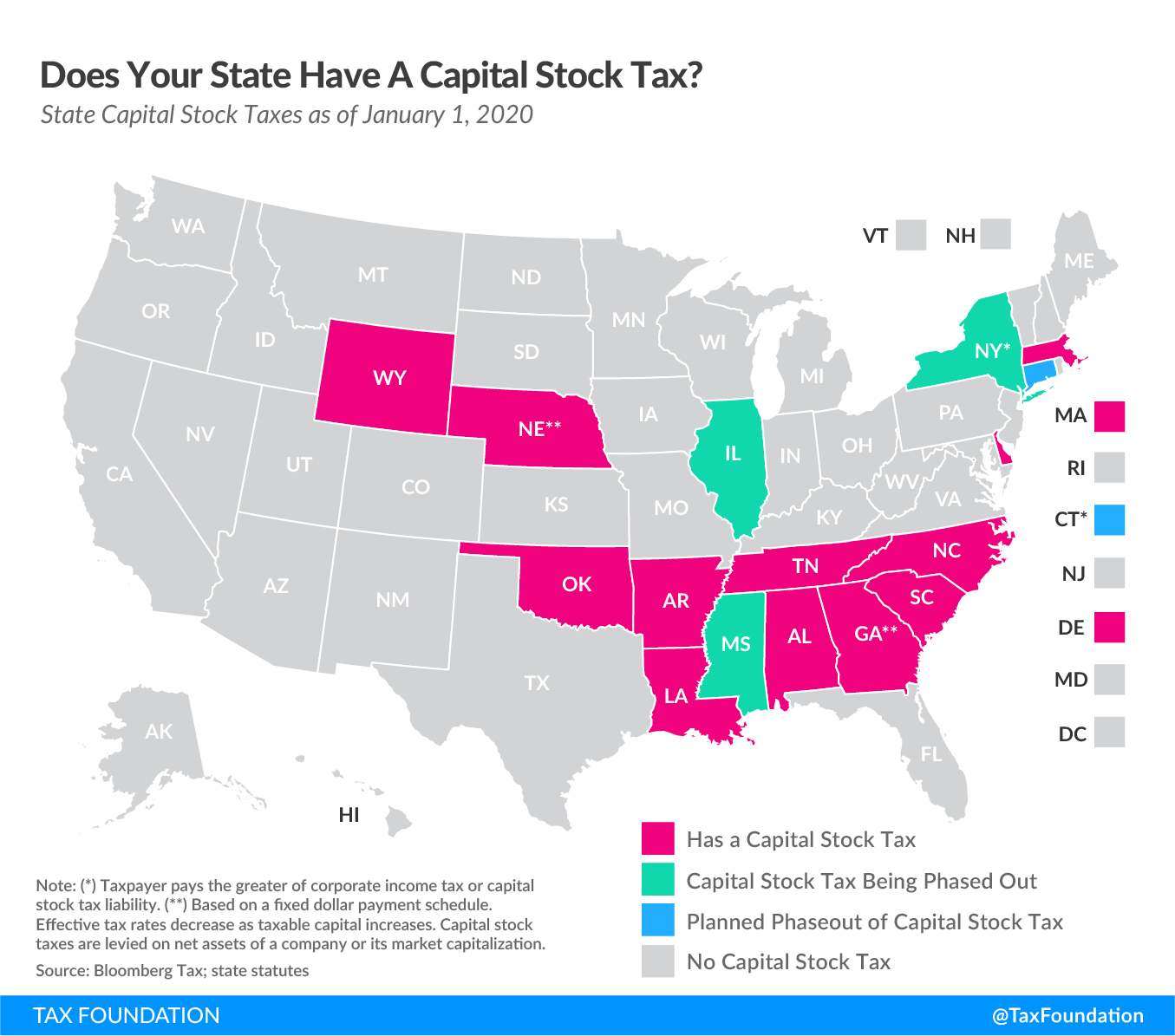

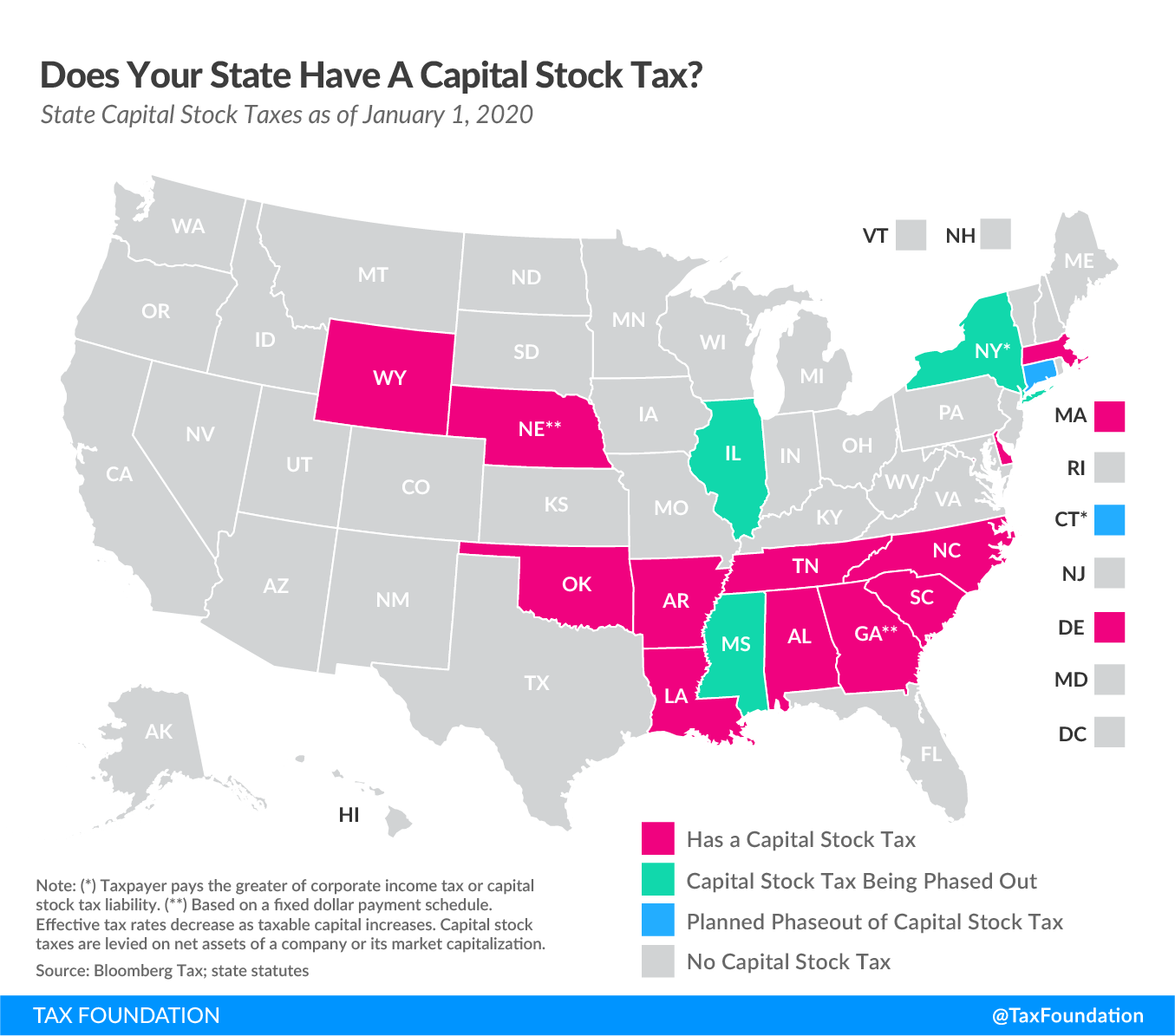

Tax Policy – Does Your State Levy a Capital Stock Tax?

This week’s map looks at another barrier to business and consumer recovery: capital stock taxes. These taxes impair economic growth in the best of times, but during an economic contraction they are particularly harmful to businesses struggling to remain viable. As many businesses may need time to return to profitability after the crisis, states should prioritize reducing reliance on these taxes, and shift toward more neutral forms of business taxation.

