Tax Blog

Tips to help you prepare for tax season

Bracing for Impact

Tax Policy - Bracing for Impact Thursday, the OECD is expected to present preliminary results on the impacts of both Pillar 1 and Pillar 2 approaches to changing international tax rules. The results will be preliminary mainly because the actual policy parameters...

Analysis of Democratic Presidential Candidate Payroll Tax Proposals

Tax Policy - Analysis of Democratic Presidential Candidate Payroll Tax Proposals Key Findings 2020 Democratic presidential candidates have proposed various changes to federal payroll tax rates and the Social Security payroll tax wage base to raise revenue and...

More Qualify for Earthquake-Related Tax Relief in Puerto Rico

The Internal Revenue Service recently announced that tax relief has once again been expanded for earthquake victims in Puerto Rico.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Tennessee’s Governor Lee Pushes to Clear Out Remnants of Income Taxation

Tax Policy - Tennessee’s Governor Lee Pushes to Clear Out Remnants of Income Taxation Tennessee Governor Bill Lee’s 2020 budget proposal includes cutting in half what’s left of Tennessee’s privilege tax. Lee’s plan would continue the trend of Volunteer State...

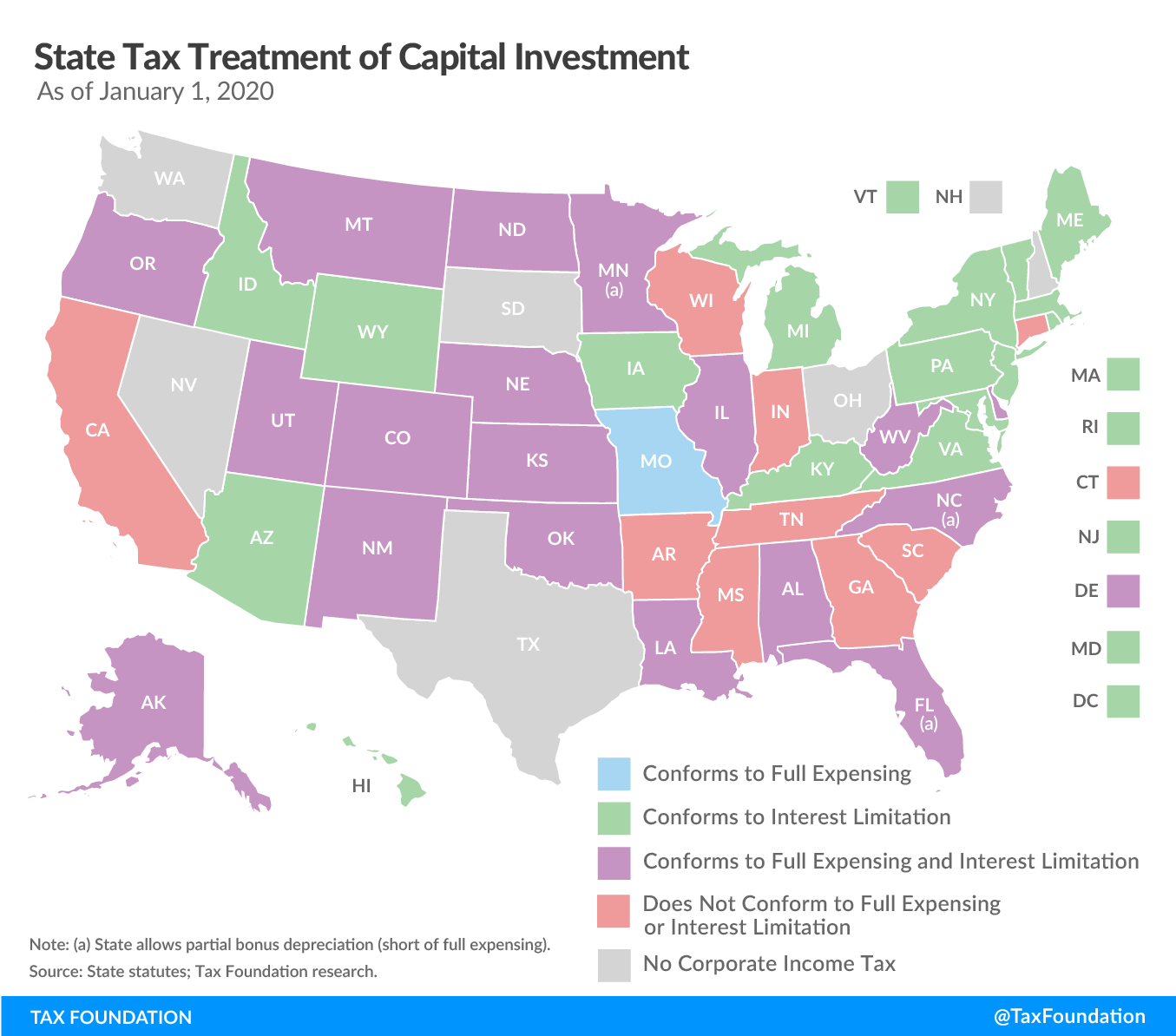

Will Arizona Lead the Way on Full Expensing This Year?

Tax Policy - Will Arizona Lead the Way on Full Expensing This Year? Earlier this week, a tax omnibus bill—Senate Bill 1398—advanced out of the Arizona Senate Finance Committee with a favorable recommendation. This bill includes many tax changes (paywall), but...

Overview of Democratic Presidential Candidate Michael Bloomberg’s Tax Plan

Tax Policy - Overview of Democratic Presidential Candidate Michael Bloomberg’s Tax Plan This week, Democratic presidential candidate and former New York City Mayor Michael Bloomberg released his plan to increase taxes on businesses and wealthy individuals, which...