled future is obligated to buy the underlying instrument at an agreed upon price, quantity, and date. Despite their high leverage and reputation as speculative instruments, futures originated and are used to this day as hedging tools. A corn farmer may sell corn futures with a quantity equivalent to their stock, locking in a price at which they’ll be compensated for their crop. Cash-settled futures do not require physical delivery and are nearly functionally identical to CFDs.[64] Total return swaps and forwards, which trade OTC, also fall into this category of derivatives that only require margin and small transaction fees to gain 1:1 exposure to the underlying security.

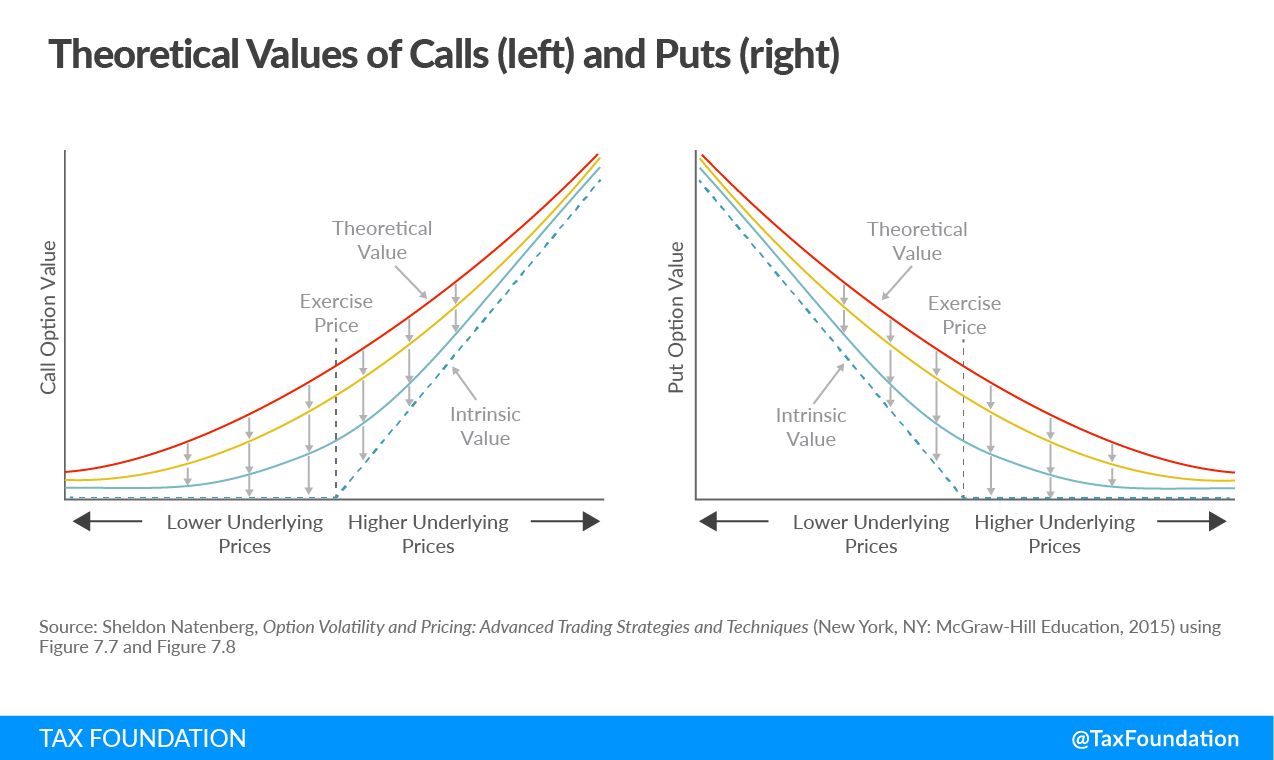

Options are similar to futures—the difference being that the purchaser of an option has the right, but no obligation, to buy or sell shares of the underlying instrument. The buyer of a call option may purchase the underlying instrument at an agreed upon price (strike) and date (expiration). Similarly, the buyer of a put option has the right to sell the underlying instrument. If one purchases a call on security A with underlying price of $100 and a strike price of $120 and at expiration security A is trading at anywhere between $0 and $120, the option is out of the money (OTM) and expires worthless. During this option’s life cycle, the buyer only pays the initial price (or premium) of the option. If the value of security A instead rises to $130, the call option is in the money (ITM) and the owner can exercise their option to purchase shares of security A at $120.[65] The owner of those shares can now hold on to them or sell at the new price of $130 for a profit of $10 per share minus the premium paid for the option.

