Tax Blog

Tips to help you prepare for tax season

South Carolina House Unanimously Approves Business License Tax Reform

Tax Policy - South Carolina House Unanimously Approves Business License Tax Reform It sometimes seems hard to get a group of politicians to agree to anything, so it’s notable that just a hundred miles northwest of Tuesday night’s heated presidential debate, 104...

Maryland Legislature Seeks Revenue with Risky Proposals

Tax Policy - Maryland Legislature Seeks Revenue with Risky Proposals Ever since Maryland’s Commission on Innovation and Excellence in Education, better known as the Kirwan Commission, began presenting its recommendations for improving Maryland’s education system...

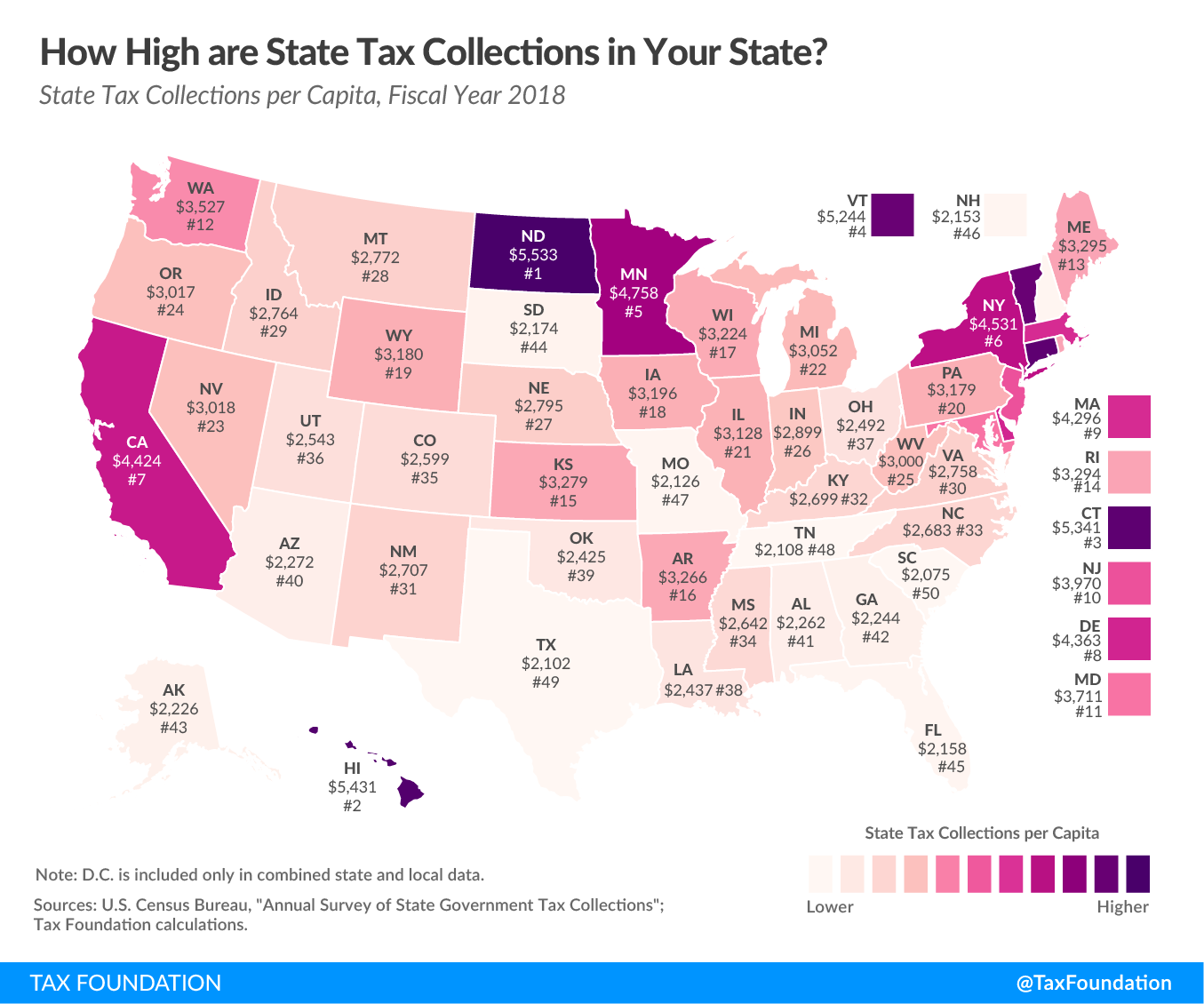

State and Local Individual Income Tax Collections per Capita

Tax Policy - State and Local Individual Income Tax Collections per Capita The individual income tax is one of the most significant sources of revenue for state and local governments. In fiscal year 2017, the most recent year for which data are available,...

