Tax Blog

Tips to help you prepare for tax season

Tax Policy Proposals for the German EU Presidency

Tax Policy - Tax Policy Proposals for the German EU Presidency Today begins Germany’s presidency of the council of the European Union. The EU presidency rotates among EU member countries every six months; Germany’s presidency will last through the end of 2020....

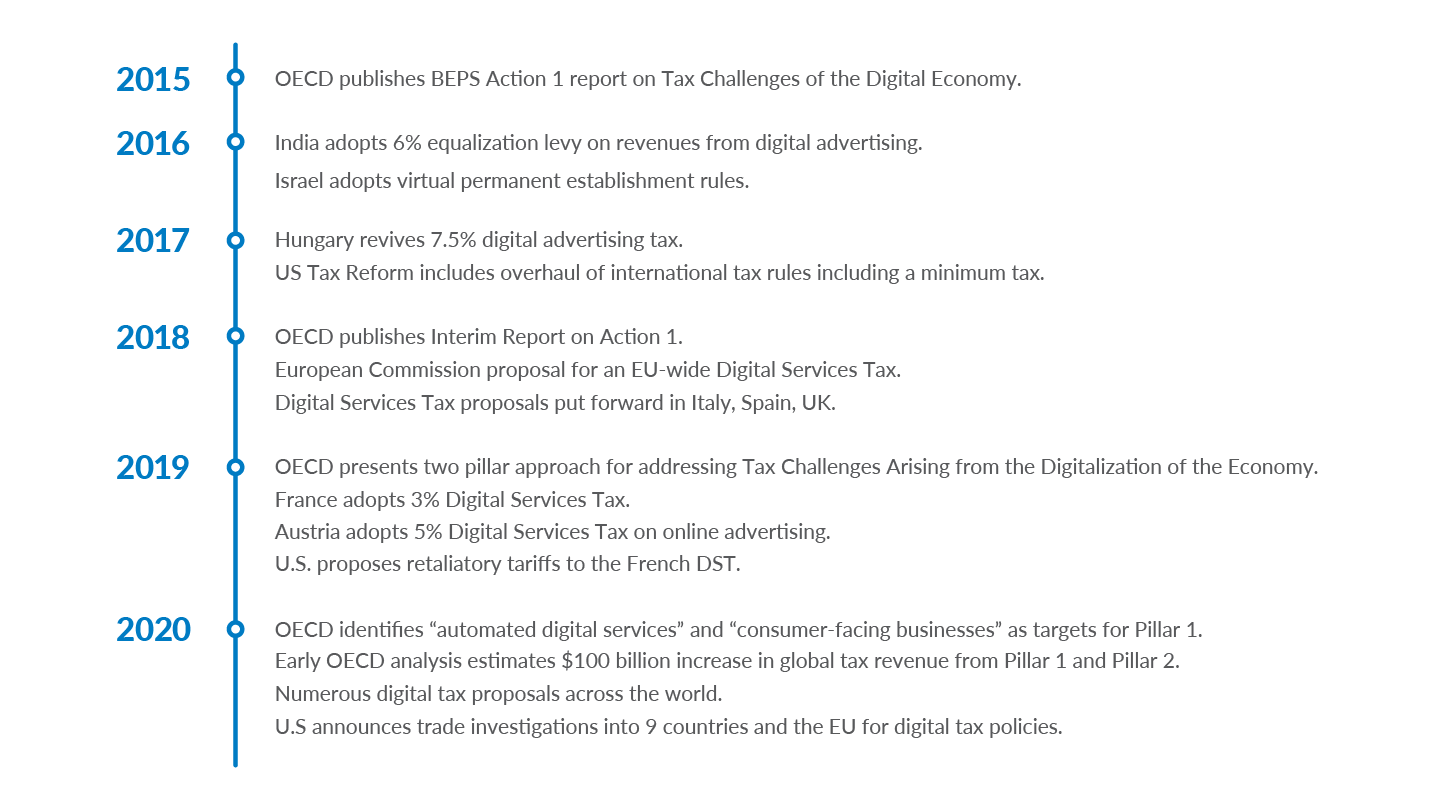

Digital Tax Deadlock: Where Do We Go from Here?

Tax Policy - Digital Tax Deadlock: Where Do We Go from Here? The growth of the digital economy over the last several decades has raised important questions about how to tax corporations that no longer need a physical presence in a country to turn a profit there....

