Tax Blog

Tips to help you prepare for tax season

Evaluating the Trade-offs of Small Business Relief Provisions of the CARES Act

Tax Policy - Evaluating the Trade-offs of Small Business Relief Provisions of the CARES Act The CARES Act provides several relief options for employers trying to maintain payroll and liquidity during the coronavirus pandemic. For example, the CARES Act provides...

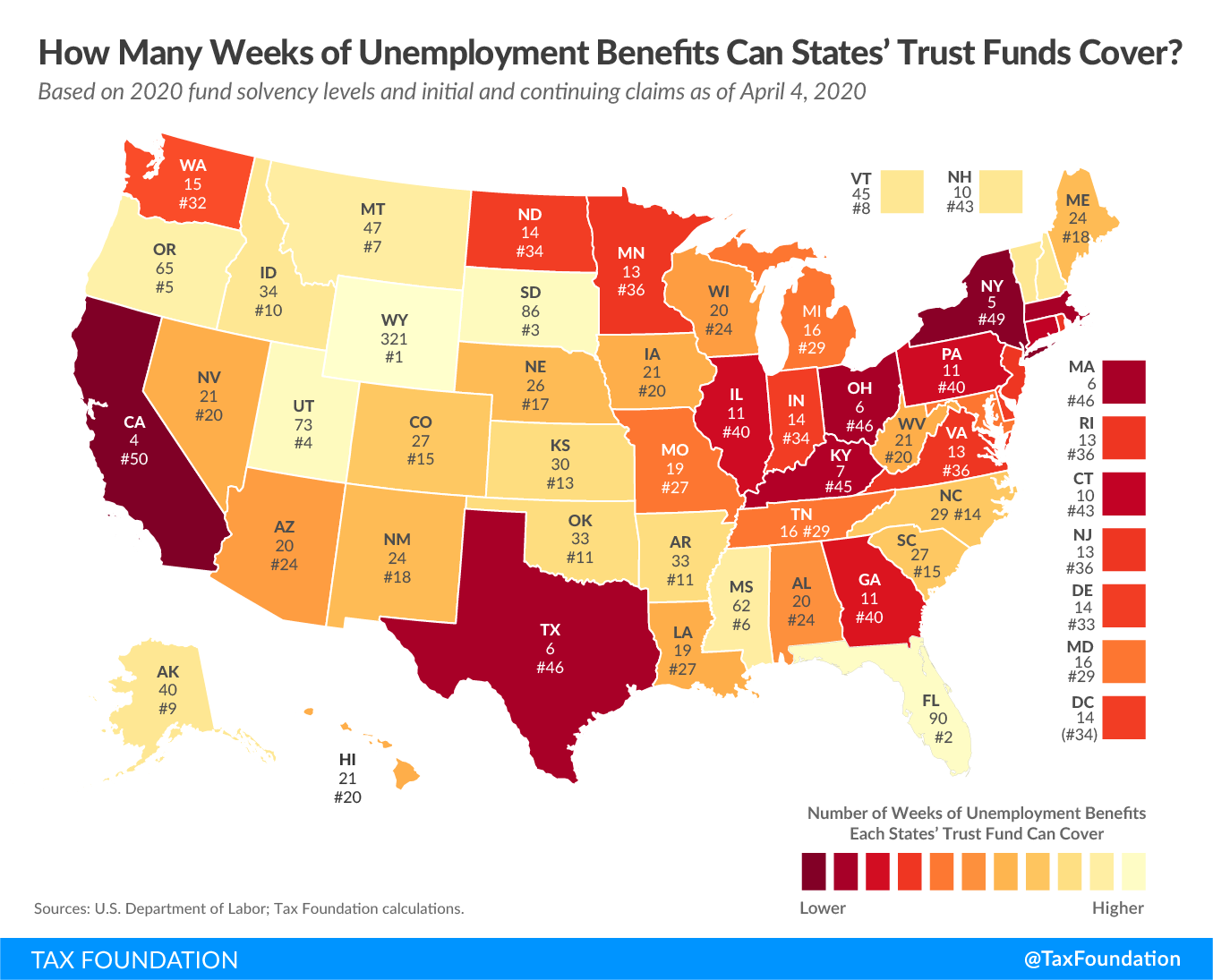

States’ Unemployment Compensation Trust Funds Could Run Out in Mere Weeks

Tax Policy - States’ Unemployment Compensation Trust Funds Could Run Out in Mere Weeks Six states, which collectively account for over one-third of the U.S. population, are currently in a position to pay out fewer than 10 weeks of the unemployment compensation...

