Tax Policy – The Child Tax Credit: Primer

Key Findings

- The Child Tax Credit (CTC) is a partially-refundable tax credit available to parents with qualifying dependents under the age of 17. Like other tax credits, the CTC reduces tax liability dollar-for-dollar of the value of the credit.

- Taxpayers may claim a maximum credit of $2,000 for each child, with a portion of the credit refundable. If the credit is greater than the taxpayer’s liability, they may receive a refund up to $1,400 based on an earned income formula. The maximum credit amount is reduced by 5 percent once adjusted gross income (AGI) reaches $200,000 for single filers and $400,000 for married filing jointly.

- The CTC, in combination with other refundable tax credits, is explicitly designed to benefit low-income families with workers and children and can significantly boost incomes and lift families above the poverty line, according to the Congressional Research Service (CRS). Specifically, the CRS estimates that the Tax Cuts and Jobs Act’s federal income tax rate changes reduced total poverty by 15 percent. Nearly all of the poverty reduction from the income tax changes were experienced by families that have both workers and children.

- The combination and interaction of various child tax benefits—including the CTC, Earned Income Tax Credit (EITC), and Child and Dependent Care Tax Credit (CDCTC)—results in complexity, vagueness, duplication, and inefficiency for filers and the Internal Revenue Service (IRS).

Introduction

The Child Tax Credit (CTC) was created in 1997 as a financial support to families with children.[1] Since its inception, the CTC has evolved into a multidimensional dependent tax benefit interacting with similar credits such as the Earned Income Tax Credit (EITC)[2] and the Child and Dependent Care Credit (CDCTC).[3] The CTC’s functional purpose is two-fold: first, reducing tax liability for parents with dependents, and second—in some cases—providing those parents with more disposable income for consumption and saving through a refund.

