Tax Blog

Tips to help you prepare for tax season

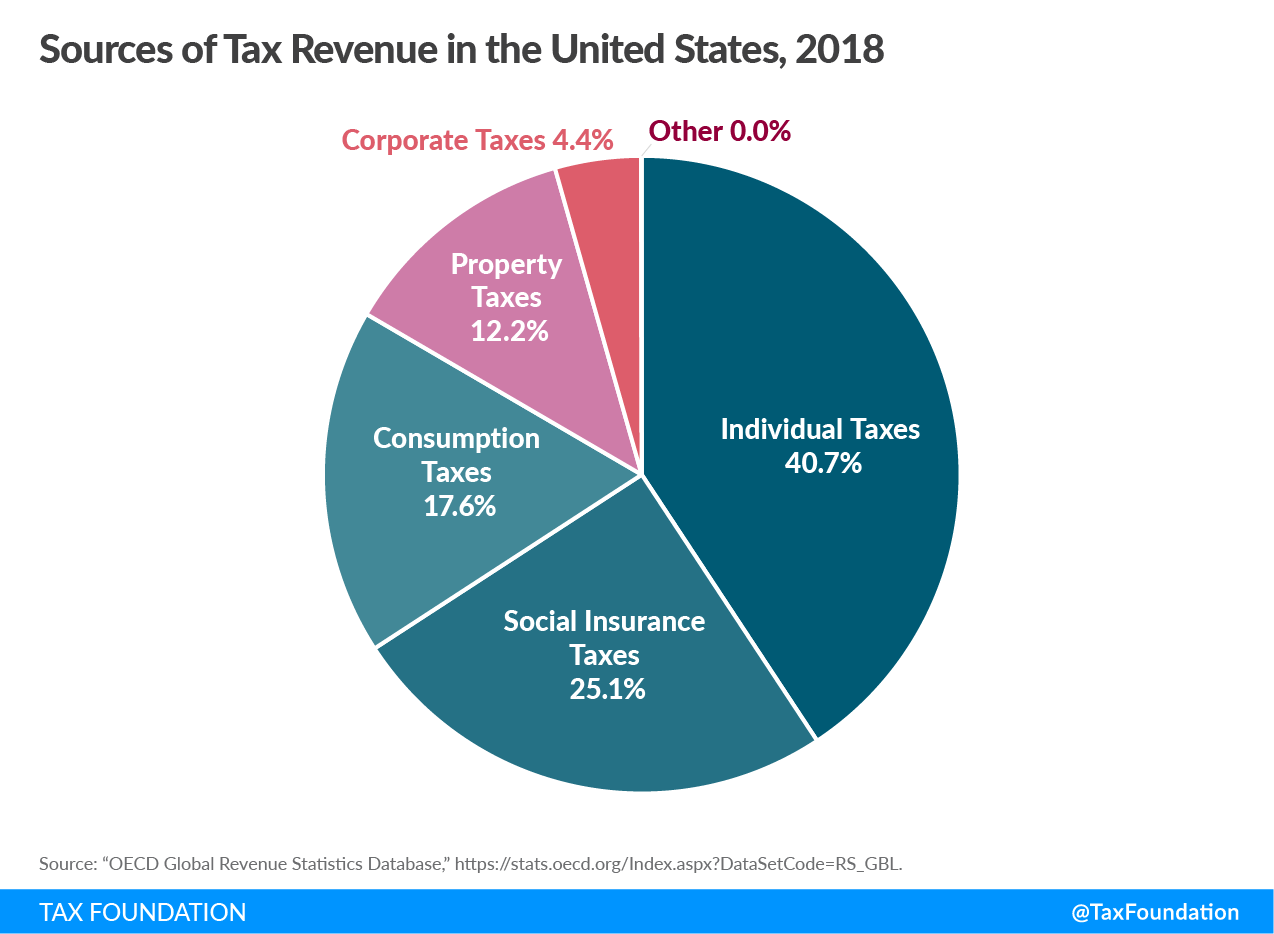

Sources of Tax Revenue: U.S. vs. OECD

Tax Policy - Sources of Tax Revenue: U.S. vs. OECD A recent report on tax revenue sources shows the extent to which the United States and other OECD countries rely on different taxes for government revenues. Policy and economic differences among OECD countries...