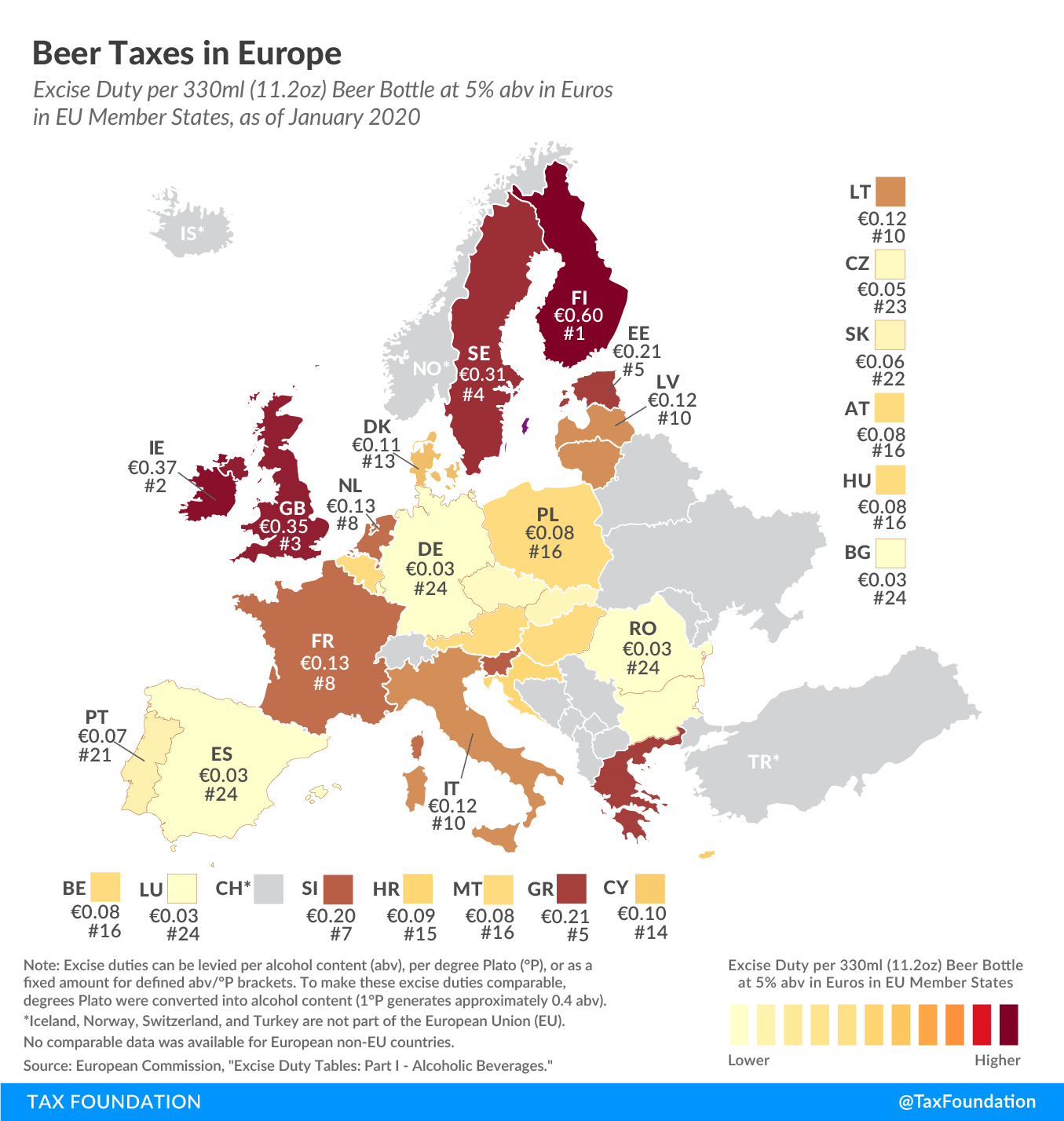

Beer Taxes in Europe

Tax Policy - Beer Taxes in Europe According to EU law, every EU country is required to levy an excise duty on beer of at least €1.87 per 100 liters (26.4 gal) and degree of alcohol content, translating to approximately €0.03 per 330ml (11.2 oz) beer bottle at 5%...

Did 1986 Tax Reform Hurt Affordable Housing?

Tax Policy - Did 1986 Tax Reform Hurt Affordable Housing? As Tax Foundation president Scott Hodge wrote in a recent blog post, improving the tax treatment of residential investments is a good way to reduce construction costs and build more affordable housing....

