Tax Blog

Tips to help you prepare for tax season

IRS mobilizing 3,500 phone operators to answer stimulus questions

IRS Tax News - IRS mobilizing 3,500 phone operators to answer stimulus questions With many taxpayers still having problems using the Internal Revenue Service’s “Get My Payment” website, the IRS announced that it is mobilizing 3,500 telephone representatives to...

IRS Breaks Down Economic Impact Payments by State

The IRS announced that close to 130 million taxpayers have now received an Economic Impact Payment—up from the 88 million toward the end of April—bringing the total amount of money issued to more than $200 billion.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

HEROES Act First Bid to Provide Phase 4 Relief for Businesses and Individuals

Tax Policy - HEROES Act First Bid to Provide Phase 4 Relief for Businesses and Individuals The Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act, a draft released Tuesday by Democrats in the U.S. House of Representatives, is the first bid to...

Accounting for Deficits: When Should They Matter and How Should We Solve It?

Tax Policy - Accounting for Deficits: When Should They Matter and How Should We Solve It? Reporting suggests that Congress will continue to consider a variety of legislative solutions to support Americans enduring the ongoing public health crisis, provide...

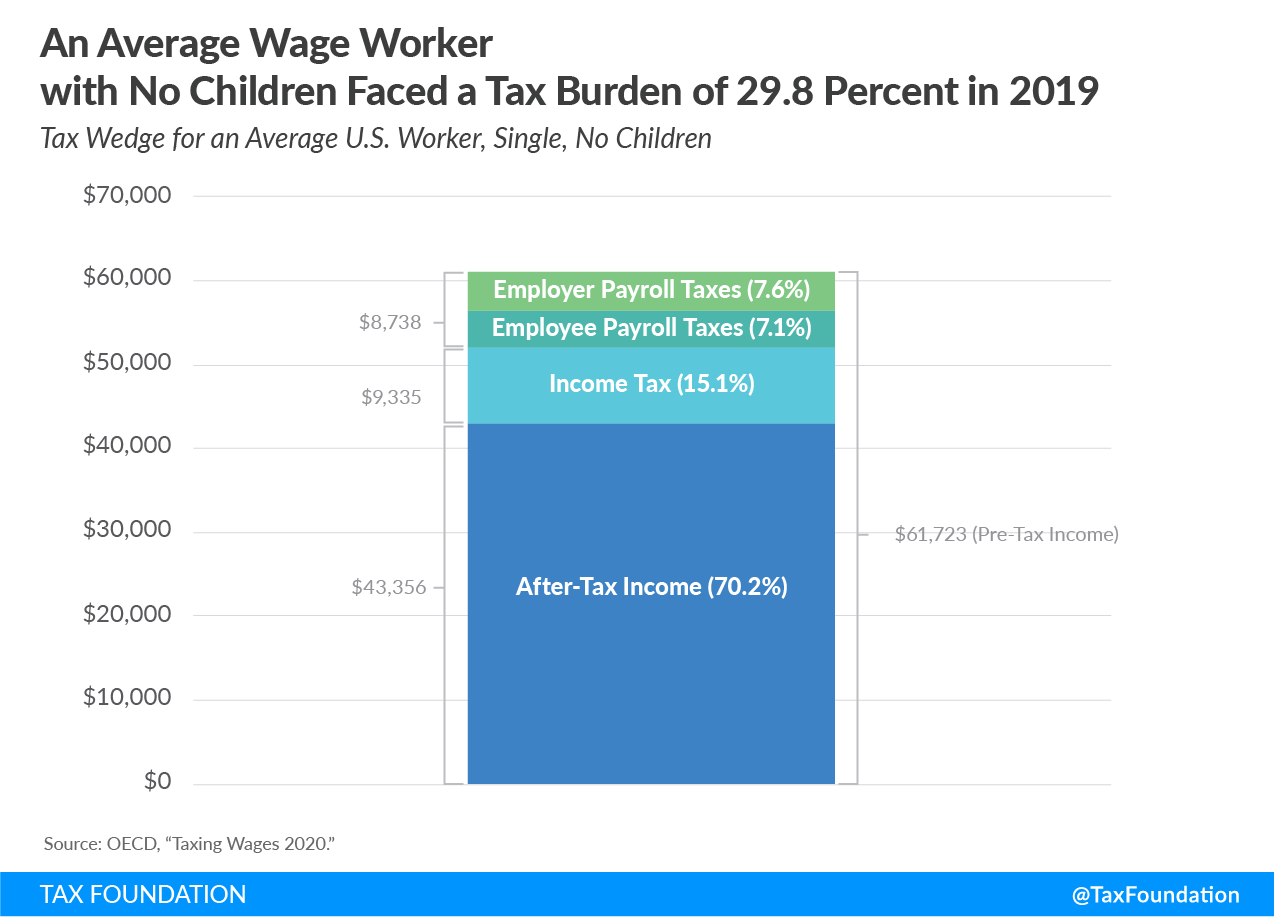

The U.S. Tax Burden on Labor

Tax Policy - The U.S. Tax Burden on Labor Key Findings Average workers in the United States face two major taxes on wage income: the individual income tax and the payroll tax (levied on both the employee and the employer). Although slightly more than half of a...

Final regs. clarify when interest in corporation is stock vs. debt

IRS Tax News - Final regs. clarify when interest in corporation is stock vs. debt The IRS has issued final regulations addressing when certain related-party interests in corporations should be treated as stock vs. debt. Source: IRS Tax News - Final regs....