Tax Blog

Tips to help you prepare for tax season

Tax Policy to Bridge the Coronavirus-Induced Economic Slowdown

Tax Policy - Tax Policy to Bridge the Coronavirus-Induced Economic Slowdown The coronavirus-related lockdowns and quarantines are causing a major but temporary pause in economic activity. Many jobs and paychecks have been suspended. Congress and the Trump...

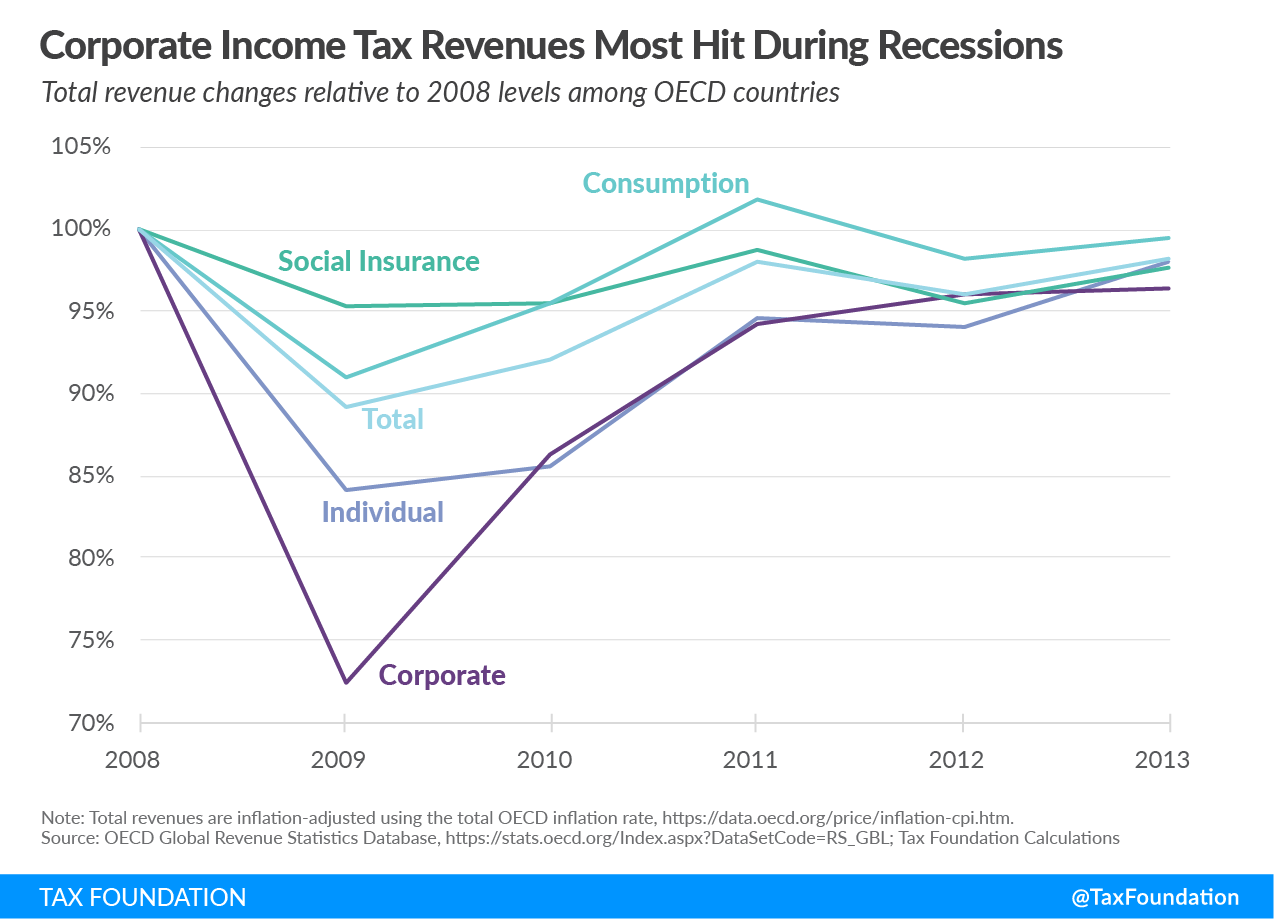

Tax Policy and Economic Downturns

Tax Policy - Tax Policy and Economic Downturns The current coronavirus outbreak has policymakers around the world advancing policies to counteract the economic effects of the crisis. Those economic effects are likely to be severe, and policymakers should...

