Tax Blog

Tips to help you prepare for tax season

April 2nd Evening State Tax Update

Tax Policy - April 2nd Evening State Tax Update On March 19 we launched a tracker providing a repository of information related to state fiscal policy responses to COVID-19. We are updating the tracker frequently and will be using the Tax Foundation blog to...

Social Security recipients will automatically receive stimulus payments

IRS Tax News - Social Security recipients will automatically receive stimulus payments The IRS announced that Social Security and Railroad Retirement benefit recipients will not have to file a tax return to receive the $1,200 stimulus payment provided by the...

Understanding the Paycheck Protection Program in the CARES Act

Tax Policy - Understanding the Paycheck Protection Program in the CARES Act Americans are still digesting the $2.2 trillion CARES Act (H.R. 748), which passed last week as the largest financial support package in U.S. history. The law runs more than 800 pages...

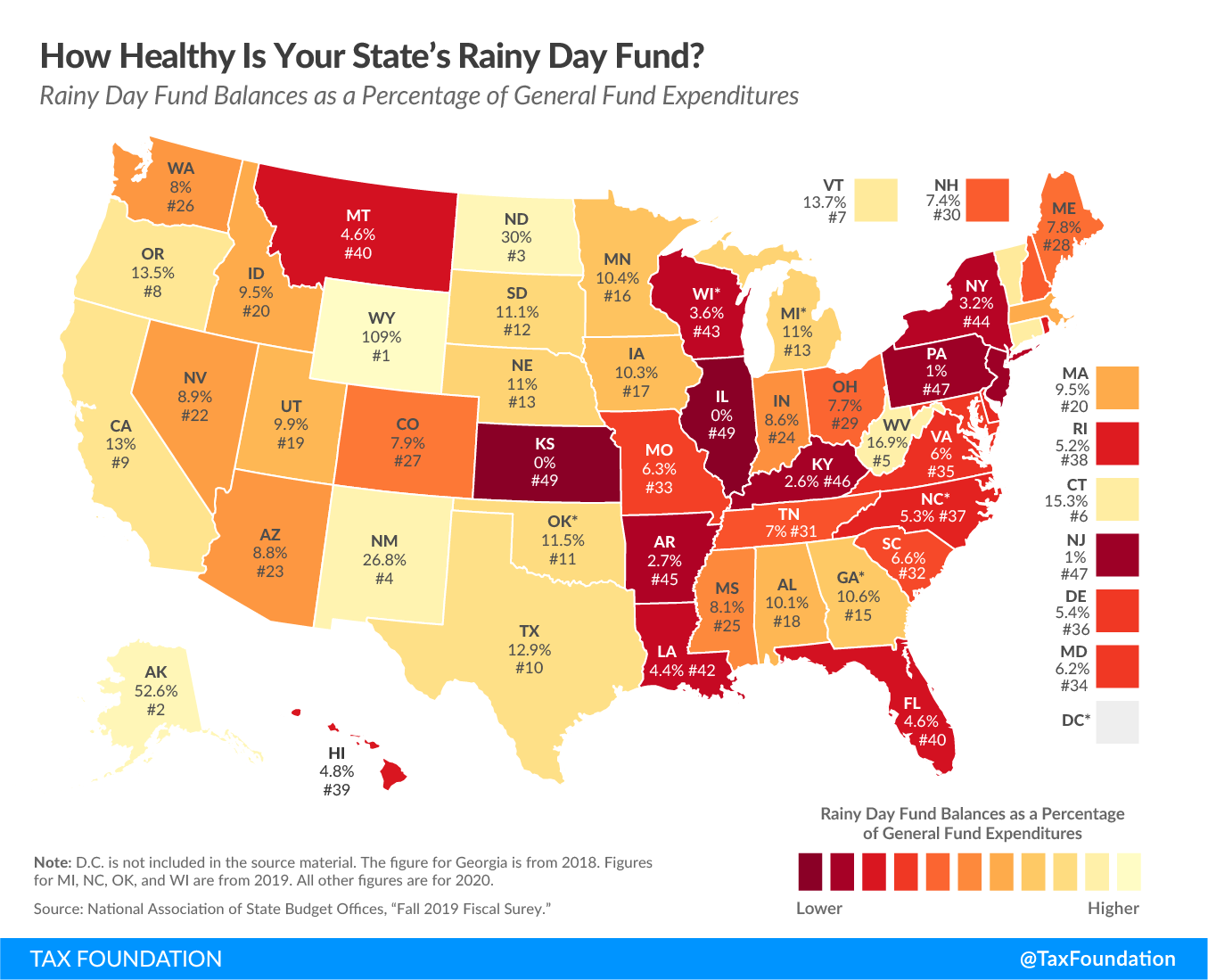

State Strategies for Closing FY 2020 with a Balanced Budget

Tax Policy - State Strategies for Closing FY 2020 with a Balanced Budget Key Findings As states grapple with declining revenues and delay tax collections, policymakers must begin to think about how to close out their FY 2020 budgets consistent with balanced...

NASBA Recommends CPE Grace Period

The National Association of State Boards of Accountancy (NASBA) on Tuesday announced that it was recommending state boards of accountancy across the country extend their CPE-completion deadlines to accommodate accountants affected by COVID-19 disruptions.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Employer tax credits form, employee retention credit guidance posted

IRS Tax News - Employer tax credits form, employee retention credit guidance posted The IRS issued a new form and instructions for employers to use to obtain advance payments of three tax credits that were created to help businesses cope with the coronavirus...