Tax Policy – Ohio Voters To Consider Requiring Two-Thirds Majority for Income Tax Increases

Ohio Senator Dave Burke (R) and 11 cosponsors have proposed an amendment to the Ohio constitution regarding taxes by introducing Senate Joint Resolution 3. The proposal would, if approved, require two-thirds majority in both General Assembly chambers to increase the individual income tax. It is no simple feat to add an amendment to Ohio’s constitution. The resolution requires three-fifths support in both chambers to pass the General Assembly and must then be approved by a majority of voters in November.

Supermajority requirements for new or higher taxes are a common and long-standing practice that is currently in place in 15 states (several states have certain exceptions from the requirements). These requirements can be useful as they increase the transparency and stability of the tax code. Transparency and stability are two of Tax Foundation’s four principles for sound tax policy. Supermajority requirements address transparency and stability by requiring increased consideration and scrutiny before tax increases can happen, which would have a positive effect on Ohio’s competitiveness. Further, supermajority requirements empower the minority party to impact tax policy—something which may not be the case with a simple majority requirement.

The joint resolution follows a series of individual income tax reforms in Ohio over the past 15 years. In fact, the state income tax burden in Ohio has seen positive declines over the last few years. Last year, the number of income tax brackets were consolidated from eight to six, and income up to $21,750 is now exempted from state income tax. Nonetheless, in Tax Foundation’s 2020 State Business Tax Climate Index, which evaluates states based on their overall tax structure, Ohio still ranks 44th for individual income tax structure (an improvement from 48th in 2018).