Ohio Voters To Consider Requiring Two-Thirds Majority for Income Tax Increases

Tax Policy - Ohio Voters To Consider Requiring Two-Thirds Majority for Income Tax Increases Ohio Senator Dave Burke (R) and 11 cosponsors have proposed an amendment to the Ohio constitution regarding taxes by introducing Senate Joint Resolution 3. The proposal...

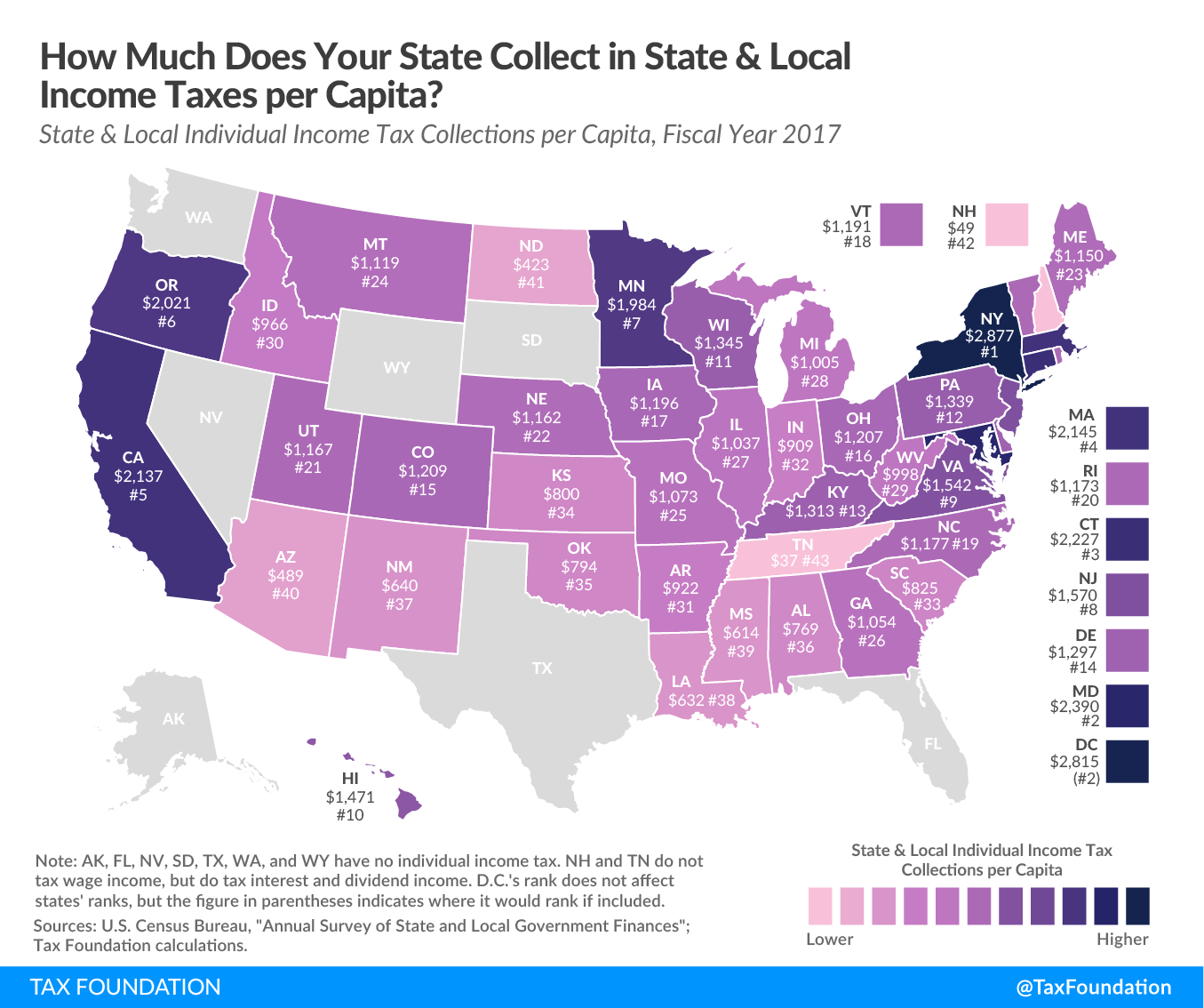

Will Nebraska Find a Path Forward in its Property Tax Standstill?

