Tax Blog

Tips to help you prepare for tax season

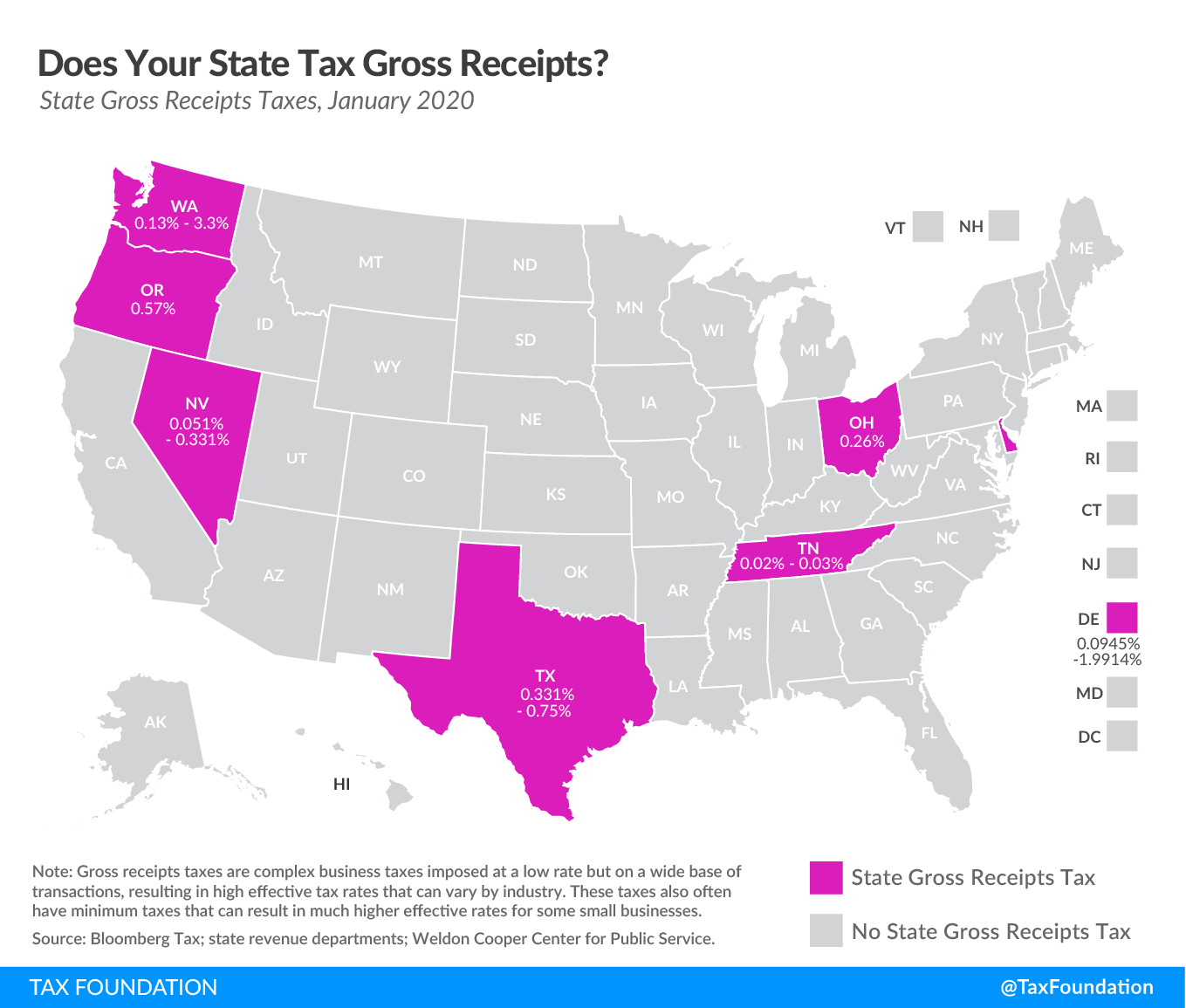

Does Your State Have a Gross Receipts Tax?

Tax Policy - Does Your State Have a Gross Receipts Tax? Although it’s unclear how soon state economies across the country may be able to open again, it’s not too early for states to think about how they can remove barriers to businesses and consumers resuming...

Tax Policy After Coronavirus: Clearing a Path to Economic Recovery

Tax Policy - Tax Policy After Coronavirus: Clearing a Path to Economic Recovery Short-term policies to “stimulate” economic growth after COVID-19 run the risk of producing short-term results and would likely prove insufficient and ineffective for sparking a...

EIP Alert: April 22 Deadline for SSA and RRB Beneficiaries with Dependents

Social Security Administration (SSA) and Railroad Retirement Board (RRB) beneficiaries with dependents need to report that information to the IRS before April 22 at noon to receive $500 for each qualifying child at the same time as their $1,200 EIP.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

What will Keep Marijuana Taxes from Going up in Smoke?

A recent audit is pointing up the need for additional attention from the IRS on just how taxes are collected from an emerging sector of the economy: the marijuana industry.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Guidance sought on employee retention credit

IRS Tax News - Guidance sought on employee retention credit In a letter to Treasury and the IRS, the AICPA pointed out several issues involving the new employee retention credit that need clarification and guidance. Source: IRS Tax News - Guidance sought...

Deadline looms for nonfilers to register for child stimulus payments

IRS Tax News - Deadline looms for nonfilers to register for child stimulus payments Social Security and Railroad Retirement beneficiaries who didn’t file 2018 or 2019 tax returns must enter their children’s information by noon EDT on Wednesday, April 22, to get...