Tax Blog

Tips to help you prepare for tax season

New Evidence on Territorial Taxation

Tax Policy - New Evidence on Territorial Taxation In the current globalized economy businesses have supply chains that can cross borders multiple times. Multinational businesses also make choices in how they want to reach their customers. A country headquartered...

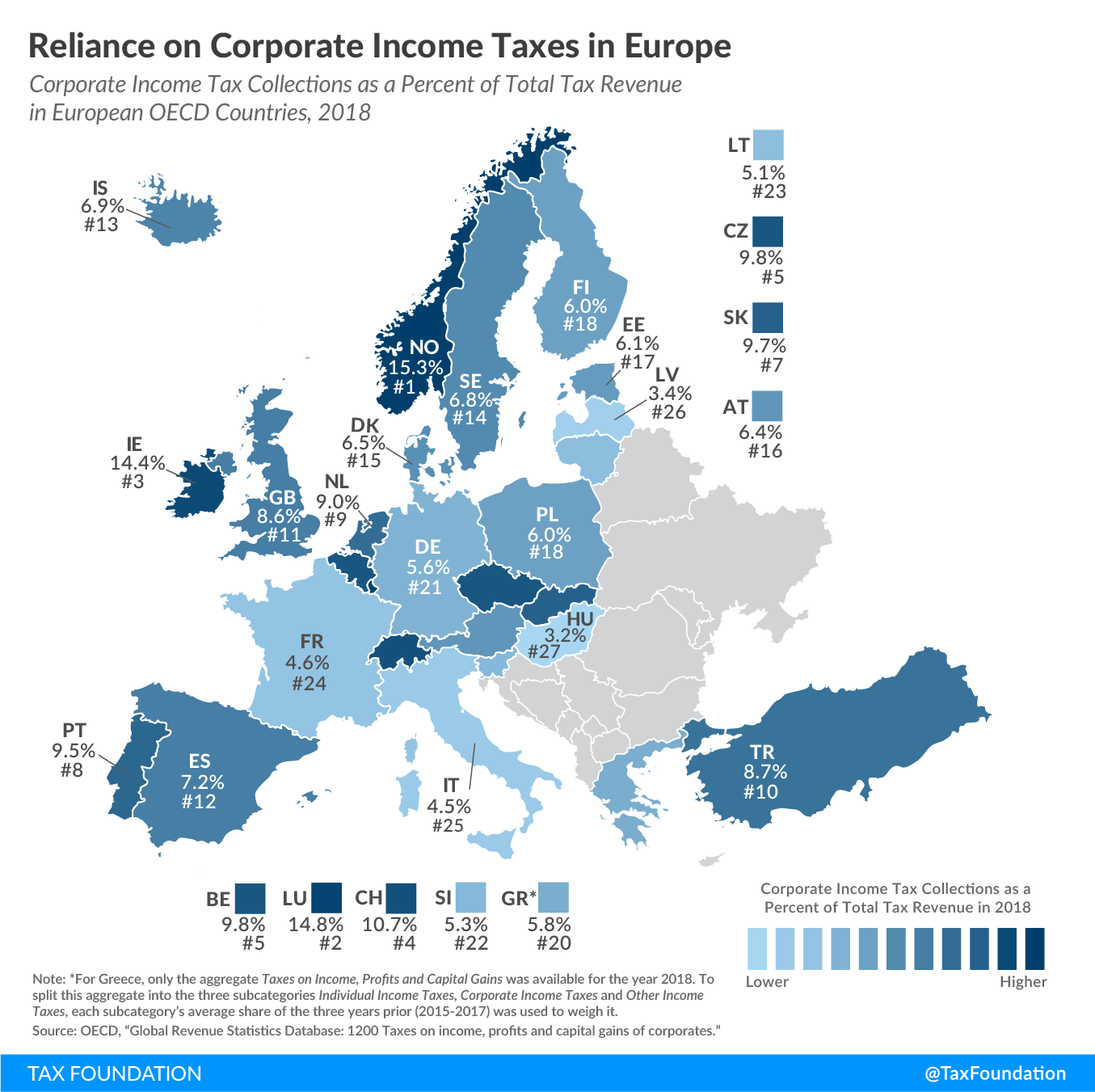

Reliance on Corporate Income Tax Revenue in Europe

Tax Policy - Reliance on Corporate Income Tax Revenue in Europe A recent report on tax revenue sources shows the extent to which OECD countries rely on different tax types. Today’s map looks at the corporate income tax, which, compared to individual taxes,...

