Tax Blog

Tips to help you prepare for tax season

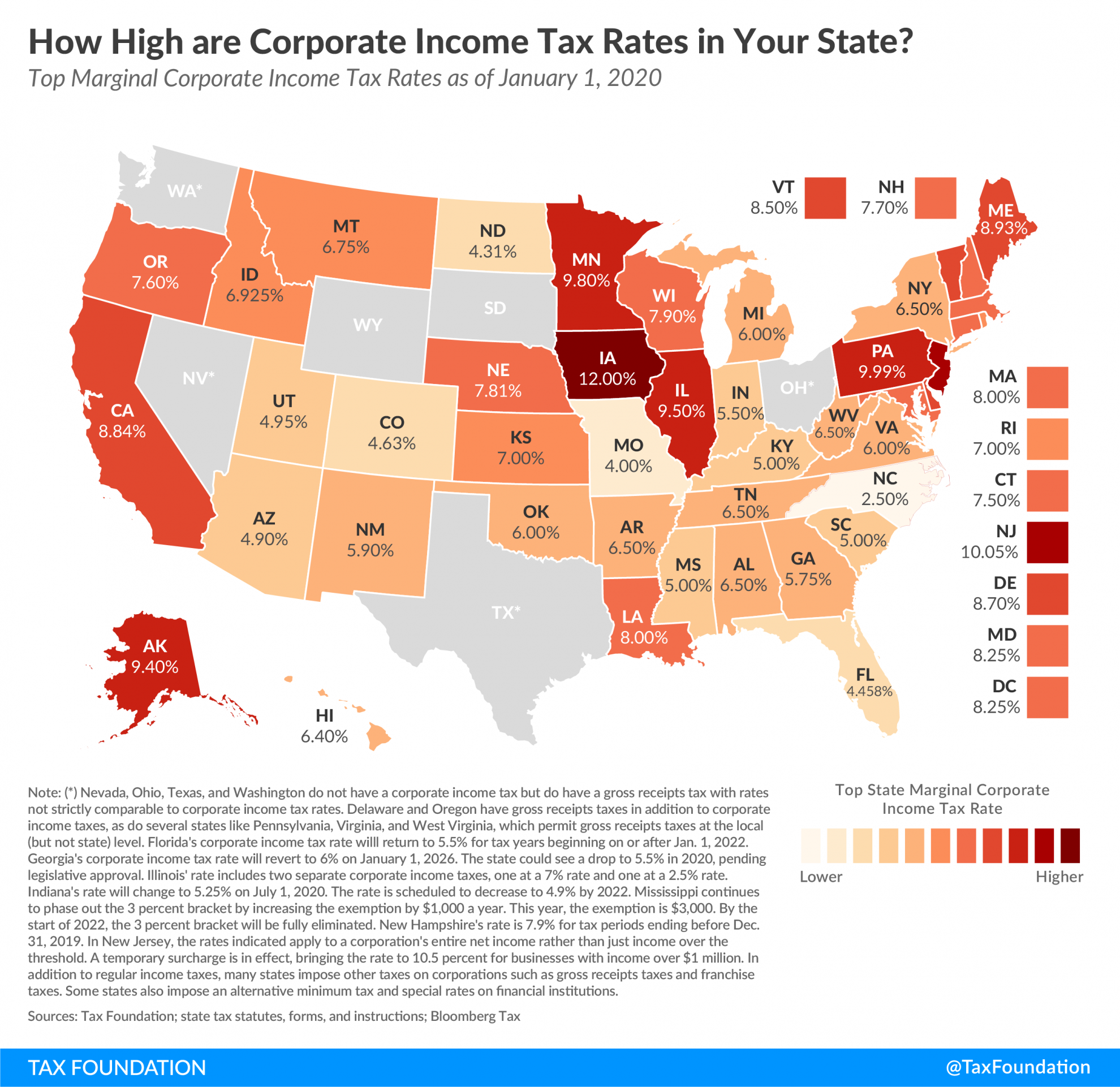

State Corporate Income Tax Rates and Brackets for 2020

Tax Policy - State Corporate Income Tax Rates and Brackets for 2020 Key Findings Forty-four states levy a corporate income tax. Rates range from 2.5 percent in North Carolina to 12 percent in Iowa. Six states—Alaska, Illinois, Iowa, Minnesota, New Jersey, and...

