Tax Policy – Summary of the Latest Federal Income Tax Data, 2020 Update

The Internal Revenue Service (IRS) has released data on individual income taxes for tax year 2017, showing the number of taxpayers, adjusted gross income, and income tax shares by income percentiles.[1]

The data demonstrates that the U.S. individual income tax continues to be very progressive, borne primarily by the highest income earners.[2]

- In 2017, 143.3 million taxpayers reported earning $10.9 trillion in adjusted gross income and paid $1.6 trillion in individual income taxes.

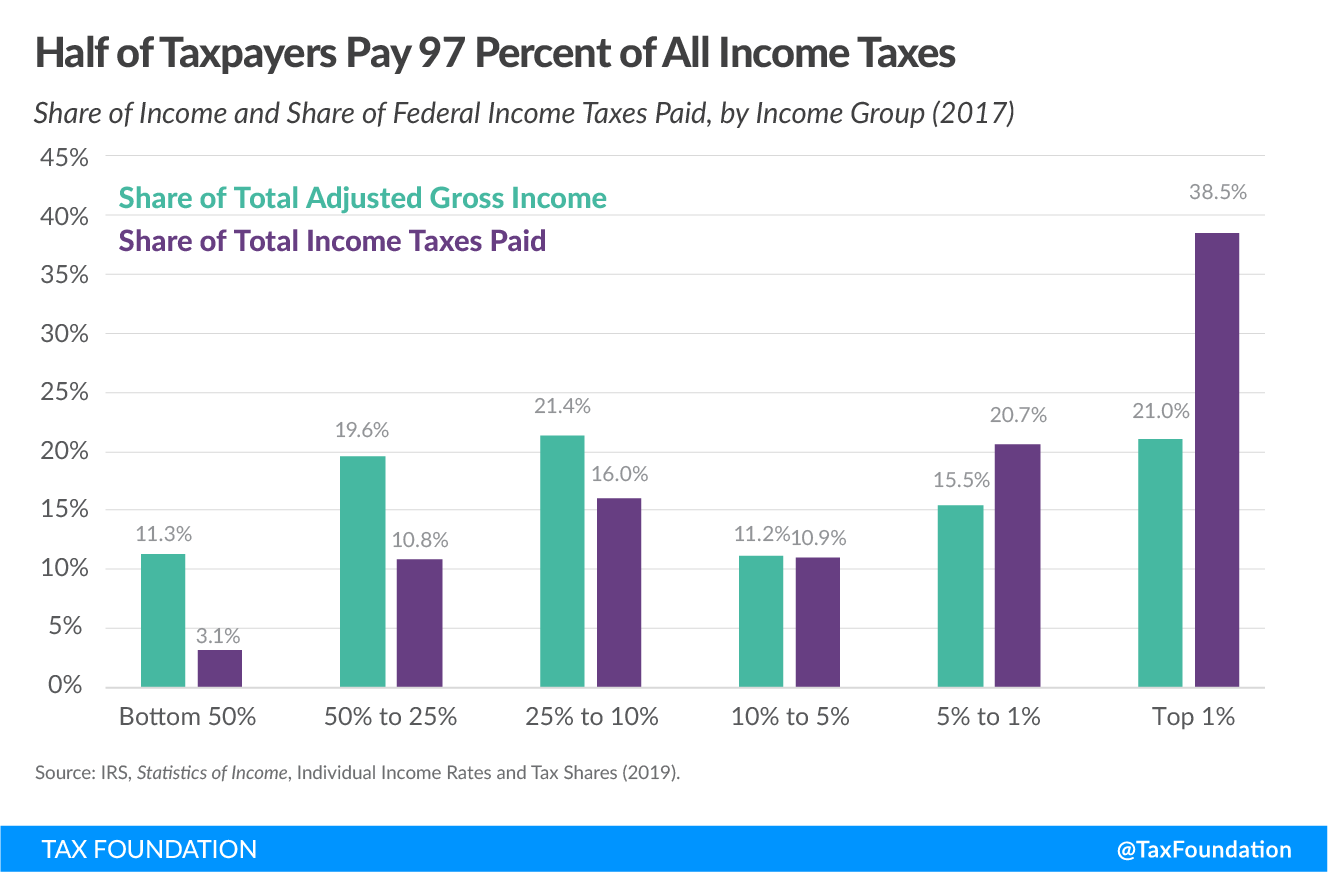

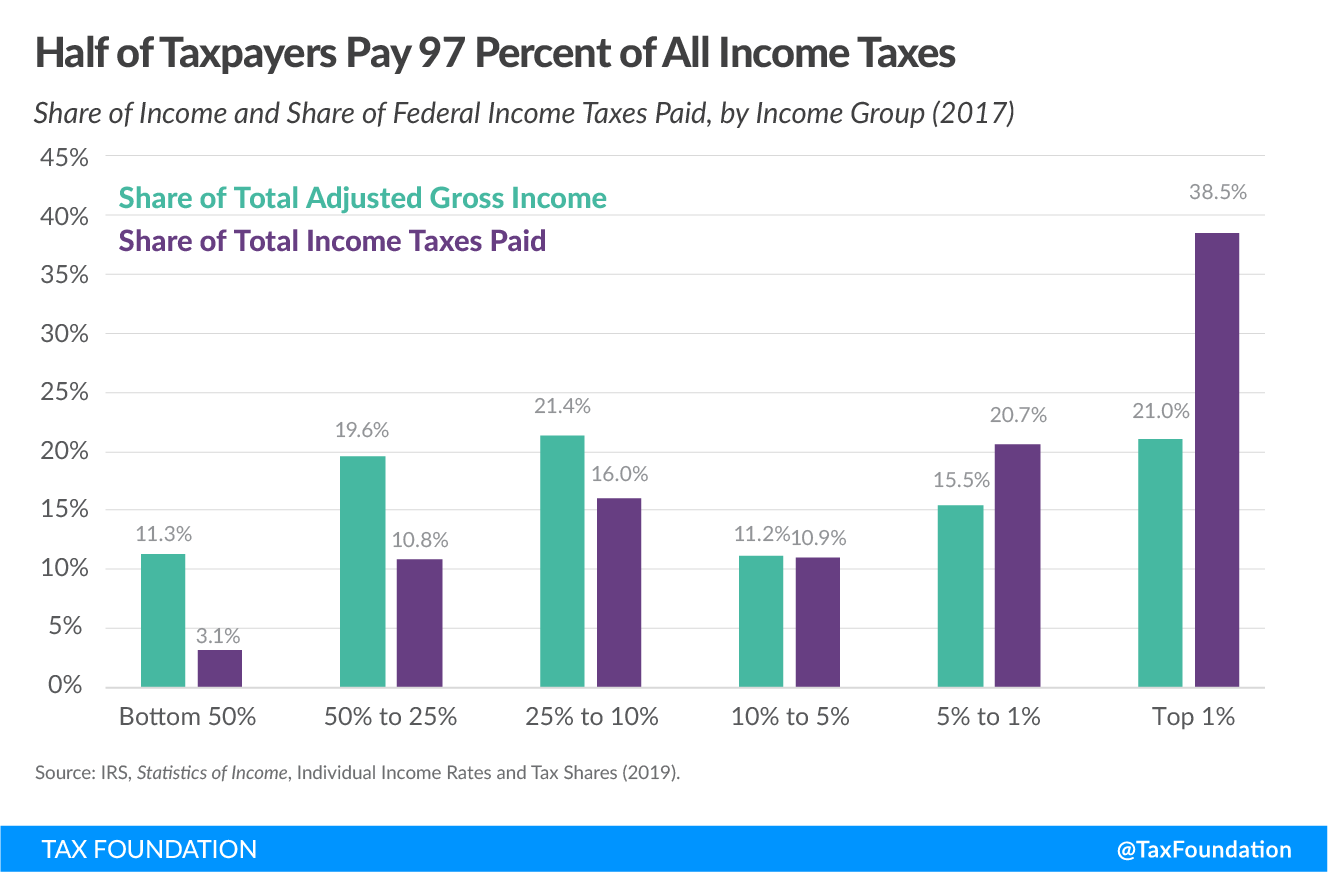

- The share of reported income earned by the top 1 percent of taxpayers rose to 21 percent, from 19.7 percent in 2016. Their share of federal individual income taxes rose to 38.5 percent, from to 37.3 percent in 2016.

- In 2017, the top 50 percent of all taxpayers paid 97 percent of all individual income taxes, while the bottom 50 percent paid the remaining 3 percent.

- The top 1 percent paid a greater share of individual income taxes (38.5 percent) than the bottom 90 percent combined (29.9 percent).

