Tax Blog

Tips to help you prepare for tax season

Bottled Spring Water Target of Taxes Once More

Tax Policy - Bottled Spring Water Target of Taxes Once More In December 2019, identical bills HB 861 and SB 1112 were introduced in Florida’s House of Representatives and Senate. The proposals would tax water extraction (excluding production from public water...

Navigating Alaska’s Fiscal Crisis

Tax Policy - Navigating Alaska’s Fiscal Crisis Introduction Alaska has a history of blazing its own path. It forgoes both an income tax and a state sales tax, a distinction shared only with New Hampshire. Many sparsely populated jurisdictions forgo property...

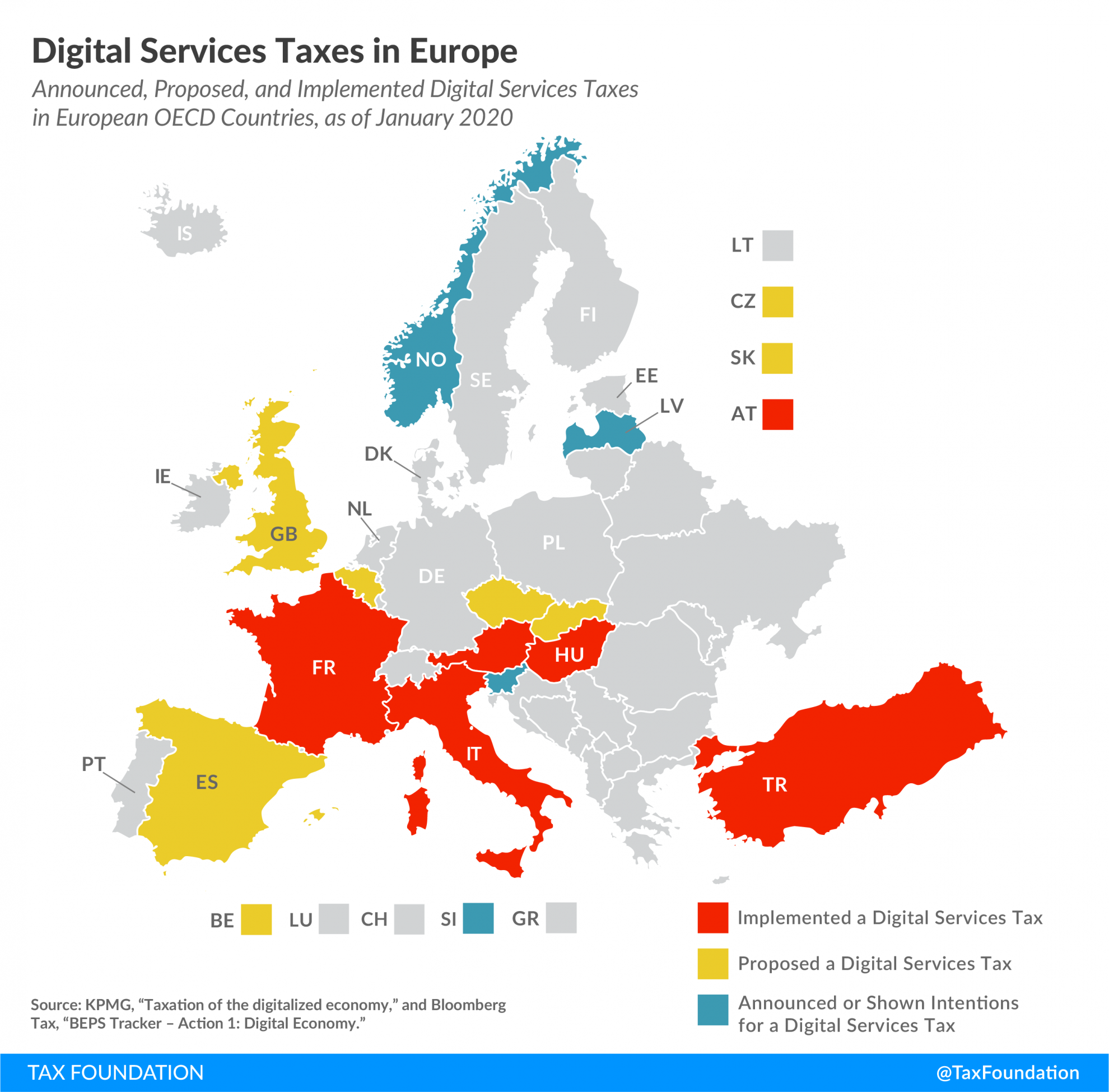

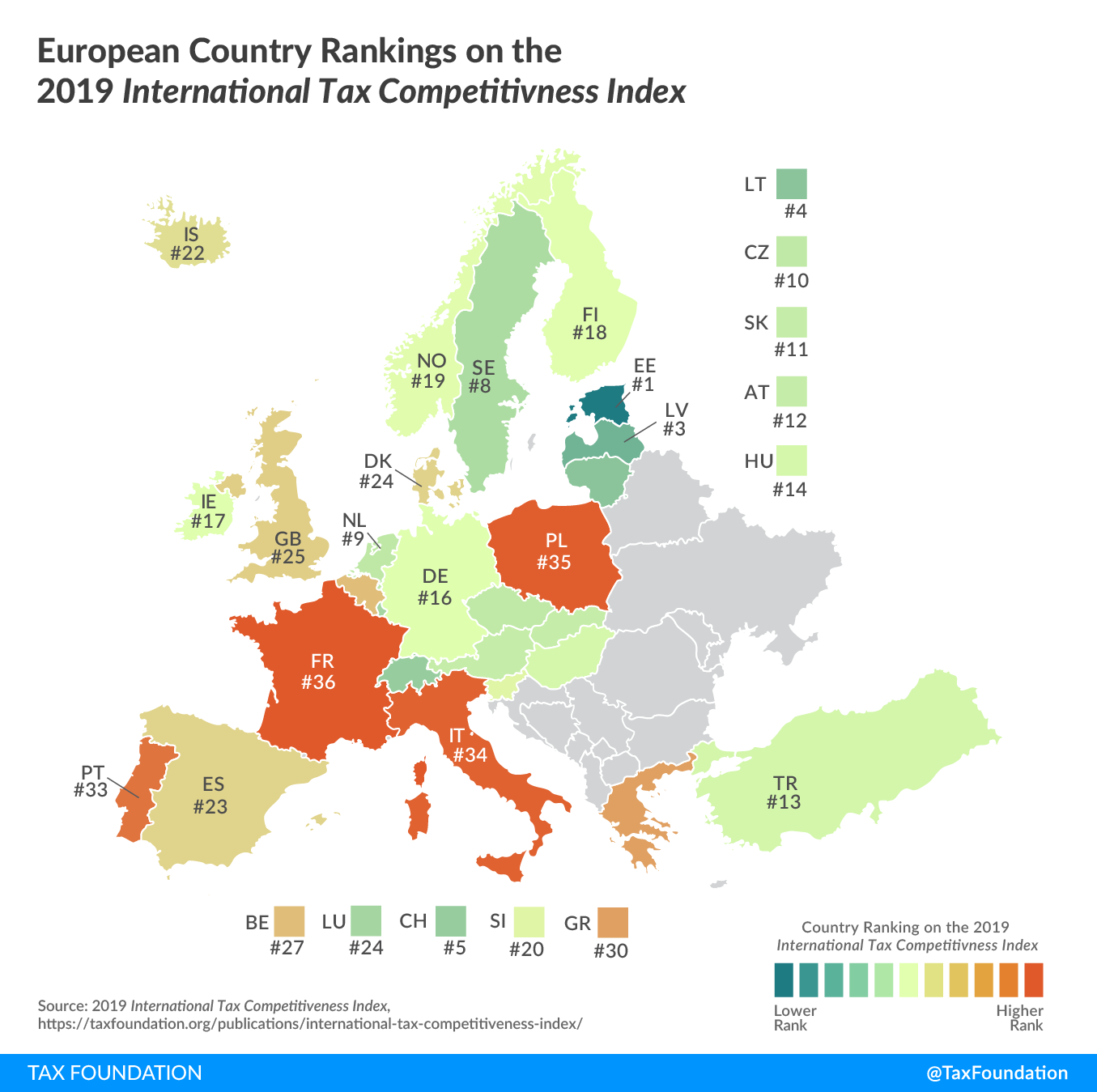

Digital Services Taxes in Europe

Tax Policy - Digital Services Taxes in Europe Over the last few years, concerns have been raised that the existing international tax system does not properly capture the digitalization of the economy. Under current international tax rules, multinationals...

Gig Economy Income Can Affect a Taxpayer’s Bottom Line

The Internal Revenue Service says a little pre-planning can help gig economy workers be ready when it’s time to file their taxes.… Read more (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

D.C. False Claims Act Bill Raises Legal and Practical Concerns

Tax Policy - D.C. False Claims Act Bill Raises Legal and Practical Concerns Legislation before the D.C. Council would allow private parties to file tax actions—a concept that has a superficial appeal (the potential for greater tax compliance without greater...

The Fiscal Reforms Agreed by Spain’s Coalition Government

Tax Policy - The Fiscal Reforms Agreed by Spain’s Coalition Government Spain’s Socialist party, led by Prime Minister Pedro Sanchez, and the left-wing Unidas Podemos have formed the first Spanish coalition government since 1930. The main measures agreed by...