Tax Policy - Will Nebraska Find a Path Forward in its Property Tax Standstill? The Nebraska Unicameral has passed the halfway point in this year’s abbreviated 60-day legislative session, but no consensus has been reached in the ongoing effort to reduce property...

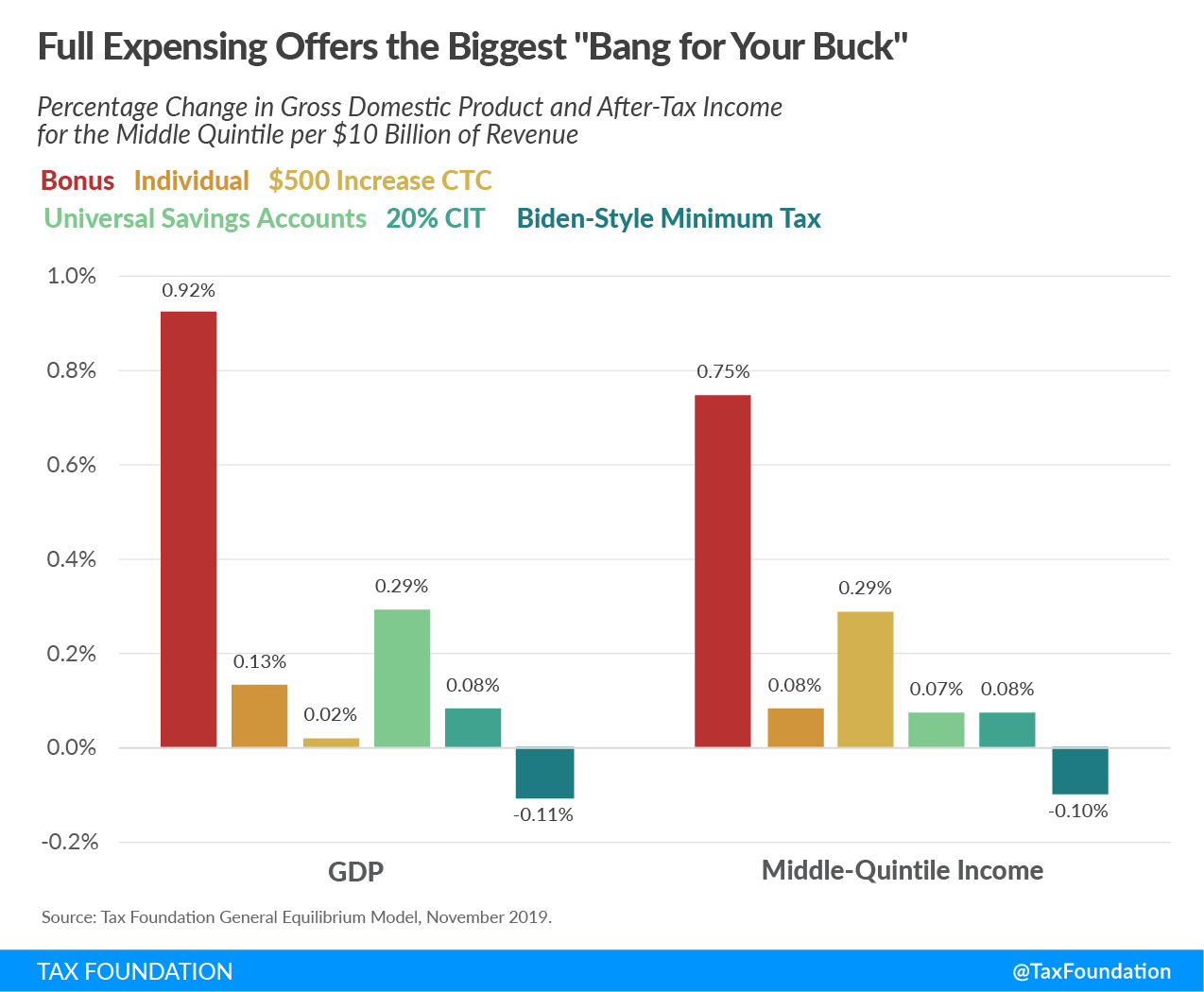

Comparing the Growth and Income-Boosting Effects of Tax Reform Options

Tax Policy - Comparing the Growth and Income-Boosting Effects of Tax Reform Options As policymakers evaluate changes to the tax code, such as proposals coming from presidential candidates and the White House, it will be important for them to evaluate the...

