Tax Policy – Maryland Legislature Seeks Revenue with Risky Proposals

Ever since Maryland’s Commission on Innovation and Excellence in Education, better known as the Kirwan Commission, began presenting its recommendations for improving Maryland’s education system more than two years ago, Maryland lawmakers have been looking for revenue to cover the proposed increases in education spending. The Kirwan plan would add $4 billion in annual costs over a decade. These costs would be split between the state government and local governments.

Both Governor Larry Hogan (R) and the legislature have promised to not increase rates on the three big state taxes: property, income, and sales. This leaves lawmakers with few options to raise the additional revenue and has forced the legislature to find creative, and usually quite harmful, revenue proposals. This legislative session, lawmakers wishing to raise additional revenue have proposed:

- expanding the sales tax base to include consumer and business services,

- taxing gross receipts of digital advertising revenue,

- adopting a throwback rule,

- taxing digital downloads through the sales tax,

- increasing tobacco and vaping excise taxes, and

- legalizing and taxing sports betting

Governor Hogan has expressed opposition to several of the proposals—notably the taxation of digital advertising and a sales tax base broadening. However, Democrats hold a two-thirds majority in the state house, which could threaten the Governor’s ability to sustain a veto of these tax increases.

Among the remaining four revenue options, two (adopting a throwback rule and relying on tobacco excise taxes) are problematic and would prove self-defeating; one is a straightforward base expansion (including digital downloads in the sales tax base); and one is murky (legalizing sports betting).