Figure 2 above shows the approximate shape of the theoretical values of options with respect to the underlying prices. As an option goes deeper in the money, the slope of its theoretical value with respect to the underlying price approaches 1 for calls and -1 for puts, meaning for every $1 move in the underlying asset there is a corresponding $1 move in the option’s value. [66] Investors can therefore approximate a position in the underlying by trading deep ITM options. Additionally, long and short positions can be precisely simulated by simultaneously buying a call and selling a put (long) or selling a call and buying a put (short) at the same strike price and expiration. This is known as trading a synthetic underlying. Synthetic underlying positions carry an additional risk that the investor will be assigned on the short option and forced to purchase or sell shares.[67]

Were an FTT such as the Inclusive Prosperity Act (which taxes the notional value of derivatives at 1/100 the rate it taxes equities) enacted, investors may look to OTC products such as total return swaps and forwards as an alternative to their underlying equities. If regulation or additional taxes on OTC trades (for example, Italy’s FTT taxes OTC trades at a higher rate[68]) makes the expansion of OTC markets infeasible, the equity options markets would constitute an additional opportunity for avoidance. However, as previously discussed, over-taxing derivatives would disincentivize their usage as risk management tools. Should an FTT be enacted, policymakers should attempt to set the rates on equities and derivatives such that avoidance isn’t too easy and risk management strategies are not too heavily discouraged.

[1] “The Relevance of the Swedish Case in the Current FTT Debate,” Swedish Social Democratic Party, n.d., https://www.abbl.lu/content/uploads/2017/06/the-relevance-of-the-swedish-case-in-the-current-ftt-debate.pdf.

[2] FINRA. https://www.finra.org/.

[3] John Brondolo, “Taxing Financial Transactions: An Assessment of Administrative Feasibility,” IMF Working Papers 11, no. 185 (August 2011), https://doi.org/10.5089/9781462309276.001.

4 Id.

5 See U.S. Congress, House, “Wall Street Tax Act of 2019, HR 1516,” 116th Cong., 1st sess., introduced in House Mar. 5, 2019, https://www.congress.gov/116/bills/hr1516/BILLS-116hr1516ih.pdf.

[6] Derived from average daily trading volume. See SIFMA, “US Equity Issuance and Trading Volumes,” https://www.sifma.org/resources/research/us-equity-stats/, and SIFMA, “US Bond Market Trading Volume,” https://www.sifma.org/resources/research/us-bond-market-trading-volume/.

[7] James R. Nunns et al., “A Comparison of TPC and the Pollin, Heintz and Herndon Revenue Estimates for Bernie Sanders’s Financial Transaction Tax Proposal,” Tax Policy Center, Apr. 12, 2016, https://www.taxpolicycenter.org/publications/comparison-tpc-and-pollin-heintz-and-herndon-revenue-estimates-bernie-sanderss/full.

[8] “Impose a Tax on Financial Transaction Taxes,” Congressional Budget Office, Dec. 13, 2018, https://www.cbo.gov/budget-options/2018/54823.

[9] For further information on the history of the FTT in the U.S., see Leonard E. Burman et al., “Financial Transaction Taxes in Theory and Practice,” National Tax Journal 69:1 (March 2016): 171-216, https://www.brookings.edu/wp-content/uploads/2016/07/Burman-et-al_-NTJ-Mar-2016-2.pdf.

[10] “Fee Rate Advisory #2 for Fiscal Year 2019,” U.S. Securities and Exchange Commission, n.d., https://www.sec.gov/news/press-release/2019-30.