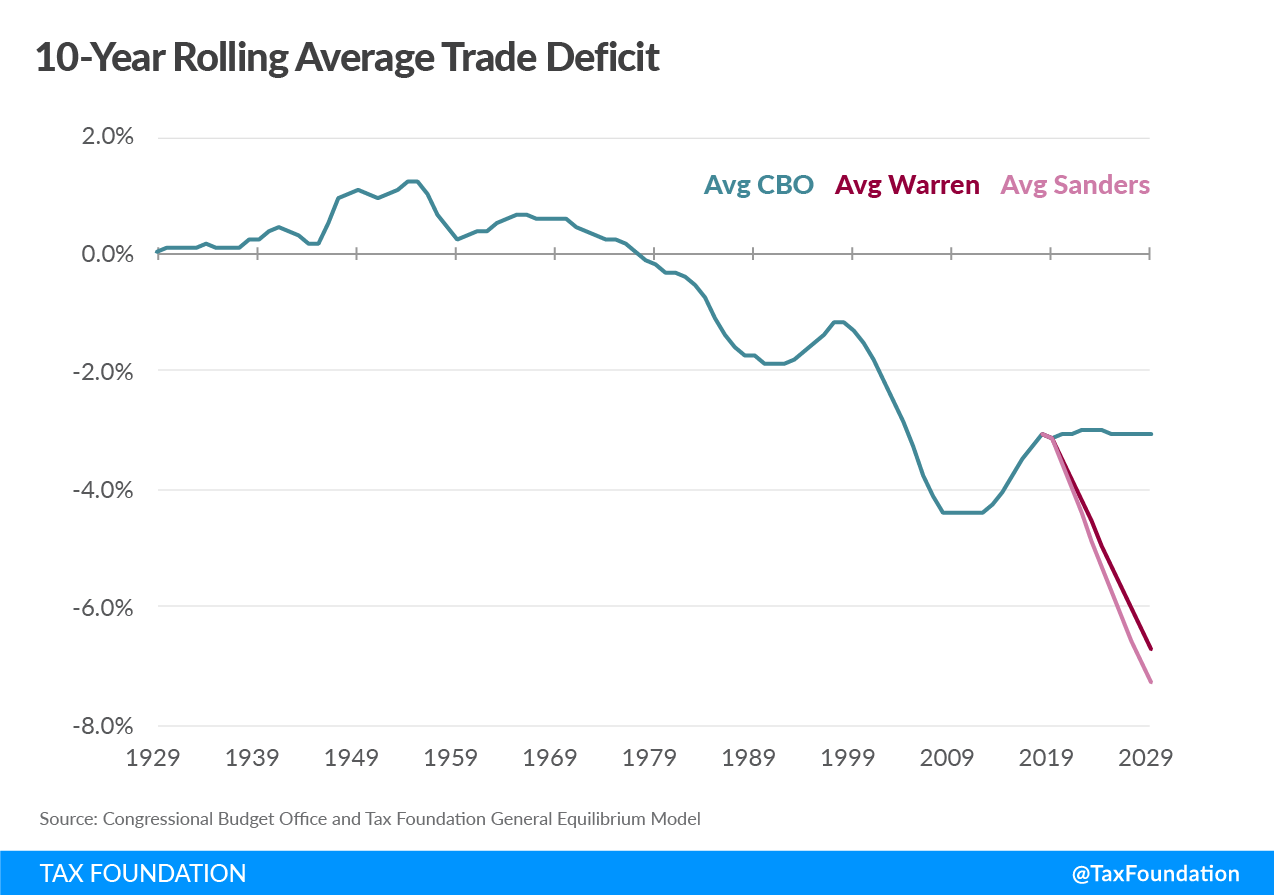

Analysis of Sen. Warren and Sen. Sanders’ Wealth Tax Plans

Tax Policy - Analysis of Sen. Warren and Sen. Sanders’ Wealth Tax Plans Key Findings Wealth taxes on ultra-wealthy households have been proposed by Democratic presidential candidates to fight against inequality and raise extra revenue but there is substantial...

The Davos Digital (Tax) Détente?

Tax Policy - The Davos Digital (Tax) Détente? The past week has been nearly nonstop with news on various fronts of a dispute over taxation of digital businesses. The main characters have been the U.S., France, and the UK, although the EU and the OECD have also...

