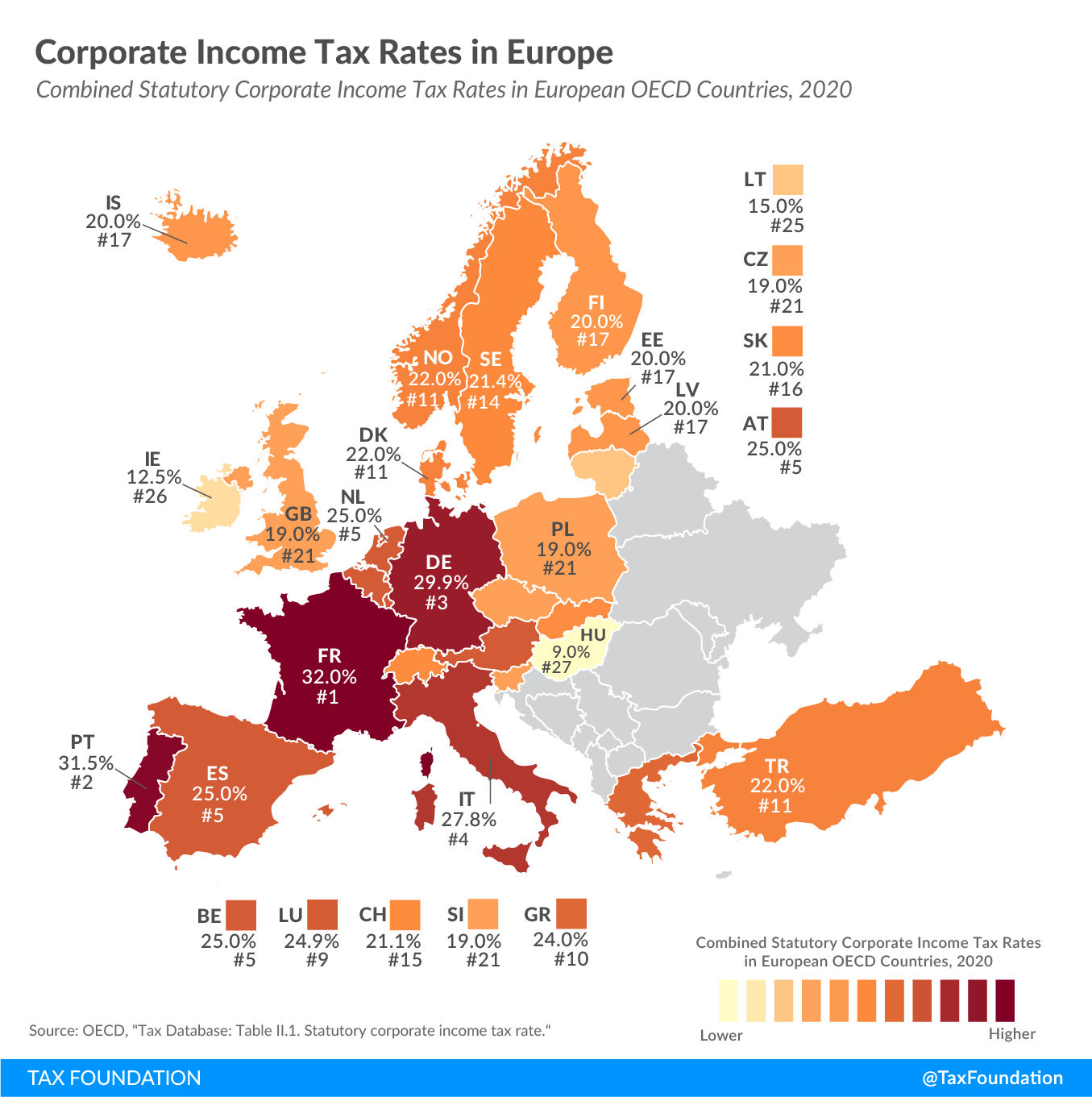

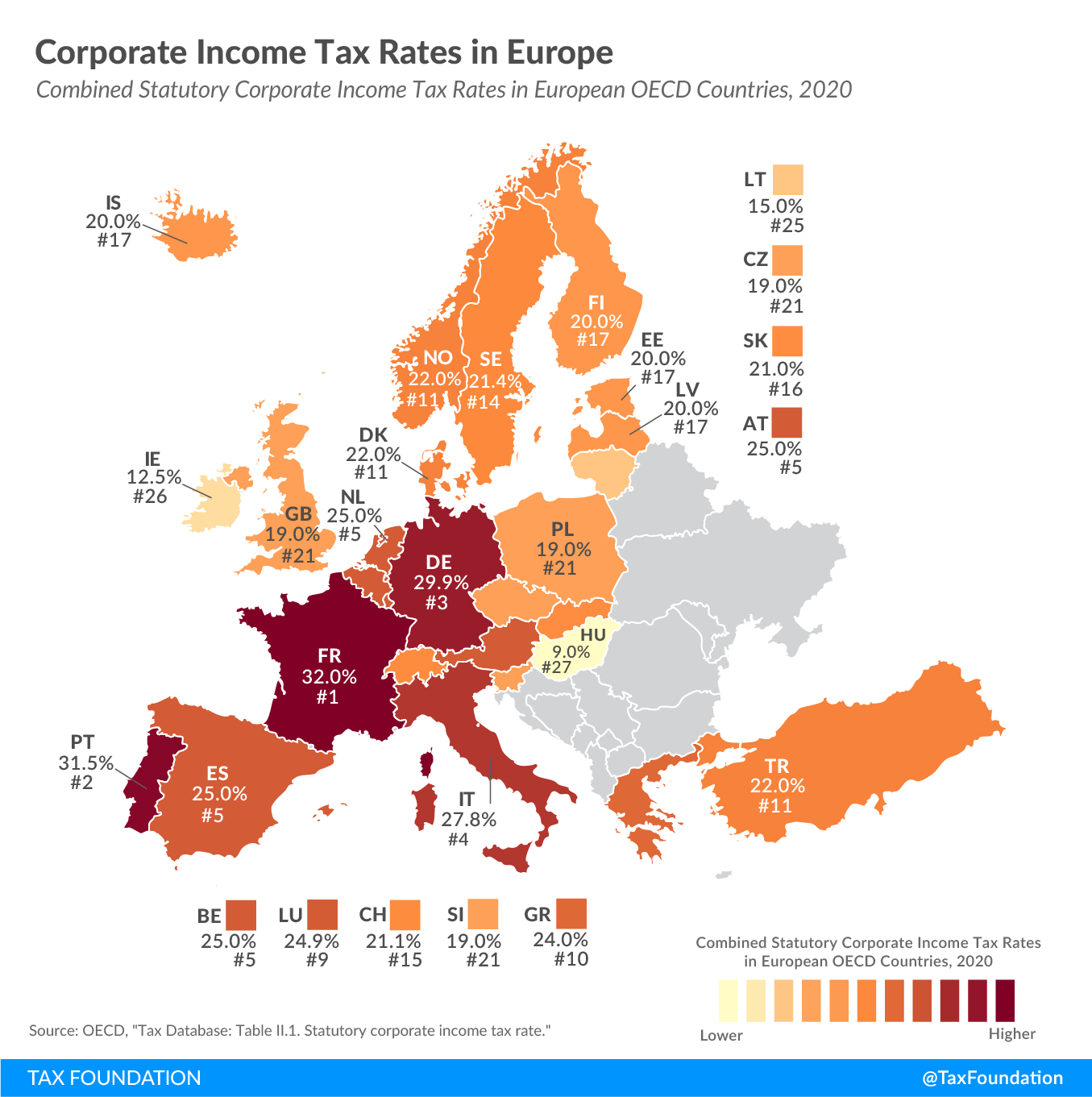

Tax Policy – Corporate Income Tax Rates in Europe

European countries—like almost all countries around the world—require businesses to pay corporate income taxes on their profits. The amount of taxes a business ultimately pays on its profits depends on both the corporate tax base and the corporate tax rate. Today’s map shows how statutory corporate income tax rates compare across European OECD countries.

France has the highest statutory corporate income tax rate among European OECD countries, at 32 percent. Portugal and Germany follow, at 31.5 percent and 29.9 percent, respectively. Hungary (9 percent), Ireland (12.5 percent), and Lithuania (15 percent) have the lowest corporate income tax rates.

On average, European OECD countries currently levy a corporate income tax rate of 21.9 percent. This is below the worldwide average which, measured across 176 jurisdictions, was 24.2 percent in 2019.

European OECD countries—like most regions around the world—have experienced a decline in corporate income tax rates over the last decades. In 2000, the average corporate tax rate was 31.6 percent and has decreased consistently to its current level of 21.9 percent.

Source: Tax Policy – Corporate Income Tax Rates in Europe