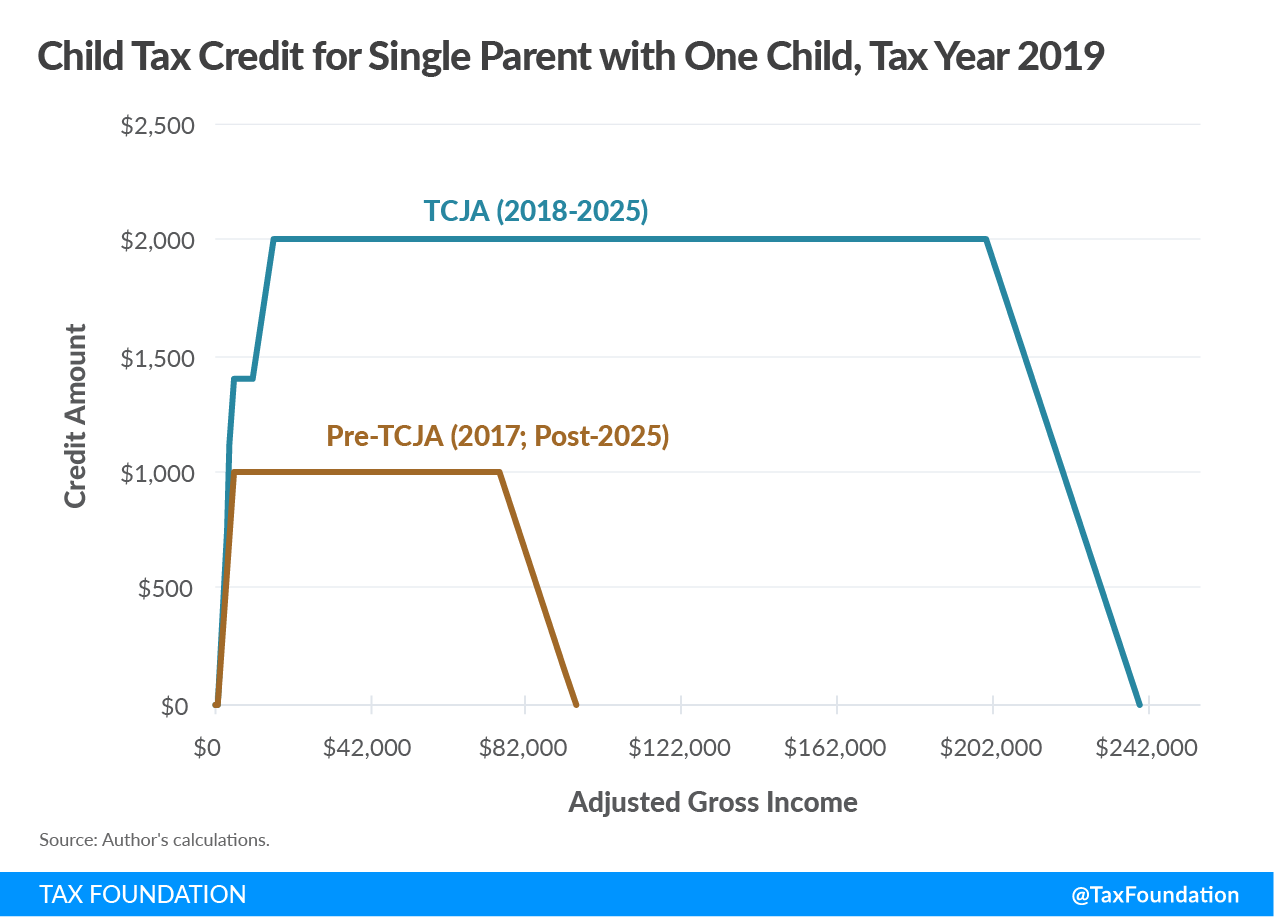

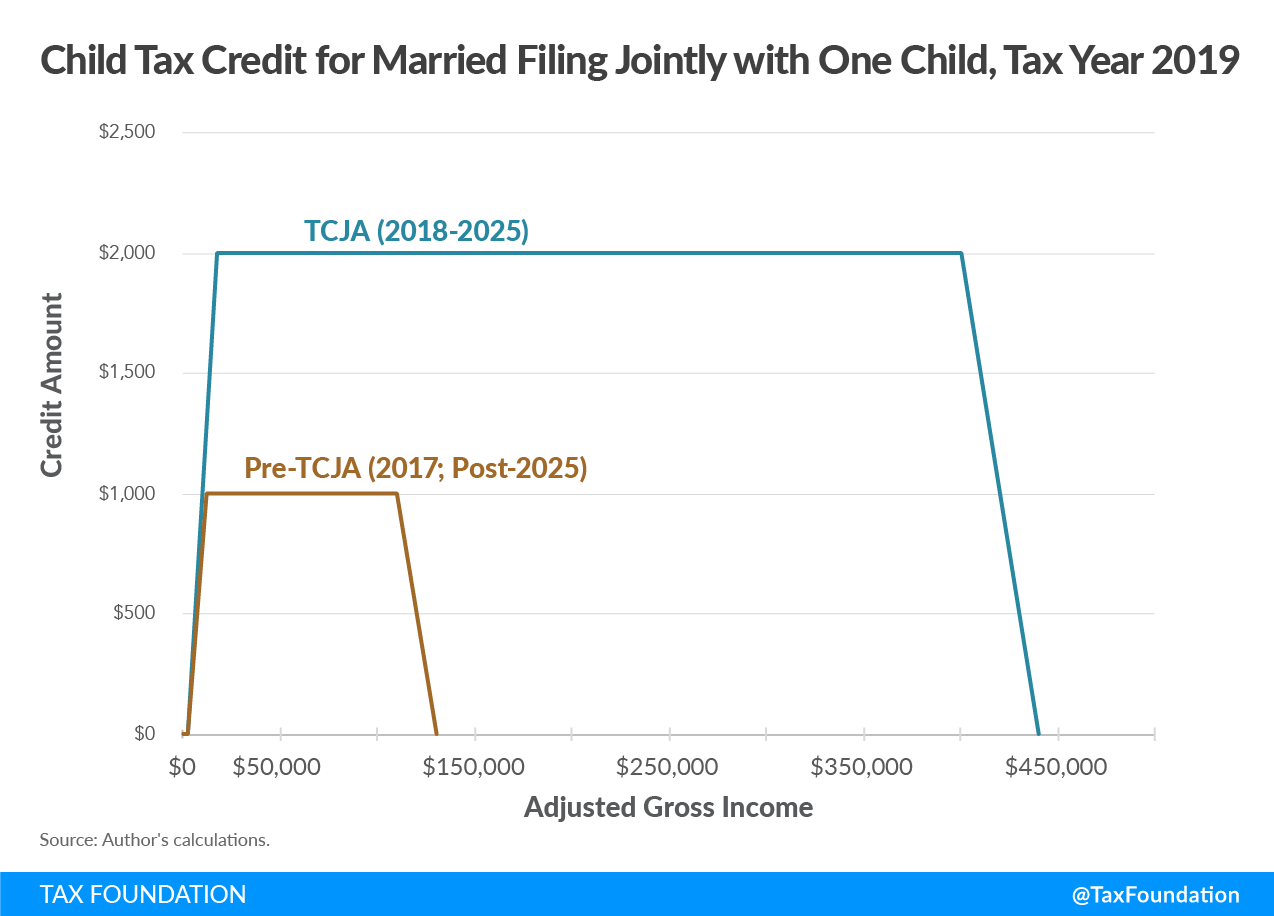

In 2017, the Tax Cuts and Jobs Act (TCJA) increased the maximum credit and refundability threshold, providing lower- and middle-income parents with an increased benefit for each eligible dependent.[4] The TCJA also increased the income phaseouts, allowing more middle- and upper-income filers to claim the credit who were previously unable to do so, and lowered the refundability threshold. However, these changes only apply through 2025.[5] Absent congressional action, the credit will revert to previous law, reducing the CTC’s maximum credit amount and income eligibility, and increasing the refundability threshold.

In order to assist policymakers in understanding the various options available to reform the CTC, this primer will provide an overview of the current CTC along with a brief legislative history and rationale for the credit. Any proposal to reform the tax treatment of parents with dependents should consider the credit’s temporarily-expanded status under the TCJA, policy design trade-offs, and interaction with other credits and deductions. Further, this paper will discuss the strengths and weaknesses of the CTC and its interaction with other dependent benefits administered through the tax code.

Overview

The CTC is a partially-refundable tax credit available to parents with dependents under the age of 17 who meet certain eligibility requirements. Like other tax credits, the CTC reduces tax liability dollar-for-dollar of the value of the credit.[6]

Taxpayers may claim a credit of up to $2,000 for each qualifying child, with up to $1,400 of the credit refundable. The maximum credit amount is reduced by 5 percent once adjusted gross income (AGI) reaches $200,000 for single filers and $400,000 for married filing jointly. If the credit is greater than the taxpayer’s liability, they may receive a refund up to $1,400. This refundable portion of the credit is called the “Additional Child Tax Credit” (ACTC) and is calculated by multiplying earned income above the refundability threshold of $2,500 by 15 percent. For example, a taxpayer with $3,000 of earned income would receive a $75 refundable credit ($3,000-$2,500 = $500 X .15 = $75).

Technically, the ACTC and CTC are separate parts of the same credit program. This distinction is critical since many filers never qualify for the ACTC because their tax liability is greater than the value of the credit’s refundable portion ($1,400). While the academic literature usually distinguishes between the distribution and benefits of the ACTC and CTC, the public policy debate often refers to both components as simply the “CTC.”

The TCJA created a nonrefundable $500 credit for certain dependents who do not meet the CTC eligibility guidelines. This new credit is for children ages 17 to 18, dependents between ages 19 to 24 in school at least five months of the year, and some older dependents. This was created in part to offset the elimination of the personal exemption. This credit is subject to the same phaseout as the CTC.

Notably, the maximum credit amount is not adjusted for inflation. However, the refundable portion is adjusted for inflation and will continue to expand until it equals the maximum CTC amount ($2,000). In 2025, these provisions are scheduled to revert to prior law—taxpayers will be able to claim up to $1,000 for each child under age 17, and this amount won’t be adjusted for inflation. Moreover, the maximum credit would phase out once AGI reaches $75,000 for single filers and $110,000 for married couples filing jointly. However, just like the new policy under the TCJA, any portion of the $1,000 credit that exceeds tax liability may be claimed as a refund, calculated as 15 percent on all wages above $3,000.

| Relevant CTC Component | Current Law (TCJA) | Pre-TCJA/Post-2025 |

|---|---|---|

| Maximum Credit Per Child | $2,000 (NII) | $1,000 (NII) |

| Maximum Refundable Portion (ACTC) | $1,400 (II) | $1,000 (NII) |

| Refundability Threshold | $2,500 (NII) | $3,000 (NII) |

| Refundability Rate | 15% | 15% |

| Phaseout Threshold (Unmarried) | $200,000 (NII) | $75,000 (NII) |

| Phaseout Threshold (Married filing jointly) | $400,000 (NII) | $110,000 (NII) |

| Phaseout Threshold (Married filing separately) | N/A | $55,000 (NII) |

|

NII = not inflation adjusted II = inflation adjusted Source: Margot L. Crandall-Hollick, “The Child Tax Credit,” IF11077, Congressional Research Service, Jan. 17, 2019, https://fas.org/sgp/crs/misc/IF11077.pdf. |