[11] Evelyn Cheng, “Just 10% of Trading Is Regular Stock Picking, JPMorgan Estimates,” CNBC, June 14, 2017, https://www.cnbc.com/2017/06/13/death-of-the-human-investor-just-10-percent-of-trading-is-regular-stock-picking-jpmorgan-estimates.html.

[12] Michael Lewis, Flash Boys: A Wall Street Revolt (New York, NY: W.W. Norton & Company, 2015).

[13] Alexander Osipovich, “More Exchanges Add ‘Speed Bumps,’ Defying High-Frequency Traders,” The Wall Street Journal, July 29, 2019, https://www.wsj.com/articles/more-exchanges-add-speed-bumps-defying-high-frequency-traders-11564401611.

[14] U.S. Congress, Senate, “Inclusive Prosperity Act of 2019, S 1587,” 116th Congress, 1st sess., introduced in Senate May 22, 2019, https://www.congress.gov/bill/116th-congress/senate-bill/1587/text.

[15] See Appendix A for a more detailed overview of avoidance strategies using derivatives.

[16] The Bank for International Settlements publishes data on the size of these markets. For more information, see “BIS Statistics Explorer,” The Bank for International Settlements, n.d., https://stats.bis.org/statx/toc/DER.html.

[17] In options trading, a synthetic underlying is a position that generates the same exposure as the underlying security.

[18] Directional risk refers to exposure to the price change of a financial asset. If an FTT encourages the use of leveraged instruments, it will encourage larger directional risk. The same concept applies to how an FTT discourages portfolio diversification and hedging—both strategies decrease directional risk.

[19] For more information, see Yakov Amihud, “Illiquidity and Stock Returns: Cross-Section and Time-Series Effects,” Journal of Financial Markets 5:1 (January 2002): 31-56, https://doi.org/10.1016/s1386-4181(01)00024-6.

[20] A market order is an order that will immediately be filled at the best available bid or offer. In contrast, a limit order will only be filled at a specific price or better.

[21] It is for this reason that low quoted depth is associated with high volatility.

[22] Michael A. Goldstein and Edward F. Nelling, “Market Making and Trading in Nasdaq Stocks,” The Financial Review 34:1 (February 1999): 27-44, https://doi.org/10.1111/j.1540-6288.1999.tb00443.x.

[23] For an example, see “Apple Inc (AAPL),” Investing.com, accessed Nov. 18, 2019, https://www.investing.com/equities/apple-computer-inc-company-profile during market hours.

[24] The SEC mandated that the minimum price movement in equities would be $.01. Prior to decimalization, quotes were fractional, and the smallest bid-ask spread was 1/16th of a dollar.

[25] Terrence Hendershott, Charles M. Jones, and Albert J. Menkveld, “Does Algorithmic Trading Improve Liquidity?” The Journal of Finance 66:1 (February 2011): 1-33, https://doi.org/10.1111/j.1540-6261.2010.01624.x.

[26] The distinction between HFT and AT (all high-frequency trading is algorithmic but not all algorithmic trading is high-frequency) is generally important because FTTs have a much larger impact on HFT than non-HFT. However, the distinction is less important in the context of this study because HFT makes up the bulk of AT activity.

[27] This fee was applied pro-rata as a portion of total messages generated. Messages include not only trades but also orders submitted and canceled.

[28] Katya Malinova, Andreas Park, and Ryan Riordan, “Do Retail Traders Suffer from High Frequency Traders?” SSRN Electronic Journal, Jan. 11, 2018, https://doi.org/10.2139/ssrn.2183806.

[29] Jeffrey N Saret, “The Effect of French and Italian Transaction Taxes on Equity Market Microstructure and Market Efficiency,” Two Sigma Investments, January 2014, https://www.twosigma.com/wp-content/uploads/WhitePaper.TransTaxes.KVW2.pdf.

[30] Leonard E. Burman et al., “Financial Transaction Taxes in Theory and Practice.”

[31] Jeffrey N Saret, “The Effect of French and Italian Transaction Taxes on Equity Market Microstructure and Market Efficiency.”

