Tax Blog

Tips to help you prepare for tax season

No need to report some transactions in video game currency, IRS says

IRS Tax News - No need to report some transactions in video game currency, IRS says Gamers who, as part of a video game, transact in virtual currencies that do not leave the video game environment do not have to report the transactions on a tax return, the IRS...

How Controlled Foreign Corporation Rules Look Around the World: Germany

Tax Policy - How Controlled Foreign Corporation Rules Look Around the World: Germany Germany has had a Controlled Foreign Corporation (CFC) regime since 1972, when the German Foreign Transactions Tax Act was enacted. Under the German regime, a CFC is a foreign...

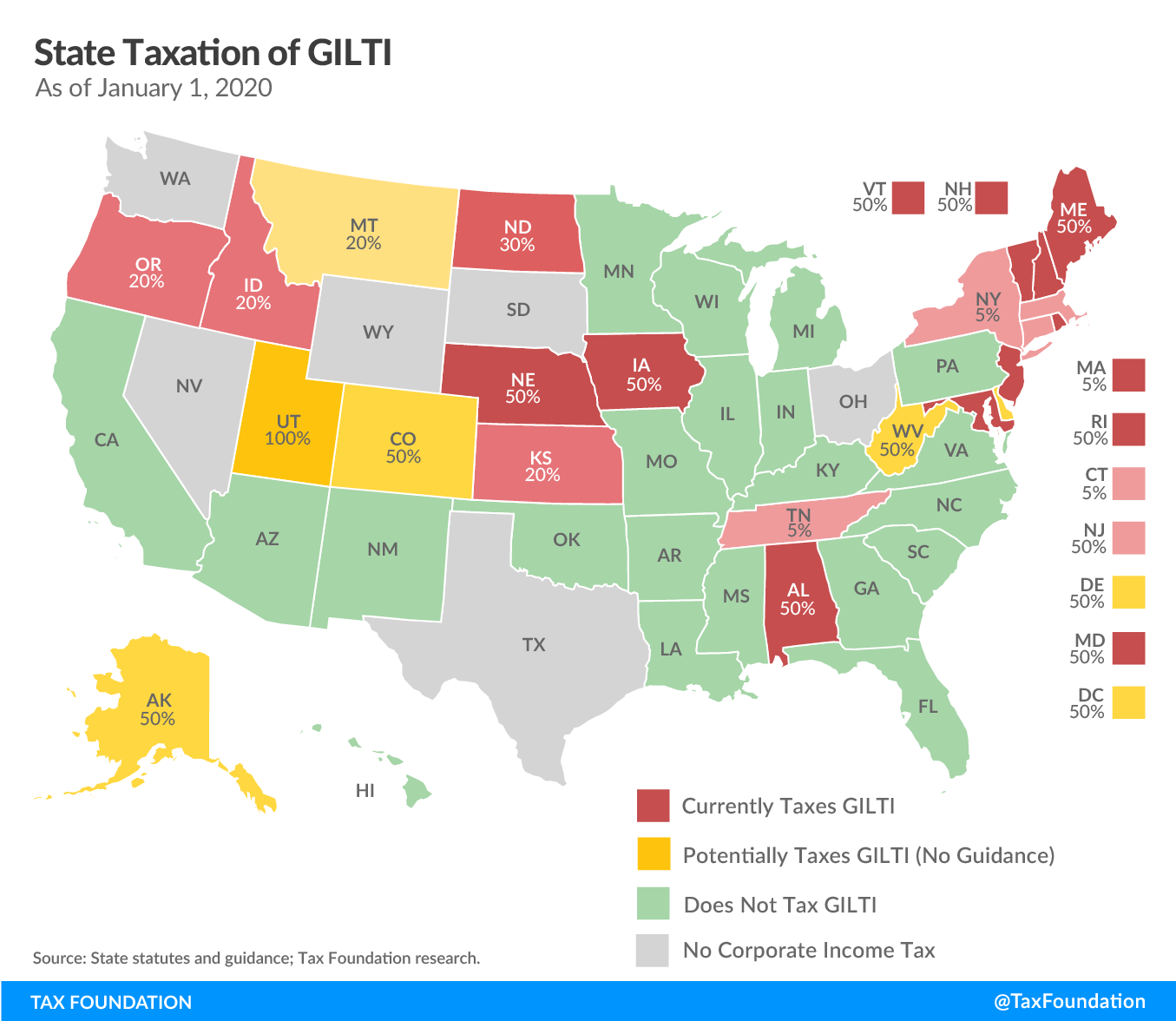

Kansas, Nebraska, and Utah Lawmakers Pursue “Not GILTI” Verdicts

Tax Policy - Kansas, Nebraska, and Utah Lawmakers Pursue “Not GILTI” Verdicts Lawmakers in Kansas, Nebraska, and Utah never voted to tax GILTI—and now their respective tax committees are getting a chance to decide whether they really should. Committee chairs in...