||

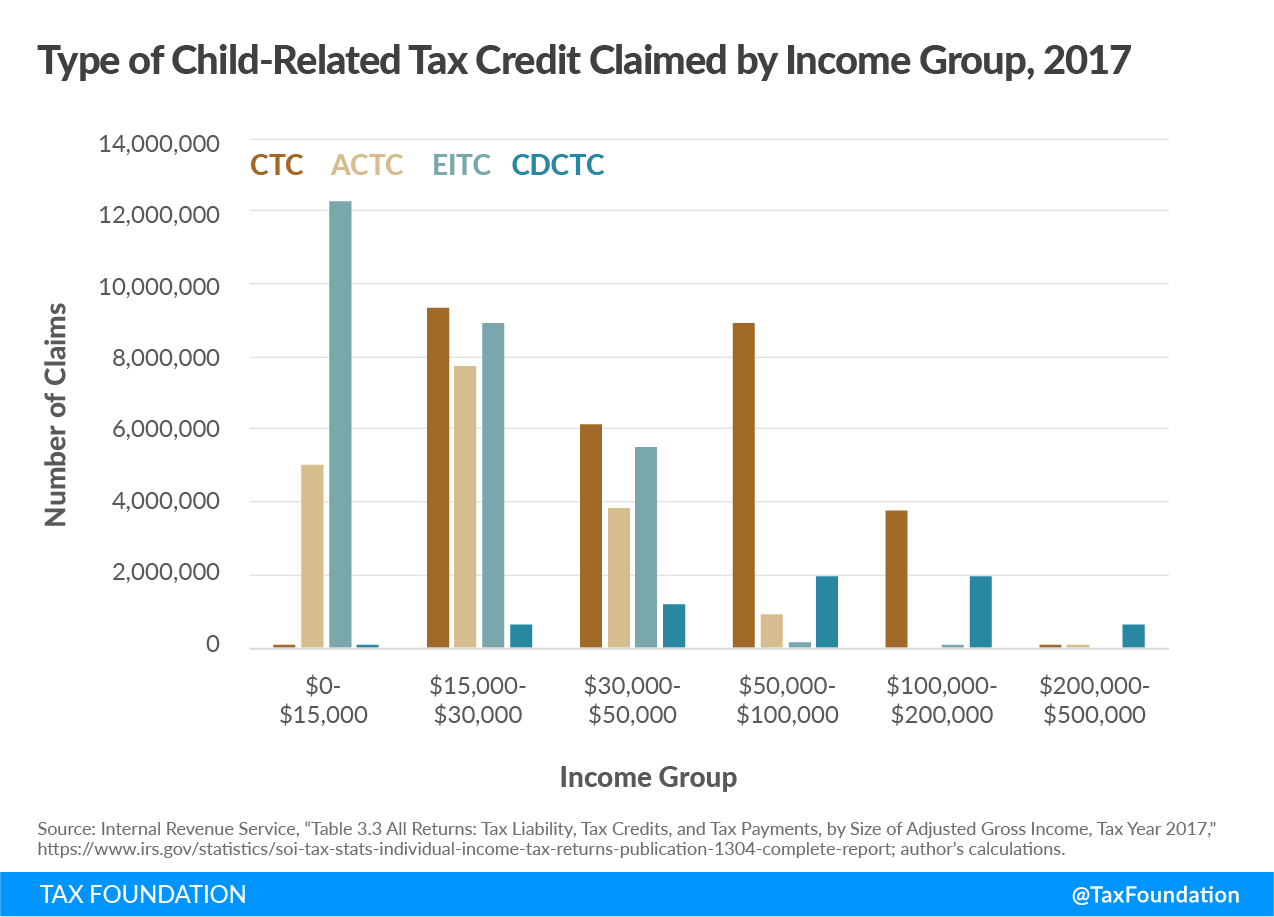

In 2016, prior to the TCJA expansions of the credit, 22 million filers claimed the CTC and 18.9 million filers claimed the ACTC. The CTC and ACTC primarily benefited taxpayers in the $50,000 to $200,000 income groups in 2017 (see Table 2).

| Income Group | Number of CTC Claims | Amount of CTC Benefits ($ millions) | Average CTC | Number of ACTC Claims | Amount of ACTC Benefits ($ millions) | Average ACTC |

|---|---|---|---|---|---|---|

| $0-$15,000 | 51,562 | $10.7 | $207.52 | 5,031,351 | $5,063 | $1,006.29 |

| $15,000-$30,000 | 9,307,440 | $1,470 | $157.94 | 7,755,137 | $11,297 | $1,456.71 |

| $30,000-$50,000 | 6,134,629 | $6,103 | $994.84 | 3,821,820 | $5,519 | $1,444.08 |

| $50,000-$100,000 | 8,909,922 | $14,167 | $1,590.03 | 913,908 | $1,269 | $1,388.54 |

| $100,000-$200,000 | 3,799,745 | $5,121 | $1,347.72 | 0 | $0 | $0 |

| $200,000-$500,000 | 1,998 | $1,284 | $64,264.26 | 36 | $0.062 | $1,722.22 |

| Total: | 28,205,296 | $28,155.70 | $998.24 | 17,522,252 | $23,148 | $1,321.06 |

|

Source: IRS, “All Returns: Tax Liability, Tax Credits, and Tax Payments,” Table 3.3, Tax Year 2017, https://www.irs.gov/statistics/soi-tax-stats-individual-income-tax-returns-publication-1304-complete-report. |

