Tax Policy – Norway Opens the Fiscal Toolbox

The coronavirus outbreak has caused policymakers around the world to think through ways to respond to the health crisis. A major element of that response has been to shutter businesses and cancel public events. This has led to major reductions in economic activity, and policymakers have responded in creative ways to support businesses and workers through this period.

The economic response to the crisis should be designed to be temporary and targeted and not be contrary to longer-term strategies to support growth. Several fiscal policy tools, including some suggested by the OECD, have been put to use in countries around the world.

Norway has adopted a response to the crisis which provides some valuable examples for policies that could be implemented in other countries.

Norway began shutting down events, businesses, and restricting travel on March 12. On March 21, the government passed a large package for tax relief and to address layoffs and bankruptcies.

The tax policies include:

- Introduction of a loss carryback provision

- Reduction of the lower rate of VAT

- Various tax payment delays

- Targeted postponements for wealth tax payments

- Reduction on taxes for air travel

Additionally, a two-month reduction in employee payroll taxes by four percentage points has been considered.

In addition to these policies, broader fiscal support measures include NOK 100 billion (US $10 billion) in loan guarantees for businesses, and a reduction in employer costs for temporary layoffs.

The entire policy package is designed to provide generous fiscal relief, although, some pieces will likely be more helpful than others. The policy response to the outbreak also reveals weaknesses in Norway’s tax system. The crisis should lead policymakers to consider ways to not only address the current crisis but to permanently improve the tax system.