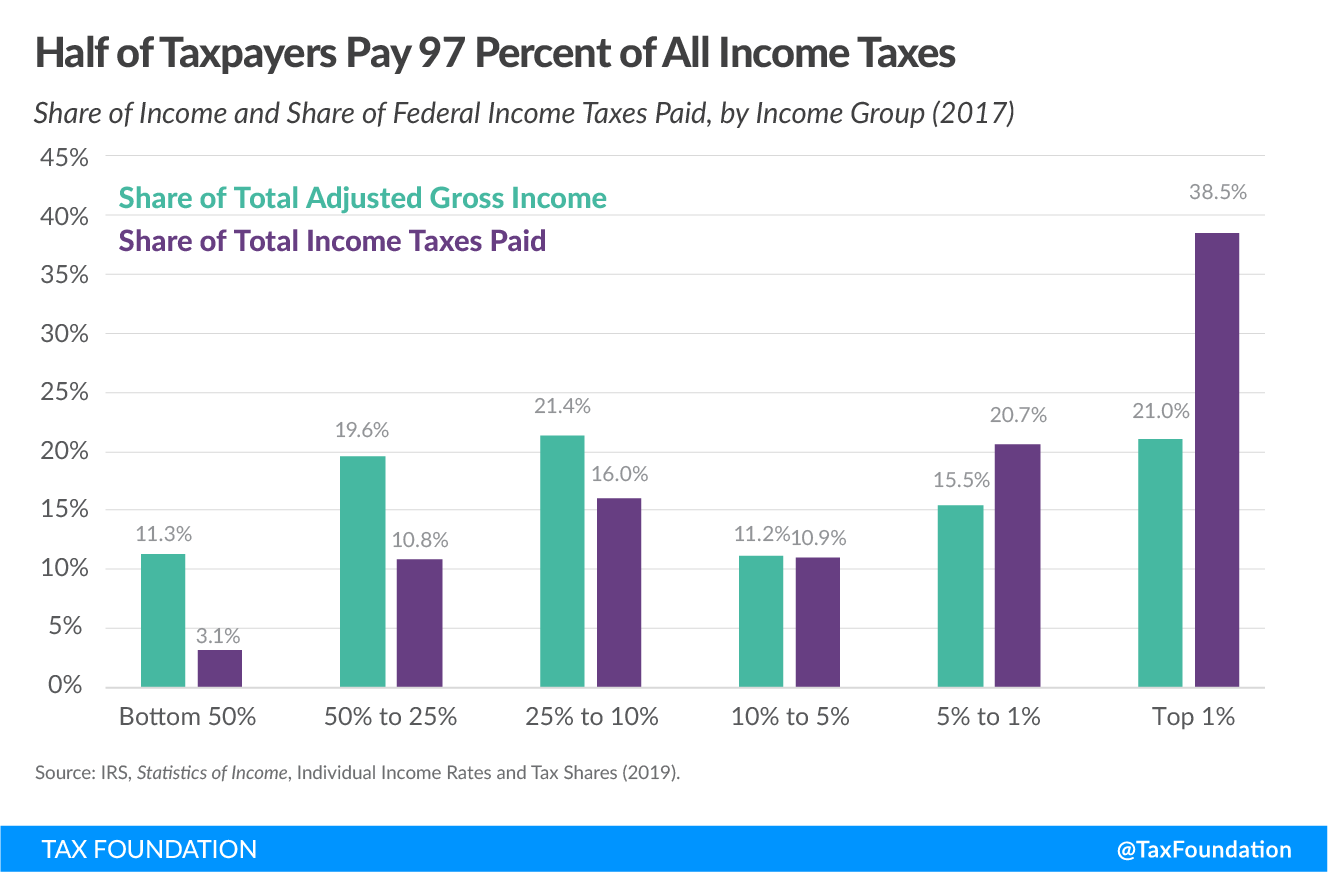

Summary of the Latest Federal Income Tax Data, 2020 Update

Tax Policy - Summary of the Latest Federal Income Tax Data, 2020 Update The Internal Revenue Service (IRS) has released data on individual income taxes for tax year 2017, showing the number of taxpayers, adjusted gross income, and income tax shares by income...

How Controlled Foreign Corporation Rules Look Around the World: Colombia and a Perspective of Latin America

Tax Policy - How Controlled Foreign Corporation Rules Look Around the World: Colombia and a Perspective of Latin America The Colombian CFC regime was enacted in 2016 (Law 1819). An entity in Colombia is considered a CFC if it is not a resident in the country and...

Analysis of the Economic, Revenue, and Distributional Effects of Repealing Step-up in Basis

Tax Policy - Analysis of the Economic, Revenue, and Distributional Effects of Repealing Step-up in Basis With Super Tuesday approaching, the six top Democratic presidential candidates continue to hone their tax proposals in order to address income inequality and...