||||||

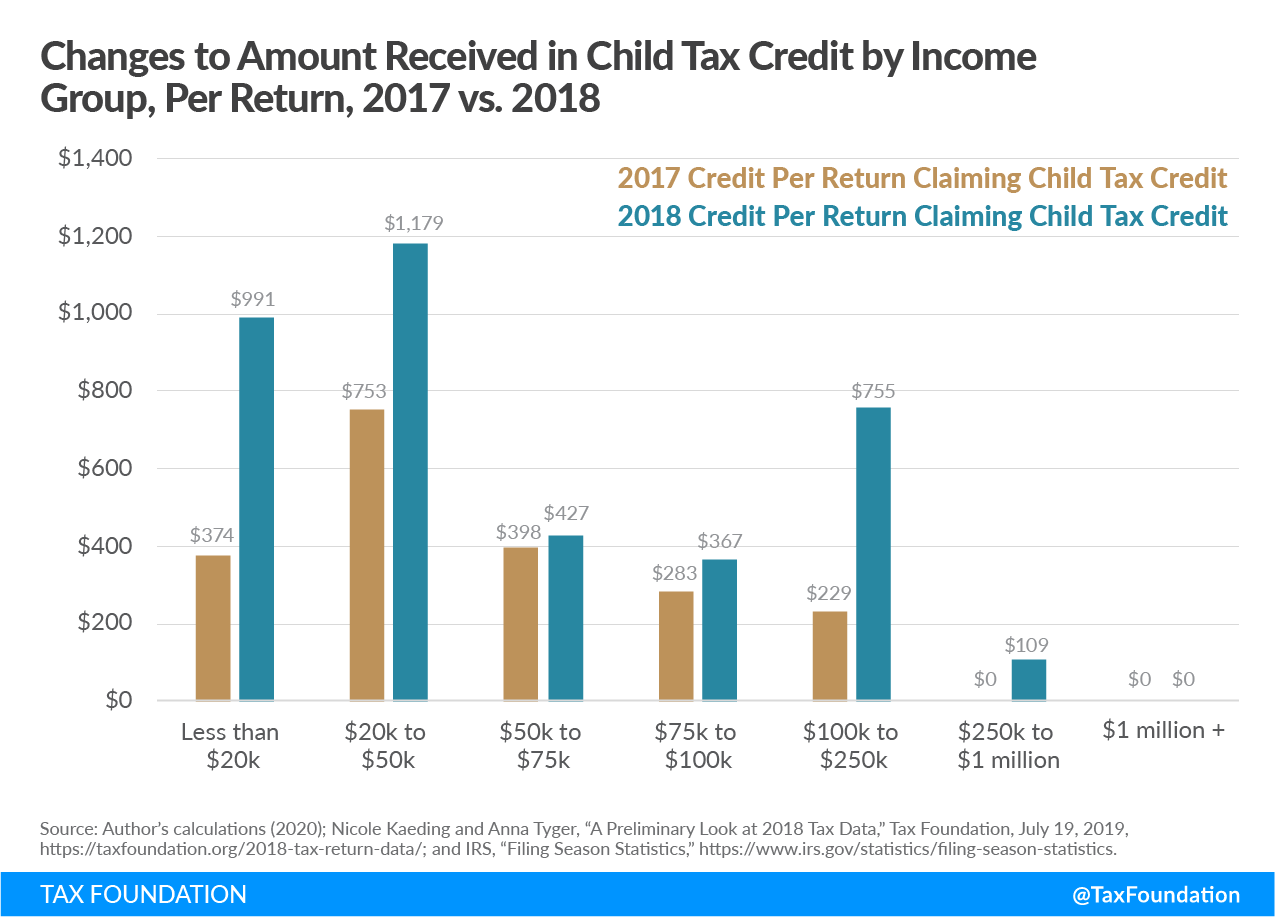

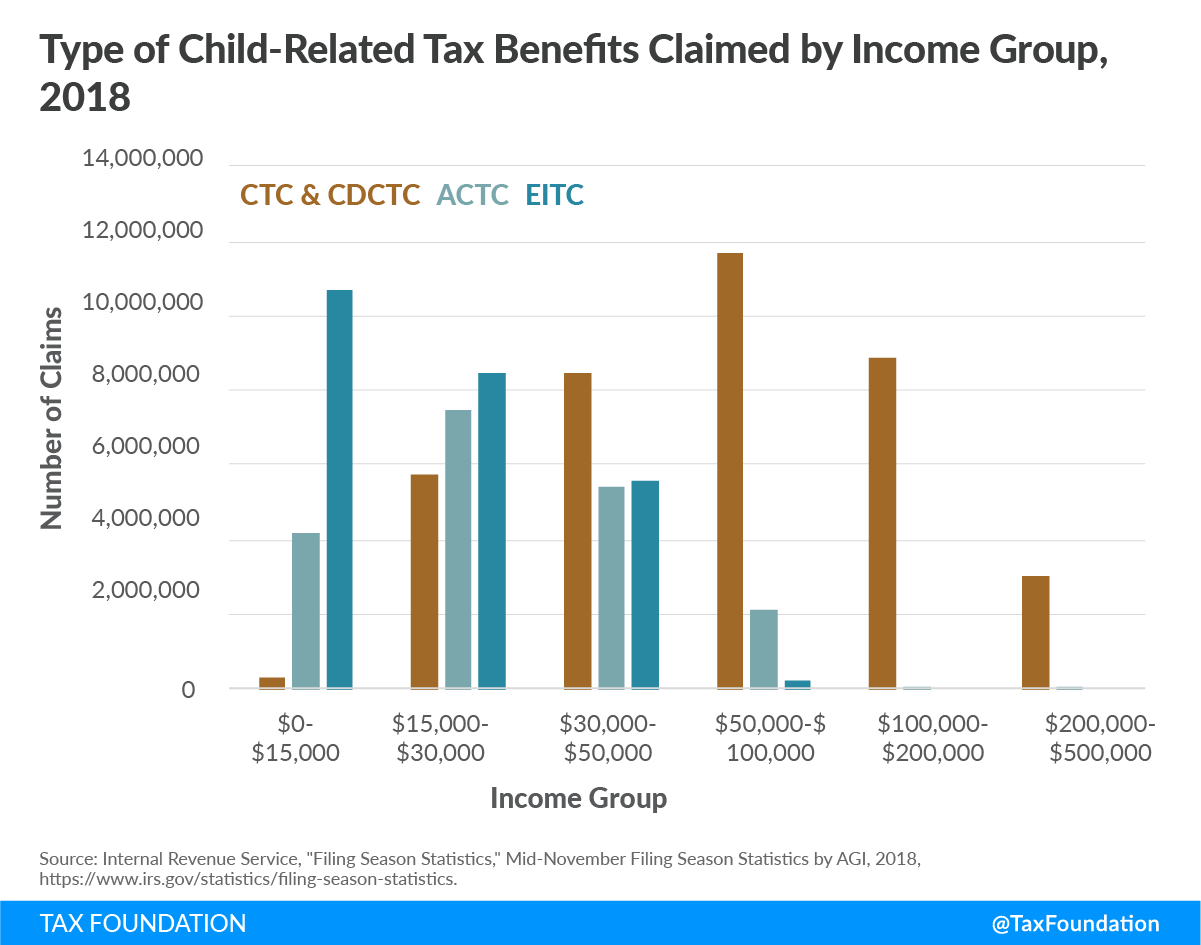

In 2017, 28.2 million filers claimed the CTC and the average credit per filer was $998.24.[7] In the same year, the average refundable portion of credit claimed per filer was $1,321.[8] Preliminary data for tax year 2018, the first year the TCJA changes were in effect, reveals that the average credit was $1,213 per filer.[9] Further, as Figure 3 shows, every income group (excluding the $1 million and above group) received a higher credit per return in 2018 relative to 2017. Since the credit was expanded to filers with incomes between $200,000 and $400,000, parents in higher income brackets were able to claim the credit for the first time (see Figure 3).

The Joint Committee on Taxation (JCT) estimates that the CTC will reduce federal revenue by $118.3 billion in 2020, with $46.2 billion of that cost associated with refundability.[10] The JCT also estimates that in 2019, more than half of the returns and half of the benefits of the CTC will come from tax returns with $100,000 of income and under (see Table 3).

| Returns (in thousands) | Share of Returns | Amount (in millions) | Share of Benefits | Average Benefit | |

|---|---|---|---|---|---|

| Below $10,000 | 1,143 | 2.3% | $707 | 0.6% | $619 |

| $10,000 to $20,000 | 4,898 | 10.0% | 7,248 | 6.2% | $1,480 |

| $20,000 to $30,000 | 5,062 | 10.3% | 9,612 | 8.2% | $1,899 |

| $30,000 to $40,000 | 4,234 | 8.6% | 9,345 | 7.9% | $2,207 |

| $40,000 to $50,000 | 3,767 | 7.7% | 9,215 | 7.8% | $2,446 |

| $50,000 to $75,000 | 7,421 | 15.2% | 19,272 | 16.4% | $2,597 |

| $75,000 to $100,000 | 5,254 | 10.7% | 14,063 | 12.0% | $2,677 |

| $100,000 to $200,000 | 12,339 | 25.2% | 34,532 | 29.3% | $2,799 |

| $200,000 and over | 4,844 | 9.9% | 13,679 | 11.6% | $2,824 |

| Total | 48,962 | 117,673 | |||

|

Source: Joint Committee on Taxation, “Estimates of Federal Tax Expenditures for Fiscal Years 2019-2023,” Dec. 18, 2019, https://www.jct.gov/publications.html?func=startdown&id=5238; author calculations. |

|||||

Other Child-Related Tax Benefits

The tax code also contains other provisions that feature child-related benefits. These include the Earned Income Tax Credit (EITC) and Child and Dependent Care Tax Credit (CDCTC). The three major child tax benefits share much in common, including their mechanical design, relative benefit, and functional effect of reducing tax liability for those taking care of children.

