Tax Blog

Tips to help you prepare for tax season

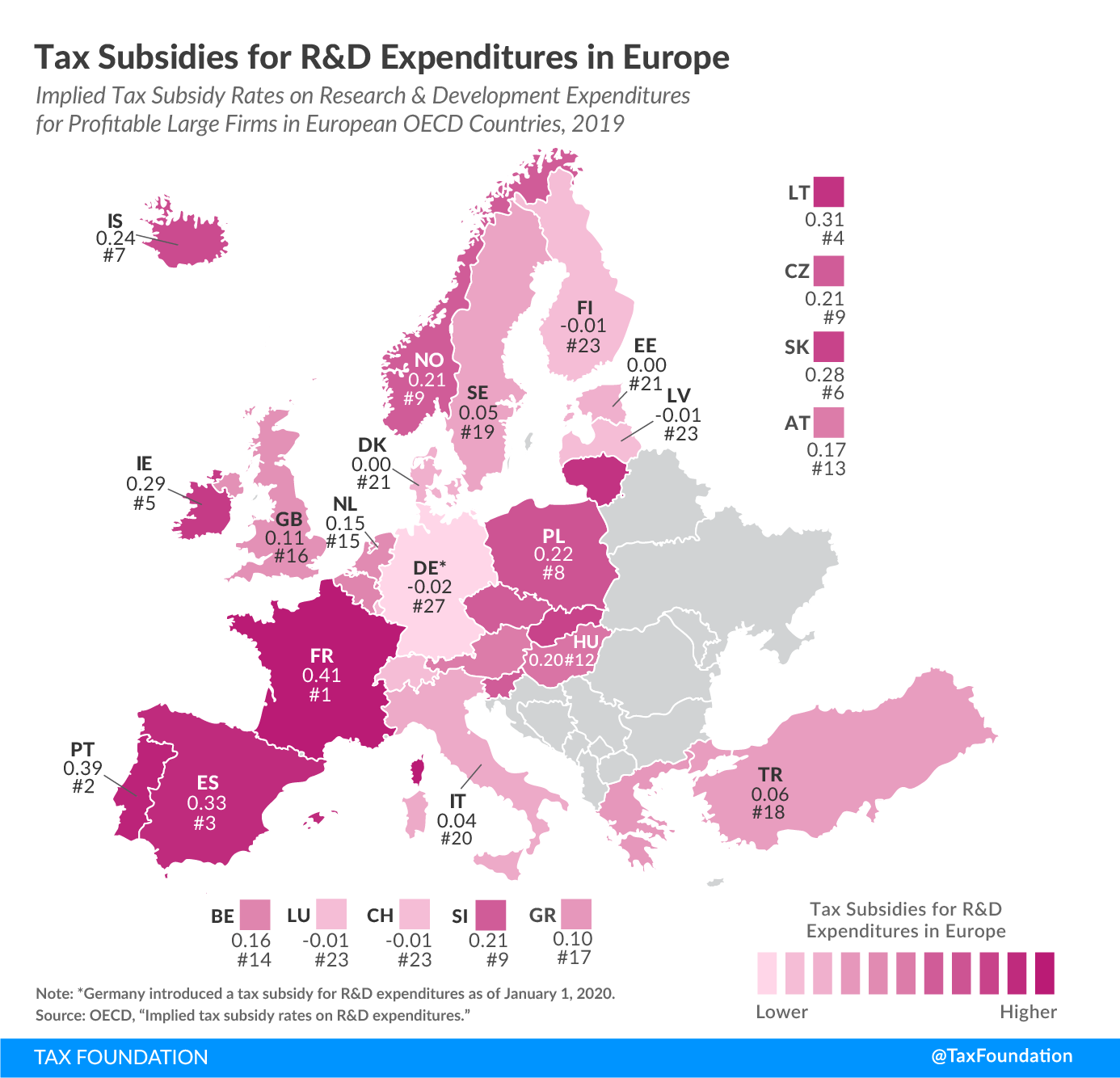

Tax Subsidies for R&D Expenditures in Europe

Tax Policy - Tax Subsidies for R&D Expenditures in Europe Many countries incentivize business investment in research and development (R&D), intending to foster innovation. A common approach is to provide direct government funding for R&D activity....

How the Puerto Rico Disaster Package Targets Relief but Creates Tax Complexity

Tax Policy - How the Puerto Rico Disaster Package Targets Relief but Creates Tax Complexity In recent years, hurricanes devastated the U.S. Atlantic coast and other island territories. Many communities—including those in Puerto Rico and the Virgin Islands—are...

Final rules determine maximum vehicle values

IRS Tax News - Final rules determine maximum vehicle values The IRS finalized the rules for maximum vehicle values under the cents-per-mile valuation rule and the fleet-average valuation rule after the law known as the Tax Cuts and Jobs Act increased those...

