Tax Blog

Tips to help you prepare for tax season

EU: The Next Generation

Tax Policy - EU: The Next Generation Today, the European Commission announced new budget plans including loans, grants, and some revenue offsets. The proposals follow other support mechanisms for workers and businesses that were designed in response to the...

Final regs. address reporting by tax-exempt organizations

IRS Tax News - Final regs. address reporting by tax-exempt organizations The IRS finalized regulations permitting tax-exempt organizations other than Sec. 501(c)(3) orgs. to omit the names of substantial donors when filing Forms 990, Return of Organization...

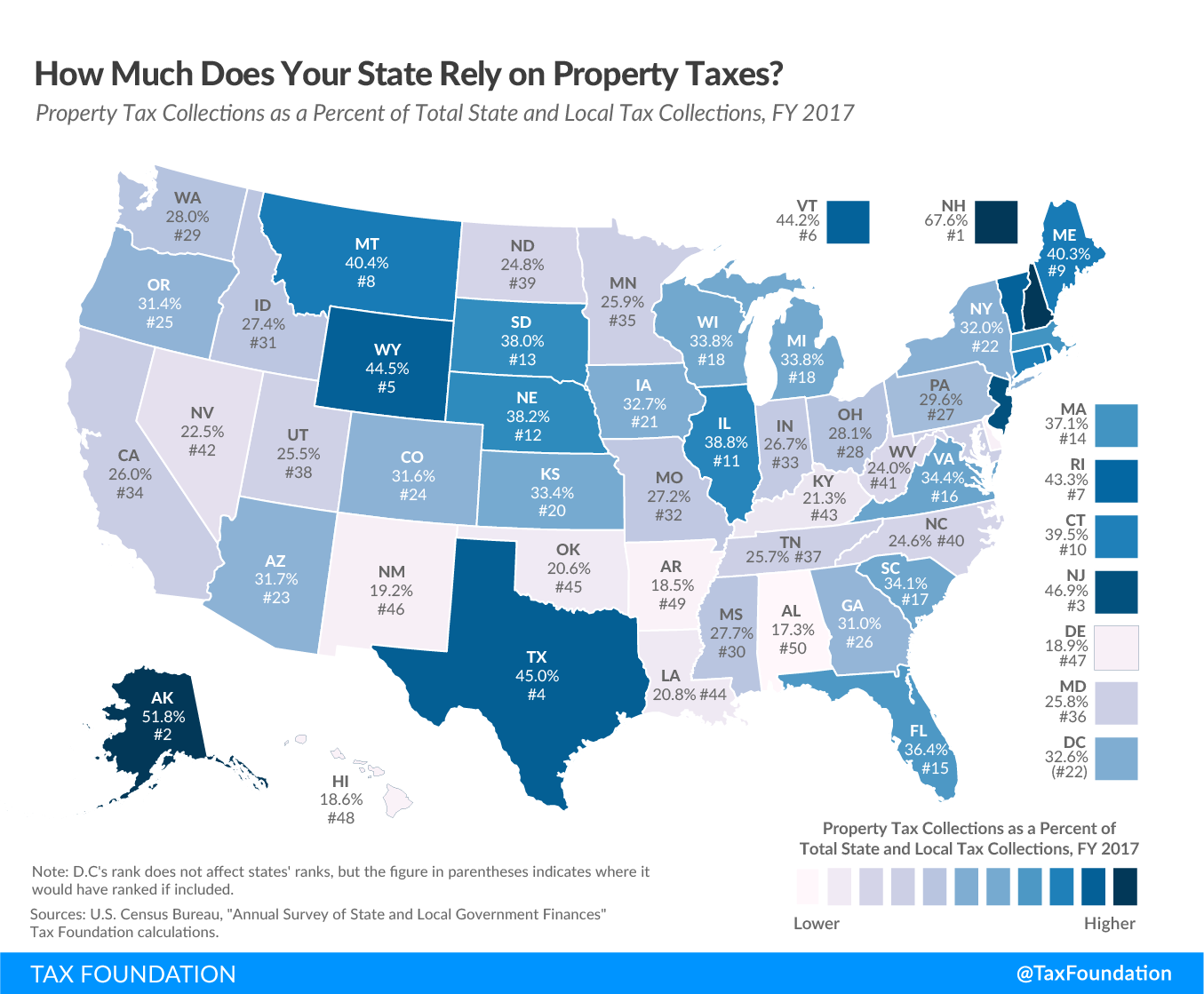

To What Extent Does Your State Rely on Property Taxes?

Tax Policy - To What Extent Does Your State Rely on Property Taxes? Property taxes represent a major source of revenue for states and the largest source of tax revenue for localities. In fiscal year 2017, the most recent data available, property taxes were such...

Premium tax credit unaffected by personal exemption decrease to zero

IRS Tax News - Premium tax credit unaffected by personal exemption decrease to zero The IRS issued long-promised proposed regulations explaining how taxpayers who may qualify for the Sec 36B premium tax credit are affected by the temporary reduction of the...

Lessons from Alberto Alesina for U.S. Lawmakers

Tax Policy - Lessons from Alberto Alesina for U.S. Lawmakers The economics world suffered a big loss over the weekend with the untimely passing of Alberto F. Alesina, the Nathaniel Ropes professor of political economy at Harvard. Alesina’s specialty was...

Net Operating Loss Carrybacks Are a Vital Source of Tax Relief for Struggling Firms in the Coronavirus Crisis

Tax Policy - Net Operating Loss Carrybacks Are a Vital Source of Tax Relief for Struggling Firms in the Coronavirus Crisis As policymakers explore options for Phase 4 relief for businesses and individuals, it is important to understand why and how the CARES Act...