Tax Blog

Tips to help you prepare for tax season

Digital Taxes, Meet Handbag Tariffs

Tax Policy - Digital Taxes, Meet Handbag Tariffs Today the U.S. Trade Representative (USTR) announced new tariffs in response to the French digital services tax. The tariffs of 25 percent on $1.3 billion worth of trade would not go into effect until January 6,...

Non-Profit Files Lawsuit over Withholding Requirements in Ohio

Tax Policy - Non-Profit Files Lawsuit over Withholding Requirements in Ohio On July 2, a Columbus-based non-profit, the Buckeye Institute, filed a lawsuit against the city of Columbus and state of Ohio claiming that a recently passed bill, HB197, is...

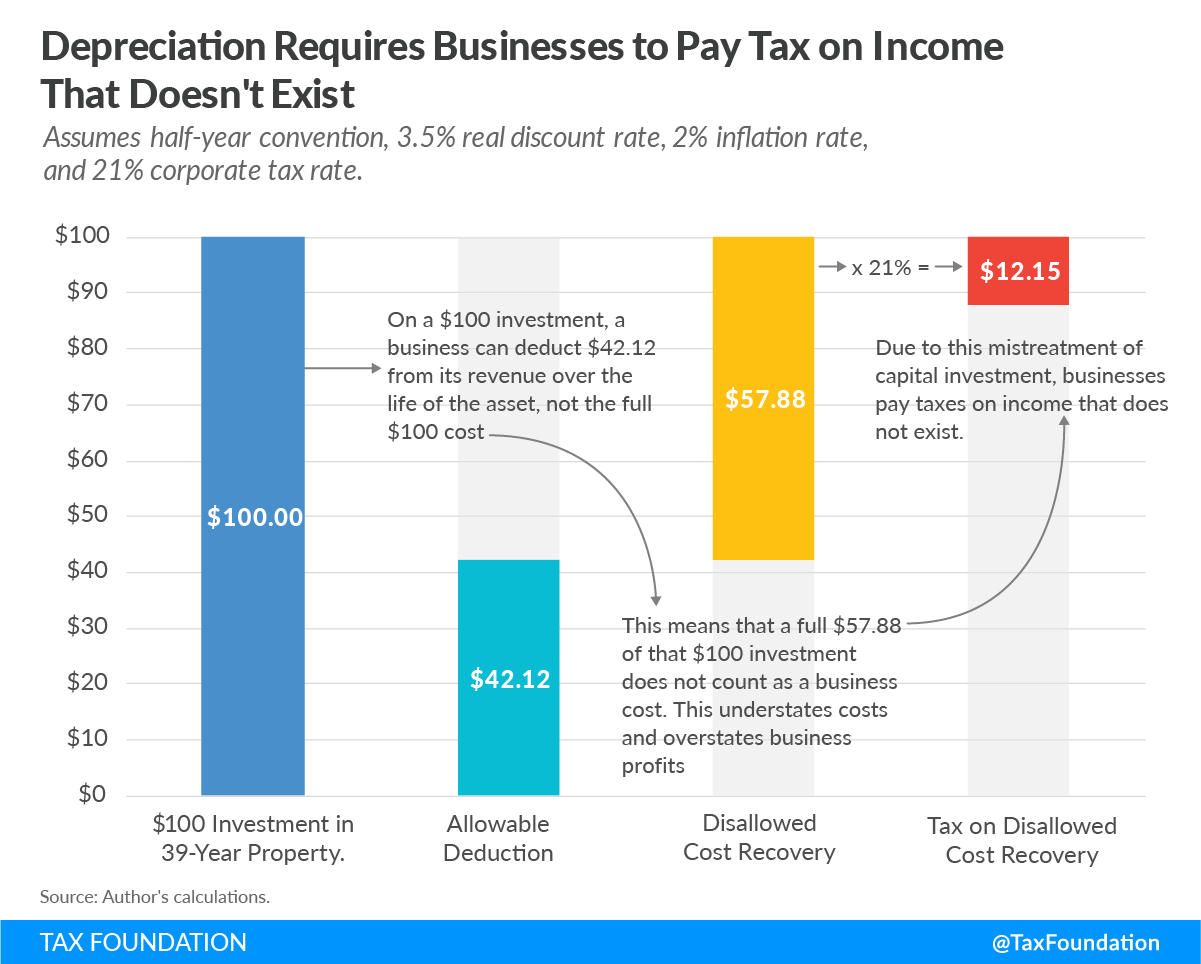

Improved Cost Recovery Is A Wide-Ranging Policy Solution

Tax Policy - Improved Cost Recovery Is A Wide-Ranging Policy Solution Investment comes in a variety of forms—be it private or public investments ranging from rural broadband and 5G to health care infrastructure and innovation. But not all investment is equal in...

Peruvian “Solidarity Tax” Unlikely to Offset Deficit Spending

Tax Policy - Peruvian “Solidarity Tax” Unlikely to Offset Deficit Spending Due to the COVID-19 crisis, Peru has found itself with high levels of government spending that has resulted in a significant deficit. In order to offset costs, the government is...

Neutral Cost Recovery and Expensing: Frequently Asked Questions

Tax Policy - Neutral Cost Recovery and Expensing: Frequently Asked Questions What is cost recovery? What is depreciation? What is the tax treatment of investments in structures? What is the tax treatment of investments in machinery and equipment? What is the...

Phase 4 Is not the Time to Experiment with Temporary Credits

Tax Policy - Phase 4 Is not the Time to Experiment with Temporary Credits Members of Congress are on a two-week recess before returning to consider a possible “phase 4” package to boost the economy and help individuals and businesses suffering from the economic...