Tax Policy – OECD Report: Tax Revenue as Percent of GDP Below Average in Latin American and Caribbean Countries

The Organisation for Co-operation and Economic Development (OECD) has compiled tax revenue data for countries around the world—including 26 Latin American and Caribbean (LAC) countries, where tax revenue as a percent of GDP is on average 11 percentage points lower than in other regions.

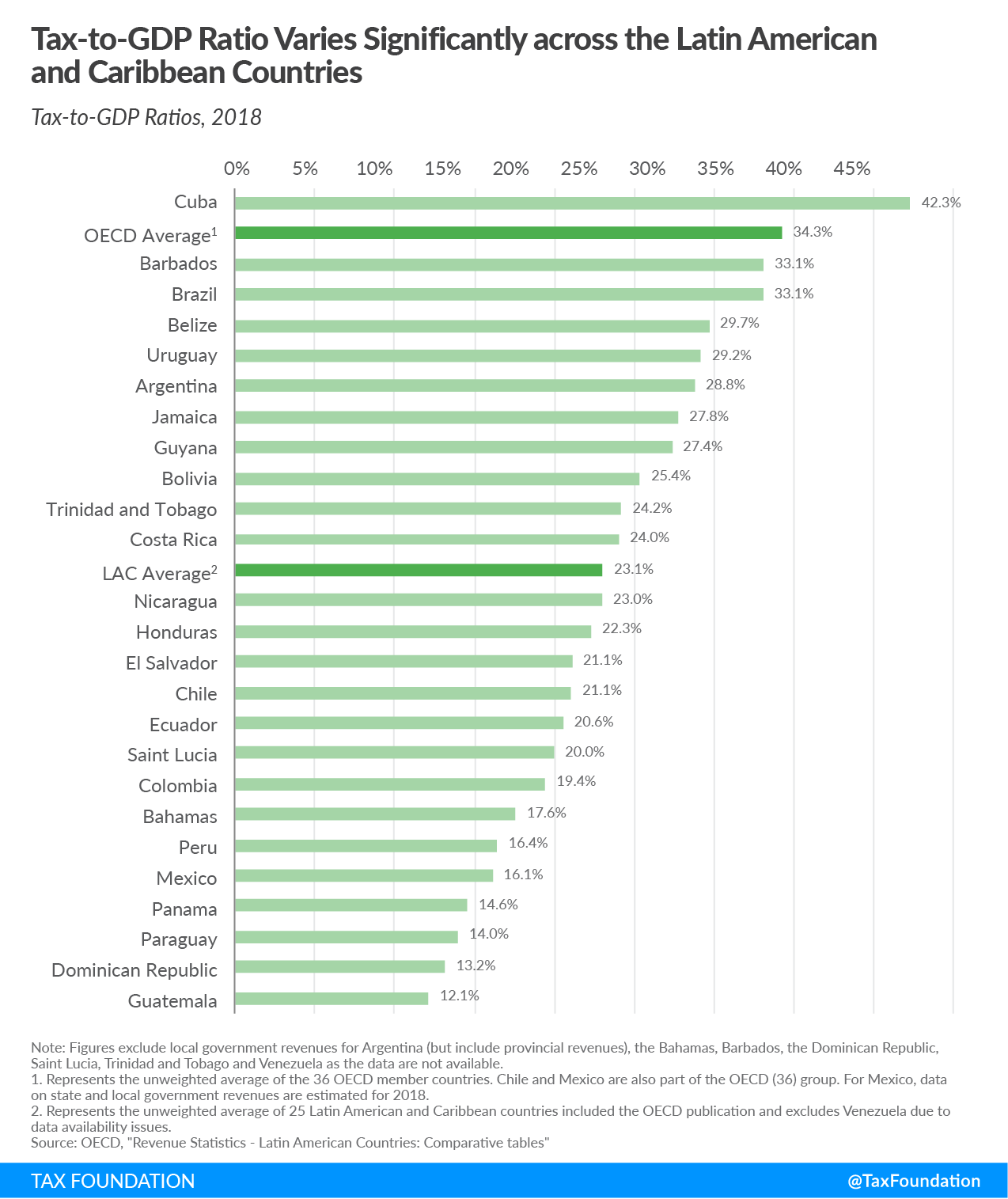

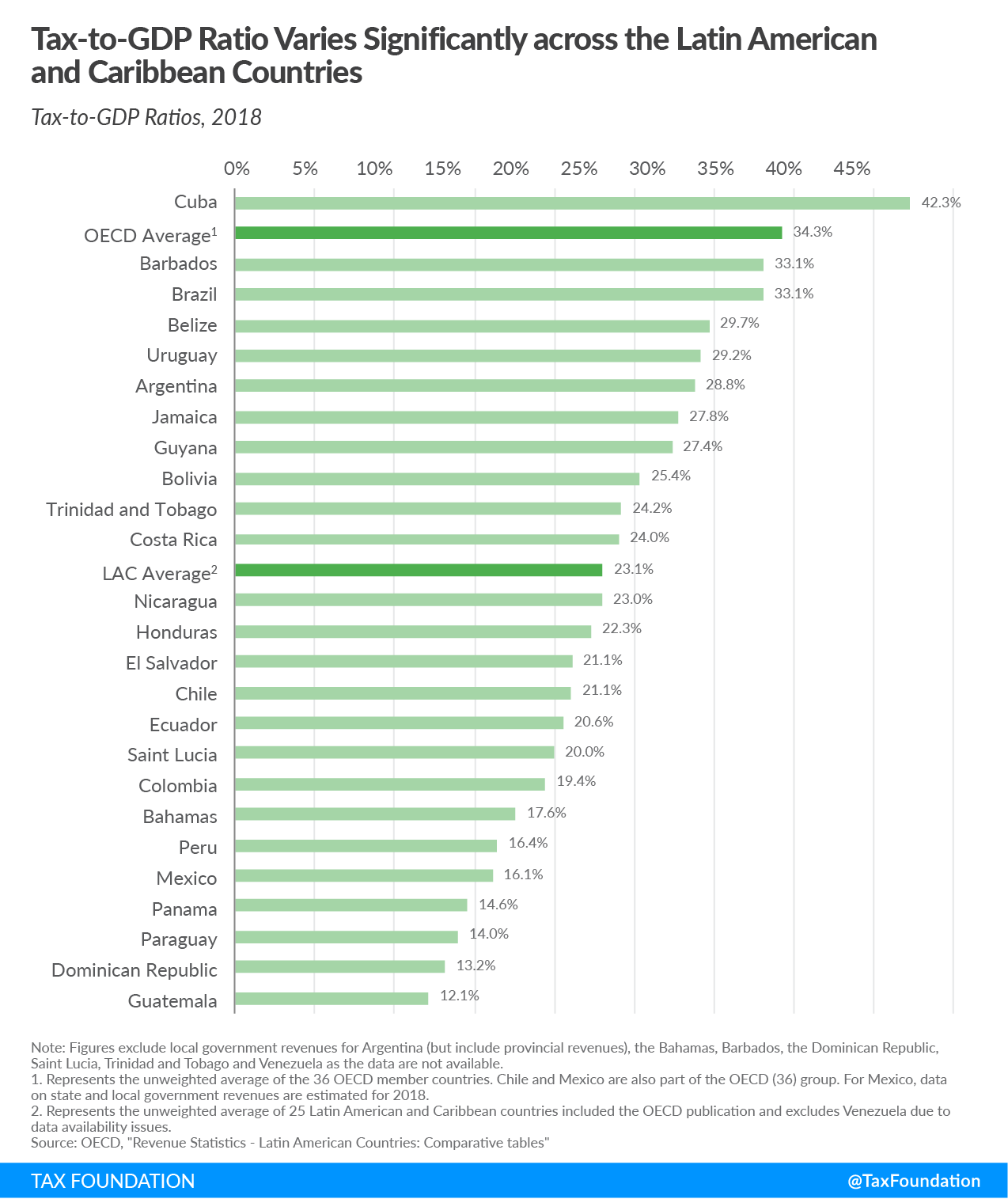

On average, the tax-to-GDP ratio for 25 countries (excluding Venezuela due to data availability issues) was 23.1 percent, compared to the OECD average of 34.3 percent. From all the LAC countries only Cuba (42.3 percent) recorded a tax-to-GDP ratio higher than the OECD average. (Mexico and Chile are also OECD member countries, therefore LAC and OECD groups overlap somewhat. Colombia also joined the OECD in 2020; nevertheless, it is not included in the OECD average for 2018.)