Loss Carryback Provision

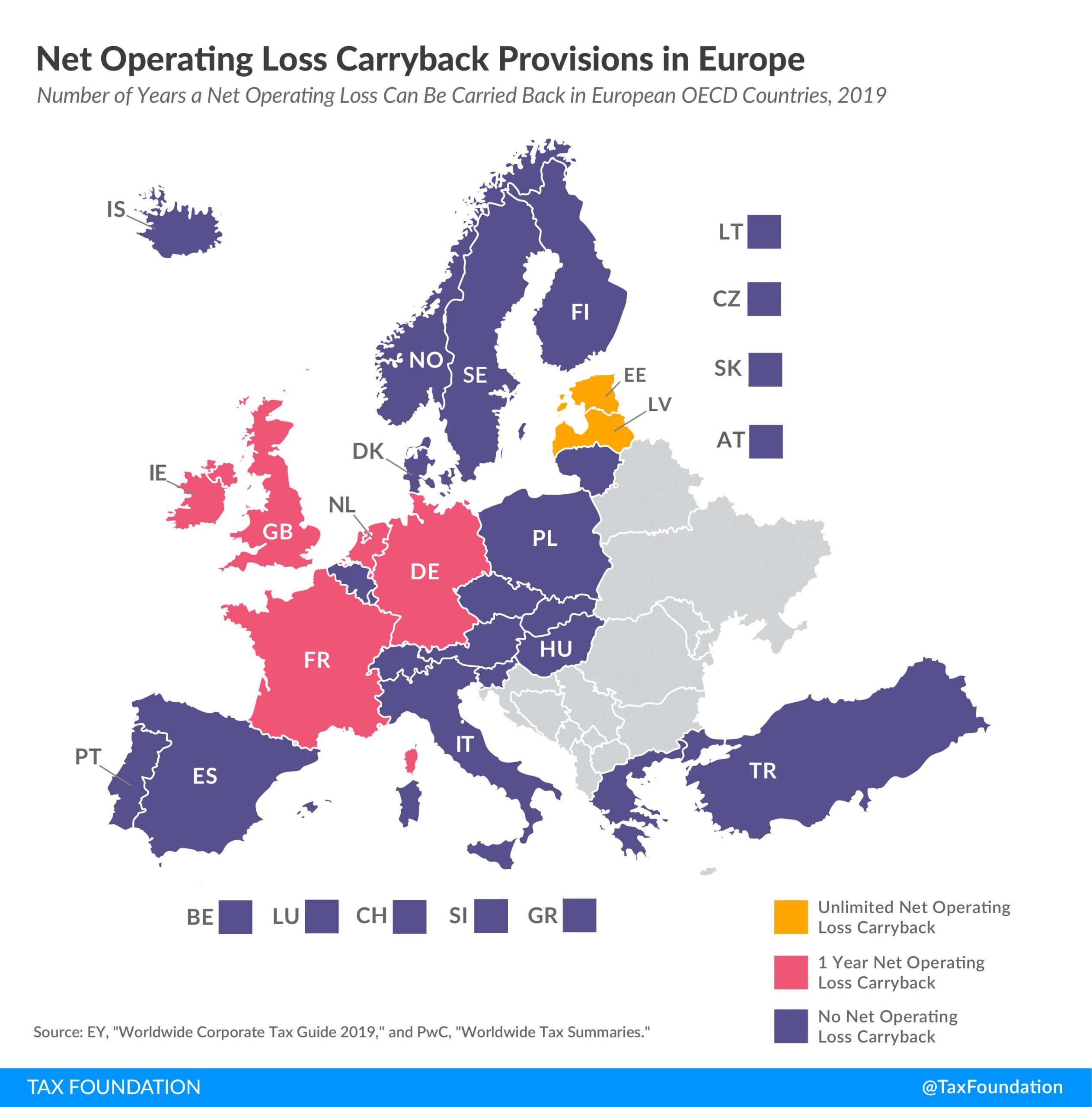

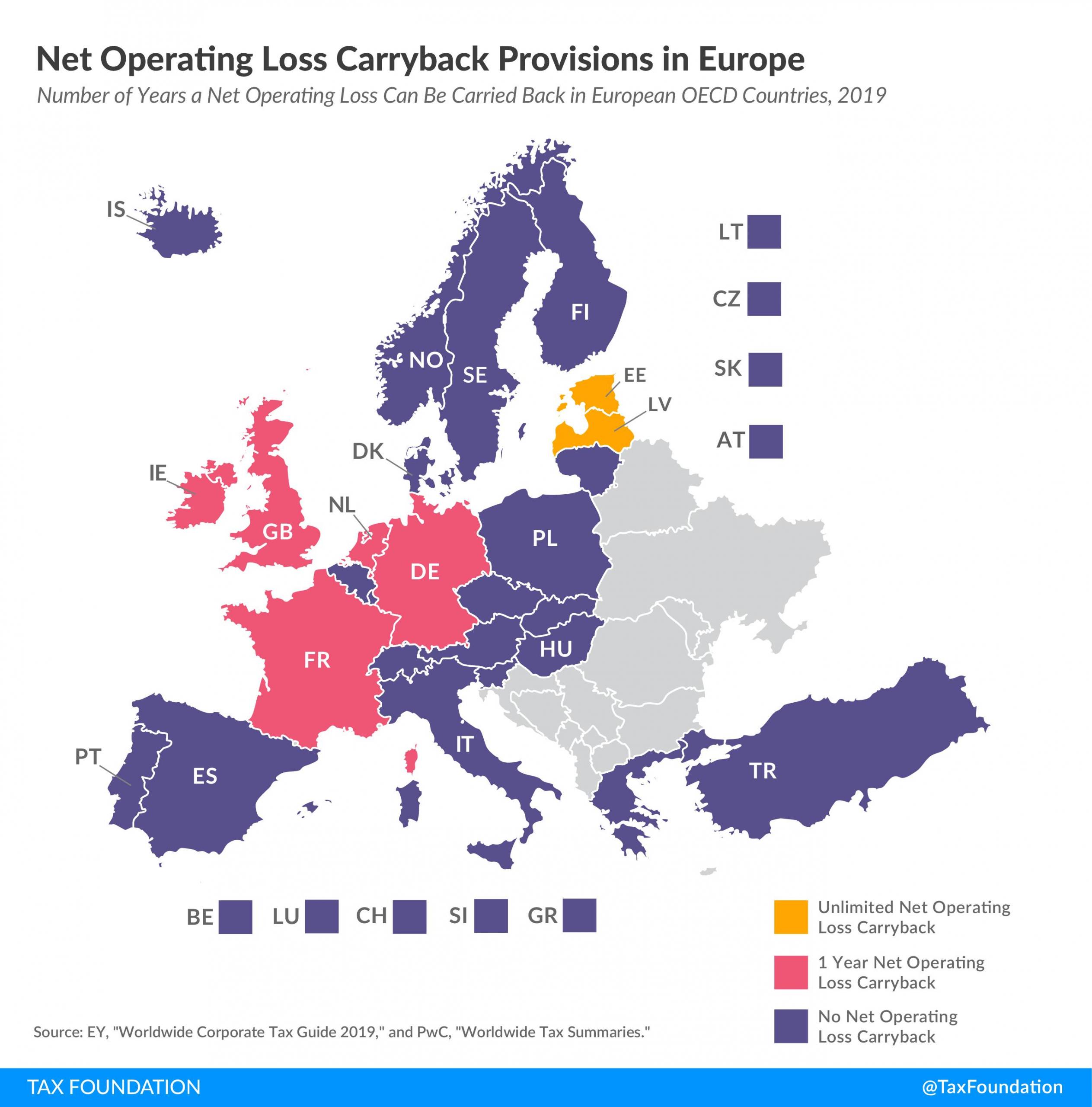

Loss provisions are a standard feature in many tax codes, generally allowing businesses to deduct current losses against future profits. However, loss carryback provisions where businesses can deduct current losses against past profits and adjust their past tax payments are less common. In 2019, 26 of the 36 OECD countries did not allow any loss carrybacks. Loss provisions can work as automatic stabilizers, allowing businesses to reduce tax liability when times are bad.

Norway generally does not allow loss carrybacks, so the introduction of a temporary loss carryback provision in response to the coronavirus outbreak will be helpful to businesses that are seeking liquidity.

The proposal would allow businesses to reduce their tax liability from 2018 and 2019 by deducting losses incurred in 2020. Up to NOK 30 million (US $3 million) in tax relief can be obtained using the carryback provision.

As a temporary policy, the carryback provision will provide relief, but loss carrybacks also make good long-term policy and the government should consider making this a permanent part of Norwegian tax law.

Targeted Consumption Tax Reductions

The government has also adopted a targeted VAT reduction. Like many countries, Norway operates a VAT system with multiple rates. The main VAT rate is 25 percent, but reduced rates of 15 percent, 12 percent, 11.1 percent, and 0 percent can apply. Different goods and services are taxed at the different rates.

In response to the outbreak, the government is reducing the 12 percent rate which applies to cultural and sporting activities as well as transport services to 8 percent from March 20 to October 31, 2020.

This policy is a bit confusing given that one of the main responses to the outbreak has been to discourage participation in public events through cancellations. It is possible that the government wants to reduce the tax costs for tickets purchased for future events and travel. However, such a targeted policy change is likely to be less effective than broader measures.

