Tax Blog

Tips to help you prepare for tax season

A Comparison of the Tax Burden on Labor in the OECD

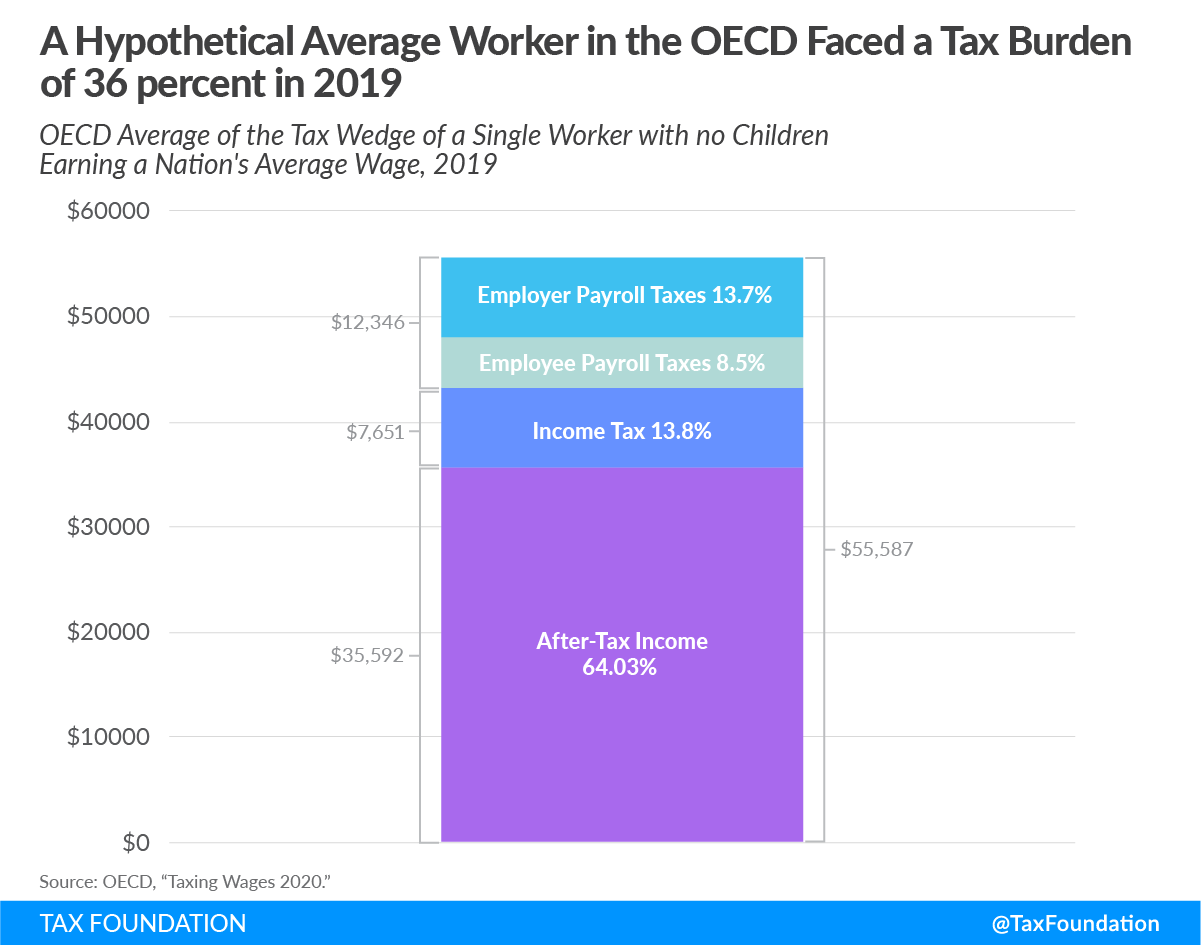

Tax Policy - A Comparison of the Tax Burden on Labor in the OECD Key Findings Average wage earners in the OECD have their take-home pay lowered by three major taxes: individual income, payroll (both employee and employer side), and value-added (VAT) and sales...

California the Latest to Propose Higher Vapor Taxes

Tax Policy - California the Latest to Propose Higher Vapor Taxes When Governor Gavin Newsom (D) submits his revised budget proposal on Thursday, it will include a vapor tax increase. California currently taxes vapor products at 59.27 percent of wholesale value,...

Designing a State and Local Government Relief Package

Tax Policy - Designing a State and Local Government Relief Package Key Findings The COVID-19 pandemic and the attendant economic contraction will wreak havoc on state and local tax revenues, with projections of a 15-20 percent decline in state revenues....

New Credits Available for Businesses Hit by COVID-19

The Internal Revenue Service is reminding employers who have been impacted by the Coronavirus pandemic that three new credits are available for them.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

IRS Announces Virtual Settlement Days

The Internal Revenue Service announced that Settlement Days will be hosted via teleconferencing platforms due to coronavirus stay-at-home orders.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Taxpayers must act soon for direct deposit of stimulus payments

IRS Tax News - Taxpayers must act soon for direct deposit of stimulus payments The IRS announced that taxpayers for whom the Service does not have direct deposit information should go to its “Get My Payment” website and enter that information by noon on...