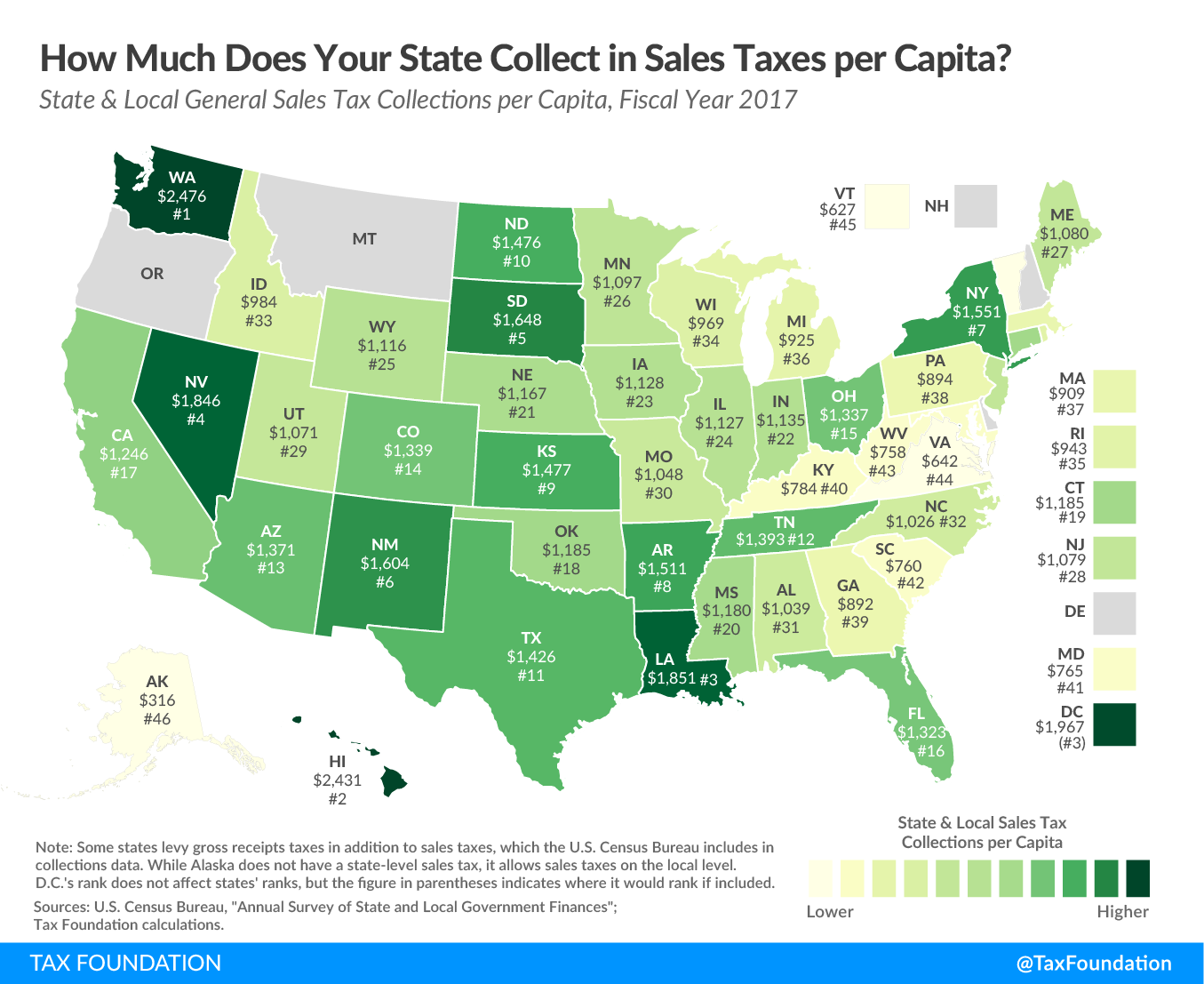

How Much Does Your State Collect in Sales Taxes per Capita?

Tax Policy - How Much Does Your State Collect in Sales Taxes per Capita? This week’s map looks at state and local sales tax collections per capita. Forty-five states and the District of Columbia have state-levied sales taxes. Five states—Alaska, Delaware,...

Federal Proposal to Levy Excise Tax on Spring Water Extraction

Tax Policy - Federal Proposal to Levy Excise Tax on Spring Water Extraction Representative Debbie Wasserman Schultz (D-FL) is proposing to levy a federal excise tax on spring water extraction—also known as a severance tax. Her bill, Save Our Spring Act of 2020,...

Analysis of Capital Gains Tax Proposals Among Democratic Presidential Candidates

Tax Policy - Analysis of Capital Gains Tax Proposals Among Democratic Presidential Candidates Key Findings Income earned from appreciating assets—rather than wages—constitutes a large portion of income for taxpayers in the highest income brackets. Democratic...

Treasury secretary announces 90-day delay in tax payment deadline

IRS Tax News - Treasury secretary announces 90-day delay in tax payment deadline Treasury Secretary Steven Mnuchin announced that individuals and businesses can delay their tax payments for 90 days due to the coronavirus pandemic. Source: IRS Tax News -...