Tax Blog

Tips to help you prepare for tax season

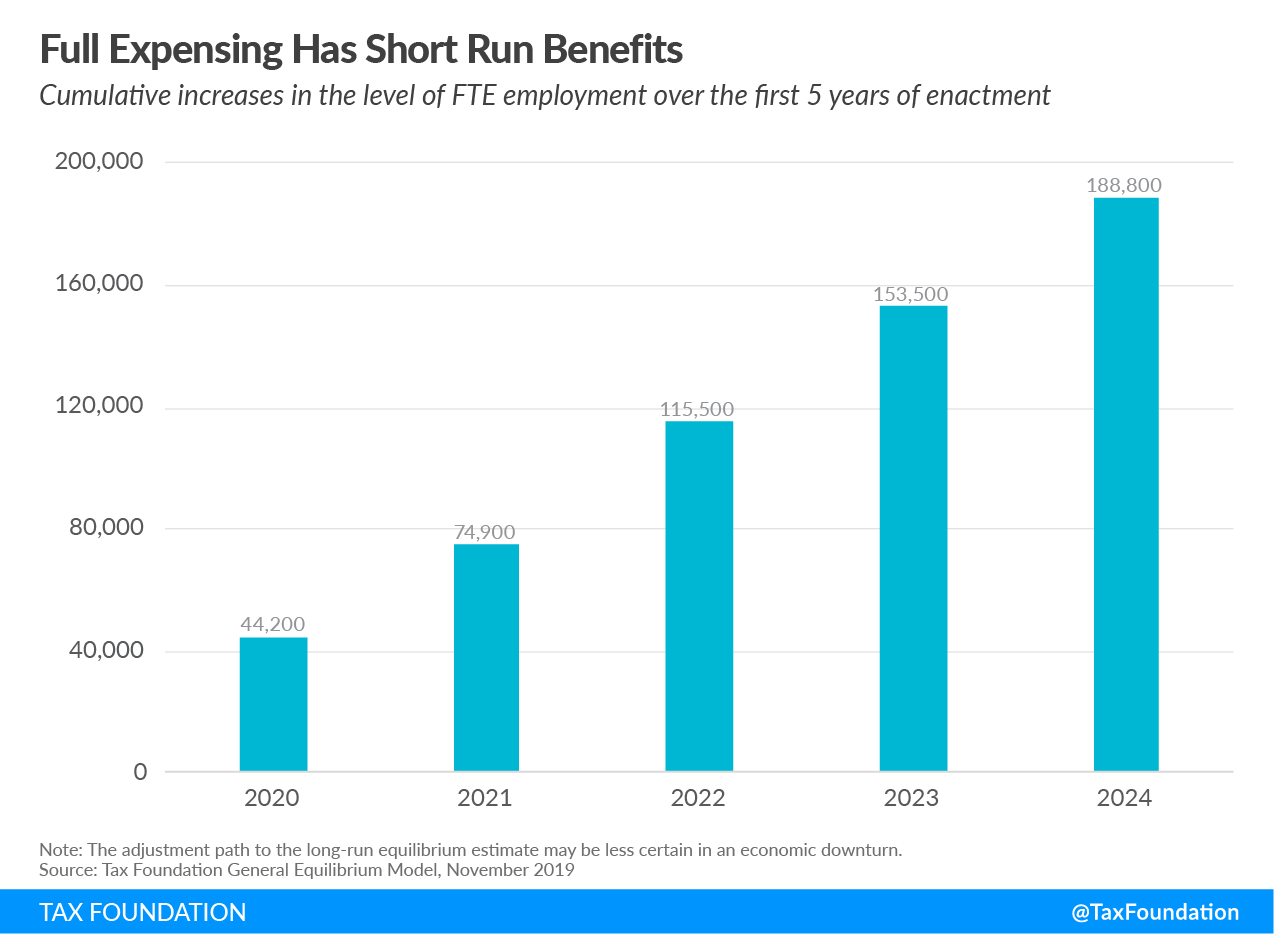

Full Expensing is Good for the Short Run and the Long Run

Tax Policy - Full Expensing is Good for the Short Run and the Long Run Full expensing for capital investment is being considered in the upcoming fourth round of coronavirus relief legislation. Though we tend to talk about full expensing as a long-run policy with...

Michigan Vapor Tax Bill Gets It Half-Right

Tax Policy - Michigan Vapor Tax Bill Gets It Half-Right In line with the nationwide trend of taxing vapor products, the Michigan Senate has passed a new 18 percent tax on vapor products. These taxes are often intended to achieve a two-fold goal: deterring youth...

CARES Act Conformity Would Promote Economic Recovery in Nebraska

Tax Policy - CARES Act Conformity Would Promote Economic Recovery in Nebraska Some Nebraska senators have recently proposed decoupling from the Coronavirus Aid, Relief, and Economic Security (CARES) Act’s tax relief provisions in order to use that revenue for...

