Tax Blog

Tips to help you prepare for tax season

Watch: Tax Foundation Experts Discuss Short-term Coronavirus Relief Packages

Tax Policy - Watch: Tax Foundation Experts Discuss Short-term Coronavirus Relief Packages The coronavirus crisis demands urgent solutions but also careful consideration. How can governments best deliver immediate relief while ensuring that tax policies remain...

AICPA posts 20 FAQs on tax filing relief

IRS Tax News - AICPA posts 20 FAQs on tax filing relief The AICPA posted FAQs explaining the latest developments in taxpayer relief during the COVID-19 pandemic. The AICPA has recommended that the IRS and Treasury Department expand the scope of recently...

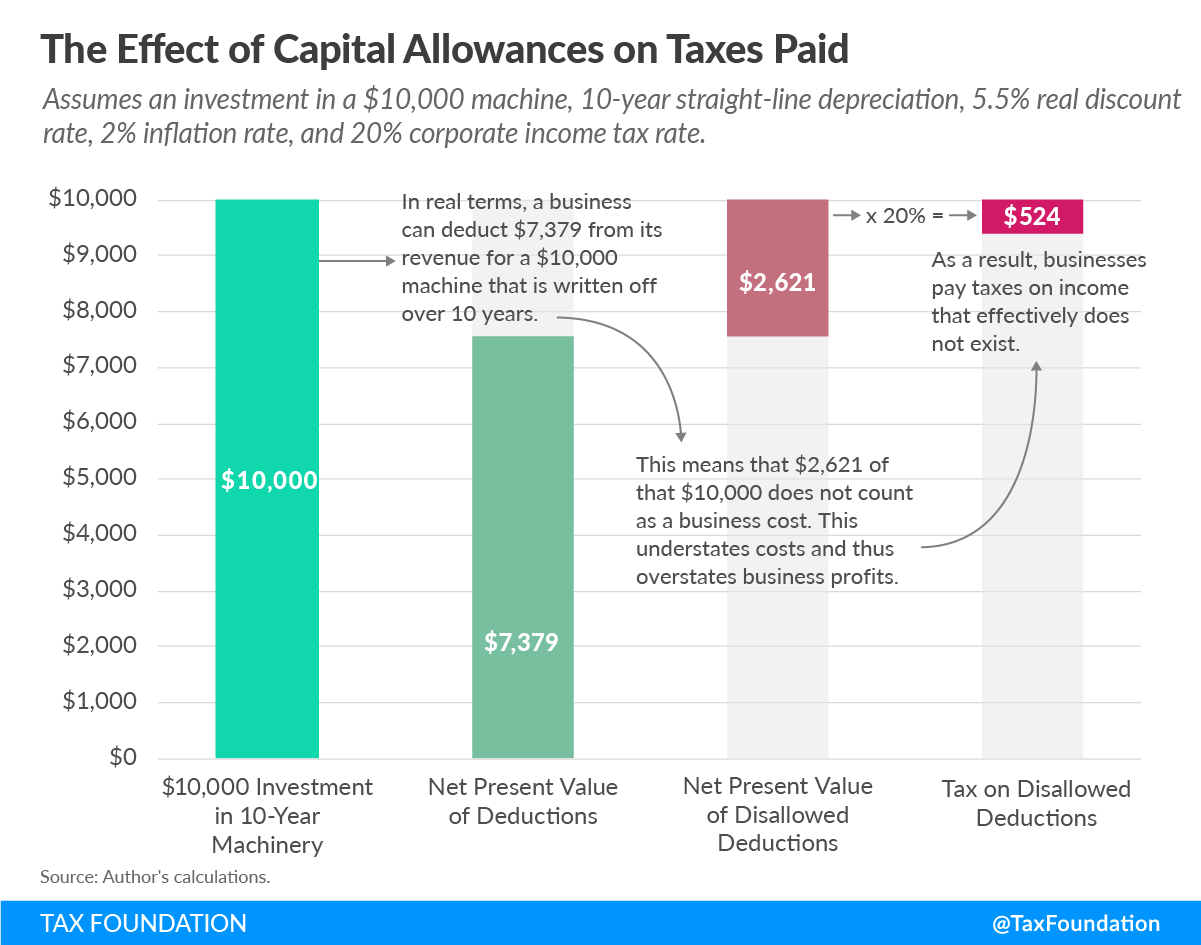

Capital Cost Recovery across the OECD

Tax Policy - Capital Cost Recovery across the OECD Key Findings A capital allowance is the amount of capital investment costs a business can deduct from its revenue through the tax code via depreciation. Higher capital allowances can boost investment which, in...