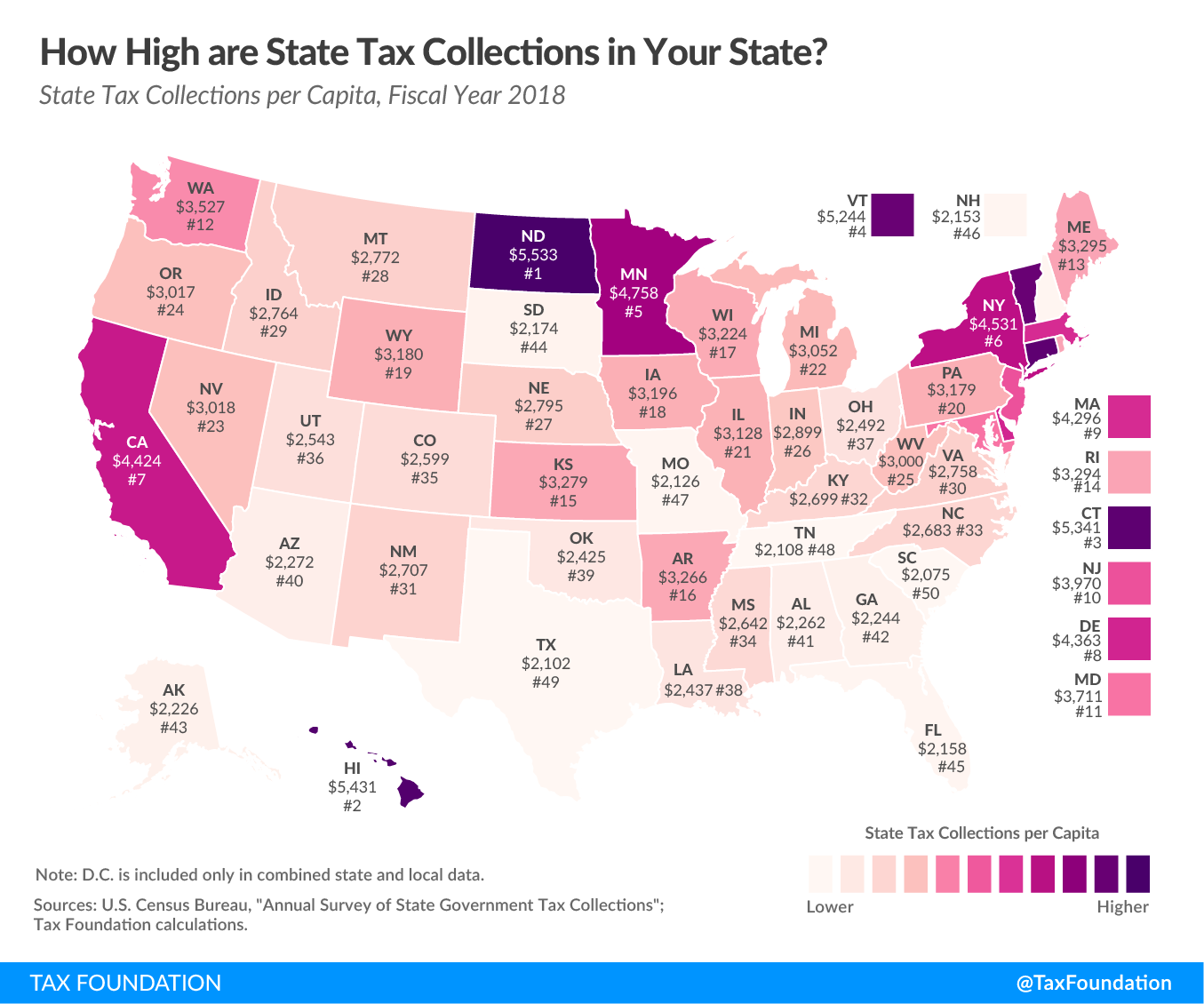

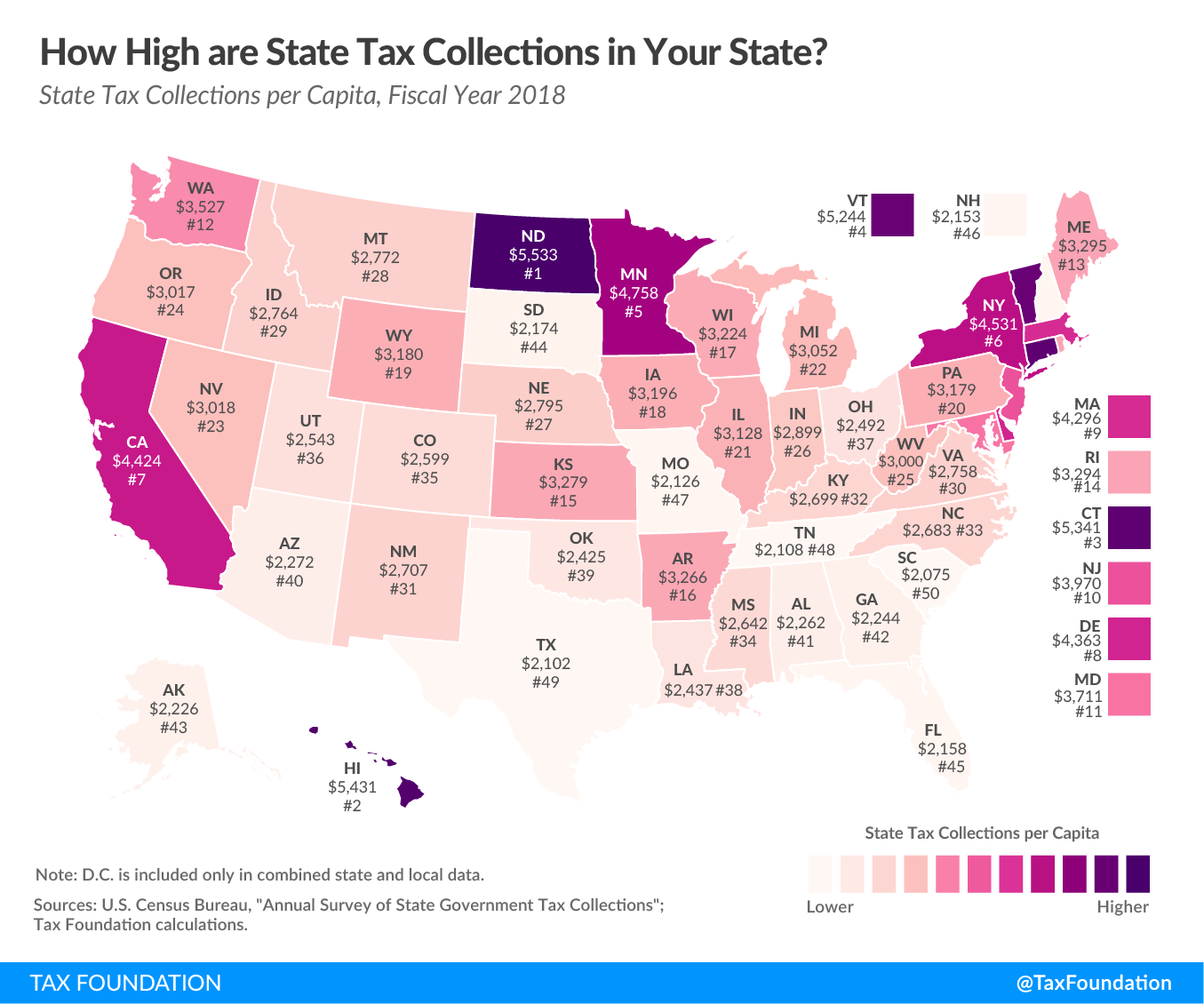

A general rule of thumb is that states should raise revenue for general spending priorities by levying broad-based taxes with low rates to guarantee stable, competitive, and neutral taxation. This is not as easy as it seems, as Maryland is already a high-tax state, collecting the 11th most in state taxes per capita from residents in fiscal year 2018. And aside from its high tax burden, Maryland ranks 43rd most competitive on the Tax Foundation’s State Business Tax Climate Index, which is a measure of the structural competitiveness of a state’s tax code rather than the total burden of taxes. In other words, there are no obvious easy choices for lawmakers looking for new revenue in Maryland, because any change would increase Maryland’s high tax burden and likely worsen the state’s structural competitiveness.

Like most other states, the bulk of Maryland’s state-level tax collections are split among sales taxes, excise taxes, and individual income taxes.

|

Source: Federation of Tax Administrators. |

|||||

| Property | Sales | Excise | Individual Income | Corporate Income | Other |

|---|---|---|---|---|---|

| 3.6% | 21% | 21.6% | 42.4% | 4.6% | 6.7% |

Digital advertising gross receipts tax

Maryland’s digital advertising tax would apply to revenues derived from digital advertising in the state based on a user’s IP address or reasonable suspicion of location. The rate would range from 2.5 to 10 percent based on the gross revenues of the companies. The tax is highly discriminatory and likely to attract legal challenges as it singles out online advertising and utilizes arbitrary revenue thresholds to determine tax burden. For full analysis, read this blog post.

Sales tax on all services

Another proposal, HB1628, would expand the state sales tax base to include services and raise an estimated $2.6 billion annually by 2025. But the proposal defines services in a way that would not only tax consumer services but also business inputs, which actually constitute the vast majority of the proposed expansion. This would cause tax pyramiding that would hurt Maryland’s competitiveness and increase costs for all Marylanders. For full analysis, read this blog post.

A healthier sales tax base broadening

Although some sales tax proposals would be overly broad and harmfully imposed on business inputs, there is room to improve Maryland’s sales tax by including consumer services in the sales tax base. However, given the high tax collections in Maryland, a base-broadening measure would be best paired with a lower rate on either sales or income taxes as a revenue-neutral improvement to the code.

An obvious first step, given modern consumption patterns, would be to include digital downloads in the sales tax base. SB1001 (HB932) would do just that. Today, consumers are more likely to buy a movie online (not currently taxed under the sales tax code) than buy a physical DVD (taxed under the sales tax code). This adjustment of the sales tax code would not pay for the Kirwan Commission’s plan but is a positive step towards modernizing the tax code.