Governor Kelly’s Tax Proposals Can Be Targeted Towards Right-Sizing Kansas’ Tax Base

Tax Policy - Governor Kelly’s Tax Proposals Can Be Targeted Towards Right-Sizing Kansas’ Tax Base Kansas Gov. Laura Kelly’s Fiscal Year 2021 budget and tax proposals can be targeted to effectively restructure Kansas’ tax base. Her budget proposal includes...

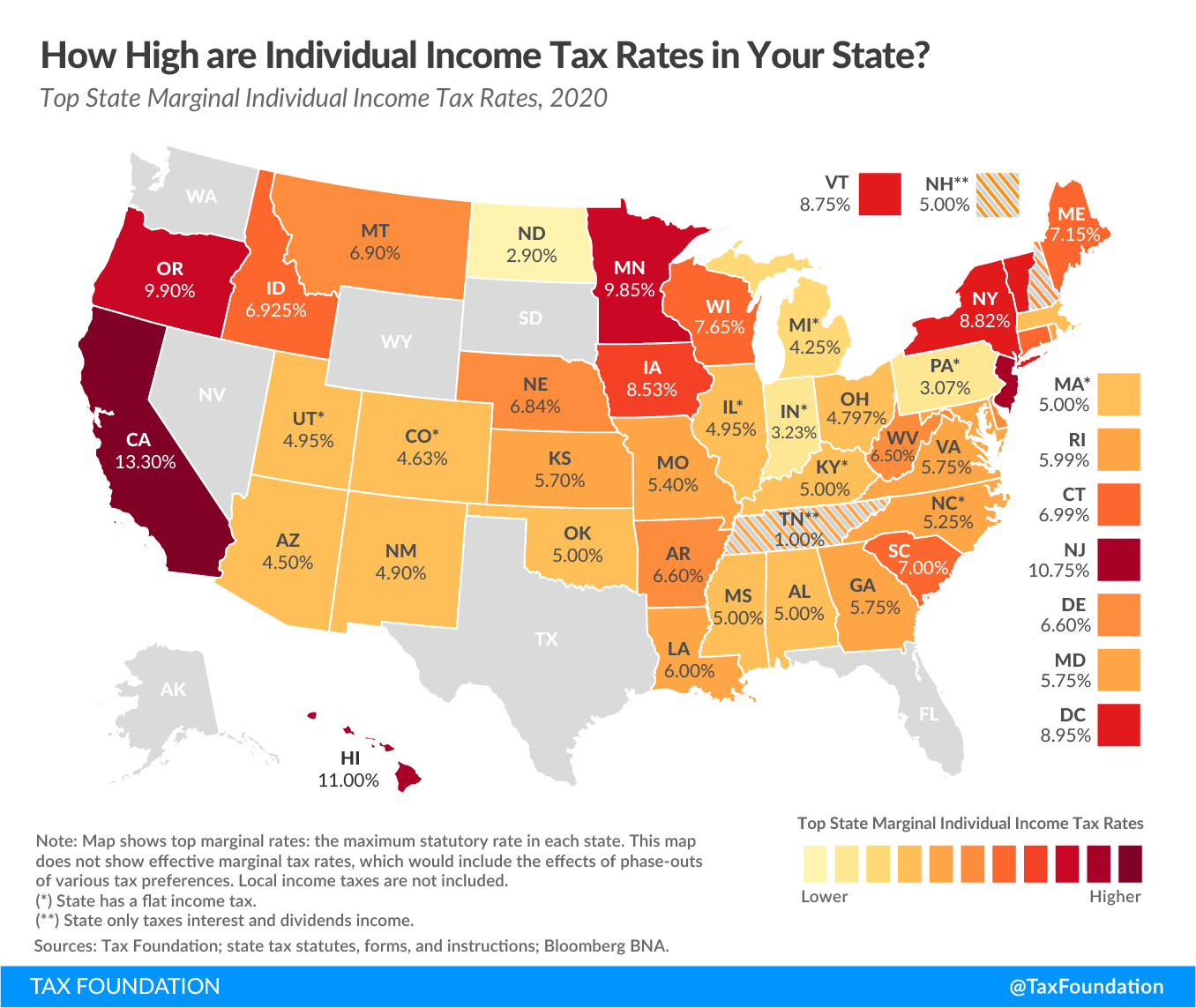

State Individual Income Tax Rates and Brackets for 2020

Tax Policy - State Individual Income Tax Rates and Brackets for 2020 Key Findings Individual income taxes are a major source of state government revenue, accounting for 37 percent of state tax collections in fiscal year (FY) 2017. Forty-three states levy...

How Controlled Foreign Corporation Rules Look Around the World: Spain

Tax Policy - How Controlled Foreign Corporation Rules Look Around the World: Spain Because of globalization and international commerce some countries have adopted Controlled Foreign Corporation (CFC) rules to reduce the effects of tax deferral. Spain, which...