The EITC is an anti-poverty tax expenditure designed to encourage those outside the labor force to enter and spurring those in the labor force to continue working.[11] The EITC equals a fixed percentage of earned income up to the maximum credit amount, with the value of the credit varying by income, number of children, and marital status and is fully refundable. The EITC and the CTC both are often described as “trapezoid”-shaped tax credits and the more dependents, the greater the benefit a taxpayer receives from each credit.

The CDCTC allows each filer to claim a dollar-for-dollar reduction in liability on as much as $3,000 of certain child-care expenses per child, up to a total benefit maximum of $6,000.[12] This credit is not refundable, but similar to the EITC and CTC, as income increases beyond a certain threshold, the credit rate declines.

All three credits are meant to counteract the regressive effects of the payroll tax and other parts of the code[13] as well as provide financial support to families with dependents. The EITC becomes more generous for families with more dependents and income, before falling off at certain income thresholds. Similarly, the CTC maxes out at $2,000 at a 15 percent refundability rate on all income over $2,500 that phases out as filers reach $200,000/$400,000 (AGI).

As Figure 4 reveals, prior to the TCJA, the majority of the EITC, CTC, and ACTC were claimed by filers with incomes under $50,000 (15.4 million claims versus 12.6 million above $50,000 in 2017) while the CDCTC was primarily claimed by those with incomes over $50,000.

As Figure 5 shows, post-TCJA, more filers with incomes over $50,000 claimed the CTC and CDCTC than before, due to the increase in income phaseouts for the CTC. The majority of EITC claims remained among those with incomes under $50,000 while the majority of CTC and CDCTC claims shifted to filers with incomes over $50,000. Overall, the average CTC increased for most filers after the TCJA (see Figure 3) relative to other credits (CDCTC and EITC).

Legislative History and Rationale for the Credit

Initial proponents of the CTC found three serious defects in the tax code’s treatment of dependents—specifically the dependent exemption—which spurred their efforts to establish an independent credit for children:

First, the dependent exemption was not adjusted for inflation, and thus had declined in real value over time.[14] Second, the dependent exemption provided a greater benefit to higher-income taxpayers since exemptions become more proportionally generous (and therefore effective at reducing tax liability) as ordinary income rates rise. Third, many parents who needed the benefit possessed neither sufficient taxable income nor tax liability to receive any windfall from the dependent personal exemption.[15]

The concept of a credit was proposed multiple times in legislation and as a policy white paper throughout the 1990s, first as a key reform item of the Republican Party’s “Contract with America”[16] before the 1994 midterm elections and as part of President Clinton’s Middle-Class Bill of Rights Tax Relief Act of 1995.[17] In both cases, the credit was designed as nonrefundable, limiting itself to reducing tax liability and precluding the prospect of any refund.

When an agreement failed to materialize on policy specifics, the discussion was shelved until a $500 nonrefundable CTC was proposed in 1997 by the House, Senate, and Clinton Administration. The Clinton Administration preferred letting filers claim their EITC after the CTC had been applied, since in many cases it would result in a higher benefit for lower-income filers who would have their tax liability wiped out by claiming the EITC first and thus be ineligible for any benefit from a nonrefundable CTC. Congressional lawmakers preferred the inverse, since it lowered the cost of the policy and allowed the CTC to perform its primary function: reducing tax liability.[18]

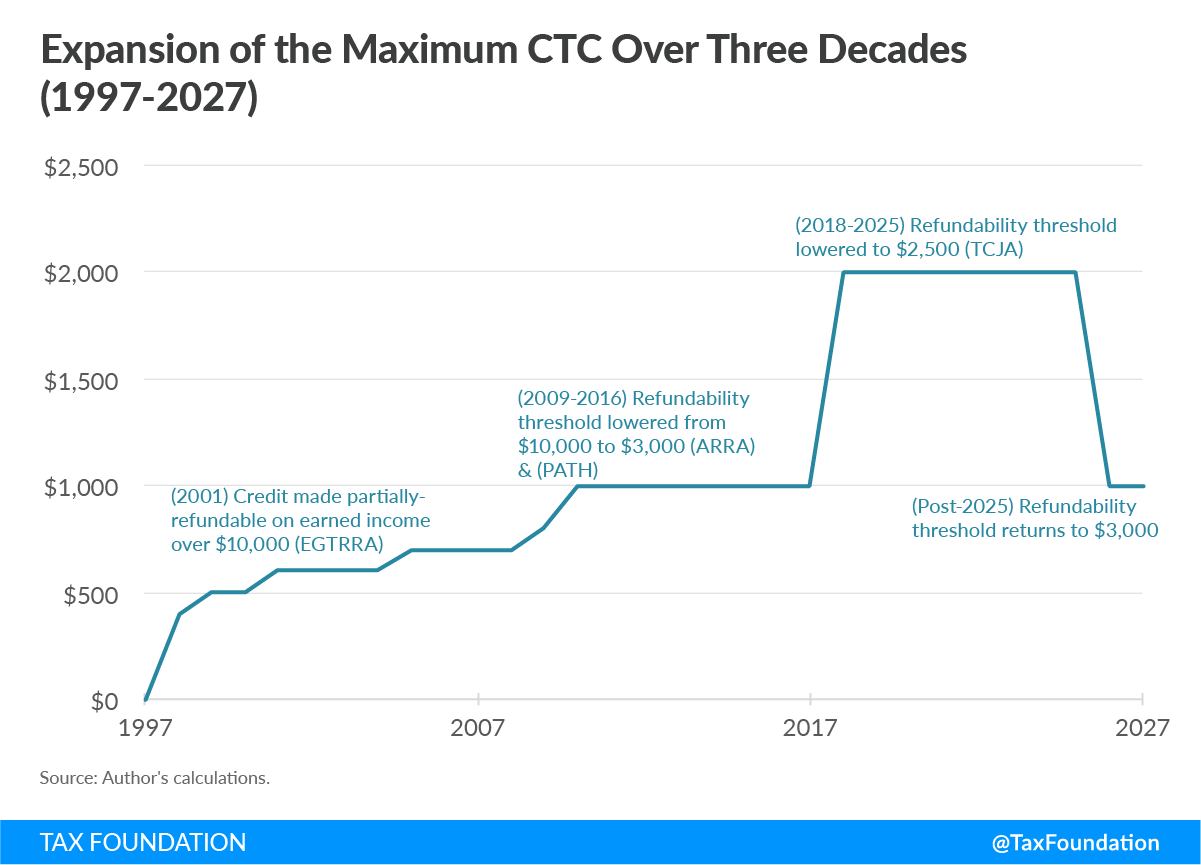

In order to understand the interaction of the CTC with other credits, it is critical to trace the CTC’s development over time. Figure 6 shows the expansion of the maximum credit since its inception in 1997 to current law (through 2027).