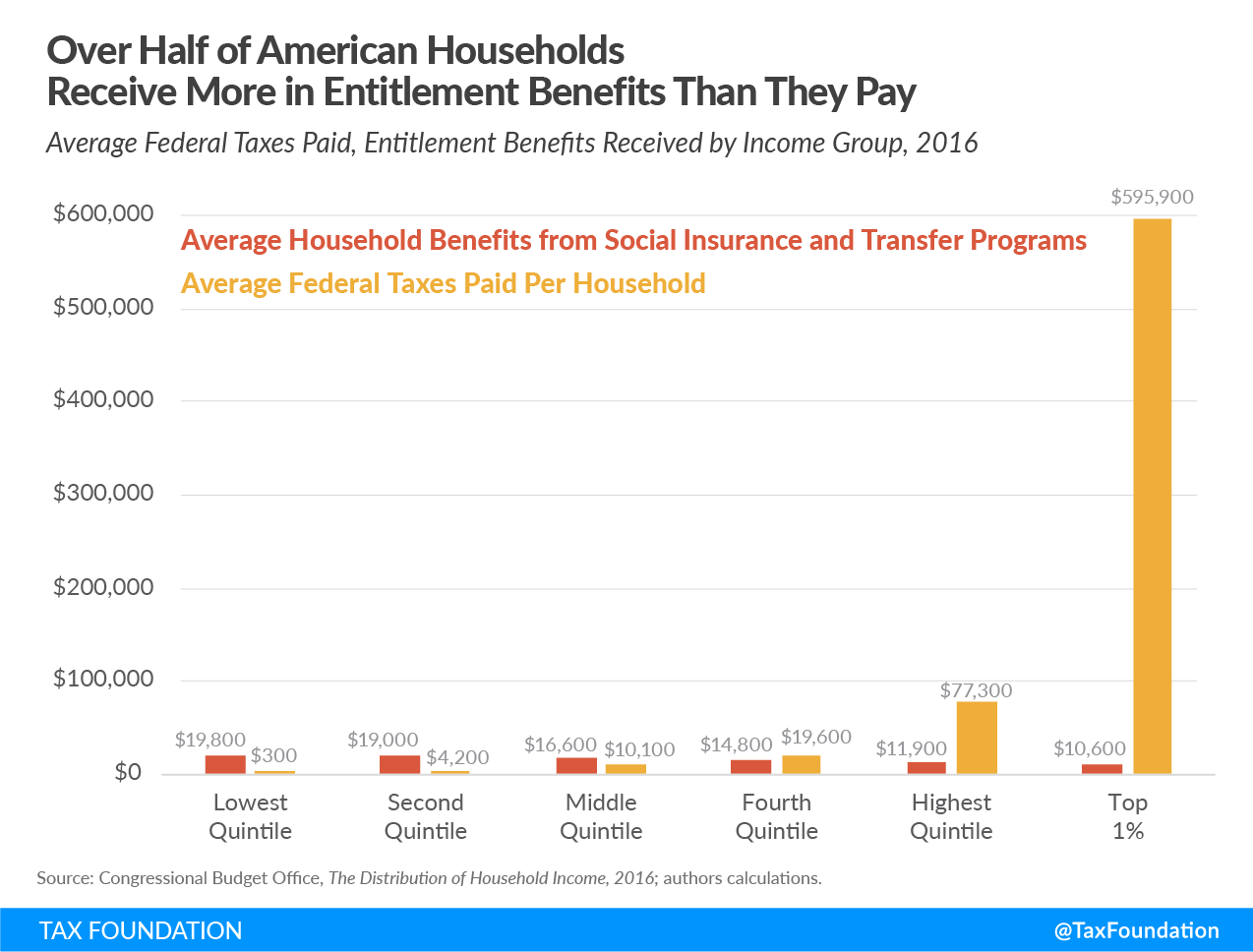

What Would Income Equality Really Look Like?

Tax Policy - What Would Income Equality Really Look Like? Income inequality, and what should or should not be done about it, is one of today’s most hotly contested economic debates. And as such, it’s had a big impact on how the tax policy debate has evolved...

