Tax Blog

Tips to help you prepare for tax season

Economic Impact Payments: The Facts

Distribution of the federal government’s economic impact payments, meant to counter the economic effects of the coronavirus pandemic in the U.S., is scheduled to start in the coming weeks, according… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Recovery rebate payments to be issued within 3 weeks

IRS Tax News - Recovery rebate payments to be issued within 3 weeks The IRS has issued guidance on these payments, which it calls “economic impact payments,” and says they generally will be direct-deposited to most qualifying taxpayers’ bank accounts in the next...

Retroactive SALT Repeal Combines Weak Stimulus with Bad Tax Policy

Tax Policy - Retroactive SALT Repeal Combines Weak Stimulus with Bad Tax Policy House Speaker Nancy Pelosi (D-CA) has suggested that a retroactive repeal of the cap on State and Local Tax (SALT) deductions should be included in any future stimulus plans....

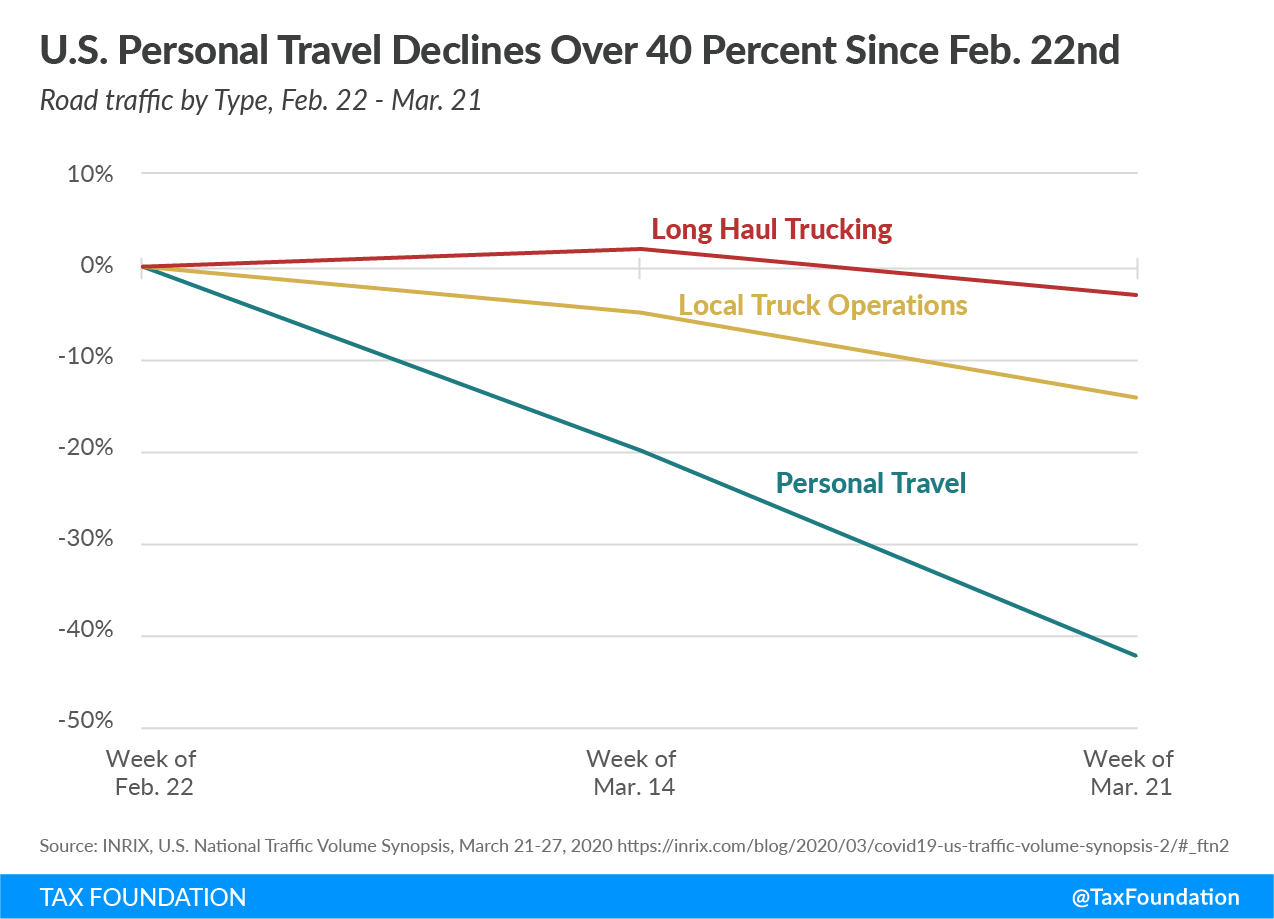

Gas Tax Revenue to Decline as Traffic Drops 38 Percent

Tax Policy - Gas Tax Revenue to Decline as Traffic Drops 38 Percent The coronavirus pandemic is affecting most aspects of the economy, and motor fuel consumption is no exception. As social distancing recommendations, shelter-in-place-orders, and quarantines have...

New Jersey Waives Telework Nexus During COVID-19 Crisis

Tax Policy - New Jersey Waives Telework Nexus During COVID-19 Crisis New Jersey is temporarily waiving corporate nexus arising from employees teleworking due to the COVID-19 pandemic—a response to the crisis that other states should follow. As we have noted...

IRS Releases “People First” Initiative

The IRS has unveiled a large series of steps providing relief on a number of fronts, ranging from easing payment guidelines to postponing compliance actions.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…