1997-2001

The CTC[19] was originally enacted as part of the Taxpayer Relief Act of 1997,[20] which lowered a variety of federal tax rates and established new tax savings accounts (e.g., Roth IRAs) and credits (e.g., Lifetime Learning Credits, etc.). In 1998, parents could claim a $400 nonrefundable credit for each child under 17. In order to target relief to middle-class families, the credit amount was reduced by $50 for every $1,000 earned over certain adjusted gross income thresholds.[21] The credit increased from $400 to $500 in 1999 and remained there until 2001.[22]

2001-2008

The Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) increased the CTC gradually throughout the first decade of the 21st century ($600 for tax years 2001-2004, $700 for 2005-2008, $800 for 2009, and $1,000 for 2010 and all years after).[23] The law also made the credit partially-refundable against payroll tax liability on earned income over $10,000 (adjusted for inflation).[24]

2008-2016

In response to the 2008 financial crisis, Congress passed the Emergency Economic Stabilization Act (EESA)[25] and the American Recovery and Reinvestment Act of 2009 (ARRA),[26] both of which expanded CTC eligibility for those with lower incomes. Specifically, ARRA lowered the refundability threshold from $10,000 to $3,000 for 2009-2010. This threshold was extended repeatedly and then made permanent under the Protecting Americans from Tax Hikes (PATH) Act.[27]

2017-Present

As part of the Tax Cuts and Jobs Act (TCJA) of 2017, the maximum CTC was increased to $2,000 with up to $1,400 refundable, the refundability threshold was lowered from $3,000 to $2,500, and income phaseout thresholds were increased from $75,000 to $200,000 for single filers and $110,000 to $400,000 for married couples filing jointly. These changes made previously-ineligible upper-income taxpayers eligible for the credit.[28] These changes will expire at the end of 2025 if Congress takes no action.

Evaluating the CTC

When evaluating the design of the CTC, we discuss four criteria: simplicity, administrability, efficiency, and neutrality. While these are not the only measures by which the credit can be assessed, they are four widely-accepted norms for what well-designed tax policy should look like.

Simplicity and Administrability

The tax code should be easy for taxpayers to comply with and for the government to administer. The CTC’s current structure is complicated by various elements that make it difficult for the taxpayer to understand and increase compliance on the federal government to ensure proper payments are collected and refunds disbursed.

To qualify for the CTC, seven conditions must be met: 1) age, 2) relationship, 3) support, 4) dependent status, 5) citizenship, 6) length of residency, and 7) family income.[29] Many of these qualifications differ from the qualifications of other child-related tax benefits; for example, see Table 4.

| Age | Phaseouts | |

|---|---|---|

| Child Tax Credit | Under the age of 17 for the entire year | Begins phasing down at $200,000 for single households, $400,000 for married households |

| Child and Dependent Care Credit | Under the age of 13 for the entire year, or the taxpayer’s spouse or dependent who is incapable of caring for himself or herself | Credit phases down between $15,000 and $43,000 but not to zero |

| Earned Income Tax Credit | Eligible Children: Under the age of 19 (or under the age of 24 if a full-time student); taxpayers without eligible children must be between the ages of 25 and 64 | Begins phasing down from $8,490 to $24,350 depending on number of qualifying children and marital status; credit equals $0 when incomes reach $15,270 to $54,884 depending on number of qualifying children and marital status |

|

Source: Congressional Research Service. |

||

These differences across various credits complicate tax filing for individuals, raising questions such as, “Which children qualify for which benefits?” and “Will I earn too much income to qualify?” For example, the CRS notes that a taxpayer’s 18-year-old child may meet all the requirements for a qualifying child for the EITC but will be too old to be eligible for the CTC.[30]

These differences also present administrative challenges: ultimately, the IRS exists to collect taxes, not to administer benefit programs through the tax code. For example, in a February 2020 report, the U.S. Department of the Treasury identified that nearly one-third of additional CTC payments from tax years 2009 through 2011 were improper, as well as 25 percent of EITC payments for fiscal year 2018.[31]

The differences in qualifying requirements across the three credits could be simplified and streamlined to better target benefits and incentives, reduce complexity, and improve administrability. Additionally, the temporary nature of the expansions to the credit enacted under the TCJA create uncertainty about the credit going forward.

Efficiency

The CTC overlaps with two other tax provisions (EITC and CDCTC) which perform similar, albeit unique and targeted, purposes. All three credits revolve around the presence and expenses of dependents, yet each remains administratively and mechanically different from the others.

The EITC, designed to incentivize work, contains a family differential, while the CTC, designed to offset the cost of having a family, contains an income phase-in. While each of these provisions and their design may have been created with good intentions, the final result is an overlapping system with less than optimal targeting of benefits. For example, in the Taxpayer Advocate Service 2008 Annual Report to Congress, one of the legislative recommendations outlined a proposal to simplify the family status provisions:[32]

Consolidate the numerous family status provisions into two. One provision (the Family Credit) would reflect the costs of maintaining a household and raising a family. It would incorporate all current family status provisions that are based on the specific make-up of the family unit and its corresponding ability to pay taxes. The second provision (which could be called the “Worker Credit” or could continue to be called the EITC) would provide an incentive and subsidy for low income individuals to work.

Others have echoed this lack of efficiency, such as Elaine Maag, a family tax scholar at the Tax Policy Center (TPC):

The child benefits are far from straightforward. Families must first understand which child qualifies for which benefits, and then must decipher the level of subsidy for which they qualify. In addition, each benefit comes with its own design issues, often a relic of limited resources and the desire of politicians to create new programs with new labels. Taken separately, each benefit may make some sense, but in tandem, the benefits add up bizarrely. And of course, the sum of the parts do not equal the whole.[33]

Ultimately, the CTC lacks efficiency in part because it is duplicative in aim and contradictory in benefit eligibility, overlapping with other credits that suffer from the same issues.

Neutrality and other considerations

Ideally, the tax code should not encourage or discourage personal or business decisions, but instead should be neutral with respect to the decision-making process. However, there is also a question of whether a household with two workers and no children should pay the same taxes as a larger household with two workers and two dependents, all else equal. There are several considerations to discuss when evaluating what treatment is neutral.

Mechanically, the CTC creates negative marginal tax rates in the phase-in range and increases marginal tax rates in the phaseout range, thus having at least some influence on taxpayers’ decisions to work. In terms of having an effect on economic growth, the CTC is negligible, as these competing effects on labor decisions work to cancel each other out.

