Tax Policy – Senate Republicans Release Economic Relief Plan for Individuals and Businesses

Thursday evening, Senate Republicans released the Coronavirus Aid, Relief and Economic Security (CARES) Act. This bill is intended to be a third round of federal government support in the wake of the coronavirus public health crisis and associated economic fallout, following the $8.3 billion in public health support passed two weeks ago and the Families First Coronavirus Response Act.

The CARES Act builds on the two former pieces of legislation by providing more robust support to both individuals and businesses, including changes to tax policy. The bill includes:

- $300 billion allocated for Small Business Interruption Loans, which are meant to help small businesses (fewer than 500 employees) impacted by the pandemic and economic turndown make payroll and cover other expenses. Notably, small businesses may take out loans up to $10 million and cover employees making up to $100,000 per year; loans taken for this purposes are forgiven after four months if the business does not lay off its employees (forgiveness is scaled down as layoffs rise).

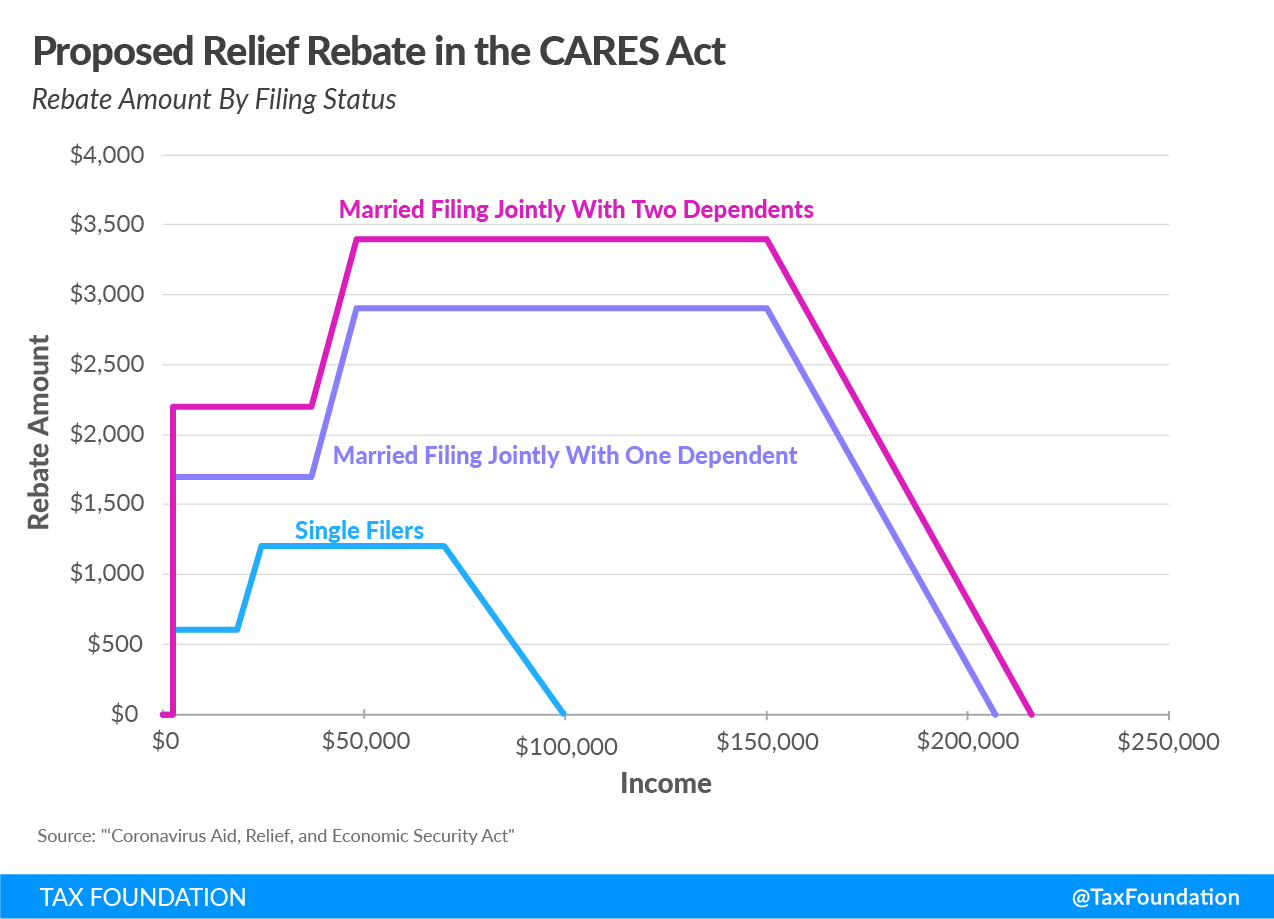

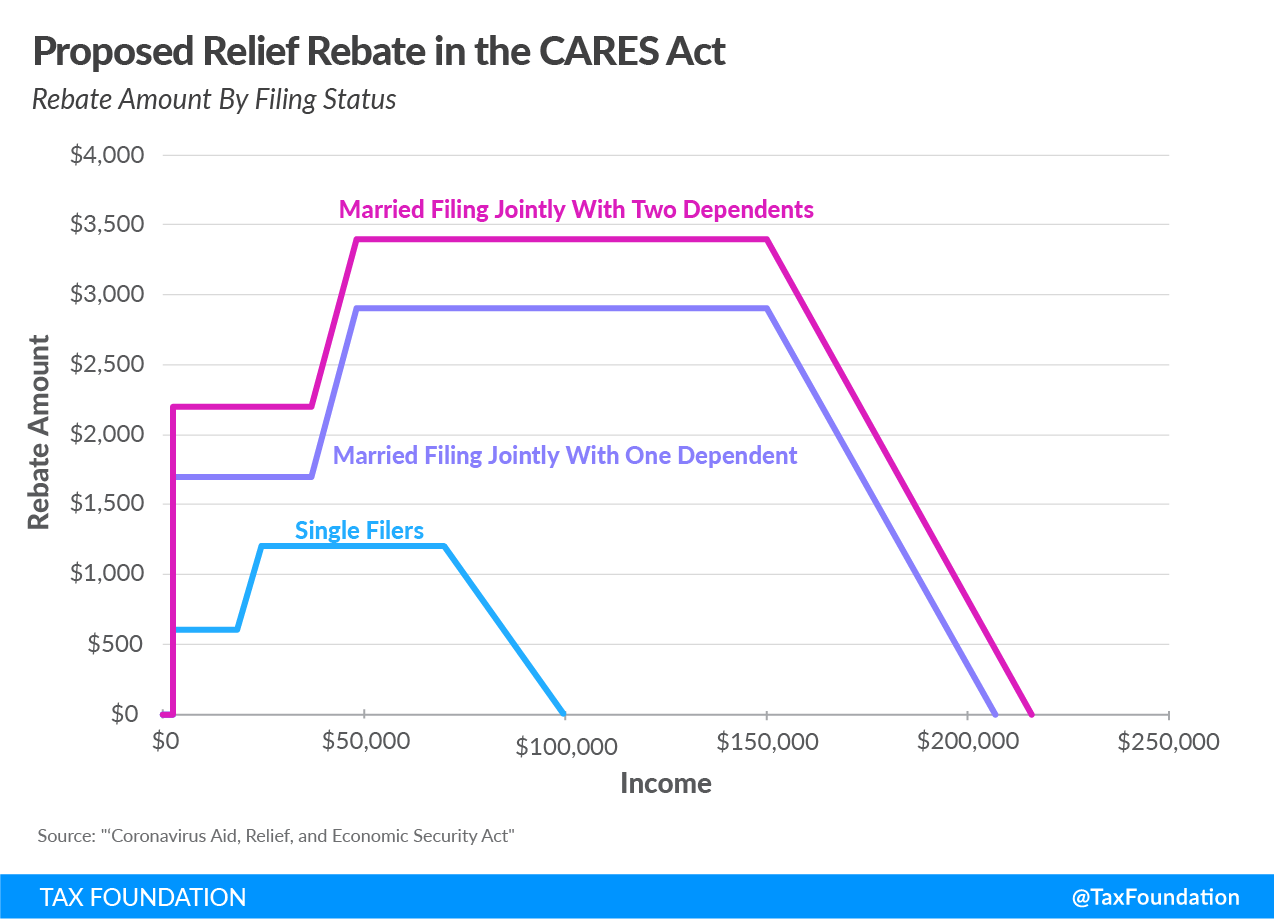

- A Recovery Rebate for individual taxpayers. Taxpayers with $2,500 in qualified income (defined as earned income, income from Social Security and certain pension income for veterans) qualify for a minimum rebate of $600 for singles and $1,200 for taxpayers filing jointly. From there, the rebate increases dollar-for-dollar with tax liability before credits until it reaches its maximum at $1,200 for singles and $2,400 for taxpayers filing jointly (see Chart 1). This means that refundable credits like the Child Tax Credit (CTC) and Earned Income Tax credit (EITC) are not considered when determining tax liability for the credit.

