Tax Blog

Tips to help you prepare for tax season

Facts and Figures 2020: How Does Your State Compare?

Tax Policy - Facts and Figures 2020: How Does Your State Compare? How do taxes in your state compare nationally? Facts and Figures, a resource we’ve provided to U.S. taxpayers and legislators since 1941, serves as a one-stop state tax data resource that compares...

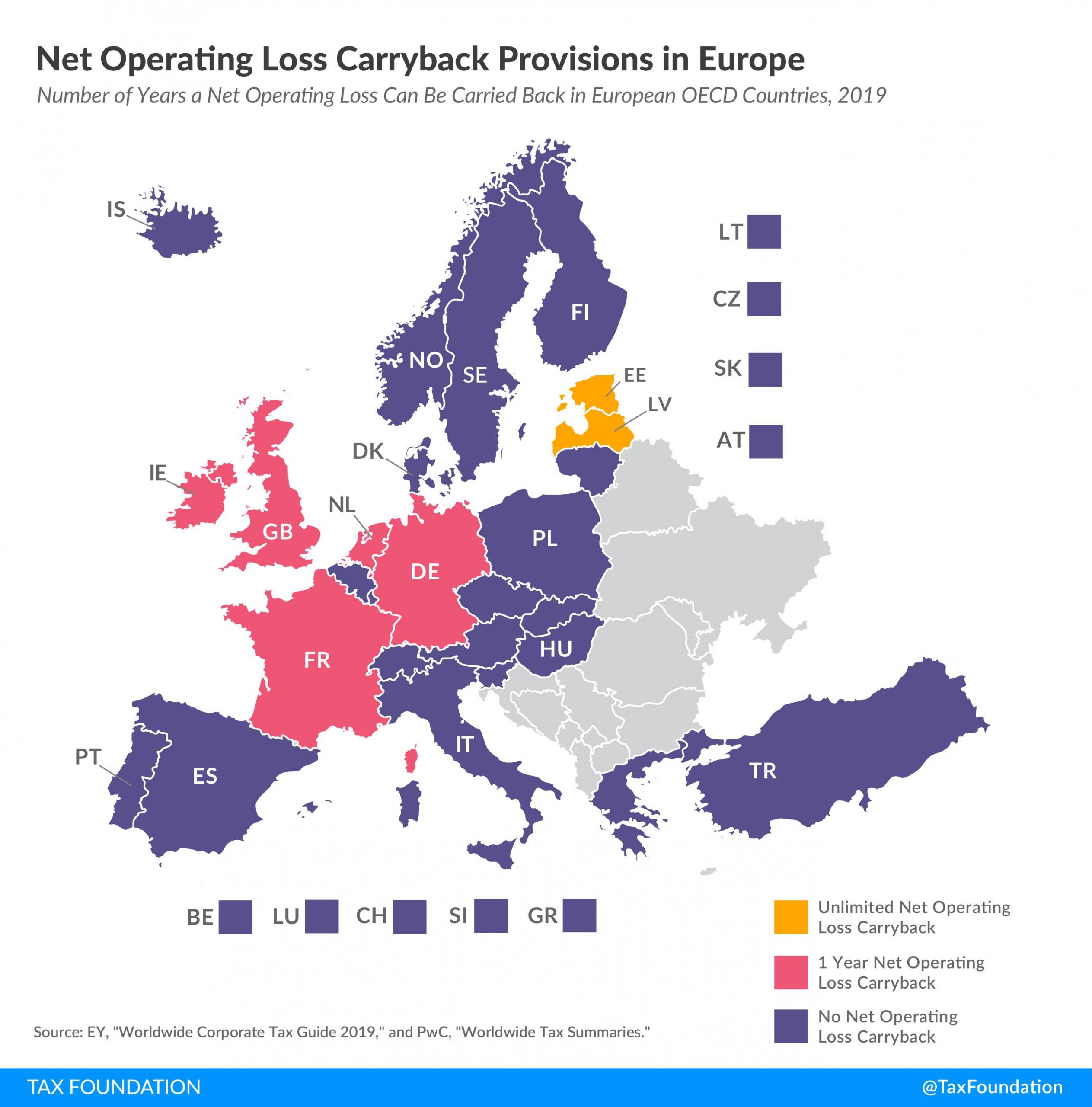

Net Operating Loss Carryforward and Carryback Provisions in Europe

Tax Policy - Net Operating Loss Carryforward and Carryback Provisions in Europe Loss carryover provisions allow businesses to either deduct current year losses against future profits (carryforwards) or deduct current year losses against past profits...

