Tax Blog

Tips to help you prepare for tax season

RIC shareholders can take Sec. 199A deduction for REIT dividends

IRS Tax News - RIC shareholders can take Sec. 199A deduction for REIT dividends The IRS issued final regulations allowing regulated investment companies (RICs) to report qualified real estate investment trust (REIT) dividends as Sec. 199A dividends to their...

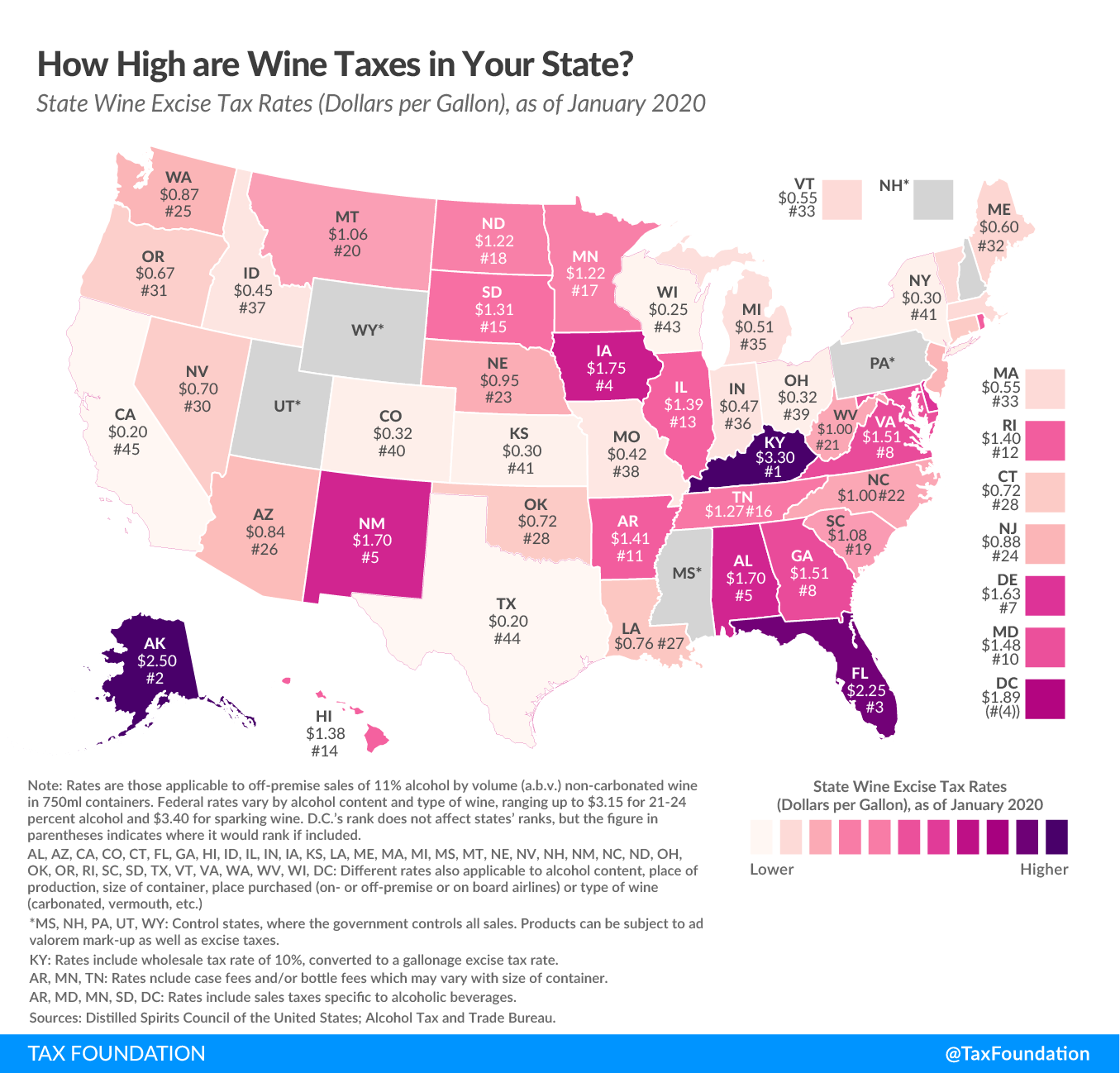

How High are Wine Taxes in Your State?

Tax Policy - How High are Wine Taxes in Your State? Whether you’re a self-appointed connoisseur or an occasional sipper of chardonnay, you may not have thought about the taxes that go into your wine purchase. But now you can quench your newly found thirst for...

IRS Unveils New Relief for COVID-19 Retirement Borrowers

The COVID-19 pandemic has forced millions of Americans to take extraordinary steps just to stay afloat financially. For those taxpayers who might want to take distributions against their retirement plans or even borrow against their plans, the IRS has announced new relief.… Read more about IRS Unveils New Relief for COVID-19 Retirement Borrowers (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Rollover relief for required minimum distributions

IRS Tax News - Rollover relief for required minimum distributions The IRS provides relief for taxpayers who had already taken required minimum distributions (RMDs) in 2020 before the CARES Act suspended the RMD requirement for 2020 in response to the coronavirus...

Economic Analysis of Financing Options for Infrastructure Spending Proposals

Tax Policy - Economic Analysis of Financing Options for Infrastructure Spending Proposals As the economic recovery is debated amid the coronavirus pandemic, there have been growing calls to include additional public investment in infrastructure such as...

Why Neutral Cost Recovery Is Good for Workers

Tax Policy - Why Neutral Cost Recovery Is Good for Workers The COVID-19 pandemic has damaged the American economy, as unemployment has skyrocketed. Despite job growth in May, the unemployment rate still sits at more than 13 percent, its highest point since the...