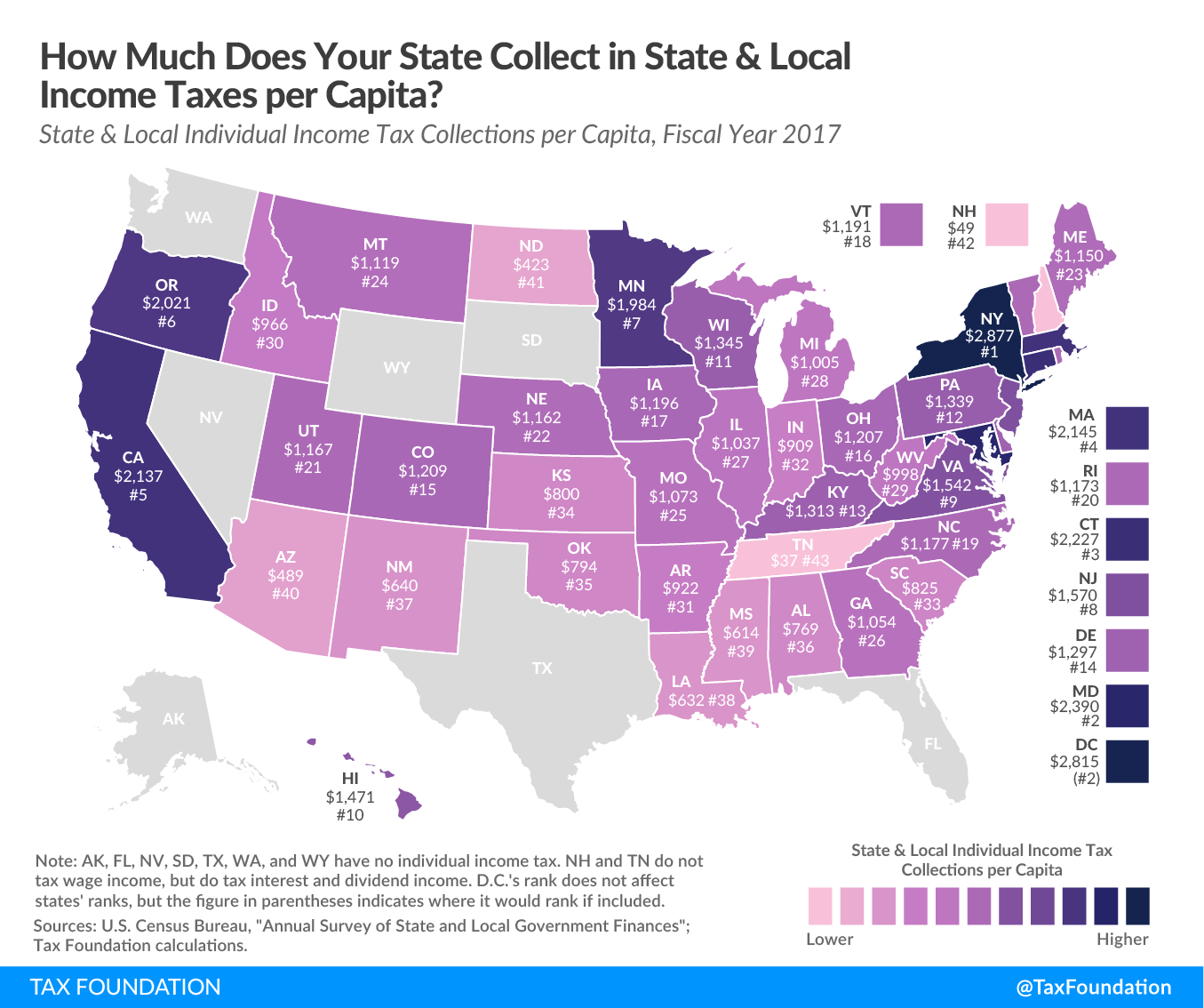

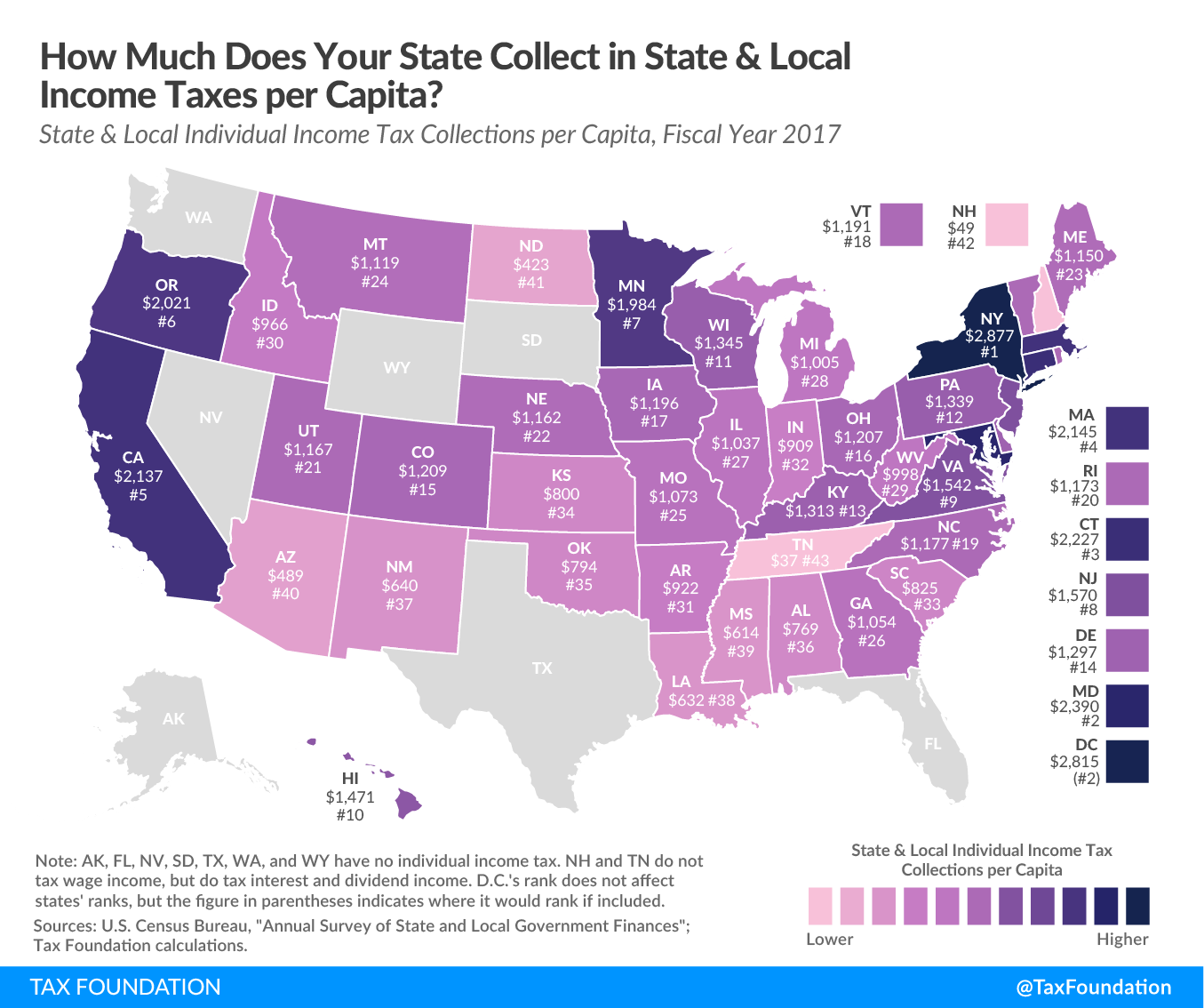

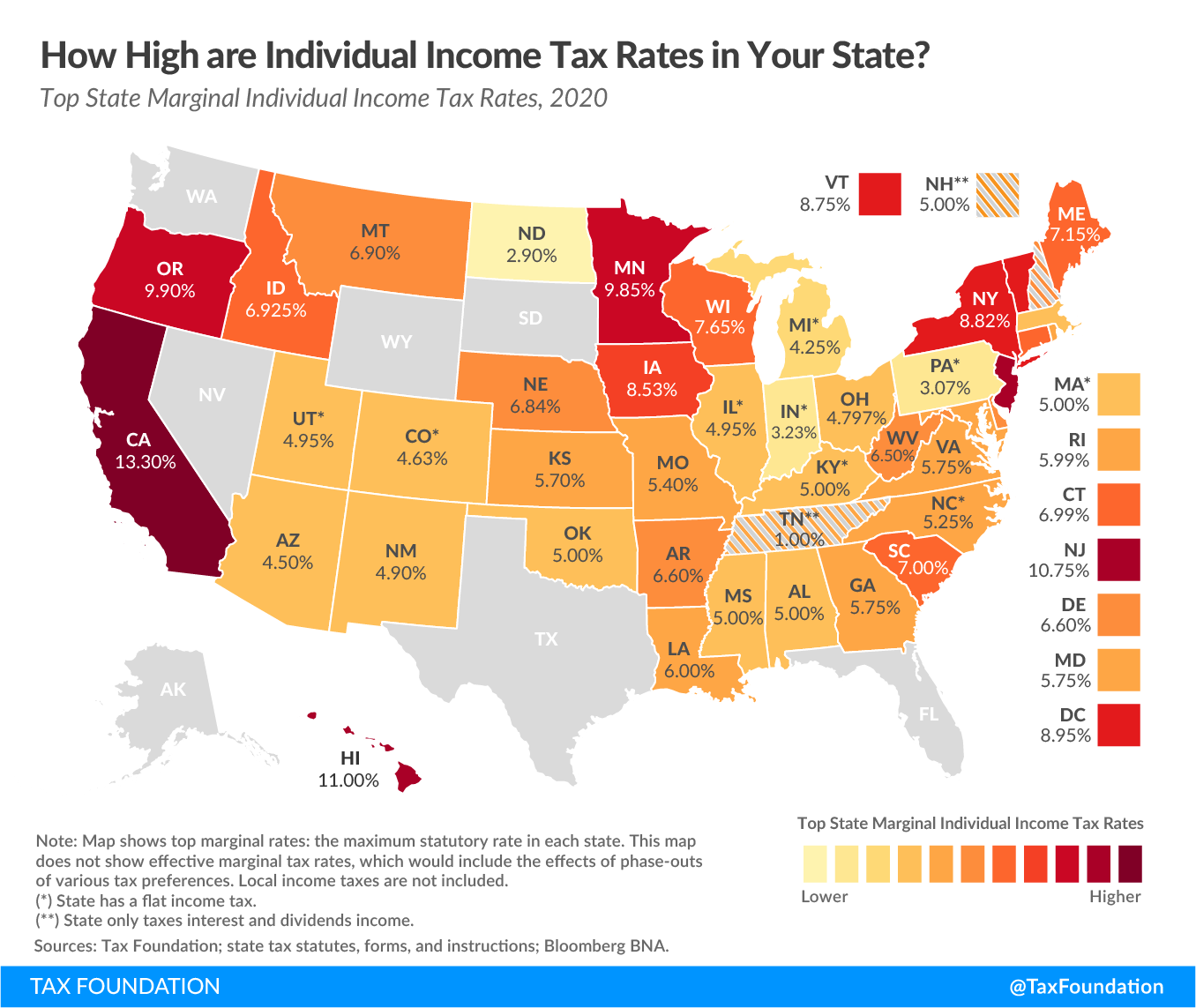

In addition to a problematic structure, Ohio taxpayers still pay a relatively high amount in state and local income taxes relative to most other states. Ohio is 16th in state and local individual income tax collections per capita, collecting $1,207 in fiscal year (FY) 2018.[1] However, an important factor to consider, especially in Ohio, is local income taxes. If we subtract out local income tax collections, Ohio only ranks 36th in state collections per capita with collections of $744 in FY 2017. Due to the continuous reform to Ohio’s income tax design, the rank is down from 28th in state income tax collections per capita collections of $854 in FY 2012. In other words, Ohio’s state income tax collections per capita have shrunk relative to other states in the last few years. The current top rate is 4.797 percent, but looking at the neighboring states, all except West Virginia levy a lower marginal rate state income tax than Ohio.

While Senate Joint Resolution 3 would reinforce the transparency and stability of Ohio’s state income tax, the amendment does not affect the ability of localities to increase income taxes on their residents (though localities may have to be careful for other reasons). As described above, local income taxes are an important factor affecting Ohio’s competitiveness—more so in Ohio than most other states. In fact, Ohio has 848 local income tax jurisdictions and the rate can be as high as 3 percent in addition to the state income tax.

Lawmakers should continue to improve Ohio’s tax code to enhance their competitive advantages. A supermajority requirement for increases to the individual income tax can be part of that picture, but it is hardly a fix-all.

[1] Latest available data. Data does not reflect income tax reform taking effect from tax year 2019.

Source: Tax Policy – Ohio Voters To Consider Requiring Two-Thirds Majority for Income Tax Increases