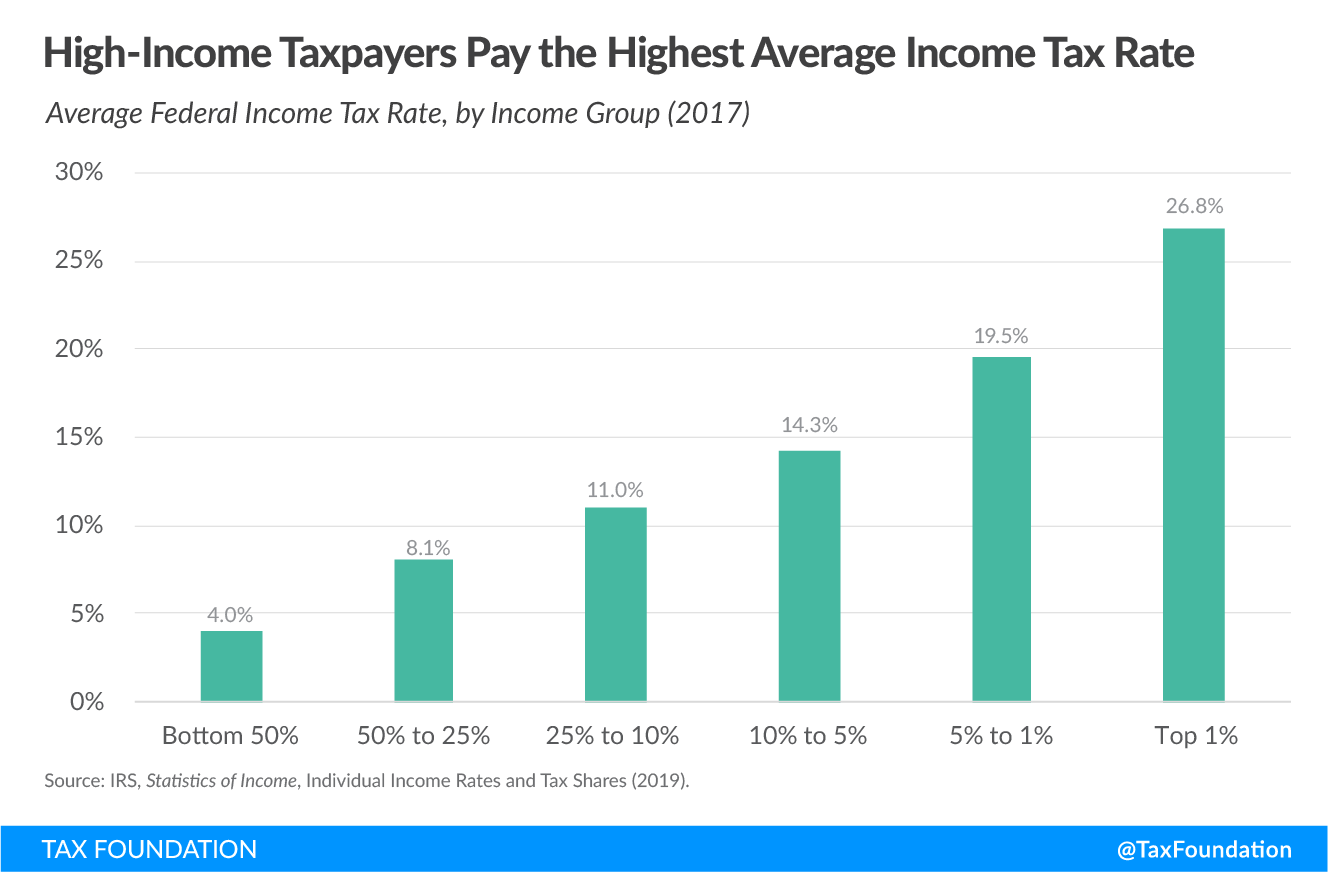

- The top 1 percent of taxpayers paid a 26.8 percent average individual income tax rate, which is more than six times higher than taxpayers in the bottom 50 percent (4.0 percent).

Reported Income Increased and Taxes Paid Increased in 2017

Taxpayers reported $10.9 trillion in adjusted gross income (AGI) on 143.3 million tax returns in 2017, the last tax year before the Tax Cuts and Jobs Act took effect. Total AGI grew $780 billion from 2016 levels, significantly more than the $14 billion increase from 2015 to 2016. There were 2.4 million more tax returns filed in 2017 than in 2016, and average AGI rose by $4,232 per return, or 5.8 percent.

Taxes paid rose to $1.6 trillion for all taxpayers in 2017, an 11 percent increase from the previous year. The average individual income tax rate for all taxpayers rose from 14.2 percent to 14.6 percent.

The share of income earned by the top 1 percent rose from 19.7 percent in 2016 to 21.0 percent in 2017, and the share of the income tax burden for the top 1 percent rose as well, from 37.3 percent in 2016 to 38.5 percent in 2017.