The regional OECD report on tax revenue statistics in LAC countries covers the years 1990 to 2018, breaking down current tax structures in the region and how they have evolved.

Tax-to-GDP Ratios

Between 1990 and 2018, the average tax-to-GDP ratio in LAC countries has risen steadily each year, with three exceptions (1991, 1996 and 2009), increasing by more than 7 percentage points, from 15.9 percent to 23.1 percent. This is mainly due to revenue increases from value-added taxes (VAT, 3.8 percentage points) and individual income and profit taxes (3.1 percentage points). Given that the OECD average has been relatively stable since 1990, the difference between the LAC and OECD average tax-to-GDP ratios decreased between 1990 and 2008 and has since remained relatively constant at 11 percentage points.

In 2018, Cuba (42.3 percent), Barbados (33.1 percent), and Brazil (33.1 percent) had the highest tax-to-GDP ratios of the 25 countries covered. Guatemala (12.1 percent), Dominican Republic (13.2 percent), and Paraguay (14 percent) had the lowest.

In general, countries in Central America and Mexico typically had lower tax‑to‑GDP ratios, at an average of 21 percent, while countries in the Caribbean had higher tax‑to‑GDP ratios at an average of 25.7 percent. For South American countries the average ratio was 23.1 percent, the same as the LAC average.