However, though it shouldn’t be ignored, economic growth is probably not the major factor by which to judge the CTC. The “bias” towards taxpayers with dependents is a policy design feature of the credit, not a bug.

The federal individual income tax is structured so that those who are lower-income pay little to no tax, and it contains provisions that work to increase the disposable income via refundable tax credits.[34] The CRS estimates that under current law, the Tax Cuts and Jobs Act’s federal income tax rate changes reduced total poverty from 14.5 percent to 12.3 percent, a 15 percent reduction, and reduced the poverty gap by about $13.9 billion annually.[35] Nearly all of the poverty reduction from the income tax is experienced by families that have both workers and children.

The CTC benefits are concentrated among lower- and middle-income taxpayers; as shown above, more than half of the benefits in 2019 are estimated to accrue to tax returns with under $100,000 of income, according to the JCT. The credit offsets burdens in other areas, such as the payroll tax and sales taxes, which fall heaviest on lower-income taxpayers (i.e., they are regressive) and reflects the idea that there are more costs associated with having a larger household.

However, as noted by the CRS, “The income tax is less effective, in comparison to many needs-tested programs, in helping the poorest families move out of poverty,” primarily because the income tax provides little benefits to people who cannot or do not work.[36]

On a more mechanical level, the CTC acts as a buffer to the escalating effective marginal tax rates[37] filers experience as the EITC benefit declines:

The original phase-in range for the CTC was pegged to coincide with the end of the phase-in range for the EITC for families with at least two children to address concerns over high marginal tax rates for families receiving the EITC. … As a result, the CTC partially offsets the high marginal tax rates associated with the phaseout of the EITC. The CTC is available to most taxpayers with children, although it phases out at a rate of 5 percent of adjusted gross income above [$400,000] for married couples and ([$200,000] for single parents.[38] Further, dependents may claim a separate child credit from their parents if they themselves have a qualifying child.[39]

Overall, the CTC helps lift families with workers and dependents out of poverty, significantly helps those in lower- to middle-income groups (i.e., lowest four deciles of filers), and offsets increasing marginal tax rates due to benefit phaseouts in other credits or the decline in effectiveness from the dependent exemption.

Contributing to the Credit Conversation: CTC As Positive Economic Benefit, Despite Lack of Pro-Growth Effects

The major question which confronts both the taxpayer and the policymaker: what purpose should the CTC serve relative to the EITC and CDCTC?

Despite their distinctives, the central point of each credit is identical: reducing tax liability, thus offsetting regressive provisions of the code and, in some cases (CTC and EITC), providing more disposable income for saving or consumption. Yet, there are overlapping and duplicative elements common to each credit, which raises the question for reform: how could each credit be adapted to accomplish its respective goals while maximizing efficiency, reducing compliance and administrative bandwidth, and providing needed relief to those who need it most?

Whether scholars and policymakers opt to pursue reform within or outside the current credit structure, a fundamental point remains salient: The CTC, just like the EITC and CDCTC, is not designed to increase macroeconomic growth. It is, however, designed to provide lower-income families the means to be more productive and independent.

Assisting families with their dependents through a child tax benefit increases the likelihood that parents will enter and continue in the labor force, thus retaining the means to consume and save, both of which aid the economy in both the short and long term. Further, children will eventually take the place of their parents in the labor force, supplying the income on which payroll and income taxes will be levied in order to pay for social services (e.g., education and public infrastructure) and various medical and retiree benefits for aged Americans (e.g., Social Security and Medicare).

Evaluating the merits of the CTC under a purely growth-oriented perspective will miss the credit’s point and the conversation about how to effectively reform it. More work is needed to reform these three separate child credit-related tax provisions toward efficiency and societal stability. While there are significant drawbacks of administering a child tax benefit through an annual tax return based on taxable income and tax liability, policymakers should pursue the most efficient version of the benefit which supports children, parents, and the economy overall.

Conclusion

The Child Tax Credit reduces tax liability for parents with dependents and assists families in escaping poverty. The TCJA temporarily increased the credit’s maximum amount, refundability, and phaseout limits, allowing more filers to claim a larger credit per dependent on earned income. Ongoing discussion among policymakers and scholars surrounding the credit’s efficacy should consider the expiration of these expansions set to take place after 2025 along with the interaction between the CTC and other child credits such as the EITC and CDCTC.

The current maze of child-related tax benefits makes filing season difficult for parents and the IRS as taxpayers contend with eligibility requirements, differing definitions, income phaseouts, and refundability thresholds. An ideal tax code should strive for simplicity, neutrality, transparency, and stability. While it is practically impossible to achieve all four principles simultaneously, any reform to the CTC should strive to at least reduce complexity and ensure stability.

While a variety of proposals suggests making the credit more generous to parents at lower income levels through various mechanisms, the overall objective of the credit is clear: reducing tax liability for parents and providing more disposable income for consumption and saving. Ideally, a consolidation and clarification of the current child-related tax credits would lead to a more transparent, simple, and stable tax code which provides certain tax offsets for work and others for claiming dependents. As policymakers and scholars anticipate the expiration of various provisions under the TCJA in 2025, the CTC will remain a central part of the debate about how the code should treat parents and their dependents.

[1] “The child tax credit was created in 1997 by the Taxpayer Relief Act of 1997 (P.L. 105-34) to help ease the financial burden that families incur when they have children.” See Margot L. Crandall-Hollick, “The Child Tax Credit: Current Law and Legislative History,” Congressional Research Service, Jan. 19, 2016, 1, https://fas.org/sgp/crs/misc/R41873.pdf.

[2] Robert Bellafiore, “The Earned Income Tax Credit: A Primer,” Tax Foundation, May 2019, https://files.taxfoundation.org/20190916171958/1TaxFoundation_FF654.pdf.

[3] IRS Publication 503, “Child and Dependent Care Expenses,” February 2020, https://www.irs.gov/publications/p503.

[4] Although commonly referred to as the Tax Cuts and Jobs Act (TCJA), the law is properly designed as: “An Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution non the budget for fiscal year 2018,” P.L. 115-97, https://www.congress.gov/115/plaws/publ97/PLAW-115publ97.pdf.

[5] As the previous note discloses, certain provisions of the Act are constrained by the laws of budget reconciliation. For more information, see Alec Fornwalt, “New Budget Resolution Gives Hope for Phase Two of Tax Reform,” Tax Foundation, June 22, 2018, https://taxfoundation.org/new-budget-resolution-gives-hope-phase-two-tax-reform/.

[6] A refundable tax credit allows a taxpayer to receive a refund if the credit they are owed is greater than their tax liability. See Margot L. Crandall-Hollick, “The Child Tax Credit: Current Law and Legislative History.”

[7] IRS, “All Returns: Tax Liability, Tax Credits, and Tax Payments,” Table 3.3, Tax Year 2017, https://www.irs.gov/statistics/soi-tax-stats-individual-income-tax-returns-publication-1304-complete-report.

