Tax Blog

Tips to help you prepare for tax season

More Tax Relief for Tornado Victims

The Internal Revenue Service is giving tornado, thunderstorm and flooding victims in three states extra time to file their various tax returns and make tax payments.Severe storms raked parts of… Read more about More Tax Relief for Tornado Victims (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

GAO Report Reveals Need to Simplify Next Round of Rebates

Tax Policy - GAO Report Reveals Need to Simplify Next Round of Rebates The Government Accountability Office (GAO) recently released a report revealing that almost a half-million taxpayers missed their total rebate payment due to complications over disbursing...

Improving the Tax Treatment of Residential Buildings Will Stretch Affordable Housing Assistance Dollars Further

Tax Policy - Improving the Tax Treatment of Residential Buildings Will Stretch Affordable Housing Assistance Dollars Further A recent Brookings Institution study points out that “even before the COVID-19 crisis, housing affordability and instability were serious...

European Countries Might Consider Scrapping the Bank Tax for Greater Financial Support

Tax Policy - European Countries Might Consider Scrapping the Bank Tax for Greater Financial Support After the 2007-2008 financial crisis, countries were pressed to tax the financial sector to partly recover the fiscal assistance governments offered to support...

Three Reasons Expanding Credits Aren’t the Best Pandemic Response for the Vulnerable

Tax Policy - Three Reasons Expanding Credits Aren’t the Best Pandemic Response for the Vulnerable Tax policy wonks often advocate for increases in refundable tax credits (e.g., Child Tax Credit, CTC and Earned Income Tax Credit, EITC) and nonrefundable tax...

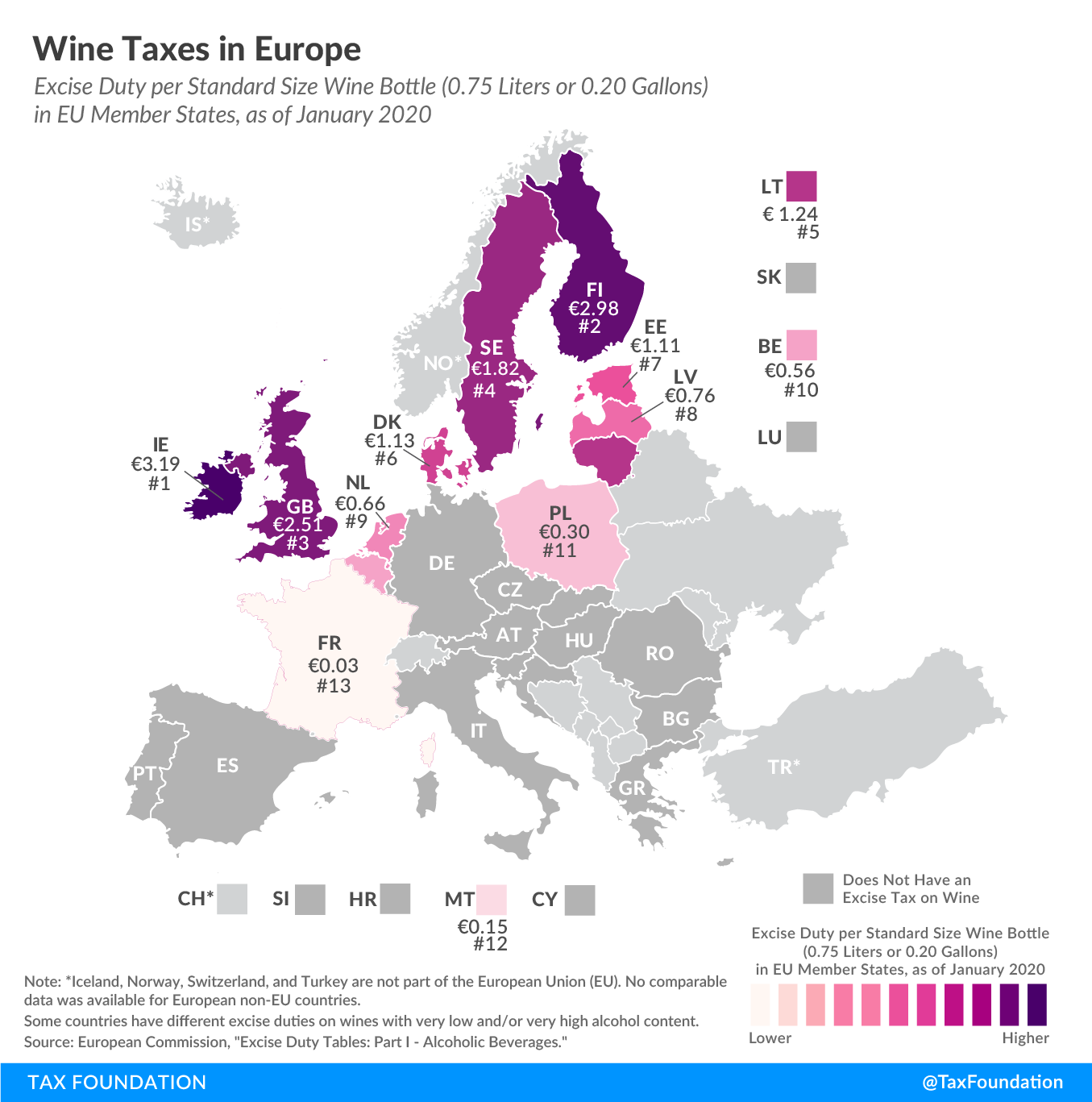

Wine Taxes in Europe

Tax Policy - Wine Taxes in Europe This is the beginning of a map series in which we’ll explore different types of excise taxes, starting with excise duties on wine. If you have ever wondered about the tax consequences of opening a bottle of wine—yes, there is a...