Tax Blog

Tips to help you prepare for tax season

Proposed regs. issued on meal and entertainment expense deductions

IRS Tax News - Proposed regs. issued on meal and entertainment expense deductions The IRS issued proposed rules clarifying that taxpayers may generally continue to deduct 50% of the food and beverage expenses associated with operating their trade or business,...

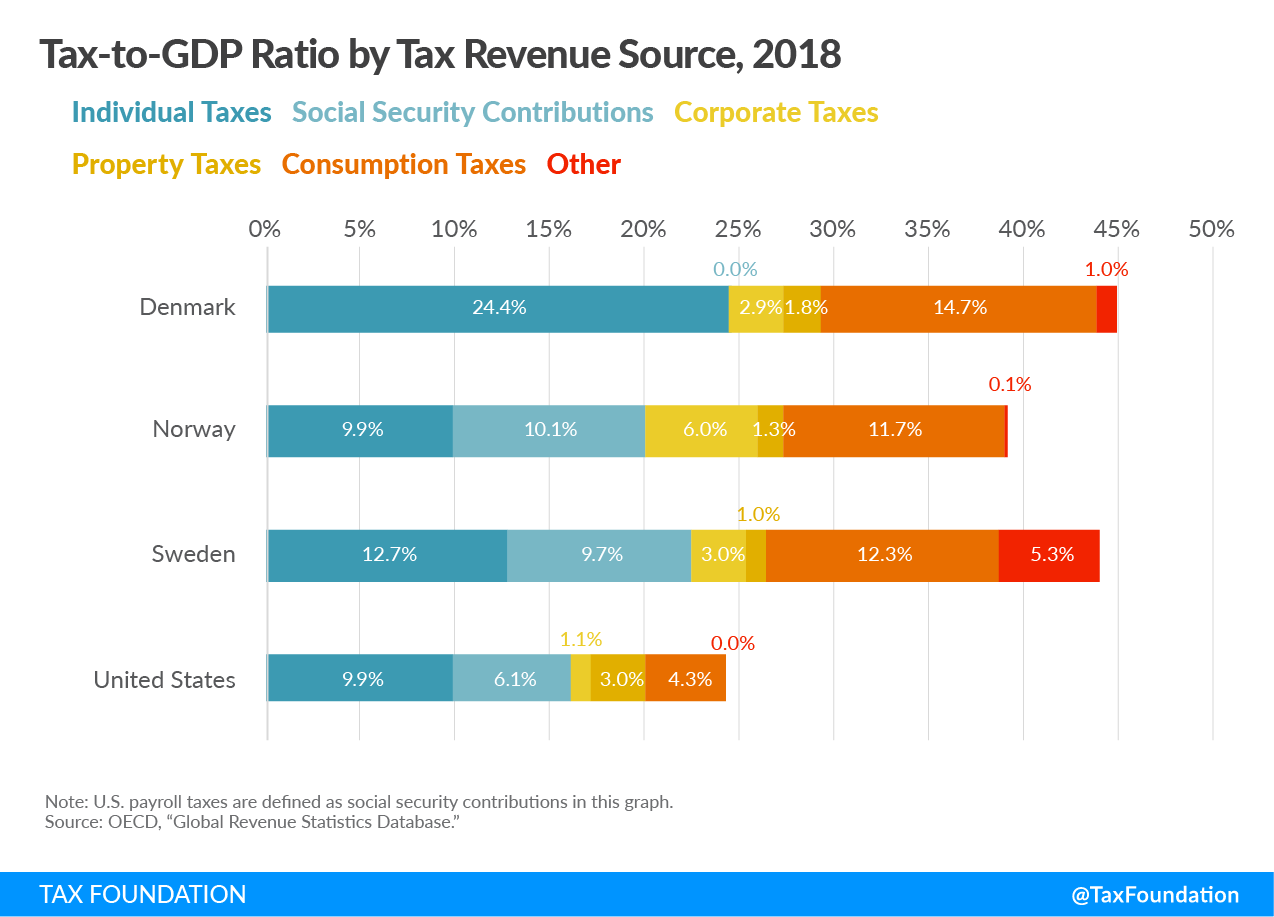

Insights into the Tax Systems of Scandinavian Countries

Tax Policy - Insights into the Tax Systems of Scandinavian Countries Scandinavian countries are well-known for their broad social safety net and their public funding of services such as universal healthcare, higher education, parental leave, and child and...

