Tax Policy – Digital Services Taxes in Europe

Over the last few years, concerns have been raised that the existing international tax system does not properly capture the digitalization of the economy. Under current international tax rules, multinationals generally pay corporate income tax where production occurs rather than where consumers or, specifically for the digital sector, users are located. However, some argue that through the digital economy, businesses (implicitly) derive income from users abroad, but, without a physical presence, are not subject to corporate income tax in that foreign country.

To address these concerns, the Organisation for Economic Co-operation and Development (OECD) has been hosting negotiations with over 130 countries that aim to adapt the international tax system. The current proposal would require multinational businesses to pay some of their income taxes where their consumers or users are located. According to the OECD, an agreement is expected in 2020.

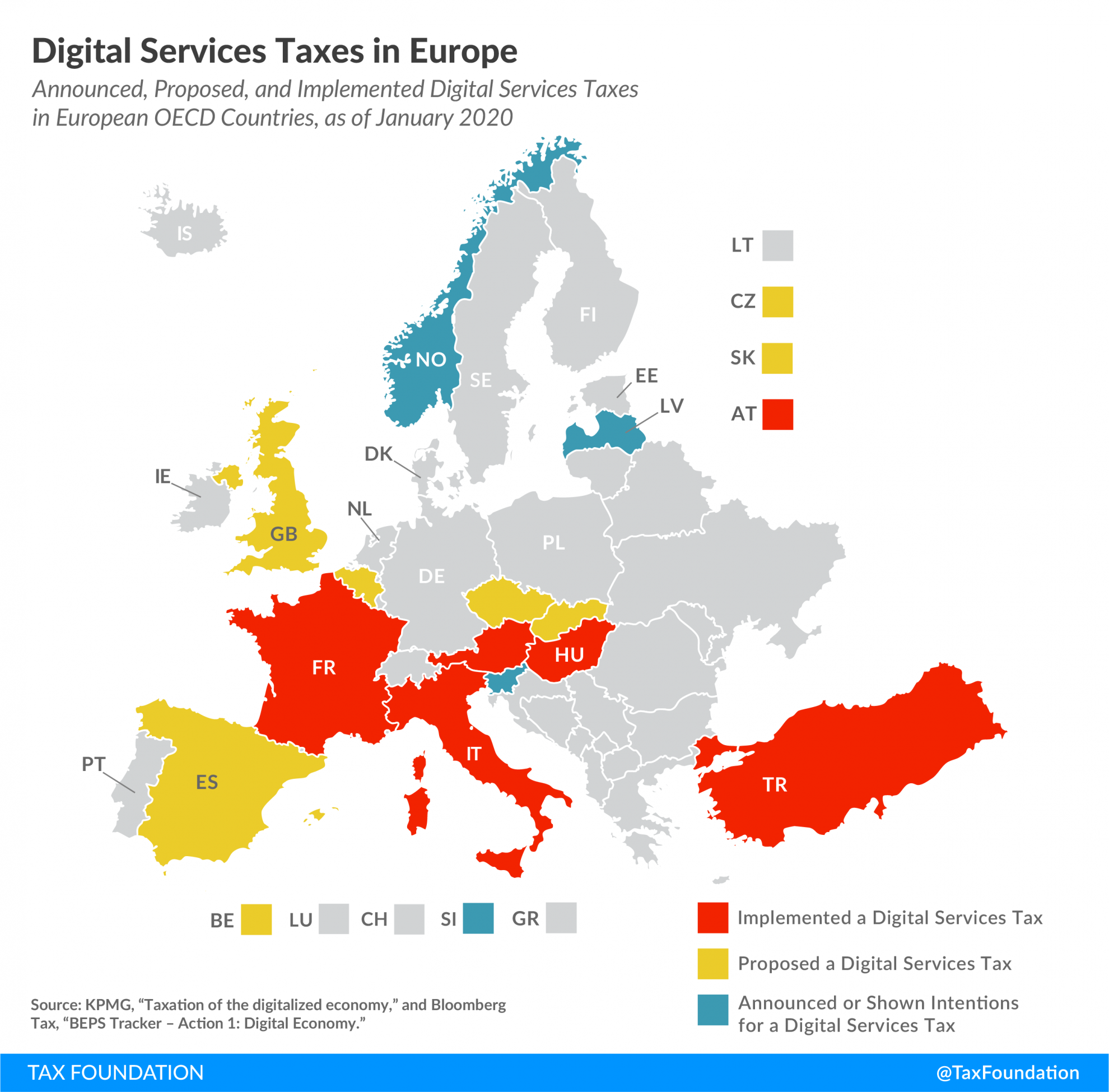

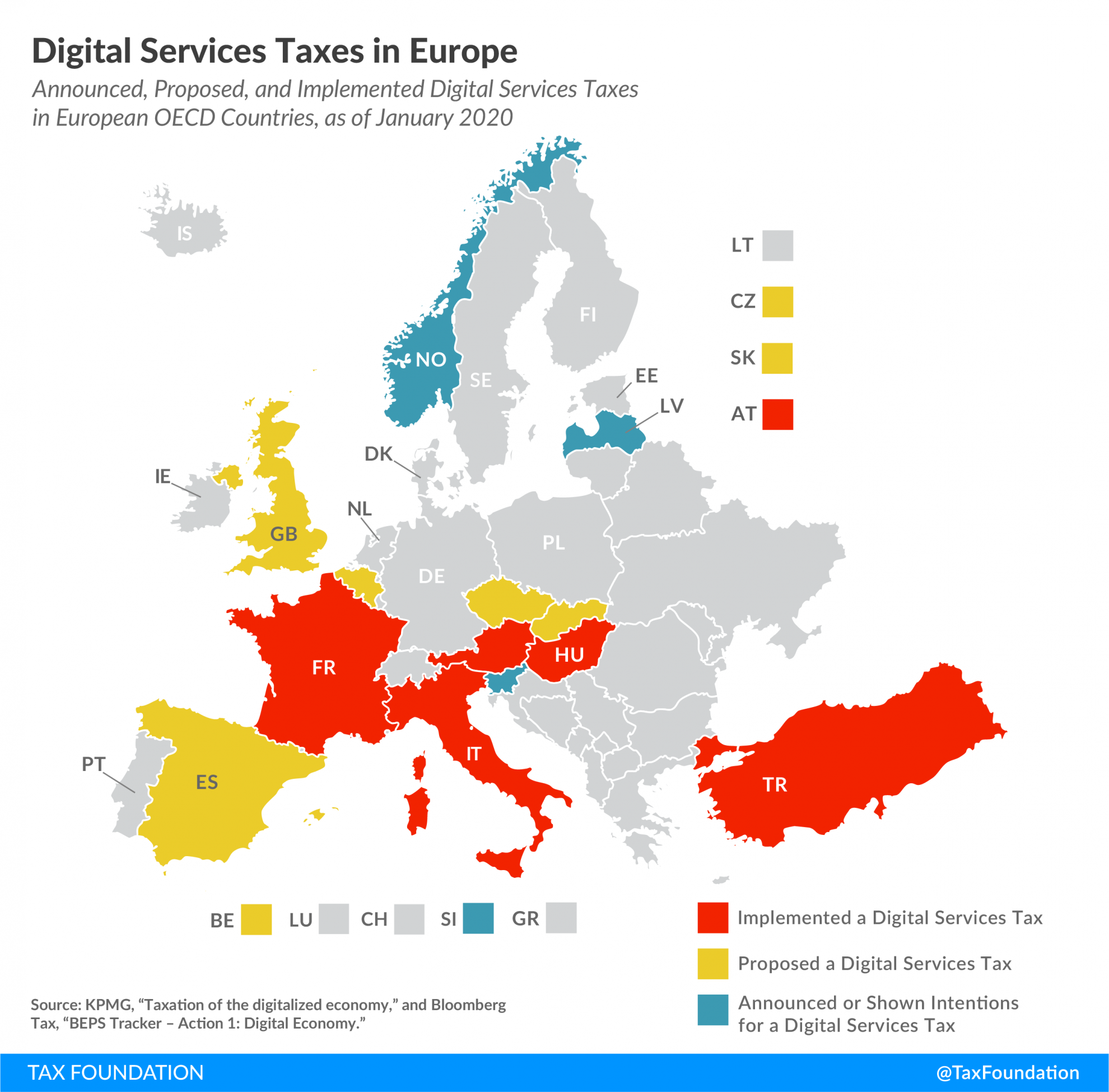

However, despite these ongoing multilateral negotiations, several countries have decided to move ahead with unilateral measures to tax the digital economy. About half of all European OECD countries have either announced, proposed, or implemented a digital services tax (DST), which is a tax on selected gross revenue streams of large digital companies.

As of January 2020, Austria, France, Hungary, Italy, and Turkey have implemented a DST. Belgium, the Czech Republic, Slovakia, Spain, and the United Kingdom have published proposals to enact a DST, and Latvia, Norway, and Slovenia have either officially announced or shown intentions to implement such a tax. Poland recently suspended its work on the digital services tax.