Drake Tax Supports EIP Returns

Drake Software today announced that Drake Tax supports Economic Impact Payment (EIP) returns, providing customers a way to help those who don’t typically file a return receive the payment recently authorized by the CARES Act.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

These States Could Tax Your Recovery Rebates

Tax Policy - These States Could Tax Your Recovery Rebates Americans are receiving rebate checks as part of the federal government’s economic response to the COVID-19 crisis—but in a few states, at least some of those checks could be taxed. Under the Coronavirus...

Partnerships can file amended returns to get CARES Act benefits

IRS Tax News - Partnerships can file amended returns to get CARES Act benefits To allow those partnerships to take advantage of the beneficial tax provisions in the Coronavirus Aid, Relief, and Economic Security Act, the IRS is allowing partnerships to file...

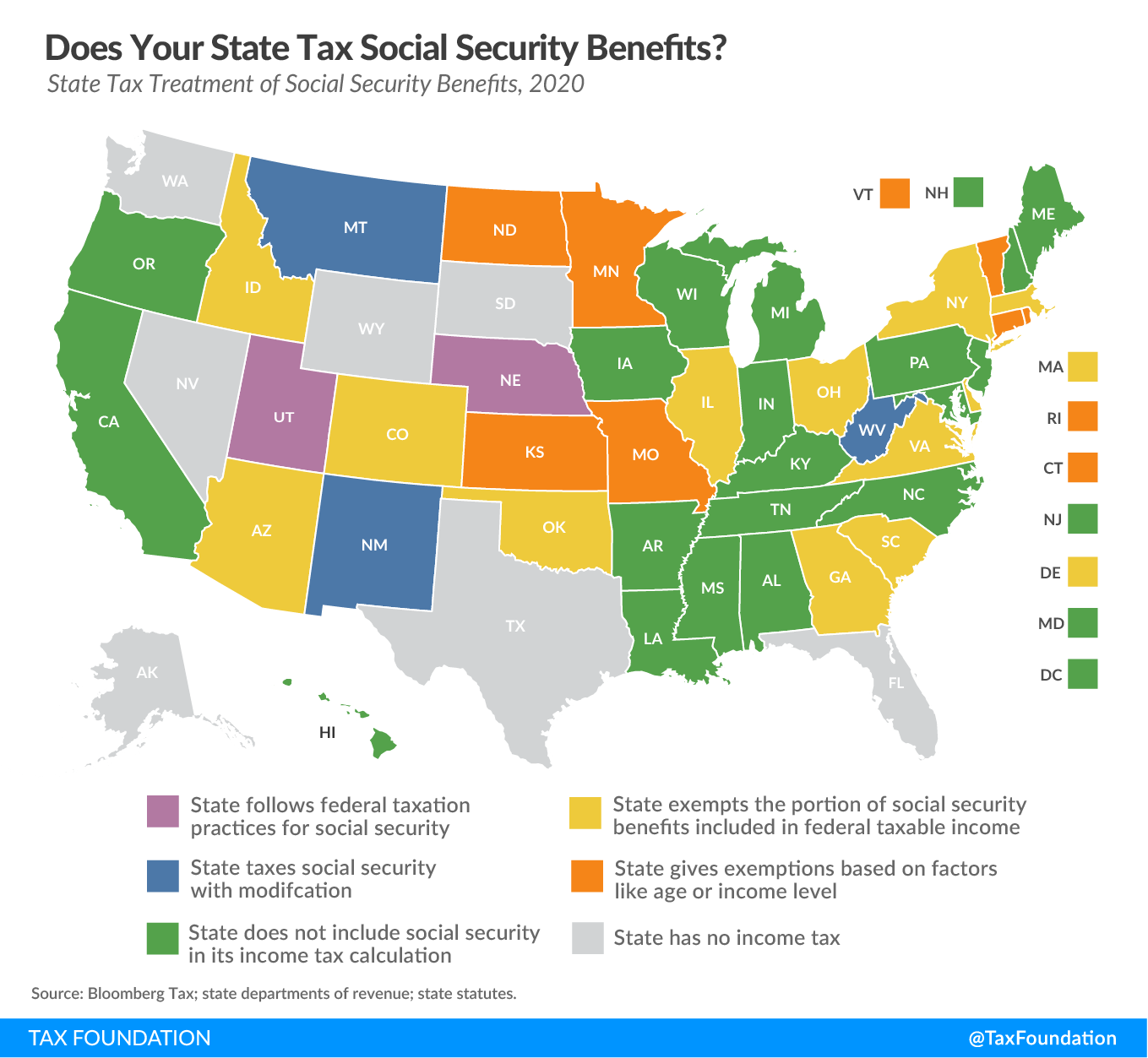

Does Your State Tax Social Security Benefits?

Tax Policy - Does Your State Tax Social Security Benefits? The question, “Does my state tax Social Security benefits?” may be simple enough, but the answer includes a lot of nuance. Many states have unique and specific provisions regarding the taxation of Social...