Sources of Tax Revenue

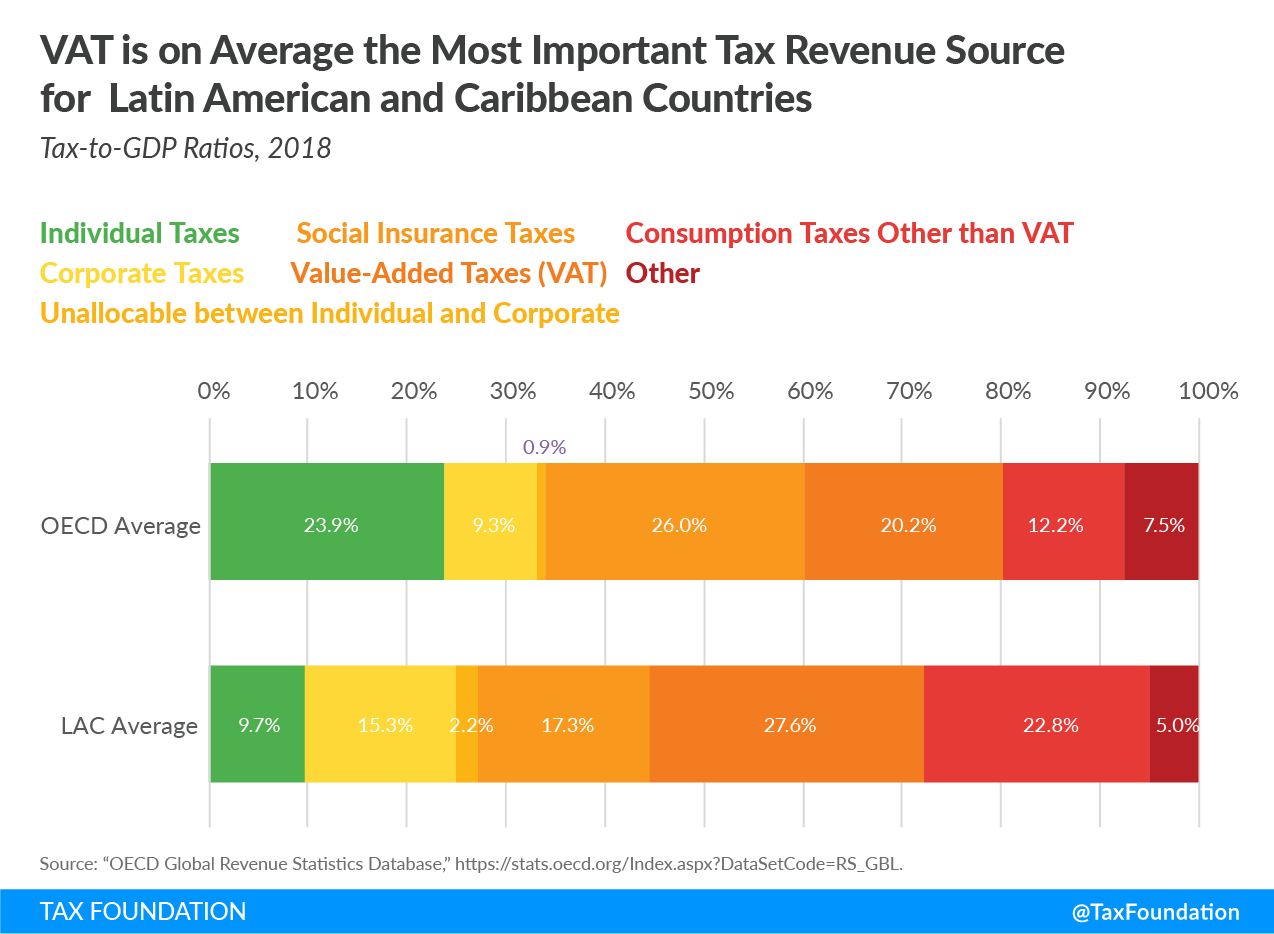

Taxes on goods and services were on average the greatest source of tax revenue for LAC countries, at 50.5 percent of total tax revenues in 2017, compared to one-third in OECD countries. VAT contributed on average 27.6 percent, making it the most important tax on goods and services in LAC countries. Corporate and individual taxes accounted, on average, for another 27.3 percent of all tax revenue. Notable differences with respect to the OECD average are LAC’s relatively higher reliance on corporate taxes and lower reliance on individual taxes. Social insurance taxes accounted for 17.3 percent of the tax revenue in LAC countries, compared to 26 percent in the OECD countries. Part of this difference can be explained by the tendency towards private provision of social security in many LAC countries.

In general, LAC countries have relatively higher reliance on corporate and consumption taxes. The average OECD tax structure differs quite substantially from that of the LAC average, as LAC countries tend to rely less on individual, social insurance, or property taxes.

Between 1990 and 2018, revenue sources have shifted to VAT (increase of 11.6 percentage points of total taxes) and individual and corporate taxes (increase of 8 percentage points of total taxes). Also, the share of social security contributions in total tax revenues has increased by 4.2 percentage points over the last 28 years. Consumption taxes other than VAT have declined by 19.5 percentage points of total revenues. While the share of corporate taxes is still higher than the share of individual taxes, since 2007, corporate tax revenue has declined by 1.6 percentage points of total tax revenue.

The decline in consumption taxes other than VAT (excise, customs, and import duties) in many LAC countries is partly due to lower trade tax revenues. Trade liberalization across the region has led to reduced import tariffs, a narrower base of goods and services subject to excise taxes, and the elimination of taxes on exports, lowering overall trade tax revenues. The exception is Argentina, where taxes on exports were reestablished in 2002. Nevertheless, the government abolished export taxes on almost all agricultural products in 2015.

While not a focus of this blog post, the OECD publication also examines the Equivalent Fiscal Pressure (EFP) in LAC countries. EFP is the sum of the tax‑to‑GDP ratio plus compulsory contributions to private social insurance systems and nontax revenues from natural resources. In 2018, the average EFP in the LAC region was 25 percent of GDP. Since 1990, the share of compulsory contributions to private social insurance systems as a percentage of GDP has increased by 0.7 percentage points, on average, while revenues from natural resources have been volatile.

VAT Revenue Ratios

The OECD report also includes VAT revenue ratios for 23 of the LAC countries. This ratio looks at the difference between the VAT revenue actually collected and what would theoretically be raised if VAT was applied at the standard rate on the entire tax base. The difference in actual and potential VAT revenues is due to 1) policy choices to exempt certain goods and services from VAT or tax them at a reduced rate, and 2) lacking VAT compliance. Higher VAT revenue ratios indicate a broader tax base, implying a more efficient VAT structure. Nevertheless, VAT revenue ratio interpretation is more difficult in countries that rely significantly on tourism, as purchases by nonresidents may not be included in the final consumption expenditure while the VAT on those purchases is included in the overall VAT tax revenues.

