Tax Blog

Tips to help you prepare for tax season

FDII and GILTI regulations finalized

IRS Tax News - FDII and GILTI regulations finalized The IRS issued final regs. on the foreign-derived intangible income deduction and the global intangible low-taxed income provisions enacted by the TCJA. Source: IRS Tax News - FDII and GILTI regulations...

How Stable is Cigarette Tax Revenue?

Tax Policy - How Stable is Cigarette Tax Revenue? .axis line, .axis path { stroke: #cccccc; } .axis text { fill: #555555; font-family: 'Lato', sans-serif; font-size: 12px; } #inflation-toggle { border-left: 1px solid #cccccc; margin-left: 0.5rem; padding-left:...

How to report coronavirus paid sick leave and family leave to employees

IRS Tax News - How to report coronavirus paid sick leave and family leave to employees The IRS issued guidance on how employers should report qualified sick and family leave paid to employees under the Families First Coronavirus Response Act. Source: IRS...

National Taxpayer Advocate’s Report Is a Road Map to Simpler Pandemic Relief Provisions

Tax Policy - National Taxpayer Advocate’s Report Is a Road Map to Simpler Pandemic Relief Provisions Last week, National Taxpayer Advocate Erin M. Collins released her first report to Congress on the challenges taxpayers have faced related to the coronavirus...

Tax Foundation Comments on the Initiation of Section 301 Investigations of Digital Services Taxes

Tax Policy - Tax Foundation Comments on the Initiation of Section 301 Investigations of Digital Services Taxes The following comments were submitted to the Office of the United States Trade Representative regarding docket number USTR-2019-0009. Thank you for the...

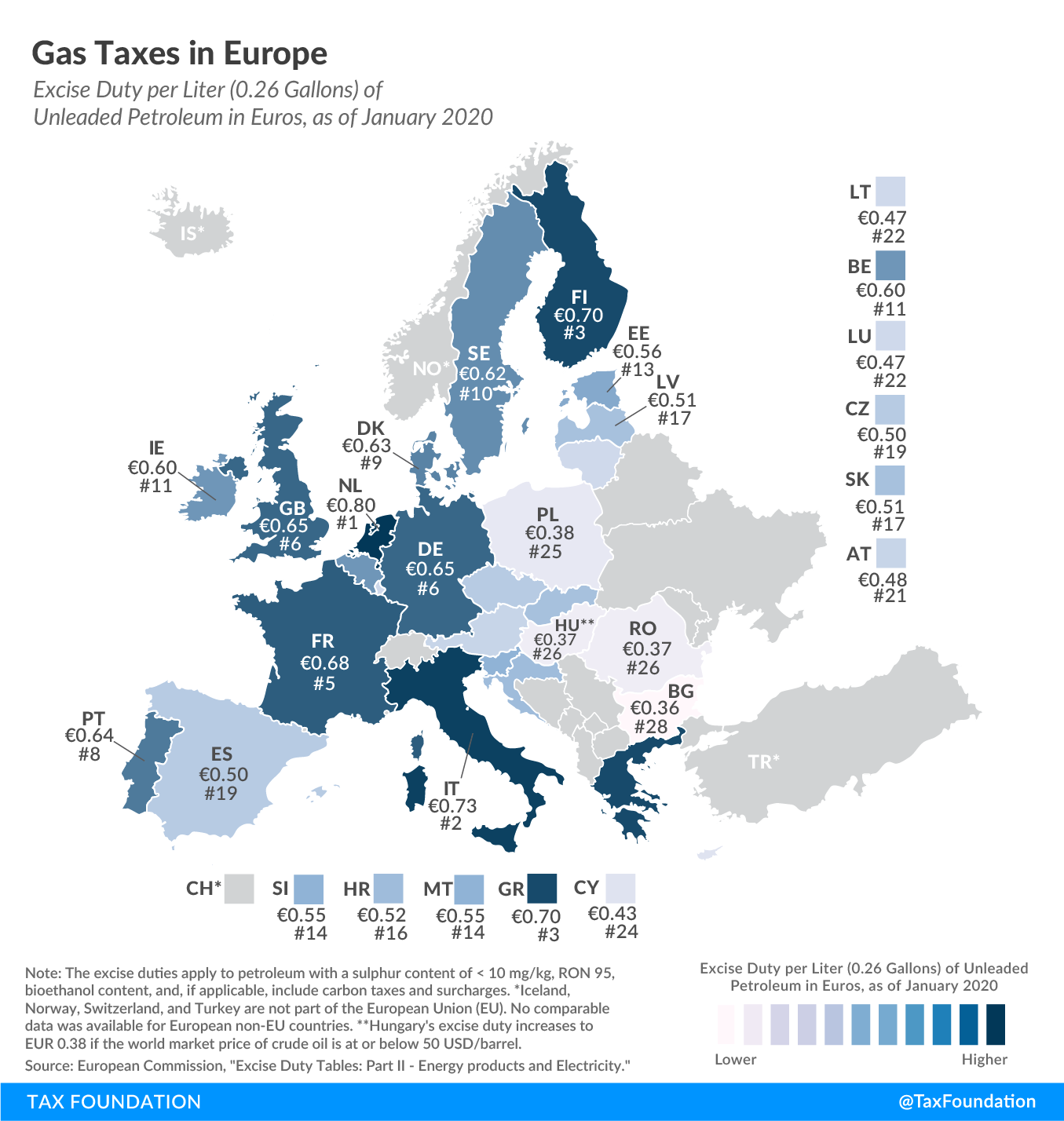

Gas Taxes in Europe

Tax Policy - Gas Taxes in Europe To facilitate and foster cross-border trade and to prevent significant competitive distortions, the European Union requires EU countries to levy a minimum excise duty of €0.36 per liter (US $1.53 per gallon) on gas. As today’s...