Banning Flavored Tobacco Could Have Unintended Consequences

Tax Policy - Banning Flavored Tobacco Could Have Unintended Consequences Several states have considered bans on flavored tobacco and nicotine products this legislative session, spurred by increased vaping by minors.[1] Among them are California, Maine, Maryland,...

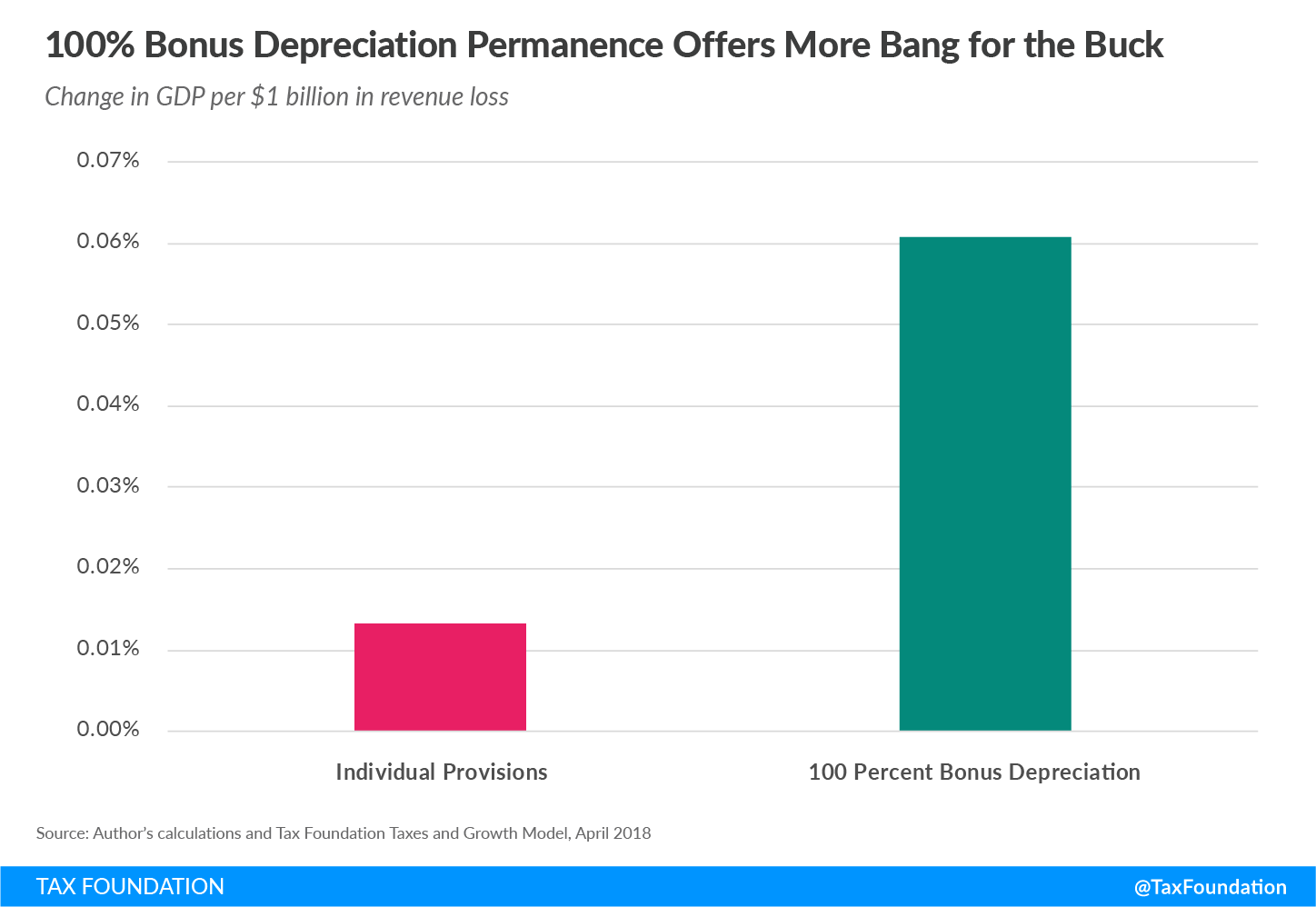

The White House Budget Highlights the Need to Extend Pro-Growth TCJA Business Tax Provisions

Tax Policy - The White House Budget Highlights the Need to Extend Pro-Growth TCJA Business Tax Provisions Monday, the Office of Management and Budget (OMB) released the White House’s fiscal year 2021 budget proposal, kicking off the first step of the budget...