The proposed and implemented DSTs differ significantly in their structure. For example, while Austria and Hungary only tax revenues from online advertising, France’s tax base is much broader, including revenues from the provision of a digital interface, targeted advertising, and the transmission of data collected about users for advertising purposes. The tax rates range from 2 percent in the UK to 7.5 percent in both Hungary and Turkey (although Hungary’s tax rate is temporarily reduced to 0 percent).

Although these DSTs are generally considered to be interim measures until an agreement is reached at the OECD level, it is unclear whether all of them will be repealed at that point.

|

Sources: KPMG, “Taxation of the digitalized economy,” Jan. 23, 2020, https://tax.kpmg.us/content/dam/tax/en/pdfs/2020/digitalized-economy-taxation-developments-summary.pdf, and Bloomberg Tax, “BEPS Tracker – Action 1: Digital Economy,” https://www.bloomberglaw.com/product/tax/aqb_chart/2917a095db6af1d712cbf7034d7be88d. |

|||||

| Country | Tax Rate | Scope | Global Revenue Threshold | Domestic Revenue Threshold | Status |

|---|---|---|---|---|---|

| Austria (AT) | 5% | Online advertising | €750 million | €25 million | Implemented (effective from January 2020) |

| Belgium (BE) | 3% | Selling of user data | €750 million | €50 million in the EU | Proposed |

| Czech Republic (CZ) | 7% | · Targeted advertising · Use of multilateral digital interfaces · Provision of user data |

€750 million | CZK 100 million (€4 million) | Proposed (implementation expected in mid-2020) |

| France (FR) | 3% | · Provision of a digital interface · Targeted advertising · Transmission of data collected about users for advertising purposes |

€750 million | €25 million | Implemented (retroactively applicable as of January 1, 2019; France has agreed to suspend the collection of the DST until December 2020 in exchange for the U.S. agreeing to hold off on retaliatory tariffs on French goods) |

| Hungary (HU) | 7.5% | Advertising revenue | HUF 100 million (€300,000) | N/A | Implemented (as a temporary measure, the advertisement tax rate has been reduced to 0%, effective from July 1, 2019 through December 31, 2022) |

| Italy (IT) | 3% | · Advertising on a digital interface · Multilateral digital interface that allows users to buy/sell goods and services · Transmission of user data generated from using a digital interface |

€750 million | €5.5 million | Implemented (effective from January 2020) |

| Latvia (LV) | – | – | – | – | Announced/Shows Intentions (the Latvian government commissioned a study to determine the increase of tax revenue based on the assumption that the country levies a 3% DST) |

| Norway (NO) | – | – | – | – | Announced/Shows Intentions (Norway plans to introduce a unilateral measure in 2021 if the OECD does not reach a consensus solution in 2020) |

| Poland (PL) | – | – | – | – | Deputy finance minister announced in May 2019 that Poland will introduce digital taxation. In September 2019, it was stated that Poland has suspended its work on digital taxation and would like to adopt a solution reached at the EU/OECD level. |

| Slovakia (SK) | – | – | – | – | Proposed (the Ministry of Finance opened a consultation on a proposal to introduce a digital services tax on revenue of nonresidents from provision of services such as advertising, online platforms, and sale of user data; however, there were no further steps and none of the political parties have put forward digital tax as their priority agenda) |

| Slovenia (SI) | – | – | – | – | Announced/Shows Intentions (Ministry of Finance announced a government proposal to submit a draft bill to the National Assembly introducing a digital services tax in Slovenia by April 1, 2020; the tax is expected to apply from September 1, 2020) |

| Spain (ES) | 3% | · Online advertising services · Sale of online advertising · Sale of user-data |

€750 million | €3 million | Proposed (the Spanish Parliament rejected the government’s proposed budget bill for 2019, which included the digital services tax; however, the new government might reintroduce a DST proposal) |

| Turkey (TR) | 7.5% | Online services including advertisements, sales of content, and paid services on social media websites | €750 million | TRY 20 million (€3.1 million) | Implemented (effective from March 2020) |

| United Kingdom (GB) | 2% | Revenues of search engines, social media platforms, and online marketplaces | £500 million (€554 million) | £25 million (€28 million) | Proposed (UK Chancellor announced that the government plans to go ahead with its DST proposal in April 2020) |

Source: Tax Policy – Digital Services Taxes in Europe