The same could be said for the temporary suspension of the tax on air passengers. That tax has been suspended retroactive to January 1 through October 31.

Payment Delays

One of the broadest measures of tax relief in the Norwegian response has been to delay some tax deadlines.

- VAT payments due on April 14 are postponed to June 10

- Social security contributions due May 15 are postponed until August 15

The government is also allowing businesses that expect significant profit reductions relative to previous years to apply to reduce their advance income tax payments. For some businesses, that reduction could be all the way to zero.

Wealth Tax Reduction

Norway has a wealth tax of 0.85 percent that applies to net wealth above NOK 1.5 million (US $130,000). The Norwegian government is temporarily postponing payments of the wealth tax for individuals whose net wealth includes businesses that are running losses. Even during this period, businesses may feel pressure to pay out dividends to provide cash flow for their shareholders to pay their net wealth tax. However, the temporary delay could relieve that pressure and allow companies to keep more cash in their businesses.

This highlights one of the key flaws with wealth taxes—that businesses have to consider the wealth tax liability of their shareholders in determining whether to pay out dividends. This can be especially important for family-owned businesses, and at a time of economic crisis, it makes sense for the Norwegian government to postpone some wealth tax payments.

Conclusion

Countries are relying on multiple policies to address the economic fallout from the coronavirus outbreak. Some policies are more targeted than others and in Norway the tax policy response reflects ways that the tax system could be improved for the longer term. The country’s response to the crisis has shown the need for loss carrybacks, the challenge of administering a multi-rated VAT system, and ways the wealth tax can create distortions.

Source: Tax Policy – Norway Opens the Fiscal Toolbox