Tax Blog

Tips to help you prepare for tax season

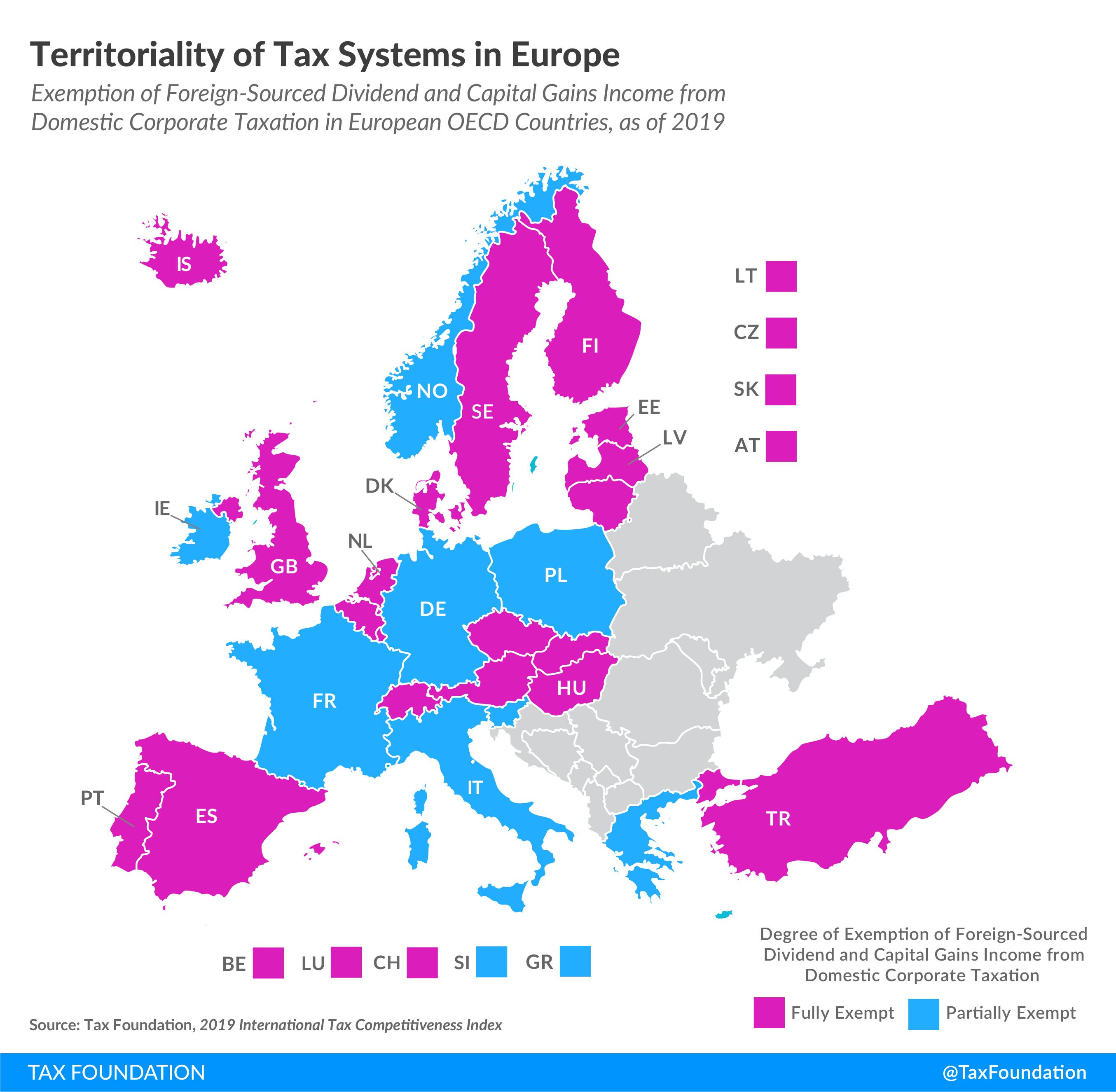

Territoriality of Tax Systems in Europe

Tax Policy - Territoriality of Tax Systems in Europe Under a territorial tax system, international businesses pay taxes to the countries in which they are located and earn their income. This means that territorial tax regimes do not generally tax the income...

Standard Mileage Rates Tweaked for 2020

The Internal Revenue Service has set the optional standard mileage rates for 2020. These rates are used to figure the deductible costs of operating a vehicle for business, charitable, medical or moving purposes.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Maryland Legislators Want to Tax Online Advertising

Tax Policy - Maryland Legislators Want to Tax Online Advertising Whenever anyone surfs the internet, they inevitably encounter online ads. They are everywhere, and they are big business. According to Forbes, the market was worth over $100 billion in the U.S. in...