Throwback rule

Conversely, implementing HB473 would be a step back for Maryland. If enacted, the proposal would implement a corporate income throwback rule. The purpose of a throwback rule is to achieve 100 percent taxability of corporate income by taxing what is called “nowhere income.” To that end, Maryland would tax corporate income generated by sales made in destination states (outside Maryland) that lack the jurisdiction (defined by economic nexus standards) to tax that corporate income. Throwback (and throwout) rules are relatively common with 25 states and the District of Columbia having one or the other rule implemented in its corporate code.

However, rather than increasing corporate income tax revenue by imposing a new tax on sales made outside Maryland, throwback rules actually result in complex, nonneutral, uncompetitive taxation. Researchers find that throwback rules drive business activity out of states because it yields high—sometimes astronomically high—in-state tax burdens. Indeed, throwback rules have such an effect on business activity that multiple studies have found that their adoption drives out enough business activity to offset the tax revenue gains that would otherwise be anticipated from taxing additional business income. Thus, over the long run, throwback rule states generate no new tax revenue but do experience economic losses due to the reconfiguration of business activity.

Cigarette, vaping, and sports betting taxes

HB732 would increase the excise tax on tobacco by $2 per pack to a total of $4 per pack of 20 cigarettes. According to its fiscal note, HB732 would raise revenues by $60.7 million in FY2021. Increasing taxes on sinful products such as tobacco is perhaps a politically expedient way to raise revenue, but it is not sustainable tax policy as tobacco excise taxes are an unstable source of tax revenue due to their narrow and declining consumer base. In addition to increasing the rate for cigarettes, HB732 includes a wholesale tax on vapor products at a rate of 86 percent. This high tax would have several negative effects on both public health and black-market activity.

One notable consequence of high state tobacco excise tax rates is increased smuggling as people procure discounted products from low-tax states and sell them in high-tax states. Smugglers wouldn’t have to look far to find cheaper smokes. All of Maryland’s neighboring states have rates lower than $4 per pack, including Virginia ($1.20) and West Virginia ($0.30). Such an increase would impact the many small business owners operating vape shops around the state and convenience stores relying heavily on vapers as well as tobacco sales.

Further, high taxes on vapor products makes it more difficult for adult smokers to switch from more harmful products to less harmful products by limiting availability of vapor products. That means excise taxes on cigarettes are less effective when vapor products are also taxed. In effect, high excise taxes on harm-reducing vapor products risks harming public health by reducing the switch from smoking to vaping. A recent publication found that 32,400 smokers in Minnesota were deterred from quitting cigarettes after the state implemented a 95 percent excise tax on vapor products.

The issues with relying on excise taxes as a revenue source also crop up for sports betting. SB4 has passed the Senate and is awaiting action in the House. Under current law, any proposal to legalize betting would need voter approval. No details are available about what the tax structure would look like. Nonetheless, states legalizing sports betting in hopes of balancing or growing their budgets might find a slight bump in revenue, but it is not a long-term solution to budget woes. Gambling can be part of the revenue picture—but states shouldn’t bet the house on it.

Maryland lawmakers have no easy answers as they seek substantial revenue increases. None of the current options are ideal, especially in a state that already has high taxes. Conversely, these proposals have the potential to significantly hurt economic conditions for Maryland businesses. The various proposals would create tax pyramiding by taxing business inputs with the sales tax; increase advertising costs for local businesses with a digital advertising tax; impose the counterproductive corporate income tax throwback rule; and drive increased tobacco smuggling while worsening health outcomes with cigarette taxes and vaping taxes.

Lawmakers face significant costs as they balance the trade-offs between their desire to dramatically raise new revenue for education spending and their need to protect Maryland’s already limited tax competitiveness.

Source: Tax Policy – Maryland Legislature Seeks Revenue with Risky Proposals