IRS proposes rules to update income tax withholding, revises Form W-4

IRS Tax News - IRS proposes rules to update income tax withholding, revises Form W-4 The IRS proposed new regulations for withholding on individuals’ wages to reflect the statutory changes in the law known as the Tax Cuts and Jobs Act, including the elimination...

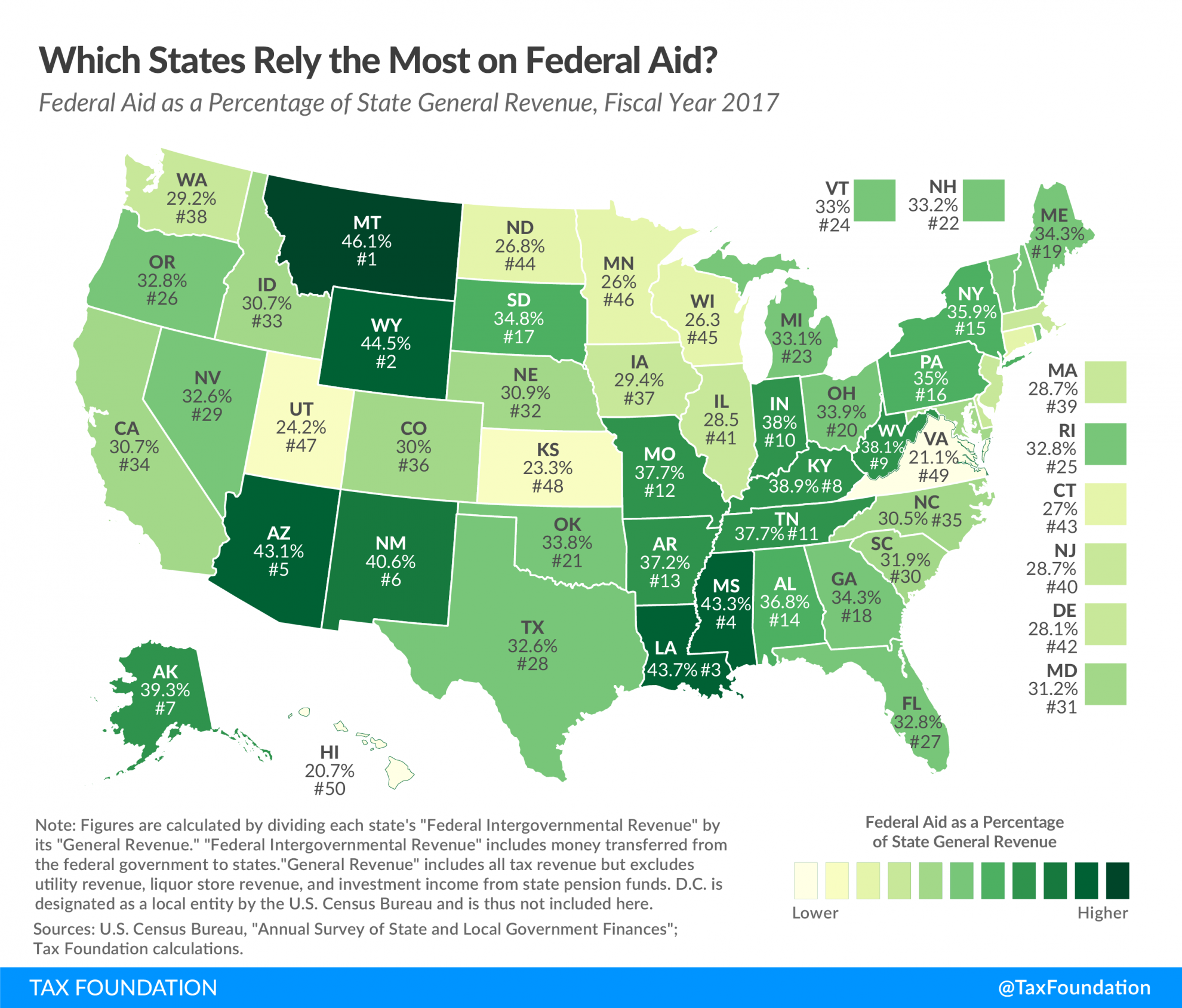

Which States Rely the Most on Federal Aid?

Tax Policy - Which States Rely the Most on Federal Aid? State-levied taxes make up the vast majority of each state’s general fund budget, and thus are the most obvious source of state revenue. But state governments also receive a notable amount of assistance...