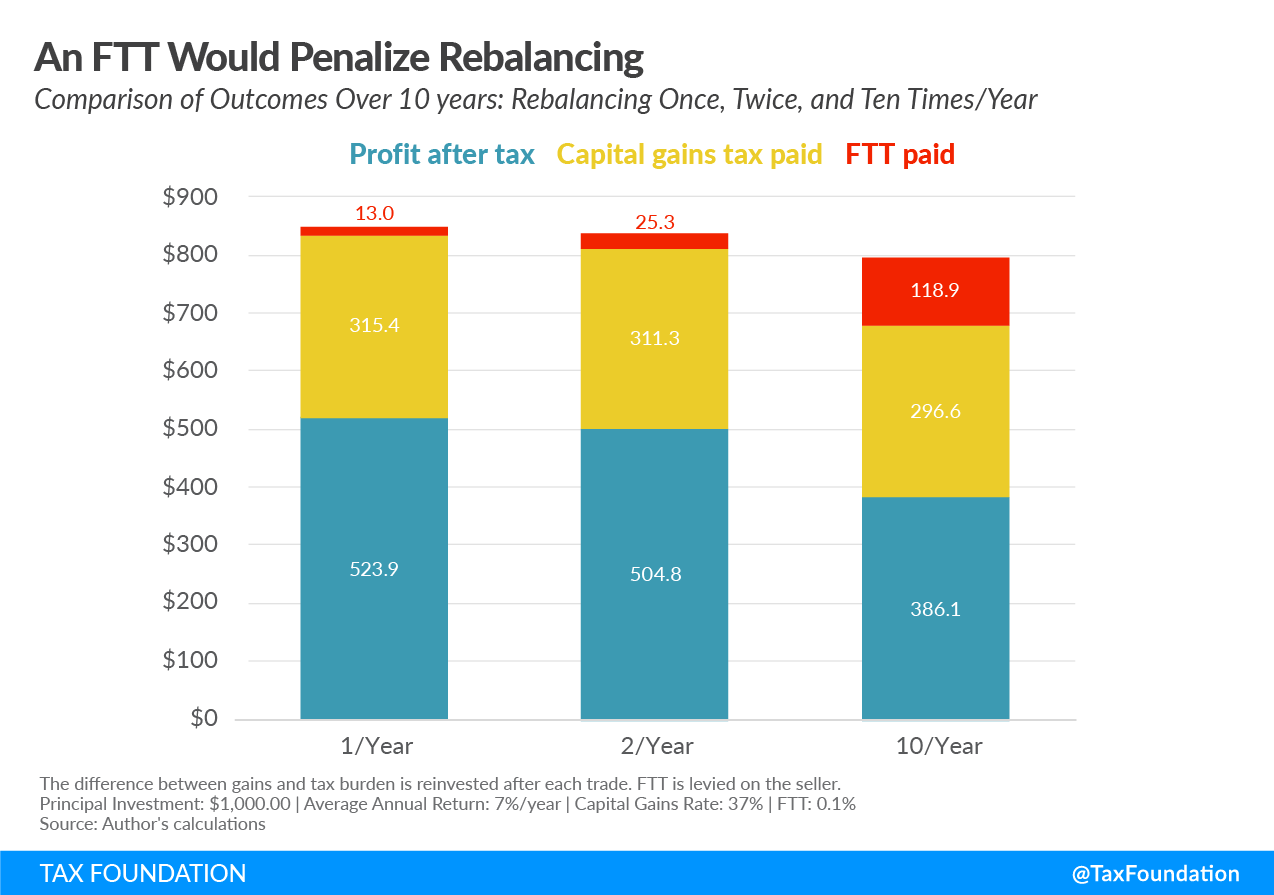

The Impact of a Financial Transactions Tax

Tax Policy - The Impact of a Financial Transactions Tax Key Findings A broad-based financial transaction tax (FTT) in the United States would be a substantial revenue source. For example, the Inclusive Prosperity Act proposed by Sen. Bernie Sanders (I-VT), with...

