Tax Blog

Tips to help you prepare for tax season

Now Available: Paycheck Protection Program Loan-Forgiveness Application

The Small Business Administration says the PPP loan-forgiveness application is now available on SBA.gov.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

HEROES Act Dependent Expansions Come with Major Drawbacks

Tax Policy - HEROES Act Dependent Expansions Come with Major Drawbacks In a previous post, I outlined portions of the dependent-related provisions in the recently-passed HEROES Act (H.R. 6800), focusing on changes to the EITC, CTC, and CDTC. Although the...

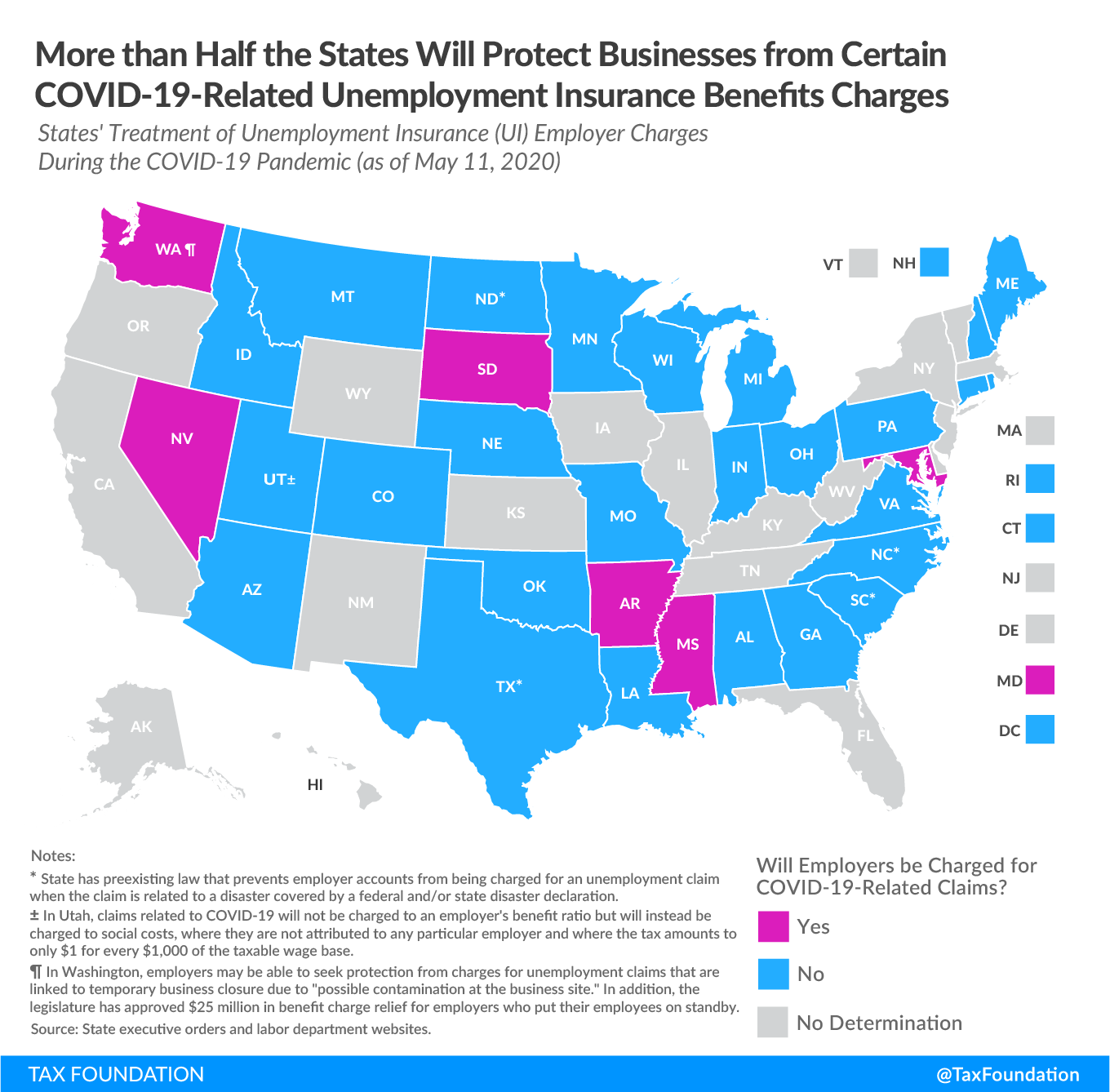

More Than Half the States Will Protect Businesses from Certain COVID-19-Related Unemployment Insurance Tax Hikes

Tax Policy - More Than Half the States Will Protect Businesses from Certain COVID-19-Related Unemployment Insurance Tax Hikes Across the country, unemployment insurance (UI) benefits are playing an important role in helping individuals who have lost work due to...

HEROES Act Temporarily Increases Dependent Credit Generosity

Tax Policy - HEROES Act Temporarily Increases Dependent Credit Generosity Among other revenue provisions (Division B) of last week’s House-passed Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act, the bill would make changes to certain...

Breaking Down State and Local Aid under the SMART Act

Tax Policy - Breaking Down State and Local Aid under the SMART Act The State Municipal Assistance for Response and Transition (SMART) Act, sponsored by Senators Bob Menendez (D-NJ) and Bill Cassidy (R-LA) in the Senate and by Rep. Mikie Sherrill (D-NJ) in the...

Neutral Cost Recovery Is Not a New Idea

Tax Policy - Neutral Cost Recovery Is Not a New Idea Today, lawmakers and the administration are exploring policies to meet the need to increase investment and economic output amid an economic downturn. Improving the cost recovery treatment of long-lived assets...