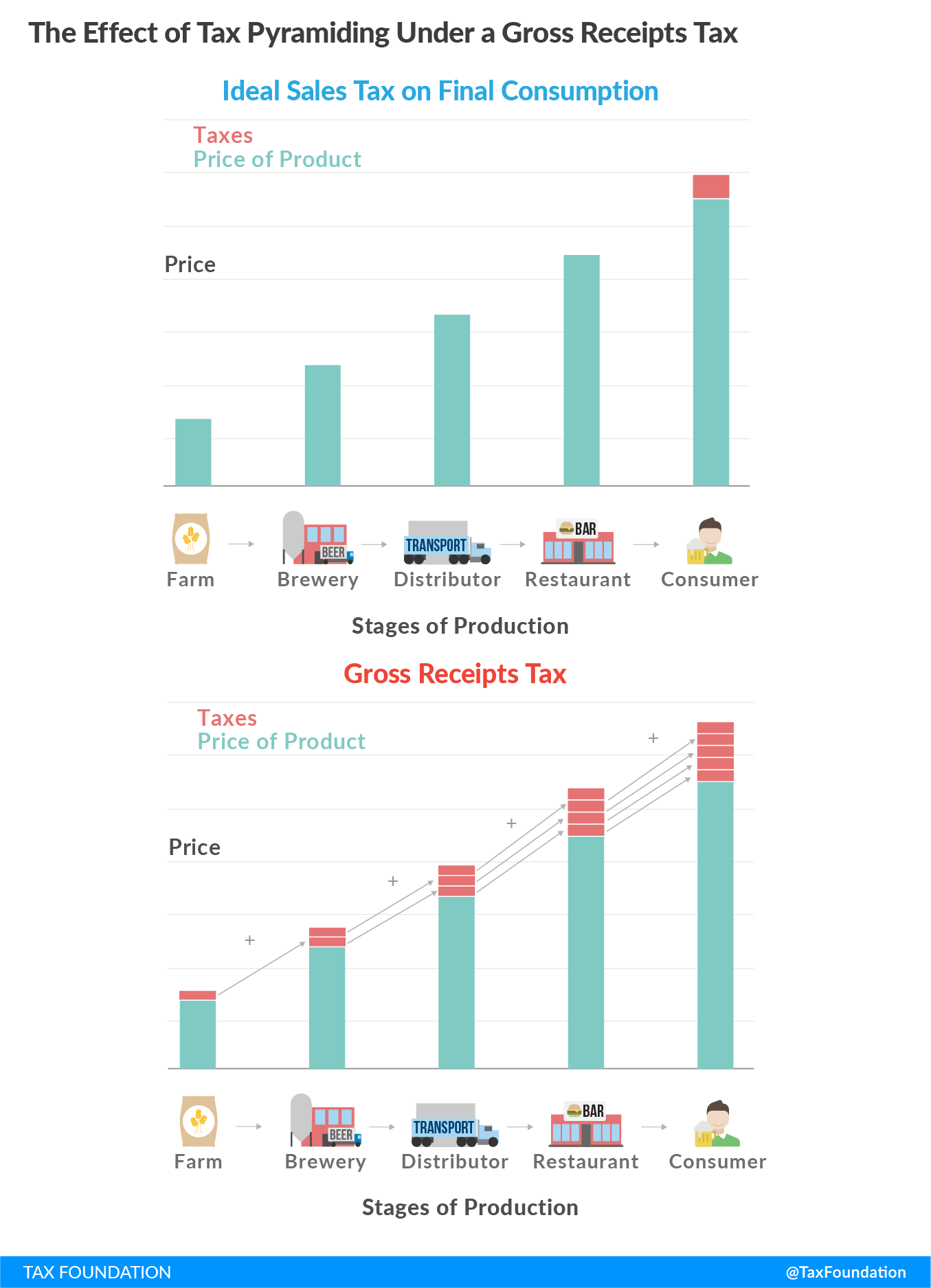

Maryland Lawmakers Consider Sales Tax Hike on Businesses

Tax Policy - Maryland Lawmakers Consider Sales Tax Hike on Businesses Last week, Maryland House Majority Leader Eric G. Luedtke (D) introduced HB1628 which, if enacted, would expand the state sales tax base to include services and raise an estimated $2.6 billion...

Recent Study on Financial Transaction Taxes Understates their Economic Harm

Tax Policy - Recent Study on Financial Transaction Taxes Understates their Economic Harm A recent article by Public Citizen, entitled “A Progressive Tax With Beneficial Effects,” estimates the impact that a 0.1 percent Financial Transaction Tax (FTT) such as the...

