Tax Blog

Tips to help you prepare for tax season

Tennessee Tornado Victims Get Tax Relief from IRS

Victims of the recent tornadoes that swept through Tennessee have gotten some tax relief from the Internal Revenue Service.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Ways and Means to IRS: Will COVID-19 Delay Filing Deadline?

The House Ways and Means Committee yesterday sent a letter to the Internal Revenue Service to ask whether the April 15 deadline should be extended due to concerns about the coronavirus.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Georgia House Passes Flat Income Tax Legislation

Tax Policy - Georgia House Passes Flat Income Tax Legislation Tuesday, the Georgia House of Representatives passed HB 949, a bill to consolidate the state’s six individual income tax brackets into one, reduce the top rate from 5.75 percent to a new 5.375 percent...

Michigan Voters Could Allow Governor to Oversee a $1.5 Billion Tax Increase by Executive Fiat

Tax Policy - Michigan Voters Could Allow Governor to Oversee a .5 Billion Tax Increase by Executive Fiat A Michigan group, Michiganders for the Commonwealth, is coordinating a petition drive to put a constitutional amendment raising taxes overall while creating...

Final regs. raise offer-in-compromise user fee

IRS Tax News - Final regs. raise offer-in-compromise user fee The IRS issued final regulations raising the offer-in-compromise user fee from $186 to $205, a 10% increase instead of the increase to $300 included in proposed regulations. Source: IRS Tax News...

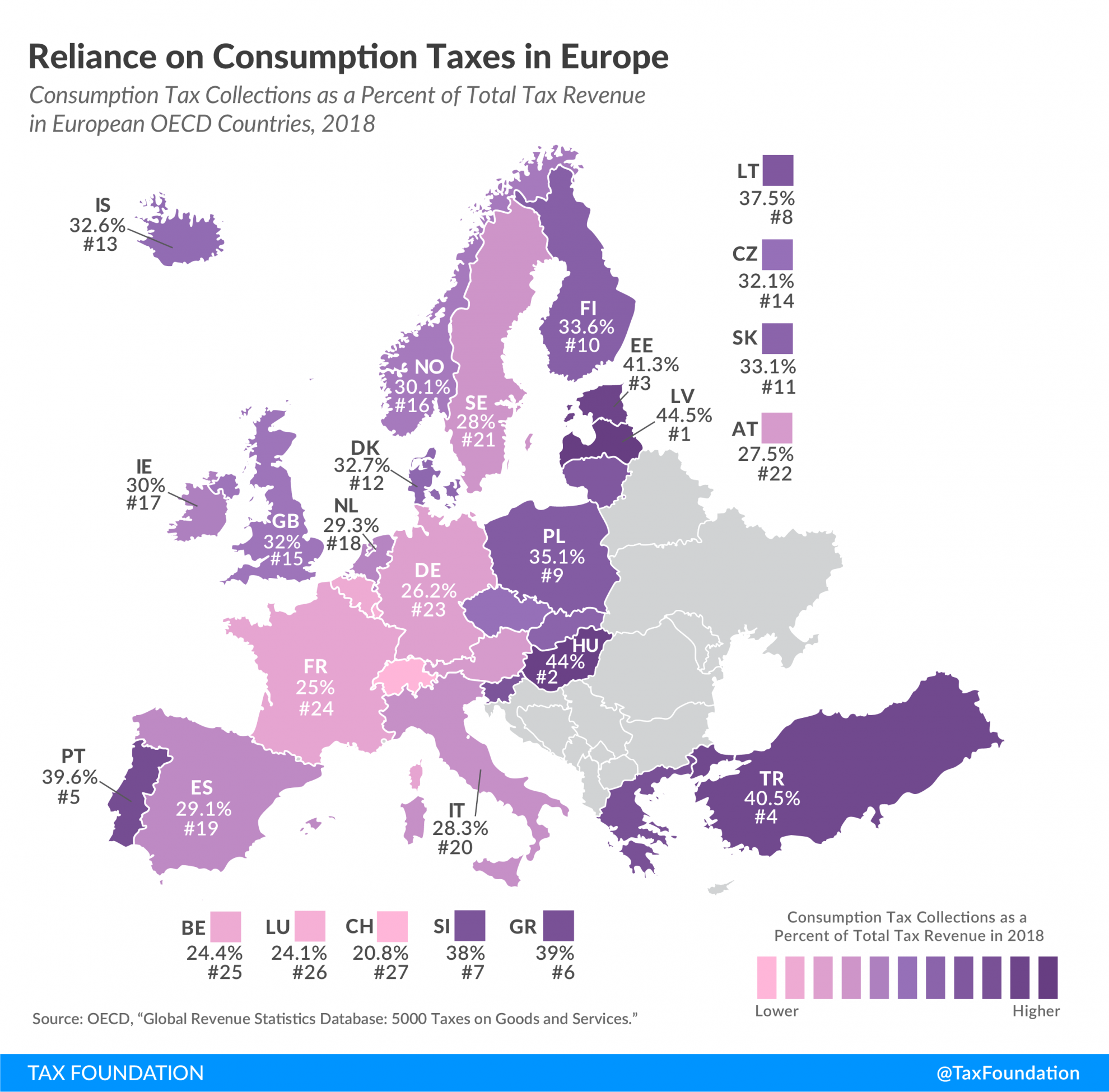

Reliance on Consumption Taxes in Europe

Tax Policy - Reliance on Consumption Taxes in Europe Today’s map highlights the extent to which European countries rely on consumption tax revenue. Consumption taxes are taxes on goods and services. All European countries levy consumption taxes in the form of...