[32] The 0.12% rate applied to exchange trades. Italy introduced a separate rate of 0.22% for OTC trades. Italy added a tax on derivatives later in 2013.

[33] At that point the bill was named the Inclusive Prosperity Act of 2015. The bill administered the same rates as the more recent version: 0.5% for stocks, 0.1% for bonds, and 0.005% for derivatives—however, some of the administrative language has changed.

[34] Robert Pollin, James Heintz, and Thomas Herndon, “The Revenue Potential of a Financial Transaction Tax for U.S. Financial Markets,” Political Economy Research Institute, July 30, 2017, https://www.peri.umass.edu/component/k2/item/698-the-revenue-potential-of-a-financial-transaction-tax-for-u-s-financial-markets.

[35] This term will be discussed in greater detail in the Liquidity section. Pollin, Heintz, and Herndon reference estimates from Shane A. Corwin and Paul Schultz, “A Simple Way to Estimate Bid-Ask Spreads from Daily High and Low Prices,” The Journal of Finance 67:2 (April 2012): 719-760, https://doi.org/10.1111/j.1540-6261.2012.01729.x.

[36] “The Opportunity for a Prop Trader,” SMB Training Blog, Jan. 5, 2014, https://www.smbtraining.com/blog/the-opportunity-for-a-prop-trader.

[37] David Finstad, “Have Institutional Investors Spoiled the Hedge Fund Party?” Institutional Investor, Oct. 21, 2018, https://www.institutionalinvestor.com/article/b1bh5sbz82rzbx/Have-Institutional-Investors-Spoiled-the-Hedge-Fund-Party.

[38] Yusuf Khan, “Revenues at the World’s Biggest Investment Banks Have Plunged to Their Lowest Levels since 2006 | Markets Insider,” Business Insider, Sept. 5, 2019, https://markets.businessinsider.com/news/stocks/deutsche-bank-morgan-stanley-bank-revenues-lowest-since-2006-2019-9-1028501022.

[39] Pollin, Heintz, and Herndon updated their working paper in 2017, partially in response to Nunns (2016). The TPC estimate considered option premiums as the base for options, whereas the updated Pollin, Heintz, and Herndon estimate uses notional value. See James R. Nunns et al., “A Comparison of TPC and the Pollin, Heintz and Herndon Revenue Estimates for Bernie Sanders’s Financial Transaction Tax Proposal.”

[40] The methodology assumes an elasticity of -1.25 across all securities. In practice, different securities have very different trading elasticities. Still, the usage of a uniform elasticity is reasonable given the lack of available data on current trading elasticities.

[41] “Effects of a Financial Transaction Tax,” Modern Markets Initiative, Nov. 13, 2018, https://www.modernmarketsinitiative.org/archive/2018/11/13/this-is-a-test-post.

[42] ld.

[43]Annual Stamp Tax Statistics 2017-2018,” Gov.UK, https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/743345/ASTP-Release-Bulletin-Sept18.pdf using Chart 1B: Stock and shares stamp tax receipts, 2003-04 to 2017-18.

[44] Stephan Schulmeister, “A General Financial Transaction Tax Motives, Revenues, Feasibility and Effects,” SSRN Electronic Journal, March 2008, https://doi.org/10.2139/ssrn.1714395.

[45] Robert Pollin, James Heintz, and Thomas Herndon, “The Revenue Potential of a Financial Transaction Tax for U.S. Financial Markets.”

[46] Frank Sammartino et al., “An Analysis of Senator Bernie Sanders Tax Proposals,” Tax Policy Center, Mar. 4, 2016, https://www.taxpolicycenter.org/publications/analysis-senator-bernie-sanderss-tax-proposals/full.

[47] As an example, over two years, an asset with a constant annual rate of return of 40 percent will provide a 96 percent return on the initial investment. A more volatile asset that provides a return of 30 percent the first year and 50 percent the second year would provide a return of 95 percent over the two years.

[48] Market makers provide liquidity by quoting buy and sell prices. Because this is considered useful, some foreign FTTs, such as the ones in France and Italy, include some exemptions for market makers.

