Tax Blog

Tips to help you prepare for tax season

New Guidance on State Aid Under the CARES Act

Tax Policy - New Guidance on State Aid Under the CARES Act On Wednesday, the U.S. Department of the Treasury issued new guidance on allowable expenses using the $150 billion in state aid provided under the Coronavirus Aid, Relief, and Economic Security (CARES)...

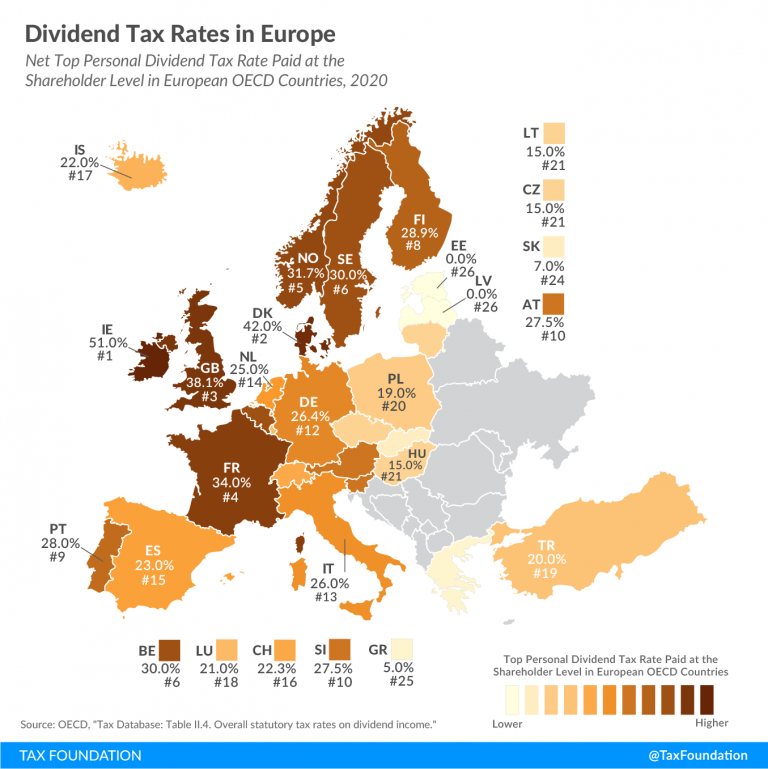

Dividend Tax Rates in Europe

Tax Policy - Dividend Tax Rates in Europe Many countries’ individual income tax systems tax various sources of individual income—including investment income such as dividends and capital gains. Today’s map shows how dividend income is taxed across European OECD...

IRS Outlines Tax Relief for Individual, Business Travel Disrupted by COVID-19

The Internal Revenue Service yesterday published a release outlining tax-relief measures that the agency is taking for individuals and businesses whose tax residency could be affected by coronavirus-related travel restrictions.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Senate Passes Additional Funding for Small Business Relief, But Questions Remain on the Deductibility of PPP Expenses

Tax Policy - Senate Passes Additional Funding for Small Business Relief, But Questions Remain on the Deductibility of PPP Expenses The U.S. Senate on Tuesday passed the Paycheck Protection Program Increase Act, which aims to top off the Paycheck Protection...

Keeping it Simple: Approaching the Next Stage of Coronavirus Tax Policy

Tax Policy - Keeping it Simple: Approaching the Next Stage of Coronavirus Tax Policy Federal policymakers are set to return to Washington on May 4 to debate the next legislative proposals to address the coronavirus crisis and global financial fallout. As they...

Relief for tax residency impacts of COVID-19 travel disruptions

IRS Tax News - Relief for tax residency impacts of COVID-19 travel disruptions Individuals and businesses can avoid having their prolonged stay in a country affect their tax residence if their cross-border travel was disrupted by the COVID-19 pandemic, under...