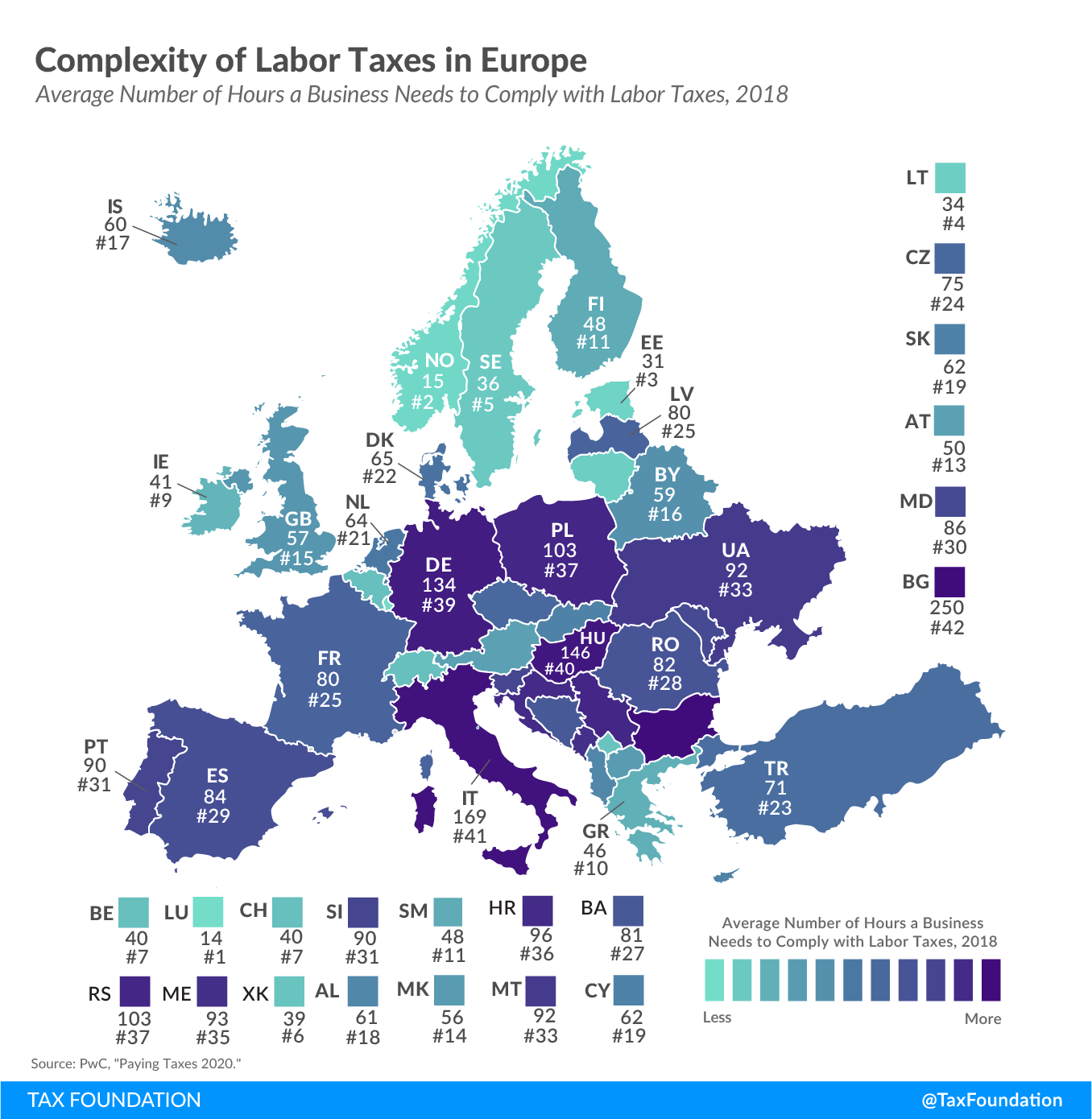

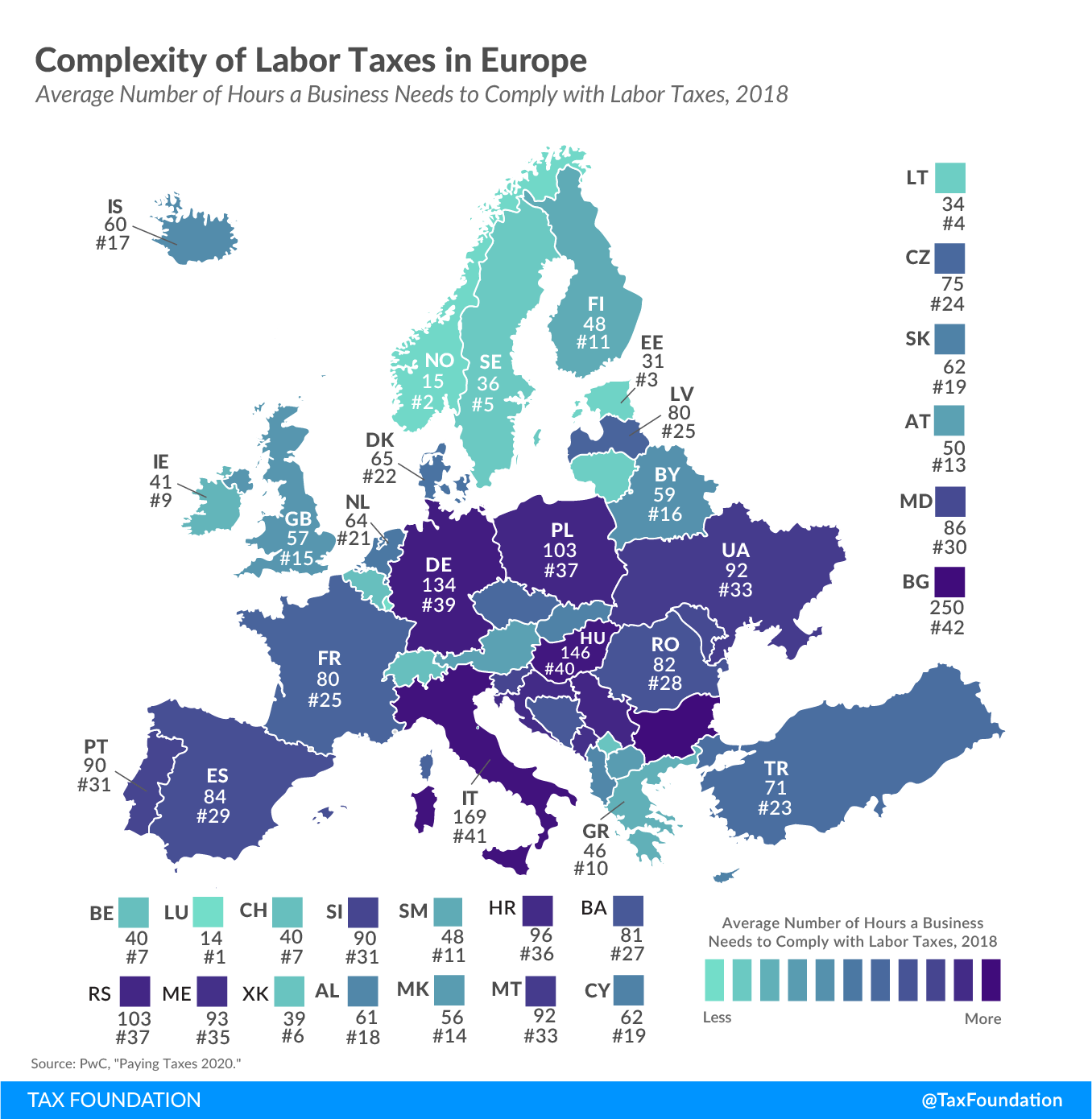

Tax Policy – Complexity of Labor Taxes in Europe

Governments require businesses to remit various types of taxes—one being labor taxes. Although labor taxes are generally not borne by businesses, they add to the administrative burden of complying with the tax system. Today’s map shows how complex—or easy—it is to remit labor taxes across Europe.