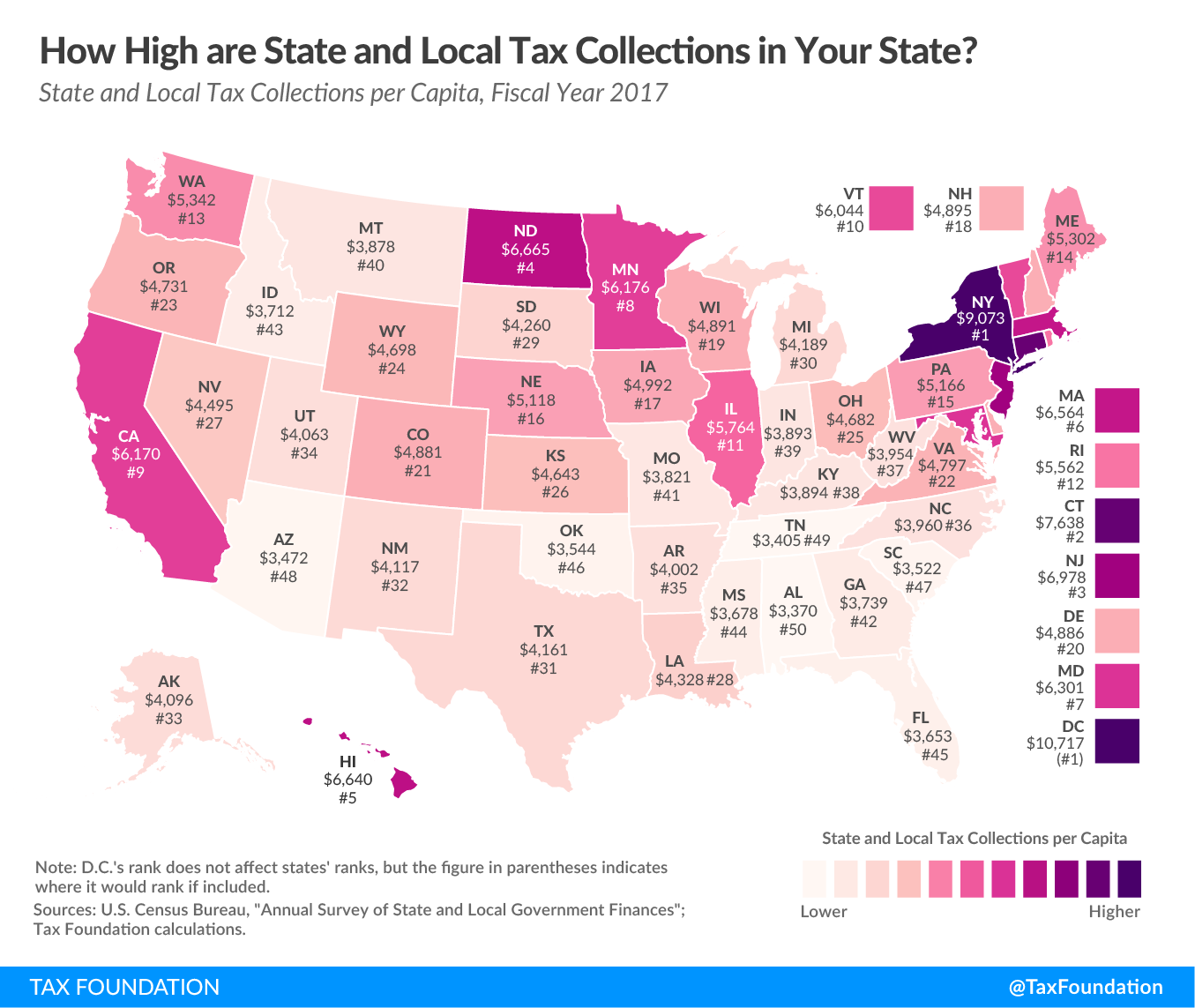

How High are State and Local Tax Collections in Your State?

Tax Policy - How High are State and Local Tax Collections in Your State? Today’s state tax map shows state and local tax collections per capita in each of the 50 states and the District of Columbia. Tax collections of $10,717 per capita in D.C. surpass those in...

Wisconsin Considers Standard Deduction Increase, TPP Tax Reduction

Tax Policy - Wisconsin Considers Standard Deduction Increase, TPP Tax Reduction Monday, a tax relief package advanced out of the Wisconsin Joint Committee on Finance and is expected to receive consideration by the full Senate and Assembly this week. Assembly...

