Tax Blog

Tips to help you prepare for tax season

IRS waives failure-to-deposit penalties during pandemic

IRS Tax News - IRS waives failure-to-deposit penalties during pandemic The IRS is permitting eligible employers who pay qualifying wages to retain an amount of the payroll taxes equal to the amount of qualifying wages that they paid, rather than deposit them...

Idaho, Mississippi, and Virginia are the Holdouts on July 15th Tax Deadlines

Tax Policy - Idaho, Mississippi, and Virginia are the Holdouts on July 15th Tax Deadlines As we all try to limit our exposure to the coronavirus as much as possible, delayed tax filing and payment deadlines are one less thing to worry about for now—at least in...

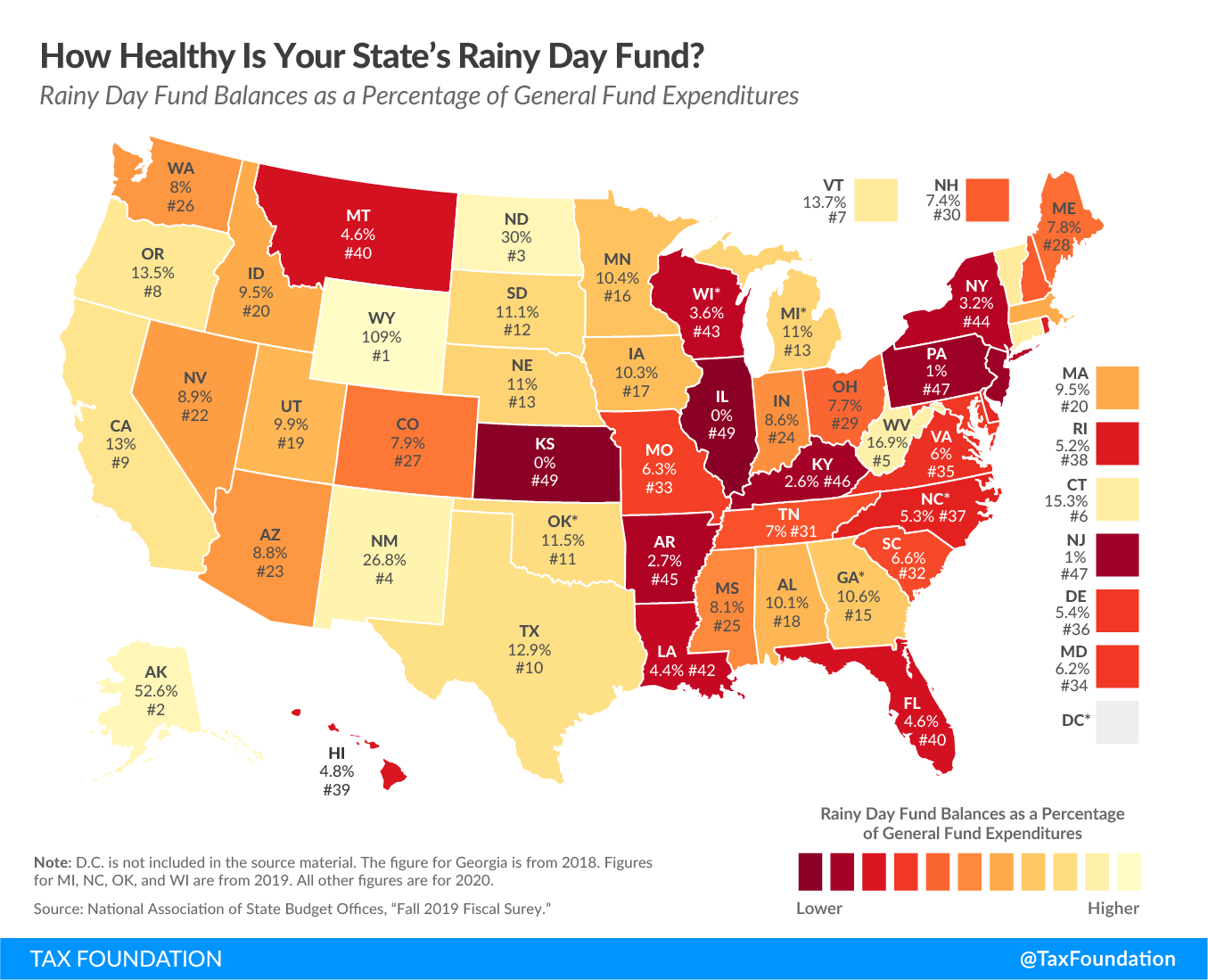

How Healthy is Your State’s Rainy Day Fund?

Tax Policy - How Healthy is Your State’s Rainy Day Fund? Economic cycles can have significant impacts on state revenue, but states can prepare for the inevitable downturns during good times by putting away money in a revenue stabilization fund—or rainy day...

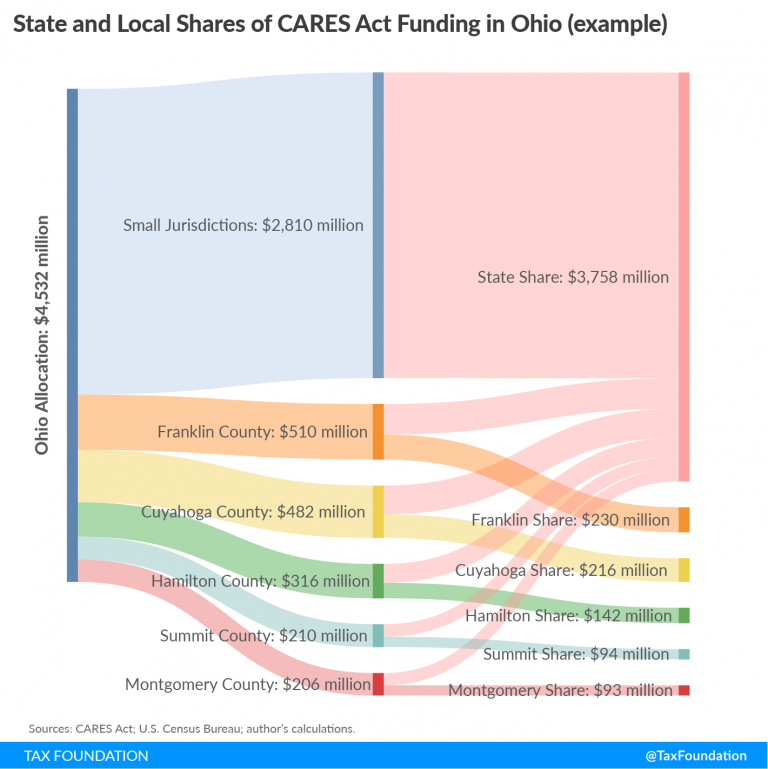

State and Local Funding Totals Under the CARES Act

Tax Policy - State and Local Funding Totals Under the CARES Act State and local governments across the country split $150 billion in federal aid under a provision of the Coronavirus Aid, Relief and Economic Security (CARES) Act, passed on March 30th. The...

FAQ on Federal Coronavirus Relief Bill (CARES Act)

Tax Policy - FAQ on Federal Coronavirus Relief Bill (CARES Act) Congress’s latest coronavirus relief package, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, is the largest economic relief bill in U.S. history and will allocate $2.2 trillion in...

IRS Implements New Signature Policy due to COVID-19

COVID-19 has disrupted life for Americans across the country, and as we’ve seen in recent weeks, the tax industry is not immune to change.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…