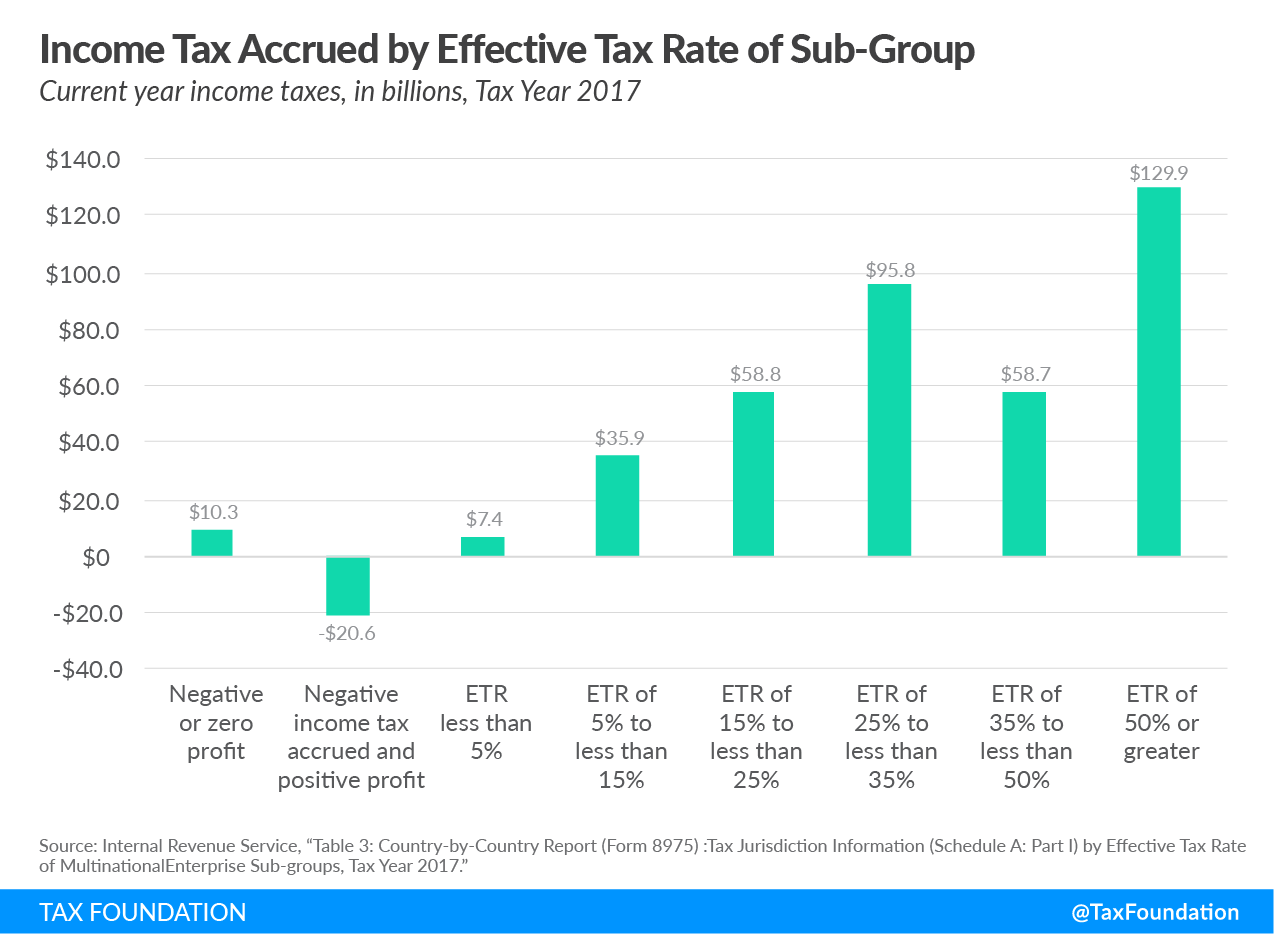

New IRS Data on Taxes of U.S. Parented Multinationals in 2017

Tax Policy - New IRS Data on Taxes of U.S. Parented Multinationals in 2017 Recently, the Internal Revenue Service (IRS) published its annual Country-by-Country Report, providing detailed statistics on profits and taxes of multinational enterprise groups...

Iowa Governor Proposes Second Round of Tax Reform

Tax Policy - Iowa Governor Proposes Second Round of Tax Reform Building on tax reforms adopted in 2018, Iowa Gov. Kim Reynolds (R) is proposing additional reforms which expand and guarantee the promises of the 2018 legislation while modestly rebalancing tax...

Measuring Marginal Effective Tax Rates on Capital Income Under Current Law

Tax Policy - Measuring Marginal Effective Tax Rates on Capital Income Under Current Law Key Findings This paper updates the user cost of capital calculation in Tax Foundation’s General Equilibrium model by including the split of equity and debt financing by...