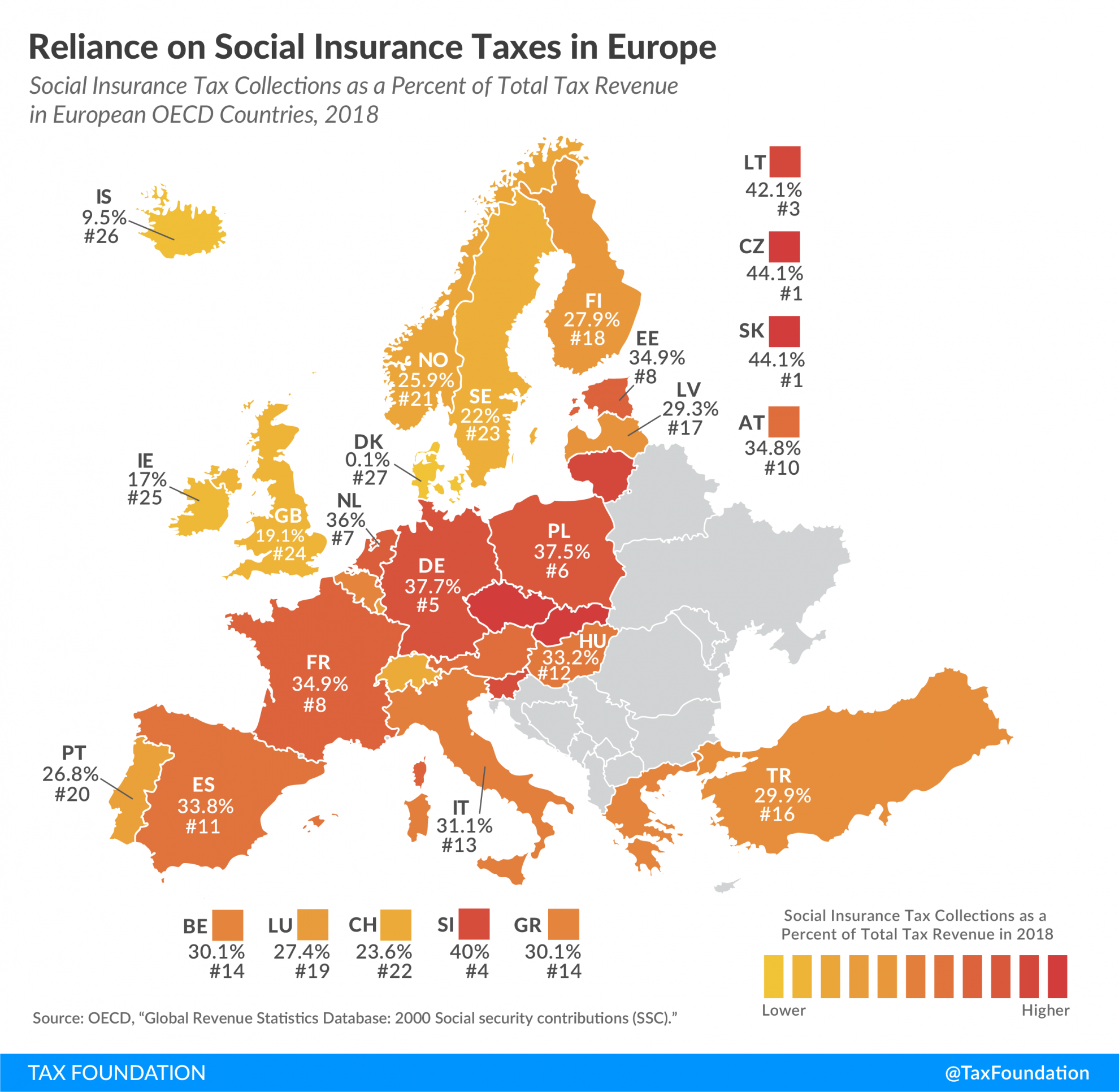

Reliance on Social Insurance Tax Revenue in Europe

Tax Policy - Reliance on Social Insurance Tax Revenue in Europe A recent report on tax revenue sources shows that social insurance taxes—also referred to as social security contributions—are an important revenue source for European governments. Social insurance...