Tax Blog

Tips to help you prepare for tax season

SSI recipients to receive stimulus payments; dependent payments require extra step

IRS Tax News - SSI recipients to receive stimulus payments; dependent payments require extra step The IRS announced that Supplemental Security Income (SSI) recipients will receive automatic stimulus payments, but some taxpayers need to enter information about...

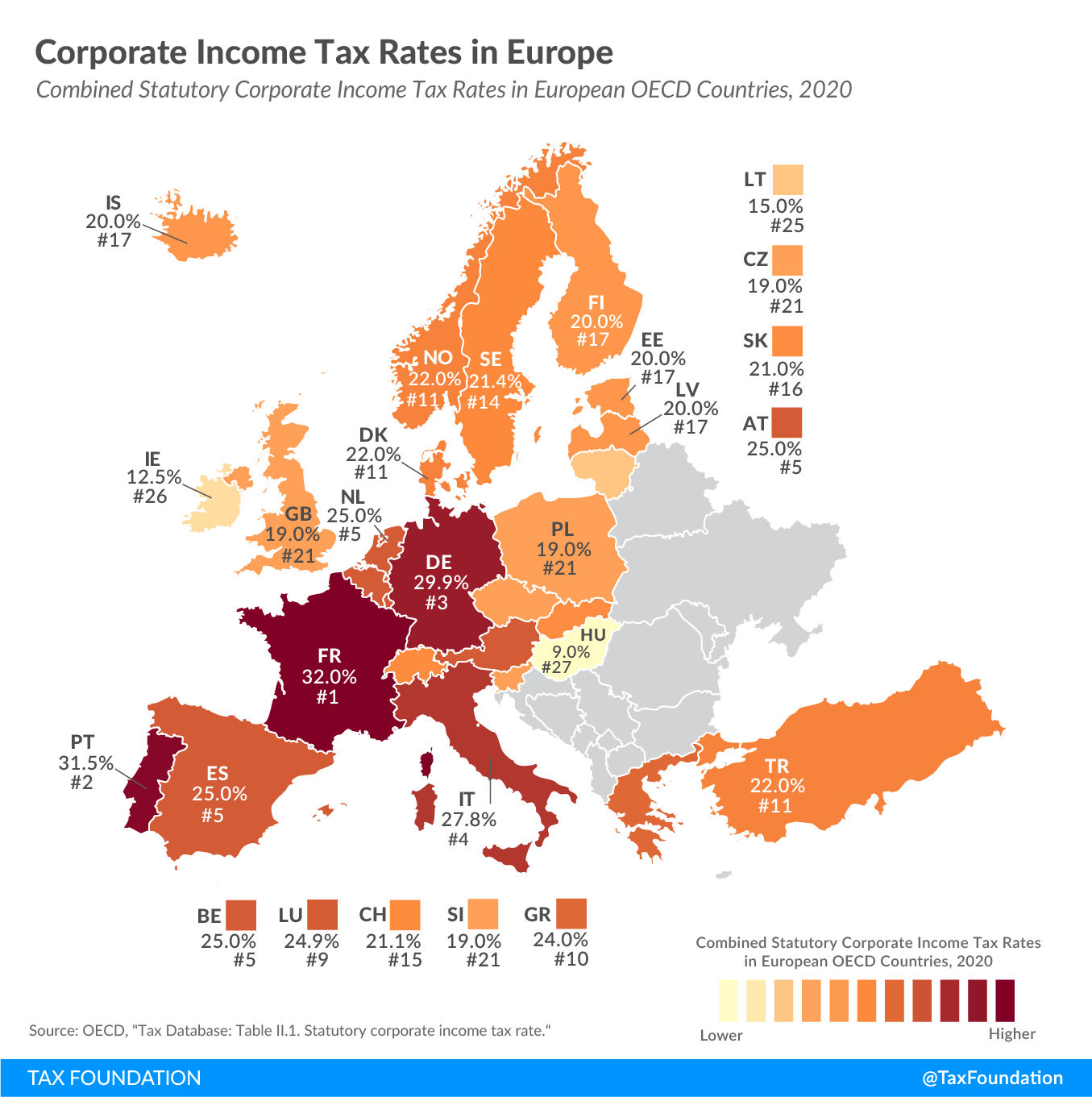

Corporate Income Tax Rates in Europe

Tax Policy - Corporate Income Tax Rates in Europe European countries—like almost all countries around the world—require businesses to pay corporate income taxes on their profits. The amount of taxes a business ultimately pays on its profits depends on both the...

