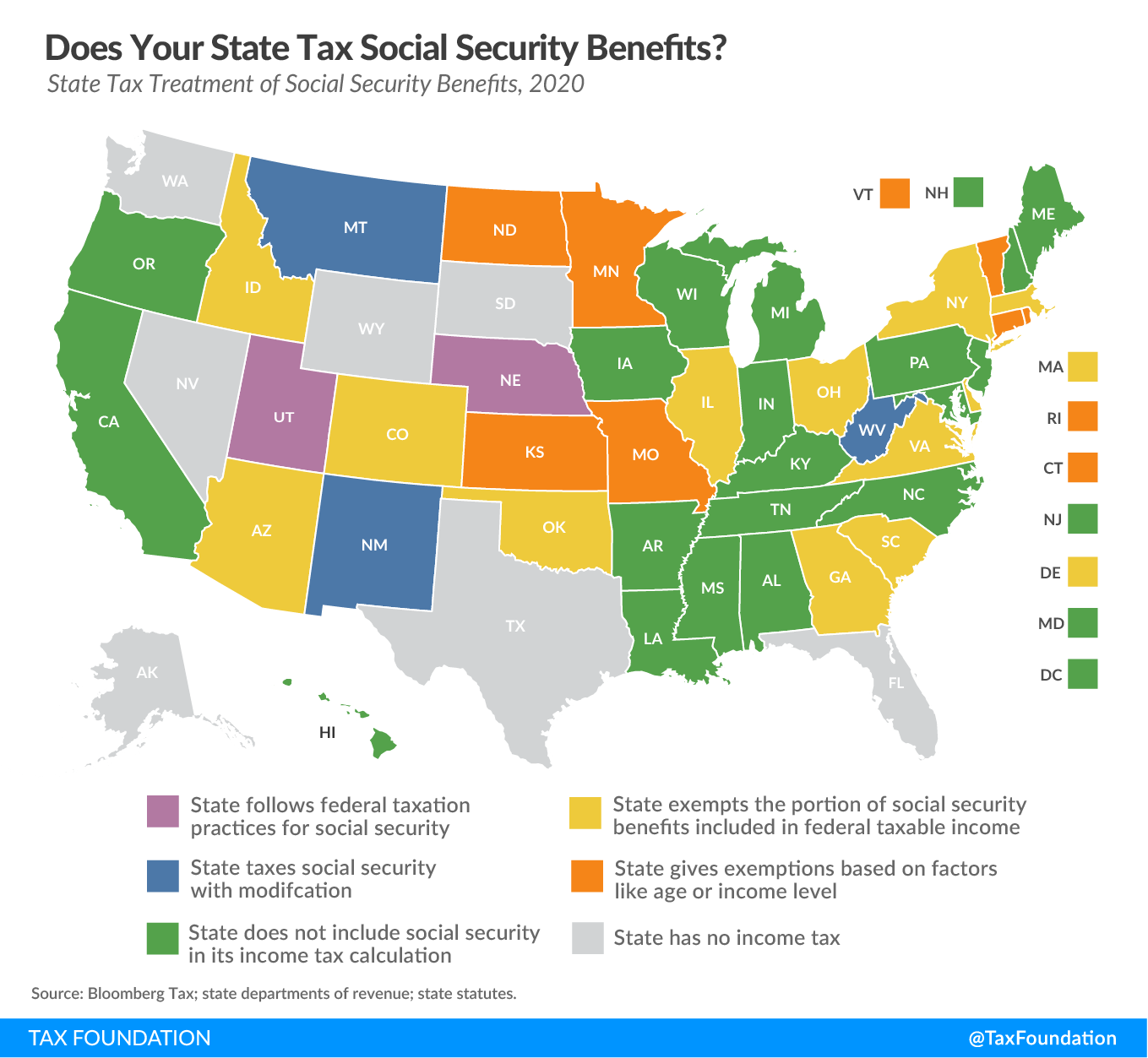

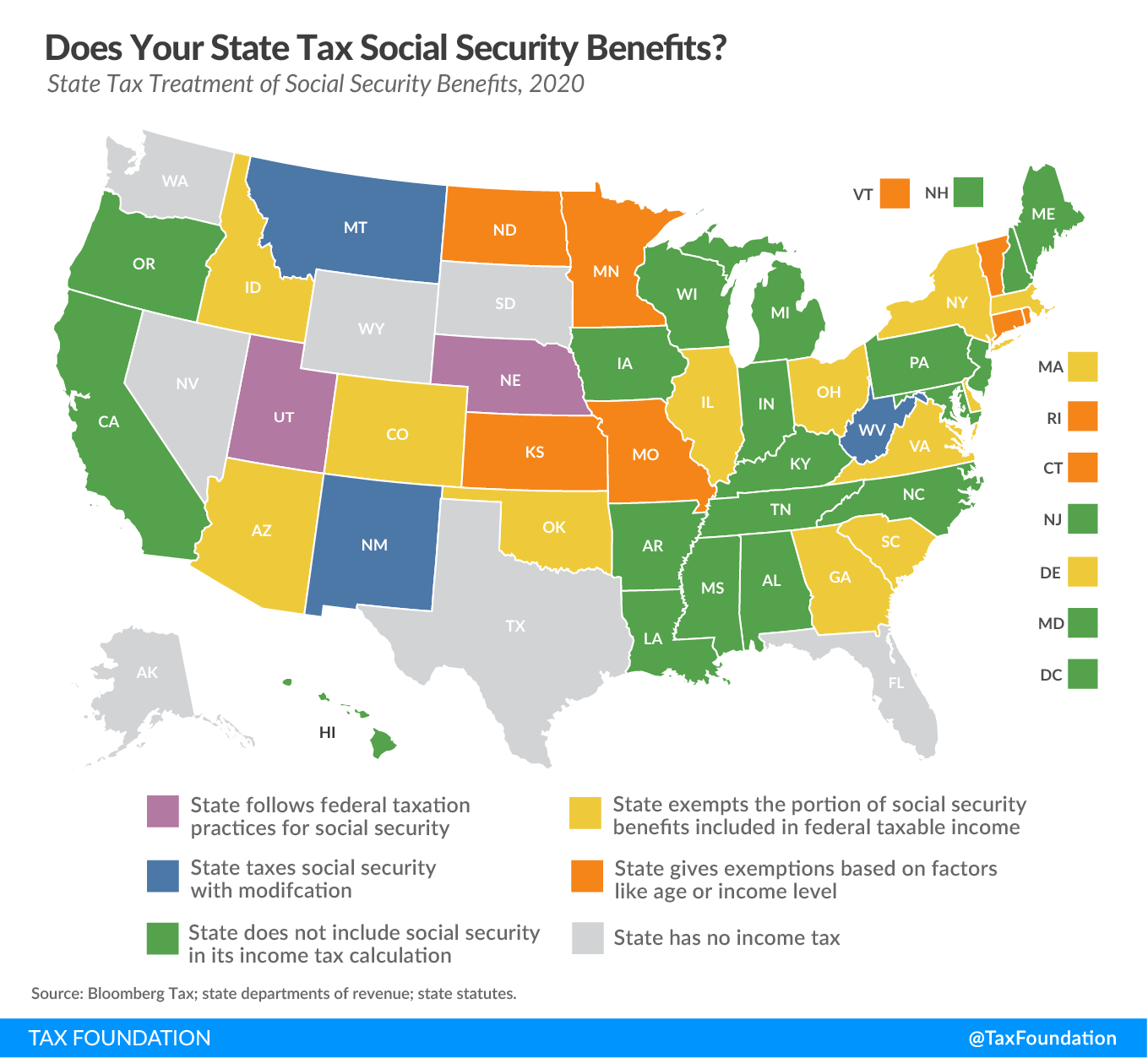

Tax Policy – Does Your State Tax Social Security Benefits?

The question, “Does my state tax Social Security benefits?” may be simple enough, but the answer includes a lot of nuance. Many states have unique and specific provisions regarding the taxation of Social Security benefits, which can be broken into a few broad categories. That’s what we do with this week’s map.

Twenty-six states and D.C. either have no income tax (AK, FL, NV, SD, TX, WA, WY) or do not include Social Security benefits in their calculation for taxable income (AL, AR, CA, DC, HI, IN, IA, KY, LA, ME, MD, MI, MS, NH, NJ, NC, OR, PA, TN, WI).

Nebraska and Utah tax Social Security benefits in the same way as the federal government. Under the federal tax code, the taxable portion of Social Security income depends on two factors: a taxpayer’s filing status and the size of his “combined income” (adjusted gross income + nontaxable interest + half of Social Security benefits). In general, if a taxpayer has other sources of income and a combined income of at least $25,000 (single filers) or $32,000 (married filing jointly), Social Security benefits are treated as income for taxation purposes. It should be noted that Utah also provides a nonrefundable retirement tax credit (this does not apply to survivor or disability Social Security benefits).

Twelve states (AZ, CO, DE, GA, ID, IL, MA, NY, OH, OK, SC, VA) exempt the portion of Social Security benefits that is included in federal taxable income.

Several states reduce the level of taxation applied to Social Security benefits depending on things like age or income level:

Connecticut excludes Social Security benefits from income calculations for any taxpayer with less than $75,000 (single filers) or $100,000 (filing jointly) in adjusted gross income (AGI).

Kansas provides an exemption for such benefits for any taxpayer whose AGI is $75,000, regardless of filing status.

Minnesota provides a graduated system of Social Security subtractions which kick in if someone’s provisional income is below $81,180 (single filer) or $103,930 (filing jointly).

Missouri allows a 100 percent Social Security exemption as long as the taxpayer is 62 or older and has less than $85,000 (single filer) or $100,000 (filing jointly) in annual income.

North Dakota allows taxpayers to deduct taxable Social Security benefits if their AGI is less than $50,000 (single filer) or $100,000 (filing jointly).

Rhode Island allows a modification for taxpayers who have reached full retirement age as defined by the Social Security Administration and have a federal AGI of under $81,900 (single filer) or $102,400 (filing jointly).

Vermont provides a graduated system of Social Security exemptions which kick in if a taxpayer’s income is below $34,000 (single filer) or $44,000 (filing jointly).

While Montana and West Virginia do not have age or income stipulations, their approaches to such taxes still warrant attention.

In Montana, some Social Security benefits may be taxable, and the state advises taxpayers to fill out a worksheet to determine how the state taxable amount differs from the federally taxable amount.

West Virginia passed a law in 2019 to begin phasing out taxes on Social Security. Beginning in tax year 2020, the state exempts 35 percent of benefits. In 2021, that amount increases to 65 percent, and in 2022, the benefits will be completely exempt.

Source: Tax Policy – Does Your State Tax Social Security Benefits?