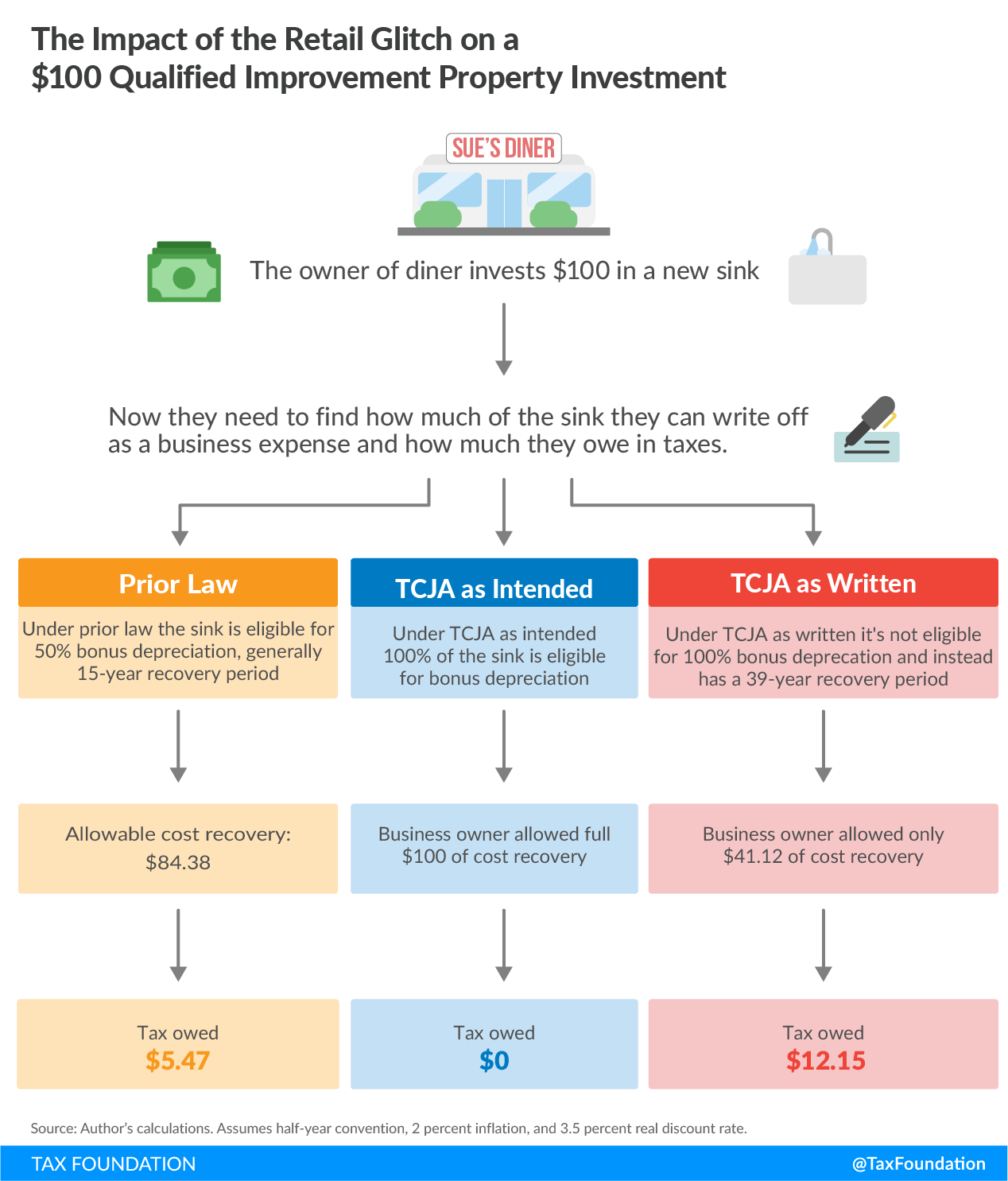

Toomey Introduces Legislation to Make Bonus Depreciation Permanent and Fix the Retail Glitch

Tax Policy - Toomey Introduces Legislation to Make Bonus Depreciation Permanent and Fix the Retail Glitch Thursday, Sen. Pat Toomey (R-PA) introduced the “ALIGN Act,” which would make 100 percent bonus depreciation for short-life assets a permanent feature of...

Summary of the OECD’s Impact Assessment on Pillar 1 and Pillar 2

Tax Policy - Summary of the OECD’s Impact Assessment on Pillar 1 and Pillar 2 Today, the OECD presented its preliminary impact assessment on the Pillar 1 and Pillar 2 proposals. The impact assessment includes estimated revenue and investment effects presented at...

The Collaborative Economy—Data Exchange with Tax Authorities

Tax Policy - The Collaborative Economy—Data Exchange with Tax Authorities The following was presented at the European Economic and Social Committee’s hearing, “The Collaborative Economy – Data Exchange with Tax Authorities.” When designing their supply chains...