Unlike corporate income taxes, which are levied on a business’s net income (or profit), capital stock taxes are imposed on a business’s net worth (or accumulated wealth). As such, the tax tends to penalize investment and requires businesses to pay regardless of whether they make a profit in a given year, or ever.

Sixteen states levy capital stock taxes (often called franchise taxes, though some states use that term for different types of taxes as well). Capital stock taxes are not always limited to C corporations, either; different states have different laws regarding the types of businesses that fall under a capital stock tax. However, regardless of which entities are subject to the tax, the incentive is clear—capital stock taxes disincentivize capital accumulation in a state.

While exact formulas and methodologies vary from state to state, capital stock taxes are usually levied on a firm’s net assets, with rates ranging from a low of 0.02 percent in Wyoming to a high of 0.341 percent in Connecticut. Among the states that levy a capital stock tax, half place a cap on the maximum liability a business may be required to pay, while the other half do not have a limit. Among the eight states with a cap, Georgia’s is the lowest at $5,000, while New York’s is the highest at $5 million.

In Connecticut and New York, the capital stock tax functions similarly to an alternative minimum tax, where firms calculate both their corporate income tax liability and their capital stock tax liability and pay whichever amount is greater.

In Georgia and Nebraska, the capital stock tax is based on a fixed dollar payment schedule, rather than on a percentage of net assets, with tax rates decreasing as taxable capital increases.

| State | Tax Rate | Max Payment |

|---|---|---|

|

Alabama |

0.175% | $15,000 |

|

Arkansas |

0.3% | Unlimited |

|

Connecticut (a) |

0.341% | $1,000,000 |

|

Delaware |

0.03% | $200,000 |

|

Georgia |

(b) | $5,000 |

|

Illinois (c) |

0.1% | $2,000,000 |

|

Louisiana (d) |

0.3% | Unlimited |

|

Massachusetts (a) |

0.26% | Unlimited |

|

Mississippi (e) |

0.2% | Unlimited |

|

Nebraska |

(b) | $11,995 |

|

New York (a, f) |

0.025% | $5,000,000 |

|

North Carolina |

0.15% | Unlimited |

|

Oklahoma |

0.125% | $20,000 |

|

South Carolina |

0.1% | Unlimited |

|

Tennessee |

0.25% | Unlimited |

|

Wyoming |

0.02% | Unlimited |

|

(a) Taxpayer pays the greater of corporate income tax or capital stock tax liability. (b) Based on a fixed dollar payment schedule. Effective tax rates decrease as taxable capital increases. (c) The tax rate is 0.15% for the first year and 0.1% for all following years. Illinois’s tax is being phased out by exempting increasing amounts of capital stock liability. The 2020 exemption is $30. The tax will be fully phased out by 2024. (d) The rate is 0.15% for the first $300,000 of taxable capital. (e) Tax will be fully phased out by Jan. 1, 2028. (f) Tax will be fully phased out by Jan. 1, 2021. Note: Capital stock taxes are levied on net assets of a company or its market capitalization. Sources: State statutes; state revenue departments; Bloomberg Tax. |

||

Taxing a company based on its net worth disincentivizes the accumulation of wealth, or capital, which in turn can distort the size of firms and lead to harmful economic effects. As legislators have increasingly recognized the damaging effects of capital stock taxes, many states have reduced them or repealed them altogether. Kansas completely phased out its capital stock tax prior to tax year 2011, followed by Virginia and Rhode Island in 2015 and Pennsylvania in 2016. New York and Mississippi are in the process of phasing out their capital stock taxes, with New York’s scheduled to phase out by 2021 and Mississippi’s by 2028. Illinois is also beginning to phase out this tax, completing the process by 2024. Connecticut will phase out its capital stock tax over five years starting in 2021.

Capital stock taxes burden businesses that may already be struggling. State plans for economic recovery would benefit from a move toward more neutral forms of taxation.

Source: Tax Policy – Does Your State Levy a Capital Stock Tax?