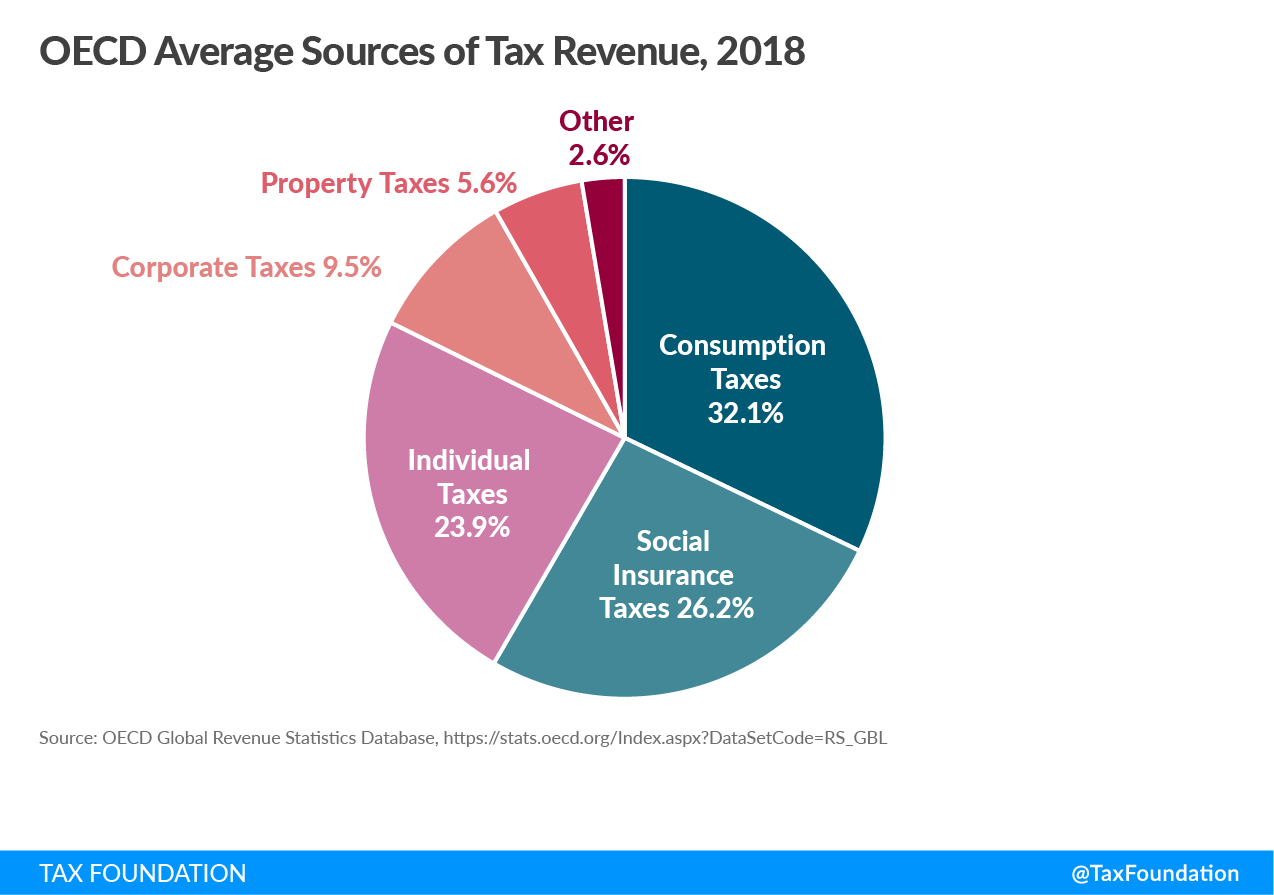

Sources of Government Revenue in the OECD

Tax Policy - Sources of Government Revenue in the OECD Key Findings In 2018, OECD countries raised one-third of their tax revenue through consumption taxes such as the Value-Added Tax (VAT), making consumption taxes on average the most important revenue source....

Analysis of Democratic Presidential Candidates Corporate Income Tax Proposals

Tax Policy - Analysis of Democratic Presidential Candidates Corporate Income Tax Proposals Key Findings 2020 Democratic presidential candidates have proposed various changes to the corporate income tax to raise revenue for their policy proposals. This includes...