TIGTA Says This Tax Season Presents Uphill Climb to IRS

TIGTA published its interim report, detailing tax-season challenges for the IRS that range from recent legislation to the COVID-19 outbreak.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

PTIN fee will be lower when it is reinstated

IRS Tax News - PTIN fee will be lower when it is reinstated The IRS has proposed to lower the fee it charges for preparer tax identification numbers (PTINs) when PTIN fees are reinstated. Source: IRS Tax News - PTIN fee will be lower when it is reinstated

IRS launches website for tracking stimulus payments

IRS Tax News - IRS launches website for tracking stimulus payments The IRS announced the launch of its “Get My Payment” website, which is designed to permit people who filed tax returns to enter their direct deposit information and check the status of their...

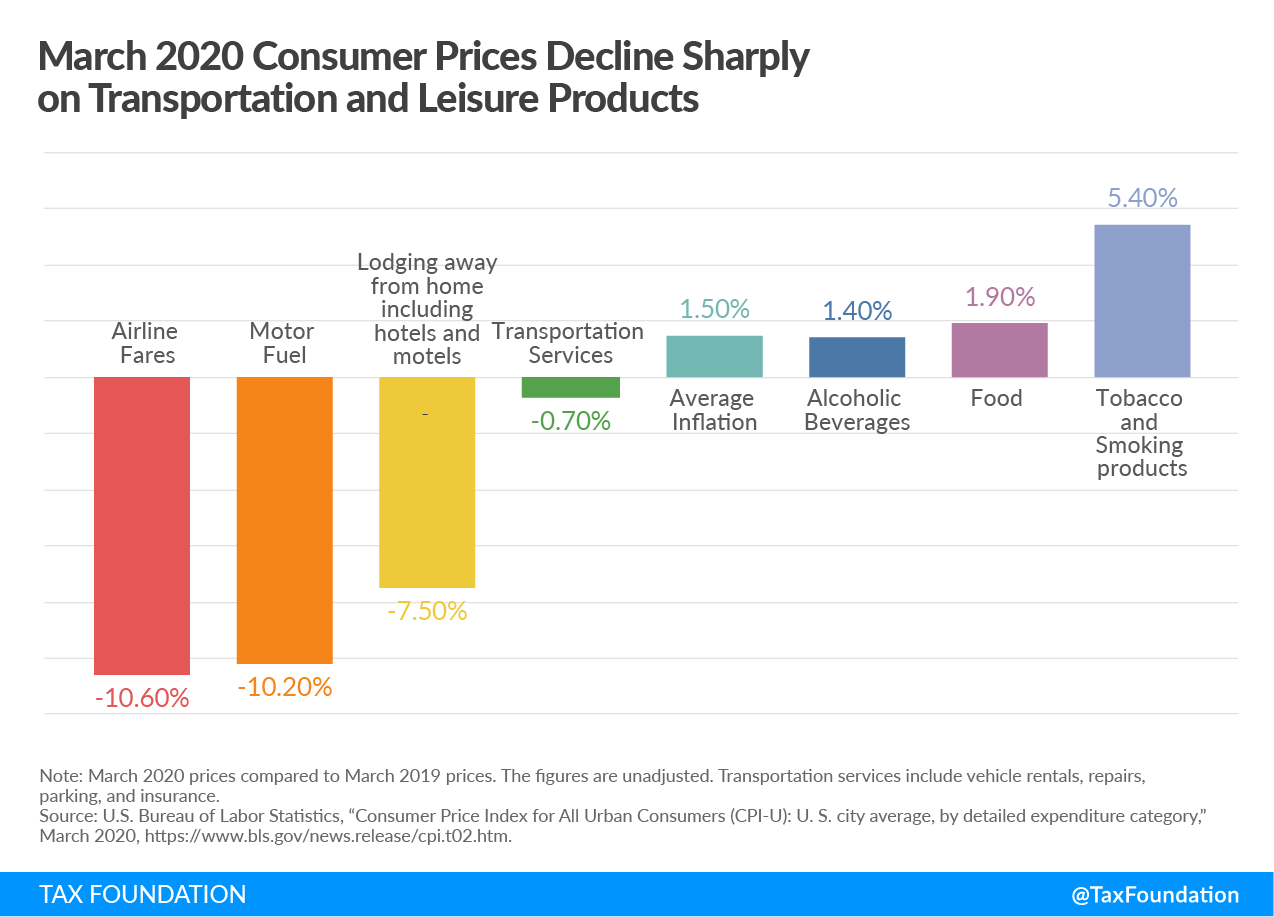

Can States Close Budget Deficits with Excise Tax Hikes?

Tax Policy - Can States Close Budget Deficits with Excise Tax Hikes? Key Findings: The coronavirus pandemic affects almost every source of state revenue, and with the duration unknown, predicting economic outcomes will be difficult. Social distancing,...