Bloomberg’s Financial Transaction Tax (FTT) Proposal Revives Bad Policy

Tax Policy - Bloomberg’s Financial Transaction Tax (FTT) Proposal Revives Bad Policy This week, former New York City Mayor and Democratic presidential candidate Michael Bloomberg released a proposal to levy a 0.1 percent tax on all financial transactions....

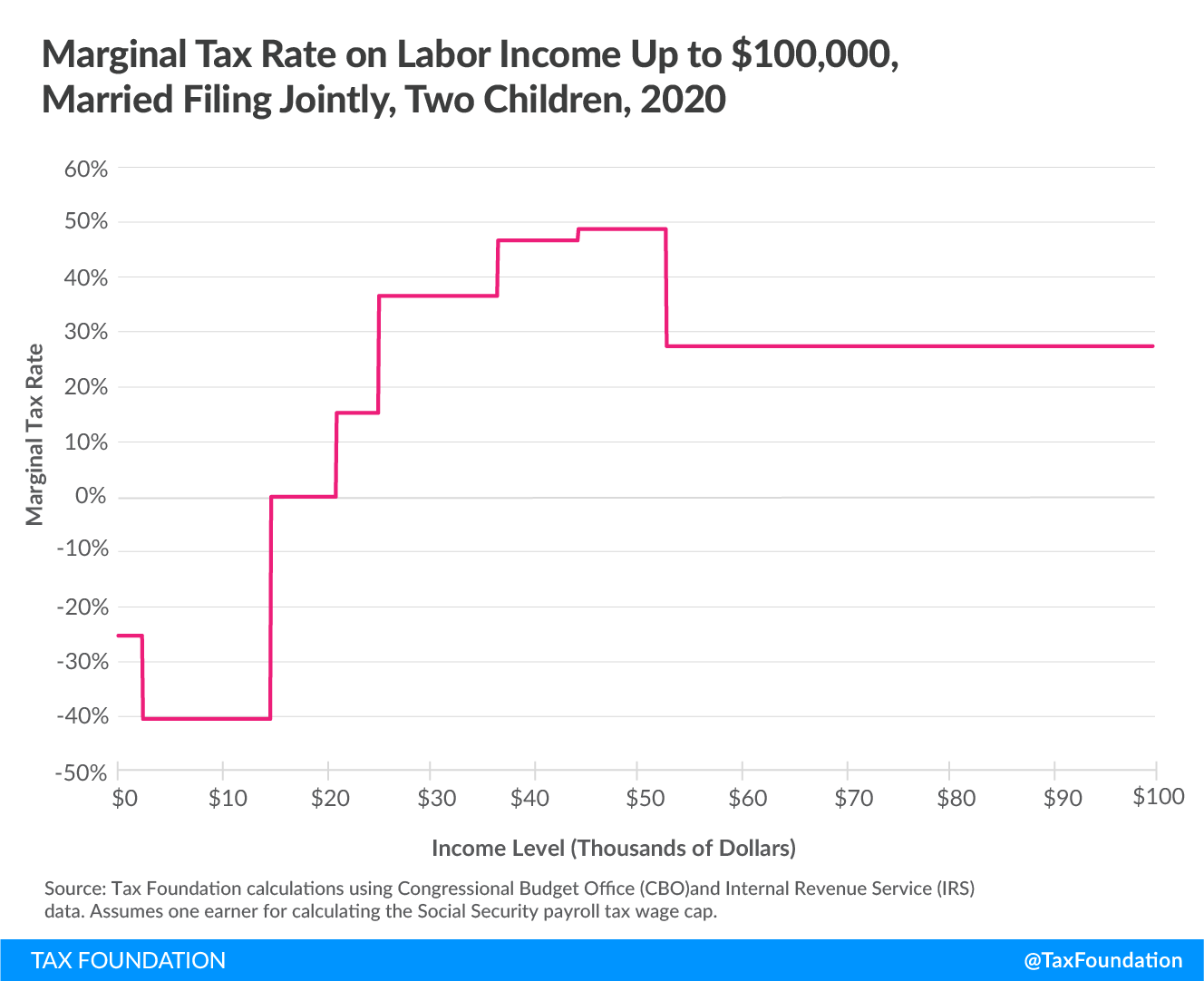

Marginal Tax Rates on Labor Income in the U.S. After the Tax Cuts and Jobs Act

Tax Policy - Marginal Tax Rates on Labor Income in the U.S. After the Tax Cuts and Jobs Act Workers in the United States face federal individual income taxes and payroll taxes on their labor income. The individual income tax system is progressive, as tax rates...