Accounting Today Looks at the IRS COVID-19 Response

For many of us, we’re living in a time that has no comparison. We’ve seen wars, famines, economic crashes, but no pandemic—until now. Jim Buttonow of Accounting Today magazine says for the Internal Revenue Service, a bad situation may be about to get even worse.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Temporary Work Locations in a Permanent Establishment World

Tax Policy - Temporary Work Locations in a Permanent Establishment World The incredible disruptions that the current pandemic has caused has led to a variety of tax questions. While much of the fiscal conversation has focused on tax relief and tax deferrals,...

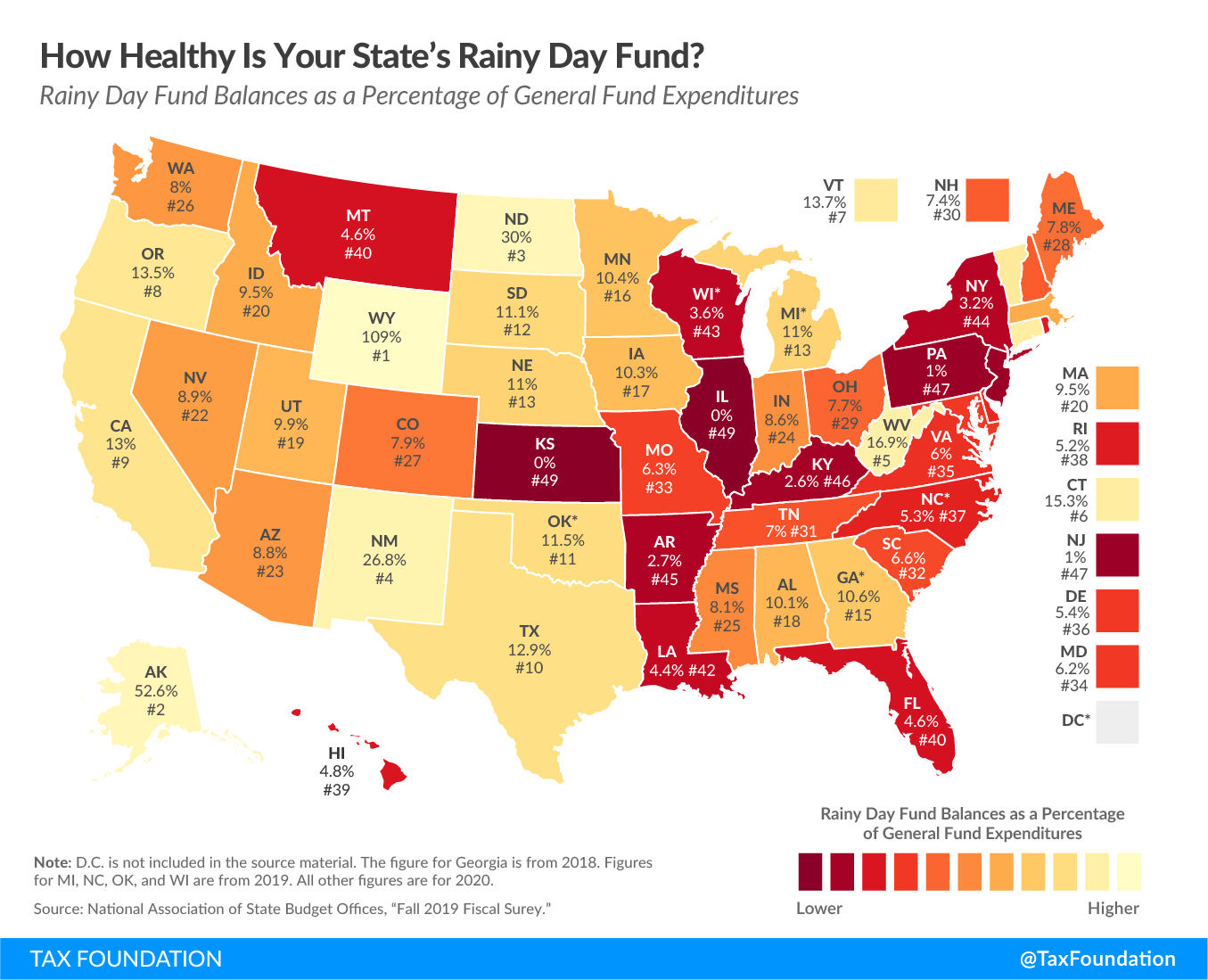

State Rainy Day Funds and the COVID-19 Crisis

Tax Policy - State Rainy Day Funds and the COVID-19 Crisis Key Findings State revenue stabilization funds, often called rainy day funds, are better funded now than they were at the start of the Great Recession and can be a valuable tool as states face a sharp...