One way of measuring the administrative burden of labor taxes on businesses is to look at the number of hours it takes to comply. The time to comply indicator—measured in an annual study by the World Bank and PwC—reflects the average number of hours it takes a domestic medium-size business per year to prepare, file, and pay labor taxes (including payroll taxes and social contributions).

Luxembourg’s labor tax compliance requires the least amount of time of all European countries, at 14 hours, followed by Norway, at 15 hours. The administrative burden is highest in Bulgaria and Italy, where businesses need 250 hours and 169 hours a year to comply with labor taxes, respectively.

Another indicator of labor tax complexity is the number of separate labor tax payments a business is required to make every year. This indicator also accounts for easier compliance through electronic filing. When a labor tax is paid and filed online by the majority of medium-size businesses, only one payment is included in the indicator (even if payments are made more frequently).

| Country | Hours Needed to Comply with Labor Taxes per Year | Number of Labor Tax Payments per Year |

|---|---|---|

| Albania (AL) | 61 | 12 |

| Austria (AT) | 50 | 3 |

| Belarus (BY) | 59 | 2 |

| Belgium (BE) | 40 | 2 |

| Bosnia and Herzegovina (BA) | 81 | 1 |

| Bulgaria (BG) | 250 | 1 |

| Croatia (HR) | 96 | 1 |

| Cyprus (CY) | 62 | 1 |

| Czech Republic (CZ) | 75 | 2 |

| Denmark (DK) | 65 | 1 |

| Estonia (EE) | 31 | 0 |

| Finland (FI) | 48 | 3 |

| France (FR) | 80 | 2 |

| Germany (DE) | 134 | 1 |

| Greece (GR) | 46 | 1 |

| Hungary (HU) | 146 | 2 |

| Iceland (IS) | 60 | 13 |

| Ireland (IE) | 41 | 1 |

| Italy (IT) | 169 | 1 |

| Kosovo (XK) | 39 | 1 |

| Latvia (LV) | 80 | 1 |

| Lithuania (LT) | 34 | 1 |

| Luxembourg (LU) | 14 | 12 |

| Malta (MT) | 92 | 1 |

| Moldova (MD) | 86 | 3 |

| Montenegro (ME) | 93 | 13 |

| Netherlands (NL) | 64 | 1 |

| North Macedonia (MK) | 56 | 1 |

| Norway (NO) | 15 | 1 |

| Poland (PL) | 103 | 2 |

| Portugal (PT) | 90 | 1 |

| Romania (RO) | 82 | 3 |

| San Marino (SM) | 48 | 12 |

| Serbia (RS) | 103 | 1 |

| Slovak Republic (SK) | 62 | 1 |

| Slovenia (SI) | 90 | 1 |

| Spain (ES) | 84 | 1 |

| Sweden (SE) | 36 | 1 |

| Switzerland (CH) | 40 | 7 |

| Turkey (TR) | 71 | 1 |

| Ukraine (UA) | 92 | 1 |

| United Kingdom (GB) | 57 | 2 |

|

Source: PwC, “Paying Taxes 2020,” https://www.pwc.com/gx/en/services/tax/publications/paying-taxes-2020.html. |

||

While Estonia’s labor tax payments are automated, most European countries file labor taxes either once or twice every year. Businesses in Iceland and Montenegro are required to make the highest number of labor tax payments, at 13 payments.

Both measures—compliance time and payments—indicate that in some European countries businesses face relatively complex tax codes. In the case of labor taxes, however, this is only part of the total administrative burden. Adding the time individuals invest in preparing, filing, and paying their individual income taxes and social contributions would increase many countries’ labor tax compliance measures substantially.

Source: Tax Policy – Complexity of Labor Taxes in Europe