Tax Policy – New OECD Study: Consumption Tax Revenues during Economic Downturns

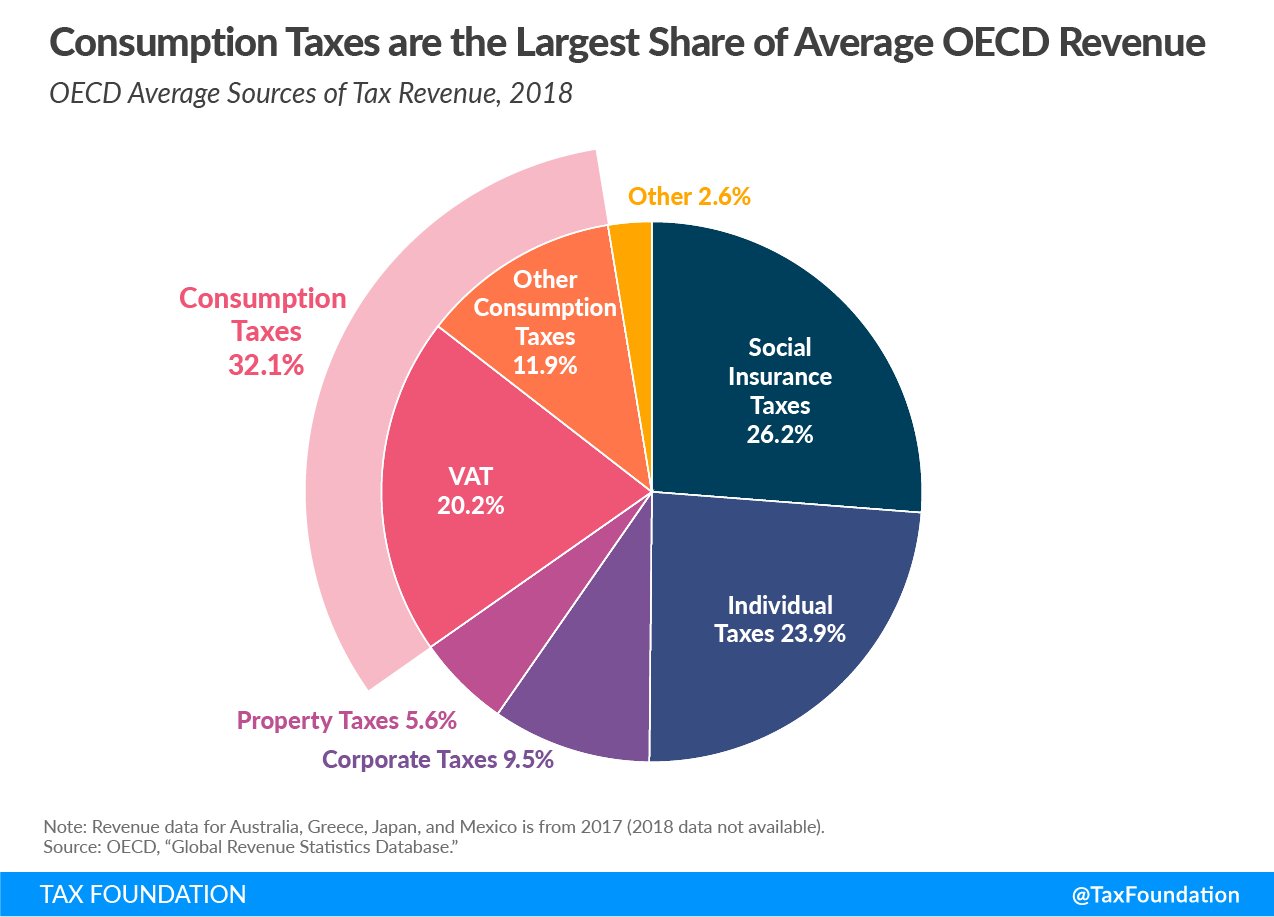

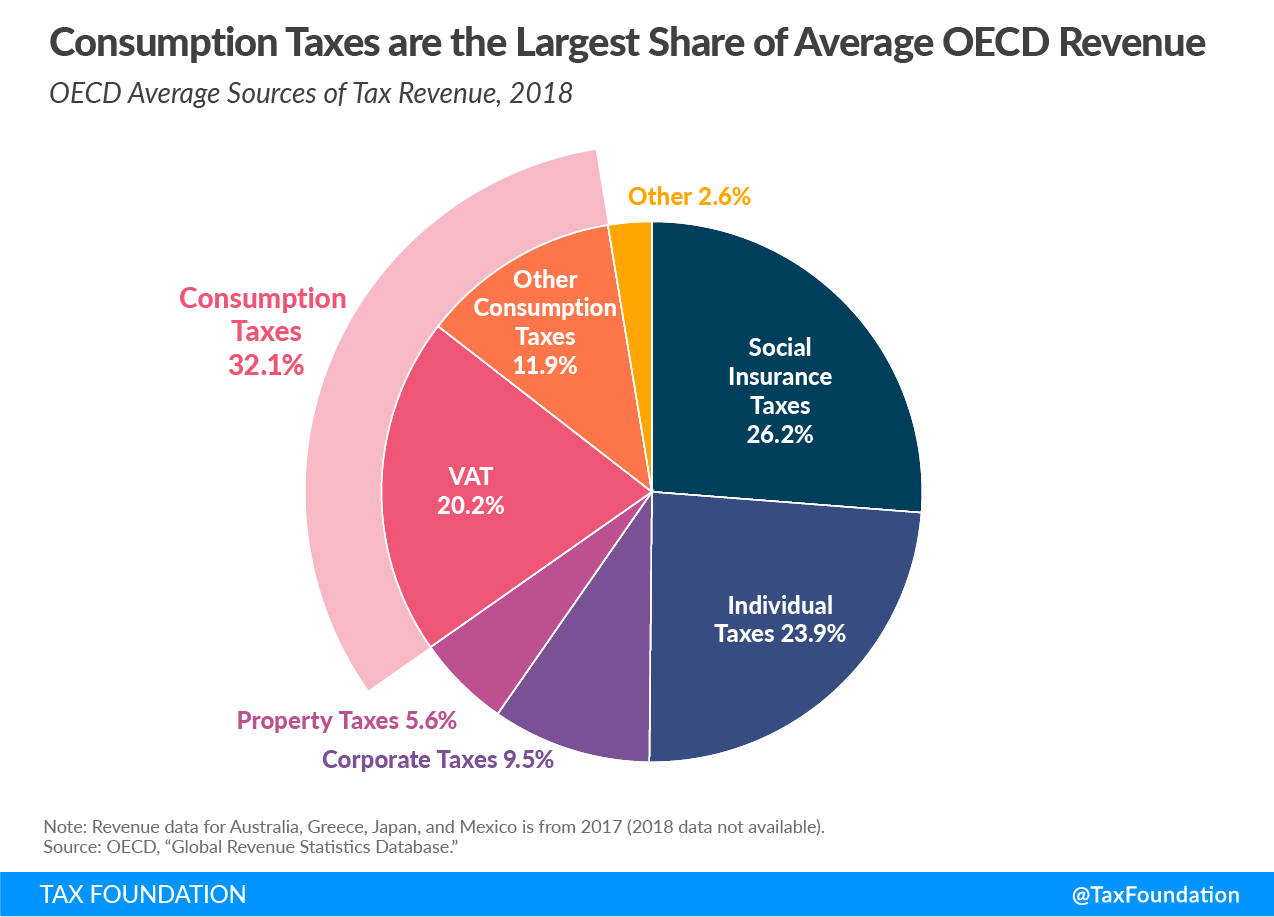

The current economic shutdown—potentially followed by an economic downturn—affects government budgets not only through increased spending but also through a decline in tax revenues. The severity of these tax revenue shortfalls will depend on a variety of factors—one being a country’s current tax structure. A new OECD study sheds light on how many OECD countries’ most important tax revenue source—consumption taxes—responds to economic downturns.

Compared to other tax revenue sources, consumption tax revenue as a share of GDP tends to be relatively stable over time, even during economic downturns. The OECD study uses the 2007-09 economic crisis to analyze what is driving this relative stability. Since Value-Added Taxes (VAT) are the largest tax on consumption—on average more than 60 percent of all consumption tax revenue is VAT revenue in the OECD—the study mainly focuses on the VAT.

To disentangle the effects of economic downturns on consumption tax revenues, the authors first break down consumption tax revenue in the OECD into implicit tax rates (ITR) on consumption—VAT revenue divided by taxable consumption—and taxable consumption as a share of GDP. This exercise shows that the relative stability of VAT revenues is partly due to these two components offsetting each other: During the Great Recession, taxable consumption as a share of GDP increased on average, while the ITR decreased.

