Tax Blog

Tips to help you prepare for tax season

COVID-19 Causes Delay of Tax Payment Deadline

COVID-19 has disrupted daily life for taxpayers across the country. Whether due to school closures or businesses shutting down, change is the one thing that feels inevitable.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Lawmakers Concerned that Delay in Tax Filing Deadline Not Fully Understood

Tax Policy - Lawmakers Concerned that Delay in Tax Filing Deadline Not Fully Understood The coronavirus crisis has broken out just as many firms and individuals are completing returns for the 2019 tax year. In response, the U.S. Treasury Department has pushed...

Coronavirus relief bill contains tax credits for employers

IRS Tax News - Coronavirus relief bill contains tax credits for employers Here’s a look at the payroll tax credit provisions for employers in the coronavirus relief bill President Donald Trump signed on Wednesday. Source: IRS Tax News - Coronavirus relief...

For Italian Banks: Converting Future Deductions to Present Tax Credits

Tax Policy - For Italian Banks: Converting Future Deductions to Present Tax Credits During the coronavirus outbreak, Italy has been hit especially hard. Policymakers have introduced numerous measures to stem the spread of the virus and provide relief to...

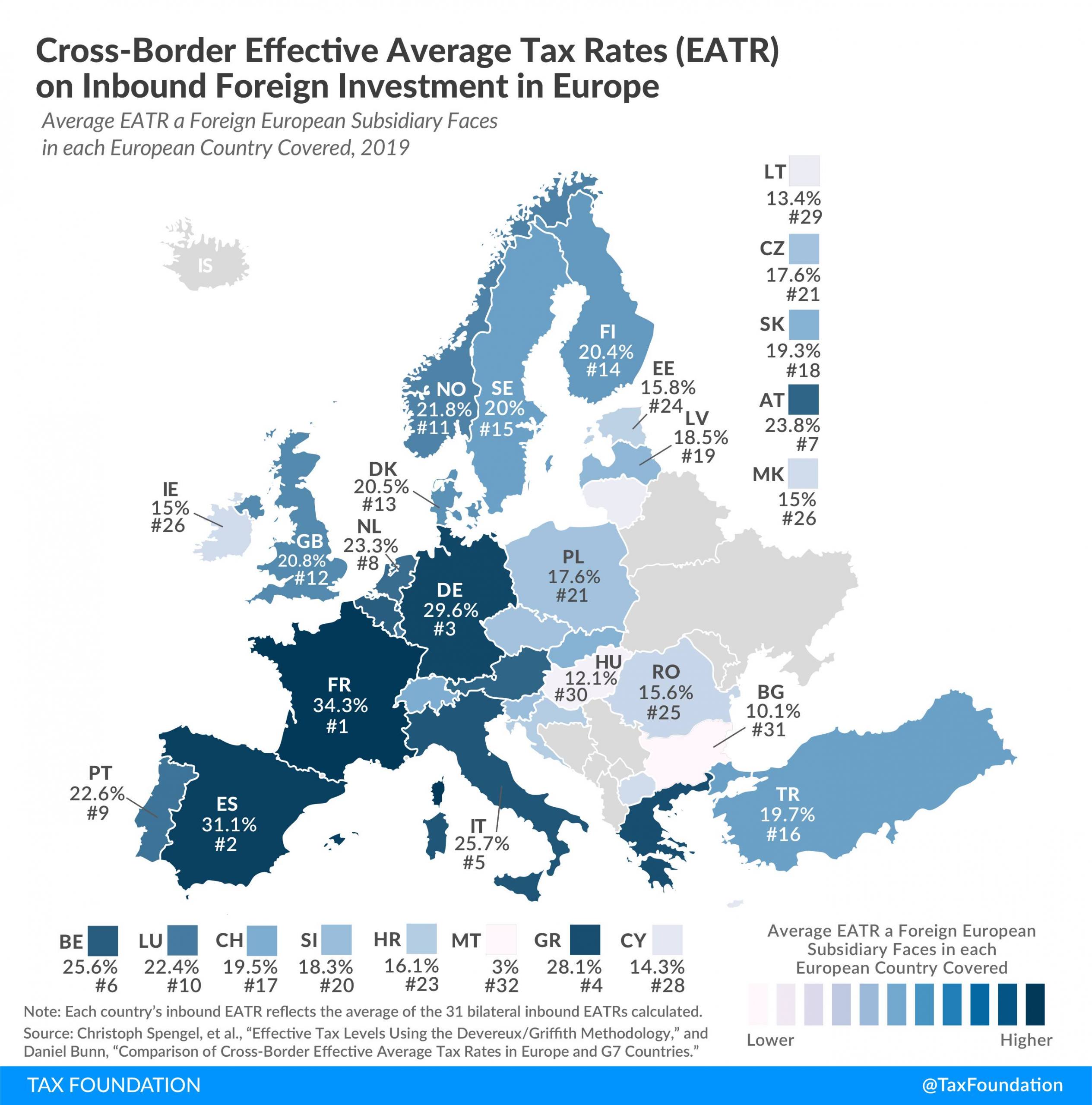

Cross-Border Corporate Effective Average Tax Rates in Europe

Tax Policy - Cross-Border Corporate Effective Average Tax Rates in Europe In today’s globalized economy, many businesses make foreign investments in countries around the world. Taxes—among many other factors—play a role in business decisions on whether and where...

AICPA expresses strong concern over lack of filing relief in coronavirus tax notice

IRS Tax News - AICPA expresses strong concern over lack of filing relief in coronavirus tax notice The IRS delayed any tax payments due April 15 to July 15 without interest or penalties accruing. The relief does not extend any tax return filing deadlines or...