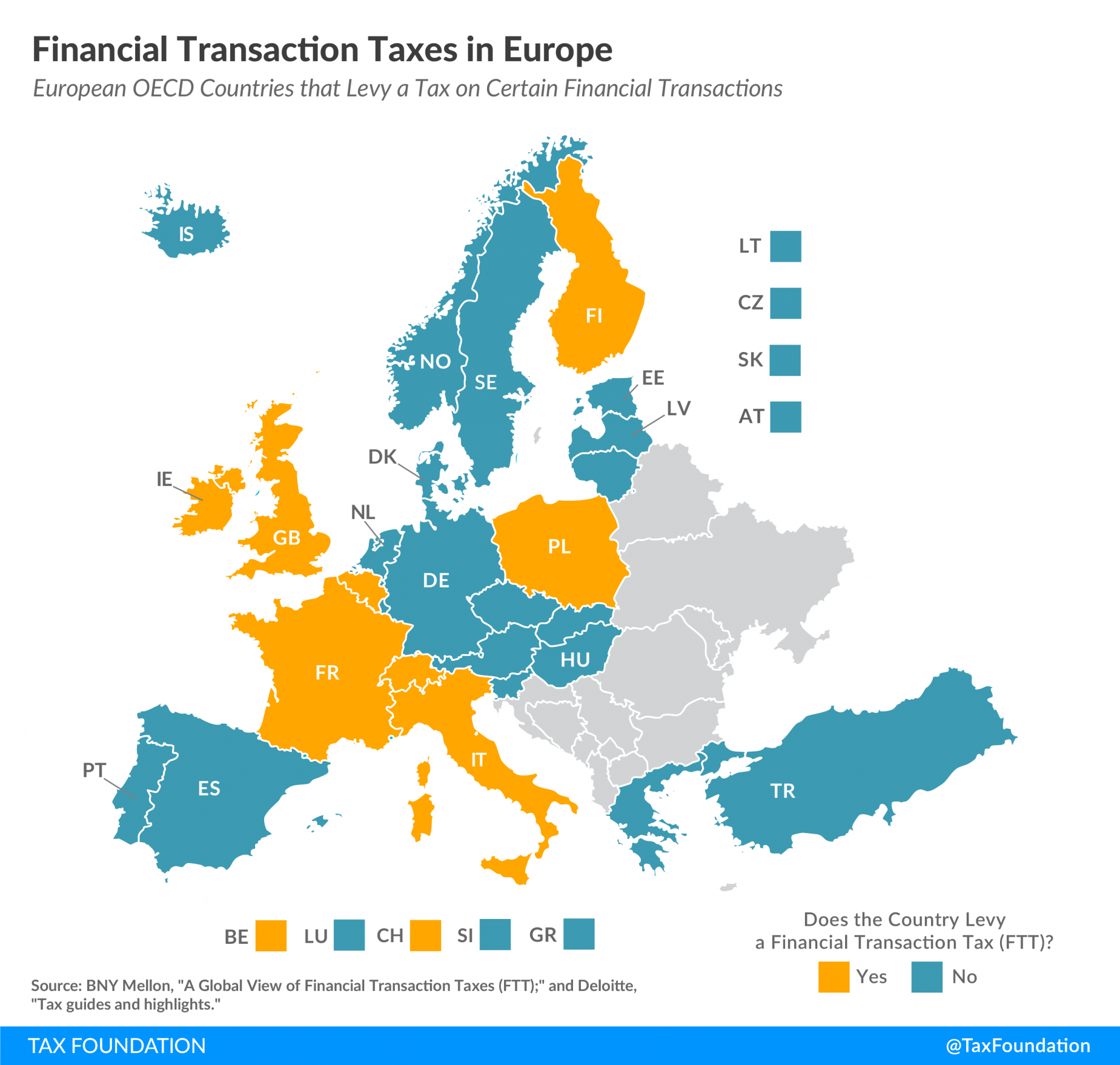

Financial Transaction Taxes in Europe

Tax Policy - Financial Transaction Taxes in Europe Since the 2008 financial crisis, financial transaction taxes (FTTs) have been debated as a potential instrument to address financial market instabilities and as a source for tax revenue. Today’s map shows which...

Looking Back on Taxation of Capital Gains

Tax Policy - Looking Back on Taxation of Capital Gains Key Findings A lookback charge is in addition to traditional income taxes due on the realization of a capital gain. In an ideal setting, the lookback charge eliminates the benefit of deferral and removes the...