The rebate phases out at $75,000 for singles and $150,000 for joint taxpayers at 5 percent per dollar of qualified income, or $50 per $1,000 earned. It phases out entirely at $98,000 for single taxpayers and $198,000 for joint taxpayers. Additionally, taxpayers making $2,500 in qualified income with children will receive a flat $500 for each child, though this amount is also subject to the phaseout.

We estimate the rebate will decrease federal revenue by about $248 billion in 2020, according to the Tax Foundation General Equilibrium Model. This credit is one-time, but policymakers may consider additional rebates if the downturn is prolonged.

We estimate that the rebates would increase taxpayer after-tax income by about 2.05 percent, ranging from 7.11 percent at the lowest quintile and falling to 1.82 percent for the 80th to 90th percentiles. The rebate is structured progressively but does not include non-filers who tend to have lower income. The rebate would also use 2018 tax returns to determine rebate eligibility, which may not accurately reflect individual incomes in 2020.

| Income level | Percent Change in After-Tax Income |

|---|---|

| 0% to 20% | 7.11% |

| 20% to 40% | 4.31% |

| 40% to 60% | 4.03% |

| 60% to 80% | 2.90% |

| 80% to 90% | 1.82% |

| 90% to 95% | 0.65% |

| 95% to 99% | 0.02% |

| 99% to 100% | 0.00% |

| Total | 2.05% |

|

Source: Tax Foundation General Equilibrium Model, November 2019. |

|

- The 2019 tax filing deadline and quarter 1, 2, and 3 estimated payments would be moved to October 15, 2020, with no cap on the amount of tax payments that can be postponed.

- Creates a $300 above-the-line charitable contribution deduction for filers taking the standard deduction and expands the limit on charitable contributions for itemizers.

- Waives the 10 percent early withdrawal penalty on retirement account distributions for taxpayers facing virus-related challenges. Withdrawn amounts are taxable over three years, but taxpayers can recontribute the withdrawn funds into their retirement accounts for three years without affecting retirement account caps.

- A variety of business tax provisions:

- Corporations may delay making quarterly estimated payments until October 15, 2020.

- Employer-side Social Security payroll tax payments may be delayed until January 1, 2021. The Social Security Trust Fund will be backfilled by general revenue in the interim period.

- Firms may take net operating losses (NOLs) earned in 2018, 2019, or 2020 and carry back those losses five years. The NOL limit of 80 percent of taxable income is also suspended, so firms may use NOLs they have to fully offset their taxable income.

- The net interest deduction limitation, which currently limits businesses’ ability to deduct interest paid on their tax returns to 30 percent of earnings before interest, tax, depreciation, and amortization (EBITDA), has been expanded to 50 percent of EBITDA for 2019 and 2020. This will help businesses increase liquidity if they have debt or must take on more debt during the crisis.

- Technical corrections to the depreciation treatment of qualified improvement property (QIP) and the limitation on downward attribution of stock ownership, which affected foreign subsidiaries of U.S. firms to excessive tax and reporting requirements.

- Aviation excise taxes on kerosene are suspended until January 1, 2021. We estimate this will reduce federal revenue by about $8 billion in 2020.

- $208 billion in emergency relief to businesses such as airlines through loans and loan guarantees.

- Health provisions to address the coronavirus crisis, including provisions addressing supply shortages, coverage of diagnostic testing for the virus, support for health-care providers, improving telehealth service access and flexibility, encouragement for the creation of drugs to treat the virus, and support for educational institutions.

The CARES Act is a positive step forward to provide economic relief to individuals and businesses facing hardship or economic ruin due to this crisis. However, several aspects of the proposal can be improved.

The recovery rebate design is most problematic, as it relies on phase-in and phaseout provisions rather than providing across-the-board relief for all households. The phase-in provisions may bypass or reduce the rebate to the most vulnerable. The phaseout provisions are a form of means testing, but households in a strong financial position in 2018 may be in economic distress today. If Congress intends to means test relief, one way to do so is to claw back when tax returns are filed next spring based on 2020 income. That way, there is minimal delay in getting the rebate out, but high-income households do not benefit in the long run. This also has the benefit of using 2020 tax return information, which is the most appropriate metric for relief, not 2018 return information.

The business provisions improve a firm’s ability to remain liquid and survive through the crisis, but more could be done given the scale of the challenge. In addition to providing NOL carrybacks for five years and suspending the net income limitation, policymakers could permit firms to accelerate the NOL deductions they currently hold, ensuring firms that did not make large profits in previous years also benefit. Additionally, the net interest limitation could be suspended entirely for this tax year.

We are optimistic that policymakers can build on this bill to ensure individuals and businesses can weather the storm and rebound effectively when the crisis abates.

Source: Tax Policy – Senate Republicans Release Economic Relief Plan for Individuals and Businesses