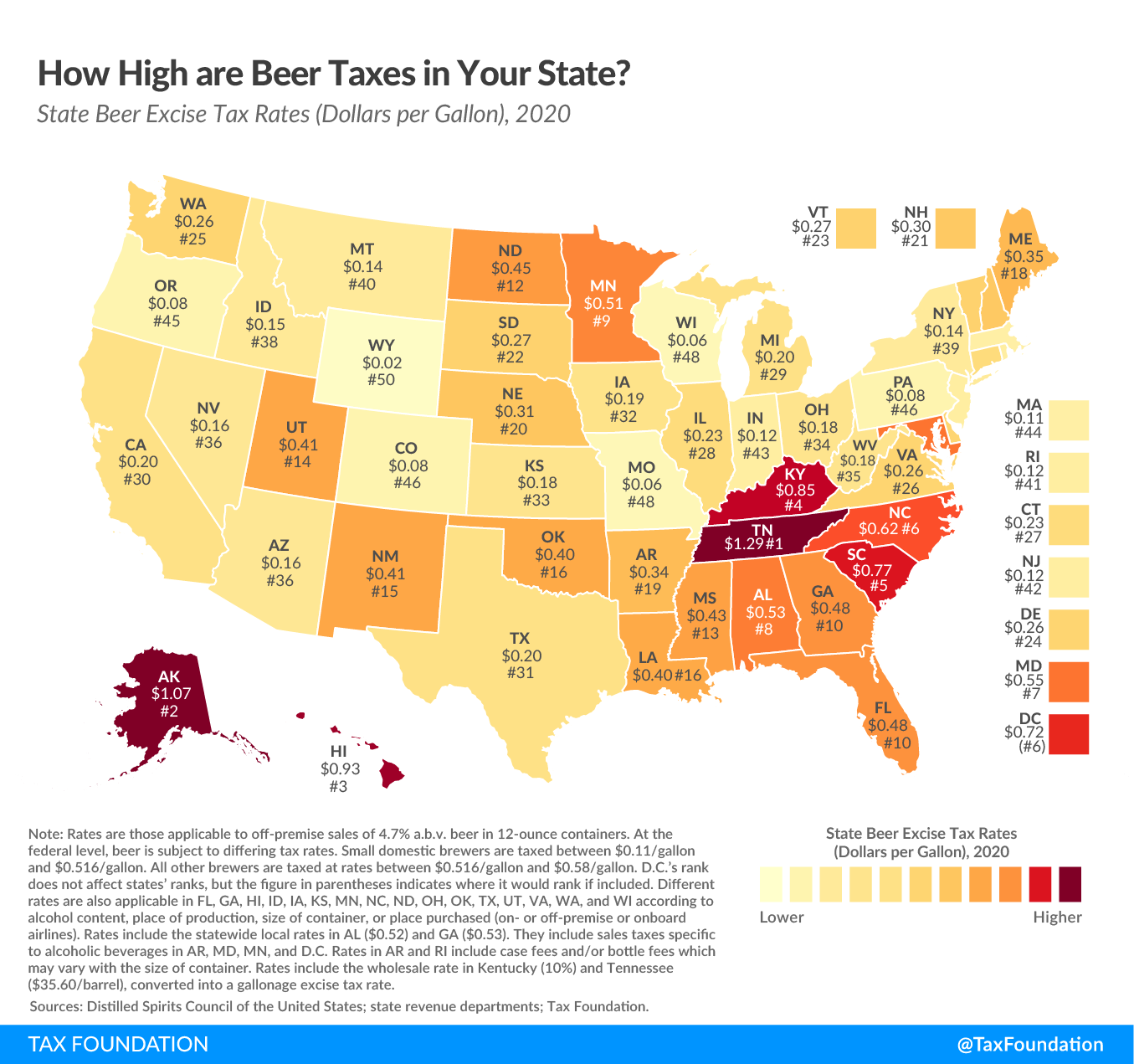

How High are Beer Taxes in Your State?

Tax Policy - How High are Beer Taxes in Your State? Even though this summer may not include sitting in the stands at an all-American baseball game or watching a community fireworks display, some summer staples are still within reach—like that beer in the fridge,...

New National Taxpayer Advocate Issues First Report to Congress

Erin M. Collins, the nation’s new National Taxpayer Advocate, has issued her first report to Congress, which details the series of challenges—some met, some unmet—faced by the IRS this year.… Read more about New National Taxpayer Advocate Issues First Report to Congress (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…