Tax Blog

Tips to help you prepare for tax season

Weighing the Value of Tax Credits During an Economic Crisis

Tax Policy - Weighing the Value of Tax Credits During an Economic Crisis Policymakers are nearing a deal on a third round of legislation to address the economic and public health crisis caused by the outbreak of COVID-19, and some have already outlined ideas for...

CARES Act tax provisions aim to stabilize pandemic-ravaged economy

IRS Tax News - CARES Act tax provisions aim to stabilize pandemic-ravaged economy The $2 trillion stimulus bill being debated by Congress contains many tax provisions. Here’s a look at the tax items, which range from credits to temporary changes to retirement...

State Aid Provisions of the Federal Coronavirus Response Bill

Tax Policy - State Aid Provisions of the Federal Coronavirus Response Bill The economic relief bill that federal lawmakers have reportedly reached an agreement on includes $150 billion designated for state efforts to combat the COVID-19 pandemic. The Coronavirus...

Working from Home Brings Greater Exposure to State Tax Codes

Tax Policy - Working from Home Brings Greater Exposure to State Tax Codes There’s a good chance you’re reading this from home. Congratulations, you’re practicing social distancing! But while you’re putting six feet of distance between yourself and other human...

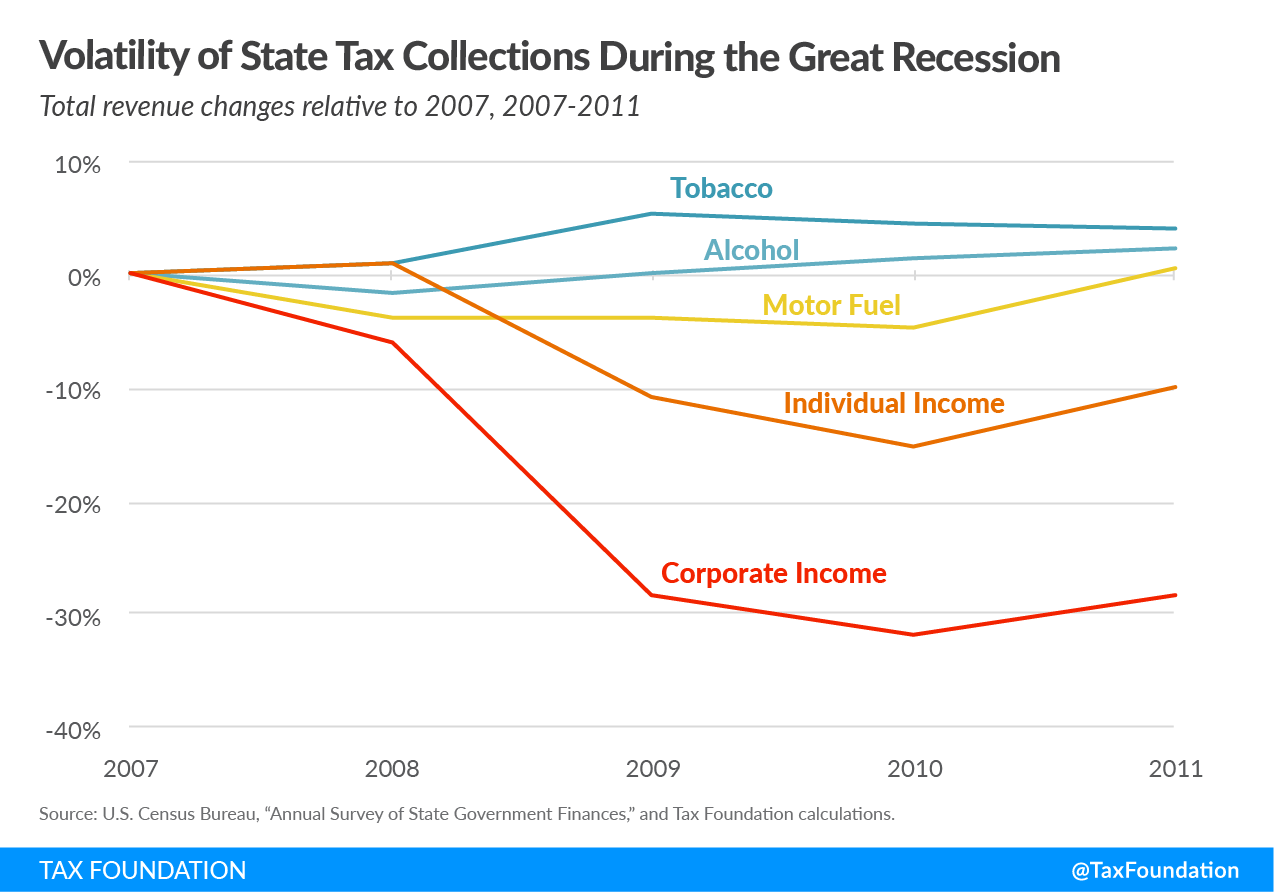

What Happens with State Excise Tax Revenues During a Pandemic?

Tax Policy - What Happens with State Excise Tax Revenues During a Pandemic? Understanding the impact of the COVID-19 pandemic on state revenues is one of the key tasks ahead for state governments. The upending of American life necessitated by efforts to slow the...

IRS posts FAQs about coronavirus-related filing and payment extensions

IRS Tax News - IRS posts FAQs about coronavirus-related filing and payment extensions The IRS posted 24 questions and answers to clarify the notice delaying certain tax filing and payment deadlines until July 15. Source: IRS Tax News - IRS posts FAQs about...