The relative increase in consumption was partly due to a drop in investment combined with consumption remaining comparably stable, making consumption a relatively larger share of GDP. In other words, the main driver of VAT revenue’s comparative stability was consumption’s stability relative to other economic aggregates.

The decline in the ITR was mainly driven by a change in consumption patterns. Both government consumption—which is effectively VAT-exempt in all but one OECD country—and consumption of necessity goods and services—which are often taxed at zero or reduced rates—increased as a share of total consumption. This shift towards no- or low-taxed consumption led to a shrinking of the VAT base, translating into lower VAT revenues and making VAT revenues less robust to economic shocks.

After the crisis, a number of countries increased their standard VAT rates to compensate for tax revenue losses. However, both government consumption and consumption of necessity goods and services as a share of total consumption have remained elevated compared to pre-crisis levels, keeping the VAT base at a narrower level. As a result, increasing the standard VAT rates raised VAT revenues less than it would have prior to the Great Recession.

Such lasting change in consumption patterns—in addition to potential new consumption changes resulting from the current crisis—has important implications for today’s tax revenue challenges. Rather than increasing standard VAT rates, broadening the VAT base can help stabilize VAT revenues during economic downturns. This would require governments to shift policy toward taxing currently non- and lower-taxed goods and services at the standard VAT rate.

Source: Tax Policy – New OECD Study: Consumption Tax Revenues during Economic Downturns