Tax Policy – State and Local Individual Income Tax Collections per Capita

The individual income tax is one of the most significant sources of revenue for state and local governments. In fiscal year 2017, the most recent year for which data are available, individual income taxes generated 23.3 percent of state and local tax collections, right behind general sales taxes (23.6 percent).

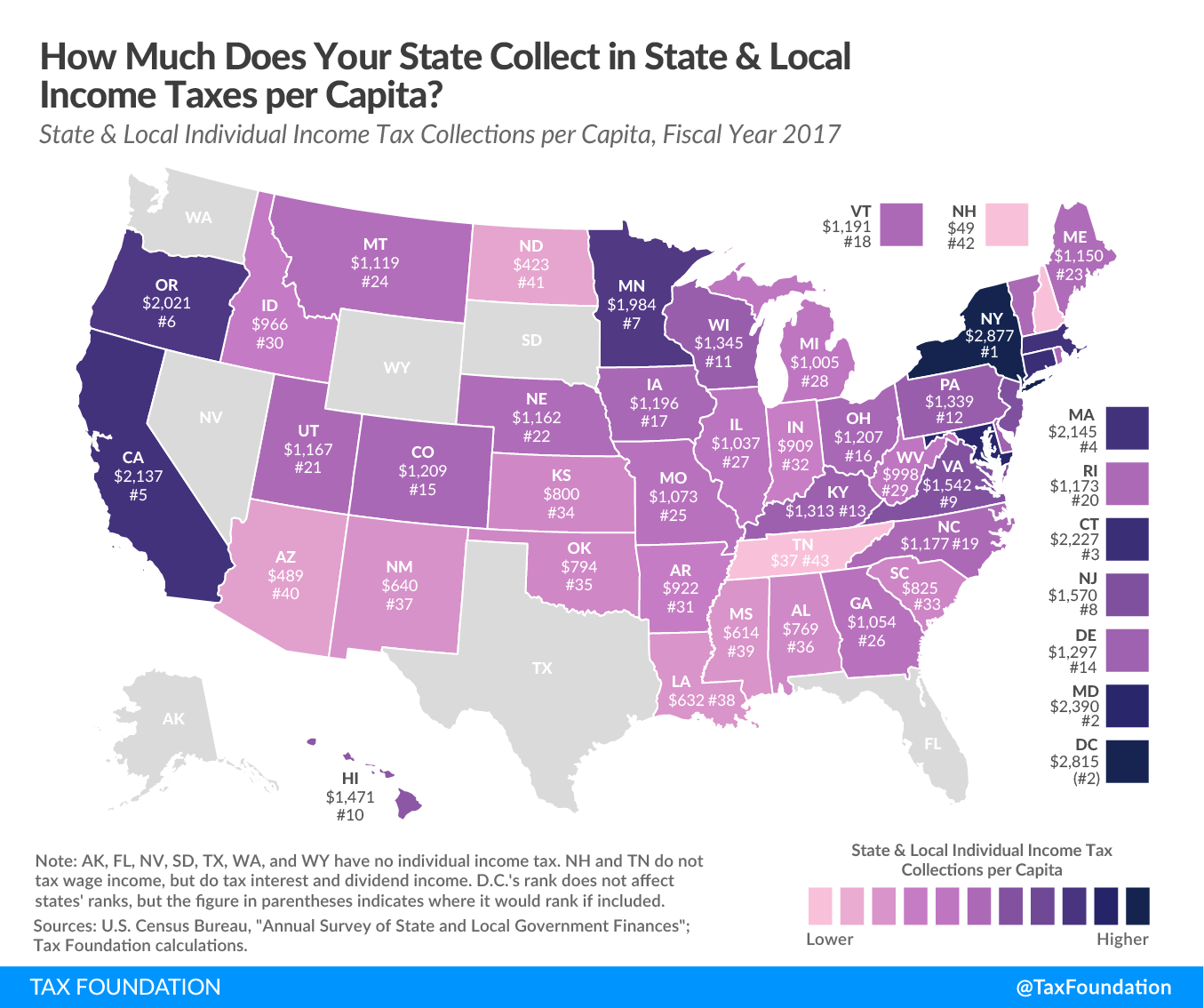

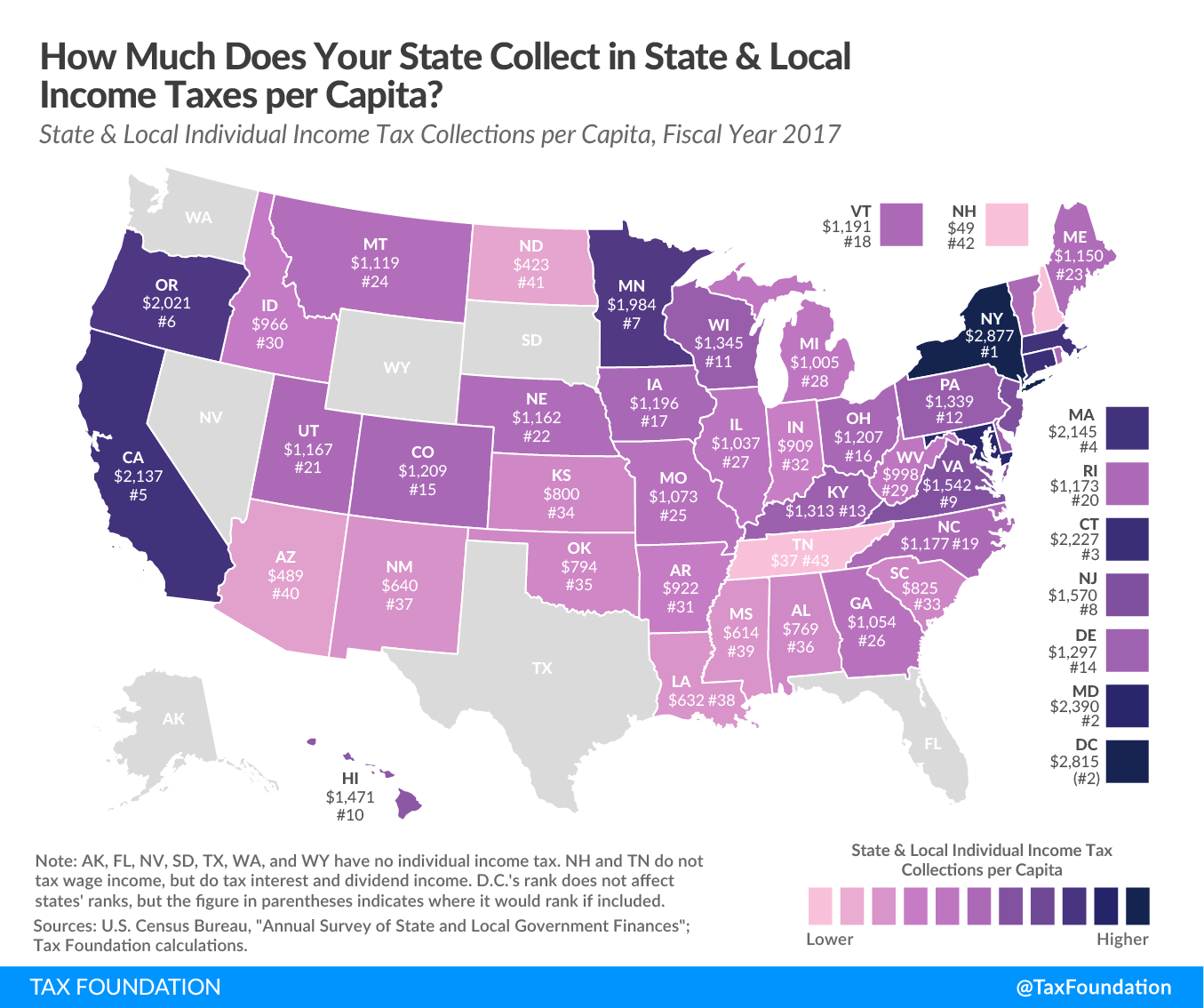

The map below shows combined state and local individual income tax collections per capita for each state in fiscal year 2017. Forty-one states and the District of Columbia levy broad-based taxes on wage income and investment income, while two states—New Hampshire and Tennessee—tax investment income but not wage income. Tennessee’s tax on investment income—known as the “Hall tax”—is being phased out and will be fully repealed by tax year 2021. Seven states do not levy an individual income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.

On average, state and local governments collected $1,198 per capita in individual income taxes, but collections varied widely from state to state, a function of both rate structures and income distributions, with higher-income states generating significantly more revenue per capita whether they have a high graduated rate system, like California, or a modest flat-rate income tax like Massachusetts. New York ($2,877), the District of Columbia ($2,815), Maryland ($2,390), Connecticut ($2,227), Massachusetts ($2,145), and California ($2,137) came in with the top five collections per capita. Tennessee ($37) and New Hampshire ($49) tax investment income but not wage income, making them the states with the lowest individual income tax collections per capita. Of the states that tax wage income, the lowest collections per capita in fiscal year 2017 can be found in North Dakota ($423), Arizona ($489), Mississippi ($614), Louisiana ($632), and New Mexico ($640).

Source: Tax Policy – State and Local Individual Income Tax Collections per Capita