[49] Björn Hagströmer and Lars Nordén, “The Diversity of High-Frequency Traders,” Journal of Financial Markets 16:4 (November 2013): 741-770, https://doi.org/10.1016/j.finmar.2013.05.009.

[50] Passive activity means liquidity providing, or market making. Liquidity providers/market makers join the bid and ask. Conversely, liquidity takers “hit” the bid or ask (this is known as crossing the spread), and is called “aggressive,” although this is not a characterization of the strategy—every trade must have a liquidity provider and taker.

[51] Will Kenton, “Flash Crash,” Investopedia, Sept. 13, 2019, https://www.investopedia.com/terms/f/flash-crash.asp.

[52] Andrei Kirilenko, Albert S. Kyle, Mehrdad Samadi, and Tugkan Tuzun, “The Flash Crash: The Impact of High Frequency Trading on an Electronic Market,” CFTC.gov, May 5, 2014, https://www.cftc.gov/sites/default/files/idc/groups/public/@economicanalysis/documents/file/oce_flashcrash0314.pdf.

[53] Johannes Breckenfelder, “Competition among High-Frequency Traders and Market Quality,” SSRN Electronic Journal, May 14, 2013, https://doi.org/10.2139/ssrn.2264858.

[54] Jeffrey N Saret, “The Effect of French and Italian Transaction Taxes on Equity Market Microstructure and Market Efficiency.”

[55] Victoria Saporta and Kamhon Kan, “The Effects of Stamp Duty on the Level and Volatility of Equity Prices,” SSRN Electronic Journal, June 1998, https://doi.org/10.2139/ssrn.93656.

[56] Noise trading describes trading activity that is not based on fundamental analysis. Noise trading causes prices to deviate from their fundamental values, and thus worsens price discovery.

[57] U.S. Securities and Exchange Commission, “Equity Market Structure Literature Review Part II: High Frequency Trading,” Mar. 18, 2014, https://www.sec.gov/marketstructure/research/hft_lit_review_march_2014.pdf.

[58] Jeffrey N Saret, “The Effect of French and Italian Transaction Taxes on Equity Market Microstructure and Market Efficiency.”

[59] “Impose a Tax on Financial Transactions,” Congressional Budget Office, Dec. 13, 2018, https://www.cbo.gov/budget-options/2018/54823.

[60] This is known as delta hedging and is a common practice among market makers that want to limit directional exposure to the instruments they trade. An options market maker might delta hedge daily, or even more frequently.

[61] The extent to which the sellers would increase option prices (and therefore, the eventual prices of the consumer goods) would depend on their risk tolerances. A market maker with a higher risk tolerance would be willing to delta hedge less frequently in response to an FTT.

[62] Leonard Burman et al., “Financial Transaction Taxes in Theory and Practice.”

[63] Viktoria Dalko, “Limit Up–Limit Down: an Effective Response to the ‘Flash Crash’?” Journal of Financial Regulation and Compliance 24:4 (2016): 420-429, https://doi.org/10.1108/jfrc-04-2016-0040.

[64] In cash settlement, no underlying security is delivered—the seller pays the buyer the associated cash payment.

[65] In this example, the party that sold the option is “assigned” on the option and must sell shares of security A at $120. In reality, options are purchased on exchanges where the counterparty is irrelevant: when someone exercises an option, the person assigned is chosen randomly.

[66] An option’s theoretical value is based on the probability that it will expire in the money—as such, volatility and time to expiration are important inputs.

[67] The vast majority of option positions are either closed or expire worthless. In 2015, 71% of equity option positions were closed, 22% expired worthless, and just 7% were exercised. An FTT could exacerbate this phenomenon. See Mark Wolfinger, “Options Expire Worthless,” The Balance, Nov. 17, 2019, https://www.thebalance.com/options-expire-worthless-4056646.

[68] Jeffrey N Saret, “The Effect of French and Italian Transaction Taxes on Equity Market Microstructure and Market Efficiency,” using Table 1.

Source: Tax Policy – The Impact of a Financial Transactions Tax