|

Note: Table does not include dependent filers. “Income split point” is the minimum AGI for tax returns to fall into each percentile. Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares (2019). |

|||||||

| Top 1% | Top 5% | Top 10% | Top 25% | Top 50% | Bottom 50% | All Taxpayers | |

|---|---|---|---|---|---|---|---|

| Number of Returns | 1,432,952 | 7,164,758 | 14,329,516 | 35,823,790 | 71,647,580 | 71,647,580 | 143,295,160 |

| Adjusted Gross Income ($ millions) | $2,301,449 | $3,995,037 | $5,220,949 | $7,561,368 | $9,706,054 | $1,230,446 | $10,936,500 |

| Share of Total Adjusted Gross Income | 21.0% | 36.5% | 47.7% | 69.1% | 88.7% | 11.3% | 100.0% |

| Income Taxes Paid ($ millions) | $615,979 | $946,954 | $1,122,158 | $1,378,757 | $1,551,537 | $49,772 | $1,601,309 |

| Share of Total Income Taxes Paid | 38.5% | 59.1% | 70.1% | 86.1% | 96.9% | 3.1% | 100.0% |

| Income Split Point | $515,371 | $208,053 | $145,135 | $83,682 | $41,740 | $41,740 | |

| Average Tax Rate | 26.8% | 23.7% | 21.5% | 18.2% | 16.0% | 4.0% | 14.6% |

High-Income Taxpayers Paid the Majority of Federal Income Taxes

In 2017, the bottom 50 percent of taxpayers (those with AGI below $41,740) earned 11.3 percent of total AGI. This group of taxpayers paid $49.8 billion in taxes, or roughly 3 percent of all federal individual income taxes in 2017.

In contrast, the top 1 percent of all taxpayers (taxpayers with AGI of $515,371 and above) earned 21.0 percent of all AGI in 2017 and paid 38.5 percent of all federal income taxes.

In 2017, the top 1 percent of taxpayers accounted for more income taxes paid than the bottom 90 percent combined. The top 1 percent of taxpayers paid roughly $616 billion, or 38.5 percent of all income taxes, while the bottom 90 percent paid about $479 billion, or 29.9 percent of all income taxes.

High-Income Taxpayers Paid the Highest Average Income Tax Rates

The 2017 IRS data shows that taxpayers with higher incomes paid much higher average income tax rates than lower-income taxpayers.[3]

The bottom 50 percent of taxpayers (taxpayers with AGIs below $41,740) faced an average income tax rate of 4.0 percent. As household income increases, the IRS data shows that average income tax rates rise. For example, taxpayers with AGIs between the 10th and 5th percentiles ($145,135 and $208,053) paid an average effective rate of 14.3 percent—3.5 times the rate paid by those in the bottom 50 percent.

The top 1 percent of taxpayers (AGI of $515,371 and above) paid the highest effective income tax rate, roughly 26.8 percent, more than six times the rate faced by the bottom 50 percent of taxpayers.

You can download the full data set in excel or PDF form above.

Appendix

- For data prior to 2001, all tax returns that have a positive AGI are included, even those that do not have a positive income tax liability. For data from 2001 forward, returns with negative AGI are also included, but dependent returns are excluded.

- Income tax after credits (the measure of “income taxes paid” above) does not account for the refundable portion of the earned income tax credit. If it were included, the tax share of the top income groups would be higher. The refundable portion is classified as a spending program by the Office of Management and Budget (OMB) and therefore is not included by the IRS in these figures.

- The only tax analyzed here is the federal individual income tax, which is responsible for more than 25 percent of the nation’s taxes paid (at all levels of government). Federal income taxes are much more progressive than federal payroll taxes, which are responsible for about 20 percent of all taxes paid (at all levels of government), and are more progressive than most state and local taxes.

- AGI is a fairly narrow income concept and does not include income items like government transfers (except for the portion of Social Security benefits that is taxed), the value of employer-provided health insurance, underreported or unreported income (most notably that of sole proprietors), income derived from municipal bond interest, net imputed rental income, and others.

- The unit of analysis here is the tax return. In the figures prior to 2001, some dependent returns are included. Under other units of analysis (like the U.S. Treasury Department’s Family Economic Unit), these returns would likely be paired with parents’ returns.

- These figures represent the legal incidence of the income tax. Most distributional tables (such as those from the Congressional Budget Office, the Tax Policy Center, Citizens for Tax Justice, the Treasury Department, and the Joint Committee on Taxation) assume that the entire economic incidence of personal income taxes falls on the income earner.

You can download the full data set in excel or PDF form above.

[1] Internal Revenue Service, Statistics of Income, “Number of Returns, Shares of AGI and Total Income Tax, AGI Floor on Percentiles in Current and Constant Dollars, and Average Tax Rates,” Table 1, and “Number of Returns, Shares of AGI and Total Income Tax, and Average Tax Rates,” Table 2, https://www.irs.gov/statistics/soi-tax-stats-individual-income-tax-rates-and-tax-shares.

[2] This data is for tax year 2017 and does not include any impact from the Tax Cuts and Jobs Act (TCJA).

[3] “Average income tax rate” is defined here as income taxes paid divided by adjusted gross income.

Source: Tax Policy – Summary of the Latest Federal Income Tax Data, 2020 Update