Tax Blog

Tips to help you prepare for tax season

PLR and other requests for IRS guidance can now be sent electronically

IRS Tax News - PLR and other requests for IRS guidance can now be sent electronically The IRS is temporarily allowing taxpayers to submit requests for private letter rulings, closing agreements, determination letters and information letters electronically...

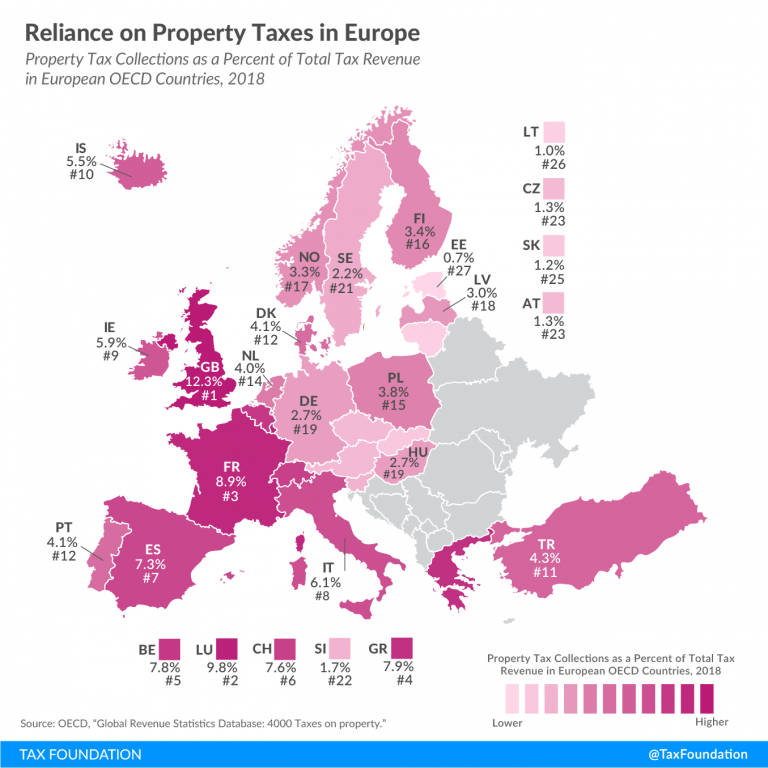

Reliance on Property Taxes in Europe

Tax Policy - Reliance on Property Taxes in Europe A recent report outlines to what extent OECD countries rely on various tax revenue sources. Today’s map looks at property tax revenue in European OECD countries, which, compared to other types of taxes, accounts...

Hunting, Fishing Tax Hits the Mark

The Tax Foundation found that an excise tax on firearms and other hunting and fishing gear is feeding tax proceeds back into projects that ultimately benefit outdoorsmen paying the tax.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

CARES Act QIP change requires action

IRS Tax News - CARES Act QIP change requires action Taxpayers with qualified property must act to take advantage of changes to the treatment of qualified improvement property, which is now eligible for bonus depreciation. Here are some considerations for...

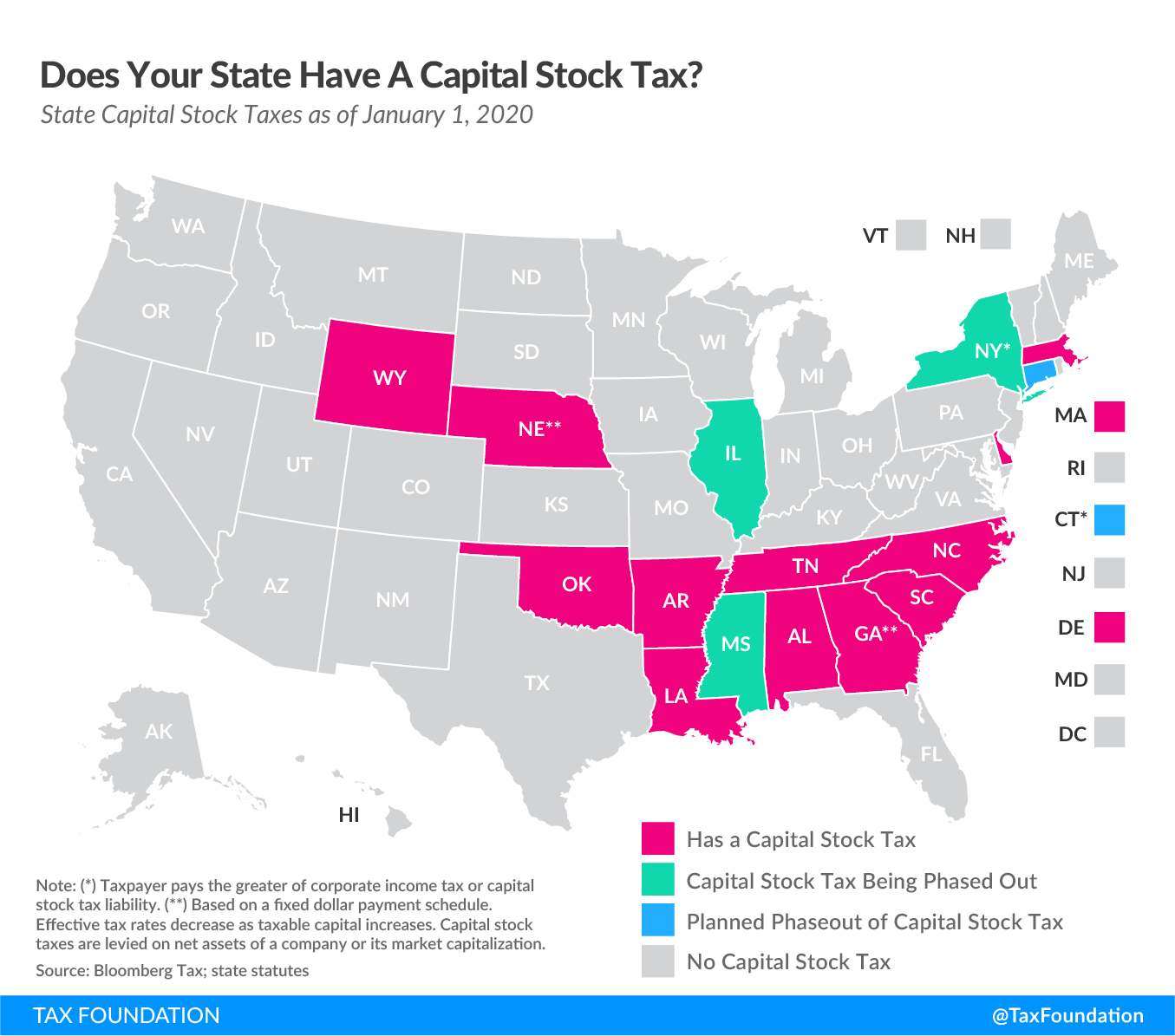

Does Your State Levy a Capital Stock Tax?

Tax Policy - Does Your State Levy a Capital Stock Tax? This week’s map looks at another barrier to business and consumer recovery: capital stock taxes. These taxes impair economic growth in the best of times, but during an economic contraction they are...

Details and Analysis of Former Vice President Biden’s Tax Proposals

Tax Policy - Details and Analysis of Former Vice President Biden’s Tax Proposals Key Findings Former Vice President Joe Biden would enact a number of policies that would raise taxes, including individual income taxes and payroll taxes, on high-income individuals...