In 2018, the average LAC’s VAT revenue ratio stood at 0.58, slightly higher than the OECD average (0.56). The Bahamas, Belize, and Saint Lucia had the highest VAT revenue ratio (above 0.80), while the Dominican Republic and Mexico had the lowest ratios (0.34). However, the Bahamas, Belize, and Saint Lucia have a high share of revenue from tourism compared to the other LAC countries, which might partly explain the high VAT revenue ratio. Nevertheless, both the Bahamas and Belize have a broad-based VAT, with a limited number of exemptions and no reduced rates.

| Country | Individual and Corporate Taxes | Social Insurance Taxes | Value-Added Taxes (VAT) | Consumption Taxes Other than VAT | Other Taxes |

|---|---|---|---|---|---|

| Argentina | 17.8% | 21.7% | 26.3% | 24.2% | 10.1% |

| Bahamas | 0.0% | 14.9% | 31.6% | 42.5% | 11.0% |

| Barbados | 27.2% | 16.9% | 27.8% | 23.0% | 5.1% |

| Belize | 25.2% | 7.6% | 28.0% | 35.1% | 4.1% |

| Bolivia | 15.0% | 24.0% | 29.7% | 20.2% | 11.2% |

| Brazil | 21.5% | 25.4% | 21.1% | 23.0% | 9.0% |

| Chile | 35.8% | 6.9% | 40.2% | 13.0% | 4.0% |

| Colombia | 33.7% | 9.6% | 29.4% | 13.4% | 14.0% |

| Costa Rica | 20.4% | 34.3% | 17.8% | 17.2% | 10.3% |

| Cuba | 26.2% | 12.3% | 0.0% | 51.9% | 9.5% |

| Dominican Republic | 30.6% | 0.5% | 34.9% | 29.4% | 4.6% |

| Ecuador | 23.5% | 24.9% | 29.8% | 20.1% | 1.7% |

| El Salvador | 33.1% | 12.8% | 37.4% | 12.9% | 3.9% |

| Guatemala | 29.2% | 16.9% | 38.7% | 13.3% | 1.9% |

| Guyana | 35.7% | 9.9% | 21.9% | 29.4% | 3.2% |

| Honduras | 28.2% | 15.1% | 32.5% | 19.7% | 4.4% |

| Jamaica | 30.8% | 3.7% | 32.7% | 27.9% | 4.8% |

| Mexico | 44.6% | 13.3% | 23.1% | 13.2% | 5.8% |

| Nicaragua | 30.7% | 25.9% | 23.0% | 18.5% | 1.8% |

| Panama | 28.2% | 38.5% | 15.6% | 13.5% | 4.3% |

| Paraguay | 16.3% | 25.4% | 36.6% | 19.3% | 2.5% |

| Peru | 36.1% | 12.2% | 40.3% | 7.8% | 3.6% |

| Saint Lucia | 25.8% | 0.0% | 31.7% | 40.0% | 2.5% |

| Trinidad and Tobago | 52.7% | 12.7% | 19.7% | 13.9% | 1.0% |

| Uruguay | 26.3% | 26.1% | 25.7% | 13.7% | 8.2% |

| LAC Average | 27.8% | 17.1% | 27.8% | 22.2% | 5.0% |

| OECD Average | 33.7% | 27.0% | 20.6% | 12.0% | 6.8% |

|

Notes: The Bahamas does not have tax income. There is no VAT system in Cuba. Data are not available for social security contributions in Saint Lucia. Individual and Corporate Taxes covers the OECD category 1100 Taxes on income, profits, and capital gains of individuals, 1200 Taxes on income, profits, and capital gains of corporates and 1300 Unallocable between 1100 and 1200. Social Insurance Taxes covers the OECD category 2000 Social security contributions (SSC). Value-Added Taxes (VAT) covers the OECD category 5111 Value-added taxes. Consumption Taxes Other than VAT covers the OECD category 5000 Taxes on goods and services minus the category 5111 Value-added taxes. Other covers the OECD categories 3000 Taxes on payroll and workforce, 4000 Taxes on property, 6000 Taxes other than 1000, 2000, 3000, 4000, and 5000, and Custom duties collected for the EU. Source: OECD (2020), “Revenue Statistics in Latin America and the Caribbean 2020,” https://doi.org/10.1787/35745b02-en; and Tax Foundation calculations based on OECD, “Global Revenue Statistics Database,” https://stats.oecd.org/Index.aspx?DataSetCode=RS_GBL. |

|||||

Source: Tax Policy – OECD Report: Tax Revenue as Percent of GDP Below Average in Latin American and Caribbean Countries