[8] Id.

[9] IRS, “Mid-November Filing Season Statistics by AGI, 2018,” https://www.irs.gov/statistics/filing-season-statistics; compare with IRS, “Individual Income Tax Returns: Line Item Estimates (2017),” Statistics of Income, Publication 4801 (Rev. 9-2019), https://www.irs.gov/pub/irs-pdf/p4801.pdf.

[10] The Joint Committee on Taxation, “Estimates of Federal Tax Expenditures for Fiscal Years 2019-2023,” Dec. 18, 2019, https://www.jct.gov/publications.html?func=startdown&id=5238.

[11] Robert Bellafiore, “The Earned Income Tax Credit (EITC): A Primer.”

[12] For those who make less than $15,000 annually, the credit rate is set at 35%. For those who make over $43,000, the credit drops to 20%. Cf. Elaine Maag, “Simplifying Child Care Tax Benefits,” TaxVox: Individual Taxes, Tax Policy Center, Apr. 15, 2013, https://www.taxpolicycenter.org/taxvox/simplifying-child-care-tax-benefits.

[13] Id.

[14] In the Joint Committee on Taxation’s explanation of the Taxpayer Relief Act of 1997, the committee cited the decline in real value of the personal exemption by more than one-third over the prior 50 years as evidence of the tax system’s failure to reflect a family’s ability to pay. According to JCT, “The Congress believed that the individual income tax structure does not reduce tax liability by enough to reflect a family’s reduced ability to pay taxes as a family size increases. In part, this is because over the last 50 years the value of the dependent personal exemption has declined in real terms by over one third.” For more information see U.S. Congress, Joint Committee on Taxation, JCS-23-97, General Explanation of Tax Legislation Enacted in 1997, Dec. 17, 1997, 6-7.” See Margot L. Crandall-Hollick, “The Child Tax Credit,” IF11077, Congressional Research Service, Jan. 17, 2019, 3 note 2.

[15] National Commission on Children, “Beyond Rhetoric: A New American Agenda for Children and Families,” 1991, https://files.eric.ed.gov/fulltext/ED336201.pdf.

[16] “The Republican ‘Contract with America’” (1994), https://global.oup.com/us/companion.websites/9780195385168/resources/chapter6/contract/america.pdf.

[17] President William Jefferson Clinton, “Middle Class Bill of Rights,” Address delivered at Carl Sandburg College, Jan. 10, 1995, https://www.c-span.org/video/?62614-1/middle-class-bill-rights.

[18] Margot L. Crandall-Hollick, “The Child Tax Credit.”

[19] The idea for a CTC was originally proposed in 1991 by the National Commission on Children final report, which recommended a $1,000 refundable CTC for all children through age 18, indexed for inflation. See National Commission on Children, Beyond Rhetoric: A New American Agenda for Children and Families. See also Margot L. Crandall-Hollick, “The Child Tax Credit: Legislative History,” R45124, Congressional Research Service, Mar. 1, 2018, 2, https://fas.org/sgp/crs/misc/R45124.pdf.

[20] P.L. 105-34 (111 STAT. 787), August 5, 1997, https://www.congress.gov/105/plaws/publ34/PLAW-105publ34.pdf. Author’s note: P.L. 105-34 was one of the first pieces of tax legislation proposed under the rules of budget reconciliation, a procedural method that would be repeated again in 2017 for consideration of the Tax Cuts and Jobs Act (P.L. 115-97).

[21] $110,000 for joint returns, $75,000 for individuals, and $55,000 for married individuals filing separately.

See Id., Title I, Sec. 101, Sec. 24(b)(2)(A)-(C).

[22] Margot L. Crandall-Hollick, “The Child Tax Credit.”

[23] P.L. 107-16 (115 STAT. 45), June 7, 2001, https://www.govinfo.gov/content/pkg/STATUTE-115/pdf/STATUTE-115-Pg38.pdf.

[24] Id. Sec. 201(c)(1)-(4).

[25] P.L. 110-343 (122 STAT 3765), Oct. 3, 2008, https://www.govinfo.gov/content/pkg/PLAW-110publ343/html/PLAW-110publ343.htm.

[26] P.L. 111-5 (123 STAT 313), Feb. 17, 2009, https://www.govinfo.gov/content/pkg/PLAW-111publ5/pdf/PLAW-111publ5.pdf.

[27] Specifically, Division Q of the Consolidated Appropriations Act, 2016, P.L. 114-113 (129 STAT. 2242), Dec. 18, 2015, https://www.govinfo.gov/content/pkg/PLAW-114publ113/pdf/PLAW-114publ113.pdf.

[28] Margot L. Crandall-Hollick, “The Child Tax Credit.”

[29] Intuit TurboTax, “What is the Additional Child Tax Credit” Updated for Tax Year 2018, https://turbotax.intuit.com/tax-tips/family/what-is-the-additional-child-tax-credit/L4IBvQted.

[30] Margot L. Crandall-Hollick, “The Child Tax Credit: Current Law,” Congressional Research Service, May 15, 2018, 5.

[31] Treasury Inspector General for Tax Administration, “Authorities Provided by the Internal Revenue Code Are Not Effectively Used to Address Erroneous Refundable Credit and Withholding Credit Claims,” Feb. 26, 2020, https://www.treasury.gov/tigta/auditreports/2020reports/202040008fr.pdf.

[32] Taxpayer Advocate Service, “2008 Annual Report to Congress, Volume One,” Dec. 31, 2008, 367, https://www.irs.gov/pub/tas/08_tas_arc_legrec.pdf.

[33] Elaine Maag, Stephanie Rennane, and C. Eugene Steuerle, “A Reference Manual for Child Tax Benefits,” Discussion Paper No. 32, Urban-Brookings Tax Policy Center, April 2011, 19, https://www.taxpolicycenter.org/publications/reference-manual-child-tax-benefits.

[34] Congressional Research Service, “The Impact of the Federal Income Tax on Poverty: Before and After the 2017 Tax Revision (“TCJA”; P.L. 115-97), Oct. 17, 2019, https://crsreports.congress.gov/product/pdf/R/R45971.

[35] Id.

[36] Id.

[37] The effective marginal tax rate is the amount of income tax levied against the next dollar of earnings at the margin. It is determined by adding the statutory rate to several other factors, (e.g., payroll taxes, corporate income taxes, excise taxes, or estate taxes at the federal level. This also could include any local and state taxes (e.g., sales tax, property tax, etc.).

[38] Brackets show updated numbers under current law. Maag, et. al. (2011) used pre-TCJA numbers ($110,00 for married filing jointly and $75,000 for single parents). See note 35 above for citation.

[39] Elaine Maag, Stephanie Rennane, and C. Eugene Steuerle, “A Reference Manual for Child Tax Benefits,” Urban-Brookings Tax Policy Center, Discussion Paper No. 32, Apr. 27, 2011, 8, https://www.taxpolicycenter.org/publications/reference-manual-child-tax-benefits.

Source: Tax Policy – The Child Tax Credit: Primer