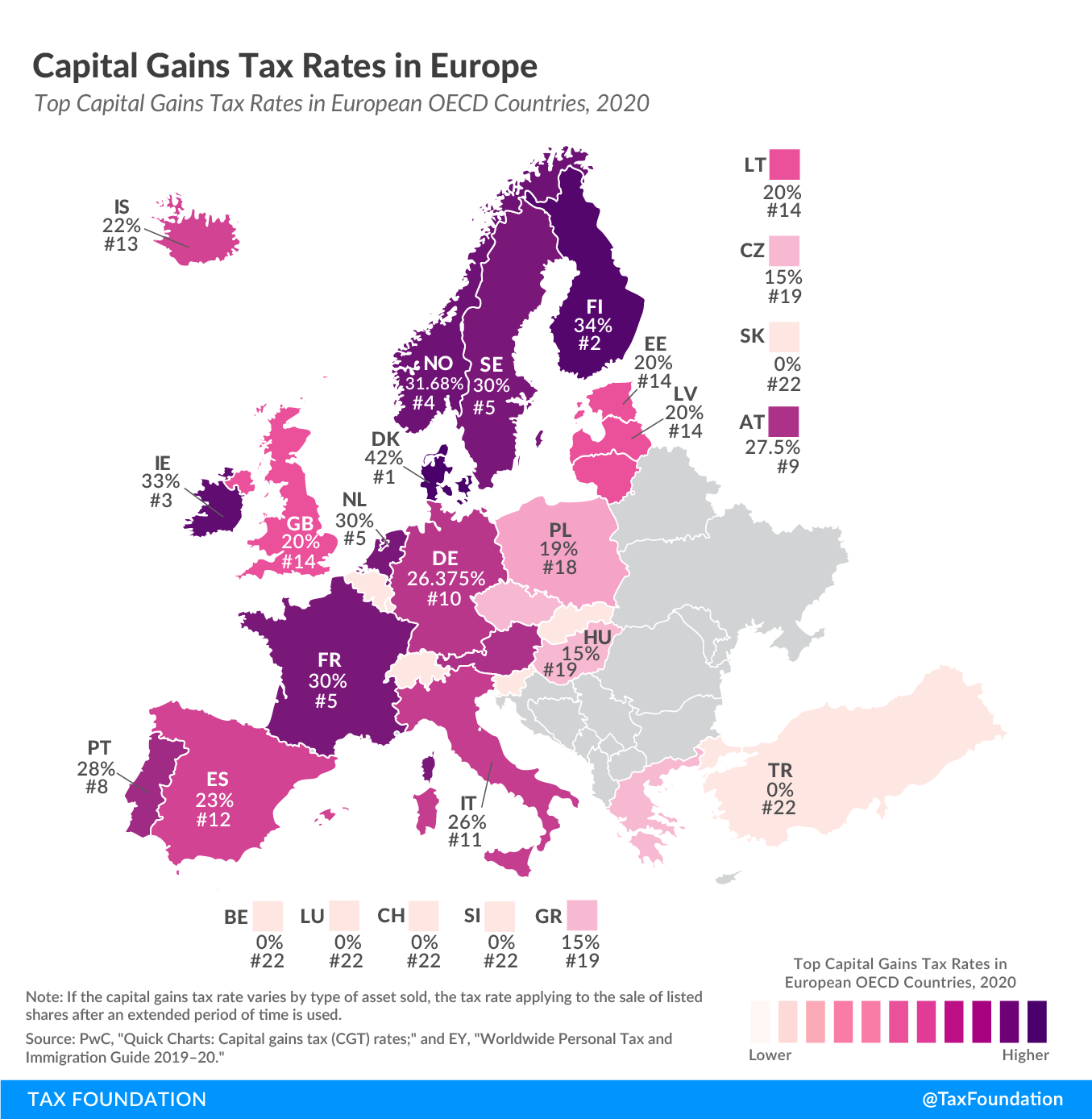

Capital Gains Tax Rates in Europe

Tax Policy - Capital Gains Tax Rates in Europe In many countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income. Today’s map focuses on how capital gains are taxed, showing how capital gains tax rates...

TIGTA Says IRS Should Act on Preparers with Overdue Returns, Debts

A new report from the Treasury Inspector General for Tax Administration (TIGTA) finds that a number of tax preparers are themselves classified as non-compliant, but in many cases, the Internal Revenue Service has not acted to recoup the outstanding tax due.… Read more about TIGTA Says IRS Should Act on Preparers with Overdue Returns, Debts (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Cautionary Notes from CBO on the Effects of Federal Investment

Tax Policy - Cautionary Notes from CBO on the Effects of Federal Investment There has been a considerable amount of talk recently from both the White House and Congress on the potential for a major federal infrastructure bill. While there are few details on what...